Polyethylene terephthalate (PET) is found in most plastic-packed products in the country. For instance, as per Macquarie University, Australians buy more than approximately 118,000 metric tons of plastic drink bottles every year, despite 250 stringent checks by the Australian water utilities for tap water. Based on such facts, the existing packaging manufacturers are increasing their capacities to bridge domestic demand gaps.

Key Highlights

- Australia witnessed a significant increase in population in the previous decade. It is anticipated to drive the demand for more consumables, like beverages, packaged meals, packaged drinking water, and convenience packages like microwave and oven safe, among others, which prefer plastic packaging medium over other alternatives, owing to high portability enabled by the lightweight of the plastics.

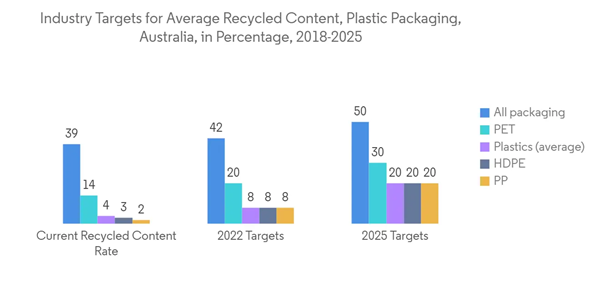

- The country also established its ambitious 2025 National Packaging Targets. The targets create a new sustainable pathway for how companies manage their packaging in the country. The Australian industry and Government also support the 2025 National Packaging Targets (2025 Targets) to deliver a new and sustainable approach to packaging. These targets will be applied to all the packaging made, used, and sold in the country. Australian Packaging Covenant Organisation (APCO) is the organization that the Government charges to facilitate the delivery of these 2025 Targets. In response, the Australian Government realized the adoption of the Circular Economy model aligning with 100% sustainable packaging practices by 2025.

- However, the country is undertaking efforts to reduce plastic packaging, but its benefits in comparison to alternatives are enabling the manufacturers to continue production.

- The stringent government regulations over plastic packaging used to reduce the environmental impact can hinder the market's growth. Substitute availability, which impacts the environment, created barriers to market growth.

- Additionally, the need for packaging equipment and goods is rising in the Australian market. The entire industry aspires to lower costs, increase productivity, and improve product quality through equipment replacement and manufacturing process optimization. These are some of the critical factors helping to create growth options for the market.

- Consumers, producers, and manufacturers know that packaging plays a significant role in the food and beverage, eCommerce, healthcare, and transportation industries after Australia experienced droughts, floods, and fires and after the pandemic turned the world upside down.

Australia Plastic Packaging Market Trends

Increasing Demand from the Food Industry

- Due to lifestyle changes, the primary force driving Australia's plastic packaging market growth is the demand for single-serve and portable food packs. Also, an increase in cross-border e-commerce, investments in improved logistics, and bilateral trade agreements are framing Australia as a significant country in food exports.

- For instance, according to Grain Trade Australia, in FY 2020, the value of almonds exported from the country amounted to approximately AUD 647.6 million (USD 449.24 million), the highest-valued horticulture export product. Also, in terms of fresh fruit, table grapes were the highest exported product in the same year, around AUD 623 million (USD 432.2 million).

- On the production end, manufacturers have been increasing their output to cater to local and international demands. It will directly boost the plastic packaging volume in the country. For instance, according to the Australian Bureau of Statistics, in FY 2020, the total production value of almonds in the country amounted to around AUD 954 million (USD 661.2 million). Almonds were also the top nut produced in the country in terms of in-shell weight.

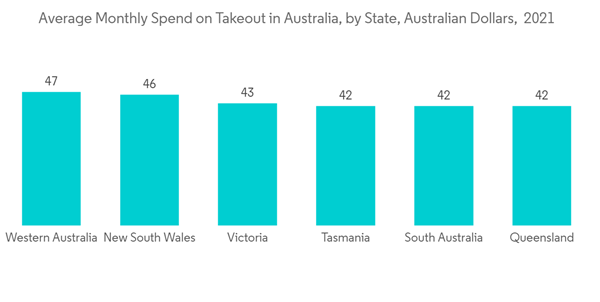

- Additionally, convenience food demand in Australia is rising due to consumers increasingly demanding healthy and convenient foods in terms of packaging and handling, leading to an increased usage of plastics in packaging.

Increased Eco-friendly Packaging and Recycled Plastics

- According to the Government's 2025 waste recycling plans, regulation on the commitment to reduce packaging waste generated and make recycling easier was designed. In 2019, of the 393,800 plastics collected for reprocessing, approximately 52% were reprocessed in Australia, and 48% were exported.

- The Australian Government released a plan to reduce plastic waste. Currently, 2.5 million metric tons of plastic waste is generated in Australia each year, with 13% of that recovered. The National Plastics Plan establishes benchmarks to increase plastic recycling and announces other interventions across the plastics' entire life cycle.

- The plan notes that Australia is taking responsibility for its plastic waste and that, under the Recycling and Waste Reduction Act of 2020, the export of unsorted mixed plastics is banned as of July 2021. Additional measures include a phase-out of non-compostable plastic packaging containing additive fragmentable technology that does not meet relevant compostable standards by July 2022, polyvinyl chloride packaging labels, and expanded polystyrene in consumer food and beverage containers by December 2022.

- The primary plastic beverage bottler, Coca-Cola, previously produced the country's first carbonated soft drink bottles made from 100% recycled plastic. The company plans to replace Coca-Cola Amatil's single-serve plastic bottles in Australia with new, fully recycled materials.

- Such increased concerns for recyclability in the country are boosting innovations in the market from the packaging manufacturers and end-user sectors. Bioplastics, fiber-based paper packaging, and other innovations are witnessing growth because the blend within the materials makes recycling more accessible and cheaper and reduces the decomposition time in landfills.

- On March 4, 2021, the Australian Department of Agriculture, Water, and the Environment announced the release of the country's National Plastic Plan, which outlines its approach to increasing plastic recycling, finding alternatives to unnecessary plastics, and reducing the impact of plastic on the environment.

- Similarly, Amcor launched its Amlite Ultra Recyclable, the first packaging product made from sustainable high-barrier polyolefin film. This laminate can easily package a range of food, home, personal care, and pharmaceutical products in recyclability. With recyclability, such change aims to reduce a pack's carbon footprint by up to 64%.

Australia Plastic Packaging Industry Overview

Australia's plastic packaging market is highly fragmented, and the current competitors are striving to differentiate their offerings based on recycled content in packages and the ease of plastic packaging recyclability. Vendors are also competing with international players who occupy a larger market share by constantly acquiring, innovating, and partnering, which is expected to intensify the rivalry. Some key players are Orora Packaging Australia Pty Ltd, Filton Packaging Pty Ltd., Flexible Packaging Solutions Pty Ltd., and Econopak Flexible Packaging.- July 2022 - Under the ANZPAC Plastics Pact, the Australian Packaging Covenant Organisation (APCO) released a new document that outlines the strategy needed to meet the regional plastic targets by 2025. It is done by redesigning, innovating, and using alternative (reuse) delivery models. Plastic packaging that is unnecessary and problematic can be eliminated.

- March 2022 - The Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia's national science agency, and the Australian government's Department of Foreign Affairs and Trade joined forces to launch the Plastics Innovation Hub Indonesia project.

- July 2022 - Australia's Woolworths Group and Pact have partnered to promote circular packaging. As a result, Woolworths' brand packaging can now contain up to 18,000 tonnes of recycled plastic annually. Including the recently opened PET recycling facility in Albury. The proposed partnership aims to make Pact Woolworths' top strategic partner by volume in the retailer's efforts to deliver more environmentally friendly packaging across its brand range and to provide the most significant boost to date in the retailer's effort to reduce the use of virgin (new) plastic in all of its brand packagings by half by 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Orora Packaging Australia Pty Ltd

- Filton Packaging Pty Ltd

- Flexible Packaging Solutions Pty Ltd

- Gravure Packaging Ltd

- Econopak Flexible Packaging

- Pro-Pac Packaging Pty Ltd

- A&M Packaging Pty Ltd

- Caspak Products Pty Ltd

- Synergy Packaging (RPC Group)

- Visy Industries Australia Pty Ltd

- Pact Group Holdings Australia Pty Ltd

- Cospak Pty Ltd

- Vacupack Pty Ltd

- Plasmo Pty Ltd