Funds granted by the governments all around the globe significantly generate demand in the auto parts manufacturing market. The United States Department of Energy has already invested USD 13 million in grants toward domestic EV parts production. Similarly, India’s Production Linked Incentive (PLI) Scheme for Auto Components has attracted companies, with INR 25,938 crore earmarked to ramp up the manufacturing of critical parts like advanced batteries and EV motors. The market growth is further accelerated by tech-savvy manufacturers investing heavily in automation, sustainability, and AI-driven production.

The surge in demand for lighter, durable components compatible with EVs and hybrids is creating fresh growth opportunities for auto parts manufacturing companies. Firms are integrating 3D printing and digital twin technology to reduce lead times and prototype costs. For instance, Spanish-based manufacturer, Gestamp, is harnessing the capabilities of LTE and 5G networks as well as IoT-based devices for the development of a smart factory that relies on data analytics and processing for the real-time control and processing of the auto parts, thereby propelling the auto parts manufacturing market growth. This initiative, funded by the European Union, is aimed at promoting digitalisation in the automotive sector of the country.

Key Trends and Recent Developments

May 2025

Toyota Kirloskar Motor opened a new dealership called Preet Toyota in Assam. Toyota's ongoing commitment to improving accessibility, building consumer trust, and meeting the rising need for mobility solutions in developing regional markets is demonstrated by the new facility. This development expands the addressable market for regional auto part suppliers by accelerating vehicle parc growth in underserved Northeast India.January 2025

Magna established a production plant in Chakan, Maharashtra, to create mirrors and latches for western Indian automakers. Over 300 jobs are anticipated to be created by the 65,000 square foot plant over the course of the next three years. This facility strengthens Tier 1 supply chain capacity in Western India, aligning with OEM localisation strategies and rising demand for precision parts like latches and mirrors.January 2024

As part of Compolive project, Ford announced to use olive tree waste such as branches, twigs, and leaves for the manufacture of sustainable auto parts to reduce plastic usage and promote sustainability. Such an initiative signals a growing shift towards bio-composites in part manufacturing, encouraging suppliers to innovate with agri-waste materials and meet sustainability benchmarks.January 2024

LKQ Euro Car Parts, a car parts and accessories provider in the auto parts manufacturing market, announced to establish a partnership with Protyre Autocare, as an aftermarket auto parts supplier for a 5-year duration. This underscores the consolidation trend in the aftermarket category, enhancing distribution efficiency and creating long-term volume opportunities for replacement part makers.Electrification Driving Modular Component Innovation

The rapid shift towards EVs has compelled companies to restructure components, indirectly impacting the auto parts manufacturing market development. For instance, Tesla’s gigacasting technique now replaces up to 70 individual parts with a single casting. This trend towards modularisation is emerging in this space, especially in China and Germany. Moreover, the EU Commission reports that EVs could make up 55% of total vehicle sales by 2030. This shift compels manufacturers to invest in new tooling, materials, and assembly lines. Modular parts also reduce maintenance costs, which happens to be a critical B2B selling point for fleet operators.Government Push for Localization of Parts Supply Chains

Global trade tensions have resulted in increased local production, stimulating the auto parts manufacturing market value. Recently, the EU launched the Critical Raw Materials Act to secure supply chains for EV components. Meanwhile, the United States Inflation Reduction Act incentivises domestic part production for clean energy vehicles. OEMs prefer local partners to recommend shipping costs and meet ESG targets. Suppliers embracing regional micro-factories and on-demand production, are witnessing faster client acquisition cycles, especially among Tier 1 manufacturers.3D Printing Accelerating Component Prototyping and Production

3D printing has become a popular trend in the auto parts manufacturing market. Companies like Ford use 3D-printed components for assembly jigs and even functional parts in select models. According to SmarTech Analysis, the automotive 3D printing market is expected to exceed USD 9 billion by 2029. Companies like BMW are integrating additive manufacturing into its Mini lineup to offer bespoke parts. This trend allows auto parts manufacturers to respond faster to unique OEM demands, improving turnaround times significantly.Smart Components and Sensor-Embedded Systems

The rise of connected vehicles has catalysed demand for smart components, reshaping the auto parts manufacturing market dynamics. For instance, Bosch offers sensor-laden steering systems that feed real-time road data to onboard computers, which has become critical for driver safety. Manufacturers are embedding microprocessors in shock absorbers, brake systems, and filters, further adding value through diagnostics. OEMs now seek suppliers who can co-develop intelligent subsystems.Lightweighting with Advanced Composites

Automakers are demanding components made from carbon fibre and magnesium alloys to improve fuel efficiency. In September 2023, in Japan, Toray Industries has partnered with Honda to develop ultra-light yet strong parts for next-gen vehicles. According to the United States Department of Energy, reducing vehicle weight by 10% can improve fuel economy by 6-8%. Suppliers able to deliver these advanced materials experience increased contracts from premium automakers like Audi and Lexus, who prioritise performance without environmental trade-offs.Global Auto Parts Manufacturing Industry Segmentation

The report titled “Global Auto Parts Manufacturing Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Component

- Battery

- Cooling System

- Compressor

- Radiator

- Pump

- Thermostat

- Underbody Components

- Brake Components

- Exhaust Components

- Engine Components

- Starter

- Pump

- Engine

- Alternator

- Automotive Filter

- Lighting Components

- Electrical Components

- Ignition Coil

- Ignition Switch

- Spark and Glow Plug

- Chassis System

- Transmission and Steering System

- Others

Market Breakup by Sales Channel

- OEM

- Aftermarket

Market Breakup by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Auto Parts Manufacturing Market Share

By Component, Engine Components Secure a Substantial Share of the Market

Engine components continue to hold the dominant share in the industry largely due to hybrid vehicle proliferation. Despite the booming EV sector, BEV and PHEV sales increased by 35% in 2023, led by markets like Japan and the United States. Engine blocks, pistons, and turbochargers are evolving with their lightweight nature and smart features. For instance, Mahle’s Smart Cylinder Head is integrated with sensors for real-time thermal monitoring.Battery parts have emerged to be the fastest-growing component accelerating the market revenue. As per the auto parts manufacturing market analysis, the global EV battery component market recorded USD 64.36 billion in 2024 and is projected to grow at a 19.20% CAGR over the forecast period. Companies like Panasonic and CATL are investing in modular battery casings with built-in cooling systems. Government initiatives are also fuelling this category’s growth. For example, India’s ACC PLI scheme and South Korea’s USD 15.1 billion battery subsidy plan have fast-tracked innovation. Automotive part manufacturers focusing on solid-state separators and thermal interface materials are attracting Tier 1 contracts.

By Sales Channel, OEM Account for the Dominant Share of the Market

OEMs account for the dominant share of the global industry as automakers prefer integrated supply chains. Tier 1 suppliers like Magna, Bosch, and Denso are being looped into co-development cycles for newer models. Contracts have been made significantly longer, often 5-10 years, allowing component firms to plan R&D activities. For instance, Hyundai’s MoU with LG Energy Solution, signed in May 2023, to build an EV battery cell plant in Karawang, near the Indonesian capital Jakarta has been one of the significant developments in this segment. OEM demand is especially strong in the EV sector, where real-time co-design helps reduce prototyping errors and recalls.Aftermarket channels are witnessing fast-paced growth in the auto parts manufacturing market. The average vehicle age in the United States hit a record of 12.5 years in 2023. Hence, parts remanufacturing demand, especially for EVs and hybrids, is growing rapidly. EU regulations now allow reuse of battery modules and motors. Aftermarket players like LKQ are integrating blockchain-based verification for component traceability. This trust factor has sparked B2B demand among fleet operators and insurance repair chains looking for quality-certified, cost-effective replacements.

By Vehicle Type, Passenger Cars Hold the Leading Position in the Market

Passenger cars significantly dominate the global industry revenue. Urbanisation and rising middle-class incomes in Asia, especially India and Indonesia have been the key motivators of the surging global demand. For example, in FY2025, India alone produced 4.3 million passenger units. Compact SUVs with advanced infotainment and safety systems require more parts per vehicle. From drive-assist modules to electronic mirrors, the component count per car is rising. OEMs are launching more variants annually, pushing suppliers to diversify SKUs and speed up tooling cycles.The booming e-commerce sector is driving the LCV category’s dominance in the auto parts manufacturing market shares. Ford’s E-Transit and Rivian’s delivery fleet are major examples. The commercial push has entailed the demand for robust, long-life auto parts, including upgraded suspension, drivetrain cooling, and modular cargo systems. Suppliers innovating in regenerative braking and thermal management are well-positioned to grow in this space.

Global Auto Parts Manufacturing Market Regional Analysis

By Region, Asia Pacific Registers the Dominant Market Share

Asia Pacific continues to be the dominant regional market for auto parts manufacturing. China, India, and Japan collectively manufacture over 60% of global vehicles. The country’s push for NEVs (new energy vehicles) has turbocharged auto component demand. Companies like BYD and Geely are signing billion-dollar supply contracts with local parts makers. India’s 2023 vehicle parts export recorded USD 21.1 billion, with Europe and the United States as top buyers. Policies like Japan’s Green Innovation Fund are pushing for carbon-neutral part production. B2B buyers in the region are shifting from price-sensitive to tech-sensitive sourcing.The auto parts manufacturing market in North America is also anticipated to gain a sizeable share during the forecast period, owing to the presence of some of the leading global automotive companies in the region. The regional market growth is supported by the rising usage of advanced technologies by vehicle manufacturers owing to the region’s superior production capabilities, state of the art infrastructure, and technological know-how.

Competitive Landscape

Leading auto parts manufacturing market players like Bosch, ZF Friedrichshafen, and Aisin are focusing on electrification, sensor integration, and sustainable production. Strategic collaborations with OEMs have become the new strategies for growth. Startups in AI-driven part inspection and recycling-based manufacturing are disrupting the traditional tiers. Companies are also investing in digital twins, traceability technology, and cloud-based supply chain platforms. Auto parts manufacturing companies are steadily incorporating sustainable auto parts, which are manufactured from tree waste to reduce their dependency on plastics and biocomposites. These sustainable auto parts reduce waste generation and contribute to the circular economy by reusing waste tree parts which are discarded. Furthermore, tests have shown that these auto parts are durable and robust and can be incorporated into vehicles for mass production, opening new avenues and creating opportunities for further development.Robert Bosch GmbH

Robert Bosch is a multinational engineering technology company in automotive parts industry, based in Gerlingen, Germany. Founded in 1886, the company offers smart building solutions, carbon neutrality solutions, and hydrogen technology, among others.DENSO CORPORATION

DENSO is an automotive component provider, headquartered in Aichi, Japan. Some of its specialties include electric/hybrid components, human-machine interfaces, wireless charging, and robotics, among others.Continental AG

Continental AG is an automotive parts manufacturer in the automotive sector, based in Hanover, Germany. Incorporated in 1871, the company offers efficient and cutting-edge solutions for the mobility and transport sectors.Valeo

Valeo, a French-based auto parts company, known for its innovations in electric systems, ADAS technologies, and thermal management. The company also focuses on sustainable mobility and partnerships with major automakers. The firm announced that it is expanding its operations in Tamil Nadu, India, to strengthen its position in the Indian subcontinent.Other key players in the market are ZF, Friedrichshafen AG, Hyundai Motor Group, Aisin Corporation, Magna International Inc., Lear Corporation, Yazaki Group, Tenneco Inc., Sumitomo Electric Industries, Ltd., Akebono Brake Industry Co., Ltd., Panasonic Holdings Corporation, Faurecia S.E., and Marelli Holdings Co., Ltd, among others.

Key Highlights of the Global Auto Parts Manufacturing Market Report:

- Historical performance and accurate forecasts through 2034.

- Emerging use of additive manufacturing for rapid prototyping of transmission and drivetrain parts.

- Profiling of key Tier 1 suppliers and OEM-affiliated part makers across NAFTA, EU, and ASEAN regions.

- Investment-centric lens with detailed CAPEX trends in EV-centric machining and automated tooling plants.

- Dedicated analysts with deep expertise in mobility supply chains and automotive value systems.

- Intelligence fine-tuned to align with procurement cycles, production capacities, and sourcing preferences.

- Multilayered research approach combining patent data, regulatory updates, and import-export flows.

- Practical, boardroom-ready insights built on scenario modelling and supplier benchmarking.

Table of Contents

Companies Mentioned

The key companies featured in this Auto Parts Manufacturing market report include:- Robert Bosch GmbH

- DENSO CORPORATION

- Continental AG

- ZF Friedrichshafen AG

- Hyundai Motor Group

- Aisin Corporation

- Magna International Inc.

- Valeo

- Lear Corporation

- Yazaki Group

- Tenneco Inc.

- Sumitomo Electric Industries, Ltd.

- Akebono Brake Industry Co., Ltd.

- Panasonic Holdings Corporation

- Faurecia S.E.

- Marelli Holdings Co., Ltd

Table Information

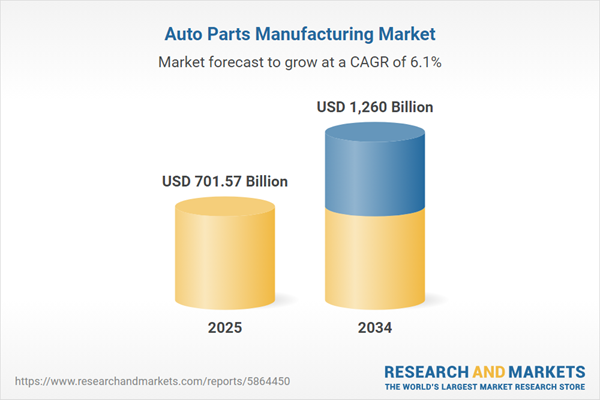

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 701.57 Billion |

| Forecasted Market Value ( USD | $ 1260 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |