Global Epidermolysis Bullosa Therapeutics Market - Key Trends and Drivers Summarized

Epidermolysis Bullosa (EB) is a rare, inherited connective tissue disorder that results in the skin being extremely fragile and prone to blistering and tearing from minor friction or trauma. The severity of EB can vary widely, with some forms being life-threatening. Current therapeutic approaches primarily focus on managing symptoms and preventing complications, such as infections and chronic wounds. Traditional treatments include wound care, pain management, nutritional support, and infection control. However, recent advancements in gene therapy, protein replacement therapy, and stem cell therapy offer promising new avenues for more effective and targeted treatments. Researchers and pharmaceutical companies are actively exploring these innovative approaches to address the underlying genetic causes of EB, aiming to improve the quality of life for patients significantly.The market for Epidermolysis Bullosa therapeutics has been witnessing significant developments driven by technological advancements and a deeper understanding of the disease's genetic basis. One of the major trends is the increasing focus on gene editing technologies, such as CRISPR-Cas9, which have shown potential in correcting genetic mutations responsible for EB. Additionally, protein replacement therapies, which aim to restore the missing or dysfunctional proteins in EB patients, are also gaining traction. Stem cell therapy represents another promising frontier, with clinical trials exploring the use of stem cells to regenerate healthy skin tissue. Furthermore, there is a growing trend towards personalized medicine, where treatments are tailored to the specific genetic mutations and characteristics of individual patients. This approach not only enhances treatment efficacy but also minimizes potential side effects.

The growth in the Epidermolysis Bullosa therapeutics market is driven by several factors. Technological advancements in gene therapy, protein replacement therapy, and stem cell therapy are expanding the treatment options available for EB, thereby driving market growth. The rising prevalence of EB, coupled with increased awareness and early diagnosis, is also contributing to the growing demand for effective therapies. Additionally, substantial investments in research and development by pharmaceutical companies and academic institutions are fostering innovation and accelerating the development of new treatments. Regulatory support, including orphan drug designations and fast-track approvals, is encouraging the development of EB therapies. Furthermore, the increasing adoption of personalized medicine approaches is generating demand for targeted and individualized treatments. Lastly, patient advocacy groups and public health initiatives are playing a crucial role in raising awareness and driving the adoption of new therapies, ultimately contributing to the market's expansion.

Report Scope

The report analyzes the Epidermolysis Bullosa Therapeutics market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Antibiotics, Analgesics, Other Product Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Antibiotics segment, which is expected to reach US$4.0 Billion by 2030 with a CAGR of a 9.3%. The Analgesics segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Epidermolysis Bullosa Therapeutics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Epidermolysis Bullosa Therapeutics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Epidermolysis Bullosa Therapeutics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Epidermolysis Bullosa Therapeutics market report include:

- Abeona Therapeutics

- Aegle Therapeutics

- Alphyn Biologics

- Castle Creek Biosciences, Inc.

- Chiesi Global Rare Disease

- Eloxx Pharmaceuticals Inc

- Holostem Terapie Avanzate Srl

- InMed Pharmaceuticals Inc.

- Krystal Biotech

- Prime Therapeutics

- Quoin Pharmaceuticals

- RegeneRx Biopharmaceuticals, Inc.

- RHEACELL

- Shionogi & Co., Ltd.

- TWI Biotechnology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abeona Therapeutics

- Aegle Therapeutics

- Alphyn Biologics

- Castle Creek Biosciences, Inc.

- Chiesi Global Rare Disease

- Eloxx Pharmaceuticals Inc

- Holostem Terapie Avanzate Srl

- InMed Pharmaceuticals Inc.

- Krystal Biotech

- Prime Therapeutics

- Quoin Pharmaceuticals

- RegeneRx Biopharmaceuticals, Inc.

- RHEACELL

- Shionogi & Co., Ltd.

- TWI Biotechnology, Inc.

Table Information

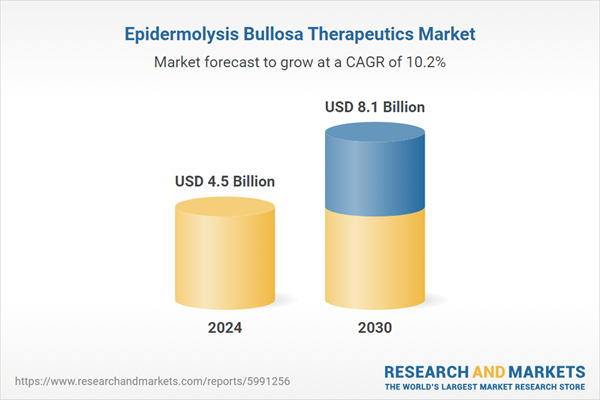

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |