Australia Wine Market Trends

The Australia wine market features a wide range of wine styles that cater to various consumer preferences. Renowned for their quality, Australian wines often receive prestigious awards, bolstering their reputation. The market growth is driven by exports, which enhance global visibility. Sustainable viticulture practices are becoming more popular, benefiting both the environment and the quality of the products. Innovative winemaking techniques further improve flavour profiles and consistency across offerings. In July 2023, Jacob’s Creek launched its new ‘Double Barrel’ Shiraz, which is aged in both American and European oak barrels. The launch event highlighted the wine's complex flavours and versatility in food pairings, appealing to a diverse range of wine enthusiasts.The Australia wine market revenue is further bolstered by its wine regions, which play a crucial role in promoting tourism, supporting local economies, and generating jobs. This industry showcases Australia’s rich cultural heritage, enhancing national identity. With increasing market potential, attractive investment opportunities are available for both domestic and international investors. The wine sector makes a significant contribution to the economy through employment and exports. A strong domestic market encourages innovation among local wineries. In June 2023, De Bortoli launched its latest ‘Noble One’ vintage, a botrytis Semillon celebrated for its remarkable sweetness. The launch featured a special event focused on food pairings, highlighting the wine's luxurious quality and global acclaim.

Australia Wine Market Growth

The Australia wine market has seen a boost from investments in research and development, which drive advancements in grape growing and winemaking techniques. The country's diverse climates enable production across various regions, enhancing resilience to climate change. Community engagement is strengthened through wine events and festivals that celebrate local culture. The demand is supported by educational programmes that improve consumer appreciation and understanding. Collaborations with the hospitality industry also enhance wine marketing and expand consumer access to quality products. In April 2023, Tyrrell's Wines announced the launch of their new ‘Vintage Fortified’ range, emphasising their commitment to traditional winemaking. The release event highlighted the unique characteristics of each fortified wine, celebrating the artistry and heritage of the Hunter Valley.The Australia wine market has been boosted by an expanding range of organic and biodynamic wines that cater to health-conscious consumers. Local sourcing is a key trend of the Australia wine market which supports regional economies and fosters community connections. International collaborations with wineries broaden market reach and encourage knowledge sharing. Strong branding initiatives enhance the global reputation of Australian wines, positioning them advantageously in the international market. The industry's ability to adapt to market trends ensures its continued relevance and growth within a competitive landscape. In May 2023, Innocent Bystander launched a new sparkling wine, ‘Pétillant Naturel’, made using traditional methods with organic grapes. The lively launch event included local food pairings, promoting sustainability and the rich winemaking culture of Victoria.

Australia Wine Market Insights

- According to Wine Australia, Australia exported 621 million litres of wine in the 2022-2023 period, with the UK and US as the primary markets.

- As per industry reports, domestic sales in Australia reached 444 million litres of wine during 2022-2023.

- According to Wine Australia, in 2022, Australia had a total vineyard area of 146,244 hectares, with South Australia representing 52% of this land.

Industry News

September 2023: Yalumba introduced its new 'Old Bush Vine Grenache' range, honouring the heritage of Grenache from the Barossa Valley. This collection highlights vintage characteristics and seeks to engage both collectors and casual wine lovers with its rich storytelling and exceptional quality.August 2023: Penfolds revealed its innovative 'Grape Expectations' series, showcasing rare varietals sourced from top-tier vineyards. The launch featured tastings and discussions with winemakers, aimed at emphasising the brand's dedication to quality and craftsmanship in wine production.

Australia Wine Market Drivers

Sustainability and Organic Practices

The Australia wine market is experiencing a boost as there is an increasing focus on sustainability within the industry, with numerous producers adopting organic and biodynamic practices. This trend reflects the growing consumer demand for environmentally friendly products. Market expansion is fuelled by wineries adopting sustainable viticulture practices, reducing chemical usage, and emphasising soil health. With consumers showing a growing interest in the provenance of their wines, brands are actively promoting their sustainability efforts. This shift not only addresses market demands but also strengthens brand loyalty and appeals to environmentally conscious consumers. In October 2023, Accolade Wines launched a revolutionary sustainable packaging initiative for the Australian wine industry: Wise Wolf by Banrock Station, crafted from 91% recycled glass. This visually striking bottle has become one of the most sustainable glass wine bottles on the market, designed to satisfy the rising consumer demand for eco-friendly packaging without compromising on taste.Diverse Varietals and Styles

The Australia wine market is experiencing growth as winemakers increasingly explore a wider range of grape varietals and styles beyond traditional favourites like Shiraz and Chardonnay. The Australia wine market dynamics and trends are influenced by a resurgence of lesser-known varietals like Grenache and Sangiovese, attracting adventurous consumers seeking unique tasting experiences. Producers are experimenting with different regions and innovative winemaking techniques, enhancing the complexity and attractiveness of their offerings. This diversity not only draws a broader audience but also positions Australia as a vibrant player in the global wine market. According to Wine Australia, there are an estimated 2,156 wineries and around 6,000 grape growers employing 163,790 full- and part-time staff across 65 winegrowing regions, contributing over $45 billion annually to the Australian economy.Opportunities in the Australia Wine Market

Health Consciousness and Lower Alcohol Options

The Australia wine market is experiencing growth as consumer health consciousness rises, leading to increased demand for lower alcohol and healthier wine options. Many wineries are responding by producing lower-alcohol wines, organic selections, and even alcohol-free alternatives, reflecting the growing interest in wellness and balanced lifestyles. The demand is fueled by wineries investigating new production techniques that maintain flavour while decreasing alcohol levels. This shift not only caters to health-conscious consumers but also generates new market opportunities, enabling brands to broaden their product ranges and reach a larger audience. In August 2024, OzHarvest launched a non-alcoholic blueberry wine called Conscious Drink, developed in partnership with a major blueberry cooperative. This innovative beverage tackled landfill waste while supporting those experiencing homelessness by repurposing low-grade fruit that would otherwise be discarded, with the Oz Group cooperative donating 40 kilograms of second-grade blueberries each week to OzHarvest.Market Restraints

The Australia wine market faces several key restraints, including climate change, which threatens grape quality and yield due to extreme weather. Regulatory challenges complicate compliance, especially for smaller wineries. Intense market competition from international brands pressures local producers. Changing consumer preferences towards health-conscious options and alternative beverages further complicate traditional wine sales.Labour shortages, economic fluctuations, supply chain disruptions, and stringent environmental regulations add to operational difficulties. Additionally, rising health trends necessitate diversification into lower-alcohol products. Lastly, market saturation increases competition for shelf space, making it challenging for new entrants to establish a foothold in the industry.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- Sparkling Wine

- Still Wine

- Fortified Wine and Vermouth

Market Breakup by Colour

- Red Wine

- Rose Wine

- White Wine

Market Breakup by Distribution Channel

- Hypermarket and Supermarket

- Speciality Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Wine Market Share

By Product Type Insights

The Australia wine market benefits from the strong celebratory appeal of sparkling wine, which is often linked to special occasions, resulting in increased sales during holidays and events. Its variety of styles, such as Champagne, Prosecco, and Cava, attracts a broad consumer audience. Sparkling wine is expected to grow at a CAGR of 4.4% during the forecast period. Additionally, sparkling wines complement various dishes, enhancing dining experiences. The growing popularity among younger consumers and the tourism boost from sparkling wine regions. In October 2023, Chandon Australia launched its new sparkling wine, “Chandon Vintage Brut,” highlighting the artistry of traditional méthode champenoise. The launch event featured food pairings and live music, showcasing the wine's elegance and complexity, aimed at attracting both enthusiasts and casual drinkers.The Australia wine market reaps benefits from a diverse range of still wine varietals, catering to various consumer tastes. Many Australian still wines have achieved international acclaim, boosting the country's reputation on the global stage. Their adaptability for food pairings makes them favoured options in both restaurants and homes. Additionally, the sustainable practices embraced by wineries appeal to environmentally conscious consumers, while strong domestic demand encourages innovation and new opportunities. In September 2024, Leeuwin Estate unveiled its latest still wine, “Art Series Cabernet Sauvignon 2021,” which garnered excellent reviews for its rich flavour profile. The launch celebrated the estate's dedication to quality and craftsmanship, reinforcing its status as a leading producer in the Margaret River region.

By Colour Analysis

The Australia wine market benefits from red wine, which offers several advantages, including health associations linked to antioxidants that appeal to health-conscious consumers. Its versatility enhances dining experiences, making it a popular choice in restaurants. Furthermore, numerous red wines possess remarkable ageing potential, appealing to collectors. Renowned varietals such as Shiraz bolster Australia’s international standing, while a wide range of options caters to different palates, influencing industry revenue. In August 2024, Penfolds launched its new “Bin 389 Cabernet Shiraz 2021,” showcasing a harmonious blend of varietals celebrated for their complexity. The release event highlighted the wine’s bold character and ageing potential, reaffirming Penfolds’ position as a leader in Australia’s red wine market.The Australia wine market benefits from rosé wine, which enjoys considerable seasonal appeal, particularly during warmer months, making it a favourite for summer gatherings. Its versatility in food pairings attracts a wide audience. The market is benefiting from the increasing popularity of rosé, particularly among younger consumers. Its range of styles and sweetness levels allows producers to meet various preferences, while its aesthetic appeal boosts brand visibility on social media platforms. In July 2023, Innocent Bystander launched its new “Moscato Rosé 2023,” celebrating refreshing summer flavours. The launch included a vibrant tasting event, pairing the wine with local cuisine, aimed at attracting a younger audience seeking a versatile, food-friendly option for the warmer months.

By Distribution Channel Insights

The Australia wine market benefits from speciality wine stores that enhance the shopping experience with knowledgeable staff who provide personalised recommendations. These stores offer curated selections of unique, high-quality wines, catering to enthusiasts. By organising tasting events and workshops, they encourage community engagement and loyalty, while also highlighting local wines and niche markets to cater to specific consumer preferences, thereby increasing demand in the Australia wine market. In September 2024, Vintage Cellars opened a flagship speciality wine store in Melbourne, showcasing a wide range of local and international wines. The grand opening included tastings and expert sessions, aiming to create a community hub for wine lovers and highlight their curated selections.The Australia wine market also benefits from the convenience of online wine shopping, allowing consumers to browse and purchase from home. E-commerce platforms offer a wider selection of wines, including rare finds not available locally. Consumers can easily compare prices and reviews, helping them make informed decisions. Industry revenue is increasing due to direct shipping and exclusive online promotions, making the online purchase of wine more appealing. In October 2024, Vinomofo launched an upgraded online platform that enhances user experience through improved navigation and personalised wine recommendations, allowing customers to easily explore a wider selection of wines and access exclusive online deals, targeting the expanding e-commerce market.

Australia Wine Market Regional Insights

New South Wales Wine Market Regional Insights

New South Wales (NSW) is home to several wine regions, including Hunter Valley and Mudgee, providing a wide array of styles and varietals to cater to various consumer preferences. In 2022, NSW produced around 69 million litres of wine, ranking it among the largest wine-producing states in Australia. The region boasts over 1,600 registered wineries and approximately 2,300 grape growers, contributing to a rich diversity of wine styles.Queensland Wine Market Trends

According to the Australia wine market analysis, Queensland features several emerging wine regions, including the Granite Belt and South Burnett, which are increasingly being recognised for their unique varietals and high-quality wines. Queensland is expected to grow at a CAGR of 3.5% during the forecast period. In 2022, Queensland produced around 5 million litres of wine, with steady growth anticipated as the industry evolves. The state hosts over 150 wineries and approximately 300 grape growers, supporting a vibrant wine community.Western Australia Wine Market Dynamics

Western Australia (WA) is home to several prestigious wine regions, including Margaret River and Swan Valley, celebrated for their high-quality wines across a range of varietals. Western Australia is expected to grow at a CAGR of 4.4% during the forecast period. In 2022, WA produced approximately 14 million litres of wine, with steady growth anticipated in the years ahead. The state boasts around 900 wineries and over 1,500 grape growers, fostering a dynamic wine community.Competitive Landscape

The Australia wine market key players are recognised for their focus on quality and innovation, producing a wide variety of wines. They prioritise sustainability and eco-friendly practices in both vineyards and production. Exporting to over 50 countries, these companies highlight the richness of Australian wine, earning numerous awards for their craftsmanship and excellence.Key Industry Players

Treasury Wine Estates Ltd.: Established in 2011, Treasury Wine Estates Ltd. is a leading global wine company headquartered in Melbourne, Australia. It owns iconic brands such as Penfolds and Wolf Blass, focusing on quality and innovation in wine production while serving markets worldwide.Accolade Wines Australia Limited: Accolade Wines, founded in 2010, is one of the largest wine companies globally, headquartered in Adelaide, Australia. The company boasts a diverse portfolio of brands, including Hardys and Grant Burge, and is committed to sustainable practices and quality winemaking across various wine styles.

Casella Wines Pty Limited: Founded in 1960, Casella Wines Pty Limited is an Australian wine producer based in Yenda, New South Wales. Known for its successful Yellow Tail brand, the company focuses on producing high-quality wines and has gained a strong international presence in the wine market.

Pernod Ricard S.A.: Established in 1975, is a French multinational beverage company headquartered in Paris. Known for its extensive portfolio of premium wines and spirits, including Jacob's Creek and Campo Viejo, it operates in over 80 countries, emphasizing innovation and sustainability in the beverage industry.

Other key players in the Australia wine market report are Australian Vintage Limited, Kingston Estate Wines Pty Ltd., De Bortoli Wines Pty Limited, Qualia Wine Services Pty Ltd., Andrew Peace Wines, Nugan Estate Pty Limited and Zilzie Wines among others.

Recent Development

July 2024: Kangaroo Ridge Wines launched its latest sustainable product, "Eco Reserve Shiraz," made from organic grapes sourced from their local vineyard. This luxury wine prioritises environmentally friendly practices, showcasing Australia’s unique terroir. The launch event included a tasting paired with local cuisine, celebrating both sustainability and craftsmanship.November 2023: Mandoon Estate introduced its premium "Sustainable Selection" range, which features wines created with minimal environmental impact. Focusing on organic farming and renewable energy in the production process, this luxury line is designed to attract eco-conscious consumers. The launch featured an exclusive tasting event, highlighting the estate's dedication to quality and sustainability.

Table of Contents

Companies Mentioned

- Treasury Wine Estates Ltd.

- Accolade Wines Australia Limited

- Casella Wines Pty Limited

- Pernod Ricard S.A.

- Australian Vintage Limited

- Kingston Estate Wines Pty Ltd.

- De Bortoli Wines Pty Limited

- Qualia Wine Services Pty Ltd.

- Andrew Peace Wines

- Nugan Estate Pty Limited

- Zilzie Wines

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

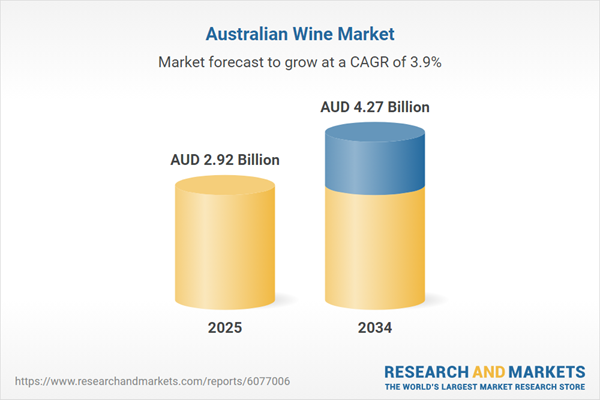

| Estimated Market Value ( AUD | $ 2.92 Billion |

| Forecasted Market Value ( AUD | $ 4.27 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 11 |