For the office market, nationwide net absorption is estimated to reach 6.2 million square meters in 2022, well above the five-year average of 5.3 million square meters. Technology and finance sectors are expected to continue being the primary drivers of office demand.

Key Highlights

- COVID-19 significantly impacted China's commercial real estate market. This is due to high vacancy rates in offices and shopping malls in major cities such as Beijing, Shanghai, Guangzhou, and Shenzhen.

- Additionally, the slowing economy has led to a decline in demand for offices and shopping malls, followed by a drop in customer flows, impacting shopping mall rental charges. It is estimated that China's economy will normalize in 2022, with a GDP growth of roughly 5% Y-o-Y. Counter-cyclical policies and structural transformations are being implemented to ensure sustained growth.

- Logistics net absorption is estimated to exceed 6 million square meters for the second year in 2022 due to the increase in space take-up by e-commerce companies, third-party logistics expansion, and the introduction of the Regional Comprehensive Economic Partnership (RCEP) scheme. Further, more cities in China are expected to shift to a balanced or landlord-favourable markets.

China Commercial Real Estate Market Trends

Technology and Innovation Driving the Market

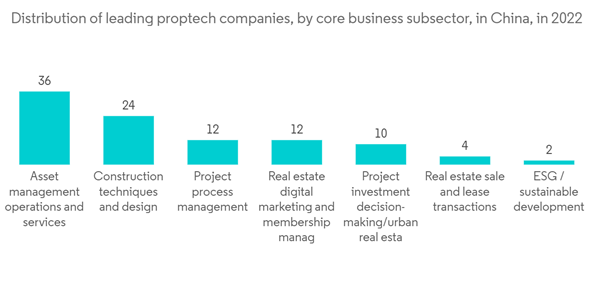

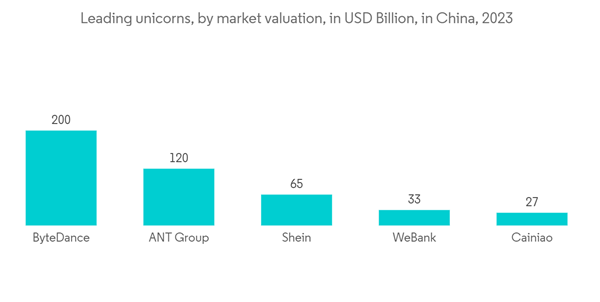

With a growing requirement for technology adoption, Chinese real estate companies are using a variety of innovative approaches to improve their technical skills while remaining competitive. Additionally, some prominent Chinese commercial real estate developers have partnered with internet and tech giants such as Alibaba, Tencent, JD, and Huawei to increase the adoption of property technology for efficient business operations. These developers can take advantage of the R&D capabilities of the tech companies while sharing business insights and giving physical space and financial resources as part of the partnership.Chinese consumers' preferences are driving China's innovation in real estate. China has emerged as a major player in many digital technologies, particularly in consumer-facing industries and Fintech. Regarding the number of unicorns and valuations, China's property technology market is catching up to that of the United States. Moreover, 75% of property technology start-ups are in Beijing, Shanghai, Shenzhen, and Hangzhou.

Companies in Tier 1 cities are more likely to be early adopters of property technology solutions. These customers are associated with the brand, the quality of the product, the level of service, and personalized engagement. Customers will begin to demand omnichannel options and experiences as Alibaba's Hema and other similar retail innovations become more prevalent.

Property technology start-ups with data on customers, properties, sales, and business operations can use it to build new product offerings and assist businesses with decision-making. Chinese start-ups may lead the world in consumer-facing property technology, physical retail innovation, and 5G-related applications.

Growth in Start-ups Driving the Office Market

As of 2021, the sectors with the most unicorns in China were technology and telecommunications, transportation and logistics, and the finance or insurance sector. Chinese unicorns in the finance or insurance sector have a significantly higher market valuation than start-ups from other sectors.Currently, China has 4,762 national-level giant companies and over 40,000 provincial-level giant firms. More than 300 little giant companies, such as XGIMI, are listed on various exchanges. Even during the COVID-19 pandemic, they maintained a positive growth rate and relatively high capital expenditure, demonstrating that such companies were less affected by the pandemic while continuing to grow rapidly.

The Ministry of Industry and Information Technology announced in March 2022 that it would support incubating an additional 3,000 little giant companies this year. China aims to create 10,000 little giant companies and 1,000 single-product champion enterprises in two years. By that time, similar companies are expected to contribute to innovations and provide momentum to China's future economic growth.

China Commercial Real Estate Industry Overview

The Chinese commercial real estate market is slightly fragmented, with the presence of a large number of players. Some of the major players include Wanda Group, GreenLand Group, Seazen, and CapitalLand. The market is characterized by the presence of large players and emerging players in the market. At the same time, players in the residential real estate market are also diversifying to invest in the commercial real estate market in China. Foreign investment has increased, so foreign players are also entering the competitive scene.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Wanda Group

- Greenland Business Group

- Seazen Holdings Co. Ltd

- CapitaLand

- Longfor

- China Resources Land Limited

- Powerlong Real Estate Holdings Limited

- China Aoyuan Group Ltd

- Wharf Real Estate Investment Company Limited

- Sun Hung Kai Properties Limited

- Henderson Land Development Company Limited

- Prologis*