Retail and hospitality organizations can deliver hyper-personalized, immersive customer experiences through AR/VR and metaverse platforms. Governments and public sector bodies will use 6G for smart cities, disaster management, and national security, while transport and logistics players can optimize autonomous mobility and real-time supply chain tracking. Importantly, 6G’s integration of AI and sensing will allow organizations across sectors to unlock new business models, enhance decision-making, and build greener, more sustainable operations. In essence, 6G is not just a telecom upgrade but a strategic driver of competitiveness and digital transformation for organizations worldwide.

By end user, the enterprises segment will lead the market during the forecast period

In the enterprises segment, 6G will be a game-changer, enabling organizations to move beyond connectivity toward intelligent, fully automated operations. With ultra-high bandwidth and terabit-level speeds, enterprises can seamlessly run immersive AR/VR training, collaborative digital twins, and real-time simulations for R&D or operations. Its sub-millisecond latency will support mission-critical applications such as robotic process automation, smart factories, and precision healthcare procedures. Enterprises in logistics and transportation will benefit from autonomous vehicle coordination and predictive supply chain visibility powered by 6G’s integrated sensing.The financial sector will use it to enhance ultra-fast, secure transactions and AI-driven fraud detection at scale. Meanwhile, energy and utilities can optimize smart grids, renewable integration, and real-time monitoring through massive IoT connectivity. Importantly, 6G’s AI-native design will empower enterprises to automate decision-making, reduce overheads, and accelerate innovation. Beyond efficiency, its green networking capabilities will help enterprises meet sustainability goals. Overall, 6G is poised to redefine enterprise competitiveness by integrating connectivity, intelligence, and sustainability into a single, powerful ecosystem.

By enterprise application, the Internet of Bio-Nano Things segment is expected to register the fastest growth rate during the forecast period.

6G will be critical for the Internet of Bio-Nano-Things (IoBNT), where nanoscale devices and biological sensors communicate to enable breakthroughs in healthcare, environmental monitoring, and biotechnology. The ultra-low latency and terabit-level speeds of 6G ensure seamless data transmission from millions of nanosensors embedded in the human body or environment. Its sub-THz and terahertz spectrum supports the tiny antennas and short-range communications needed for nanoscale devices.With AI-native intelligence, 6G networks can analyze and act on biological and chemical data in real time, enabling applications such as personalized medicine, early disease detection, targeted drug delivery, and neural interface systems. Beyond healthcare, IoBNT powered by 6G could monitor pollutants, food safety, and agricultural conditions at a molecular level. The importance of 6G lies in providing the bandwidth, reliability, and intelligent orchestration that make large-scale IoBNT ecosystems feasible, safe, and effective.

North America is expected to hold the second-largest market size during the forecast period

The 6G market in North America is experiencing rapid growth, driven by significant investments from regional governments and increased international collaboration. In August 2024, the US and Sweden signed a new bilateral agreement to pool resources, expertise, and technology leadership in new, developing, and future connectivity technologies. These will cover the cooperation areas of 6G Research, including Possible Funding, 6G spectrum allocation to include the introduction of new technologies in existing frequency bands, global harmonization of 6G frequency bands, development of international standards-aligned technologies, promotion of a wide and open 6G ecosystem, and 6G technologies that can be used for bridging digital divides. In the US, the foundation for 6G innovation has been established since 2021, as the administration has invested USD 2.5 billion to further research and development in 6G. Key institutions like Stanford, MIT, and Purdue are pushing the frontiers through novel thrusts in areas like terahertz communications, AI-driven network management, and advanced antenna technologies.Breakdown of Primary Interviews

The study offers insights from a range of industry experts, including solution vendors and Tier 1 companies. The breakdown of the primary interviews is as follows:- By Company Type: Tier 1 - 20%, Tier 2 - 10%, and Tier 3 - 70%

- By Designation: C-level - 9%, Directors - 18%, and Others - 73%

- By Region: North America - 55%, Europe - 9%, Asia Pacific - 36%

Research Coverage

The market study covers the 6G market size across different segments. It aims at estimating the market size and the growth potential across various segments, including Usage Scenario (Further-enhanced Mobile Broadband (FEMBB), Extremely Reliable and Low-latency Communications (ERLLC), Long-distance and High-mobility Communications (LDHMC), Ultra-massive Machine Type Communications (UMMTC), Extremely Low-power Communications (ELPC)), Enterprise Application (Holographic Communications, Tactile/Haptic Internet, Fully Automated Driving, Industry 5.0, Internet of Bio-Nano Things, Other Enterprise Applications (Deep-sea Sightseeing and Space Travel)), Communication Infrastructure (Cellular, Broadband, Fixed), End User (Consumers and Enterprises (Manufacturing, Healthcare & Life Sciences, Automotive, Media & Entertainment, Aerospace & Defense, Other Enterprises [Retail & E-commerce, Energy & Utilities, Education])), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global 6G market’s revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.The report provides insights into the following points:

- Analysis of key drivers (Technological advancements, deliver extreme performance and highly advanced use cases, growing metaverse traction), restraints (High initial cost, limited spectrum availability, regulatory and standardization challenges, terahertz (THz) frequency challenges and energy efficiency concerns), opportunities (Transformative applications, global connectivity, detailed sensing and high-precision positioning technologies offered by 6G networks), and challenges (Security and privacy, ethical and social implications, environmental concerns) influencing the growth of the 6G market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 6G market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the 6G market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the 6G market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as AT&T (US), NTT DoCoMo (Japan), Orange S.A. (France), Reliance Jio (India), Bharti Airtel (India) Vodafone Group (UK), SK Telecom (South Korea), Deutsche Telekom (Germany), Verizon (US), China Mobile (China), Telefonica (Spain), China Unicom (China), Rakuten Mobile (Japan) KT Corporation (South Korea), Singtel (Singapore), KDDI Corporation (Japan), and e& (UAE).

Table of Contents

Companies Mentioned

The key companies profiled in this 6G market report include:- AT&T

- Ntt Docomo

- Reliance Jio

- Bharti Airtel

- Vodafone

- Sk Telecom

- Verizon

- Deutsche Telekom

- Telefonica SA

- China Mobile

- China Unicom

- Orange SA

- Rakuten Group

- Kt Corporation

- Singtel

- Kddi Corporation

- E&

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | October 2025 |

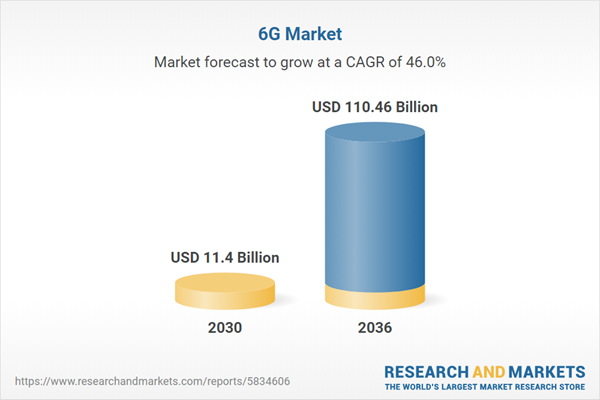

| Forecast Period | 2030 - 2036 |

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 110.46 Billion |

| Compound Annual Growth Rate | 46.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |