Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

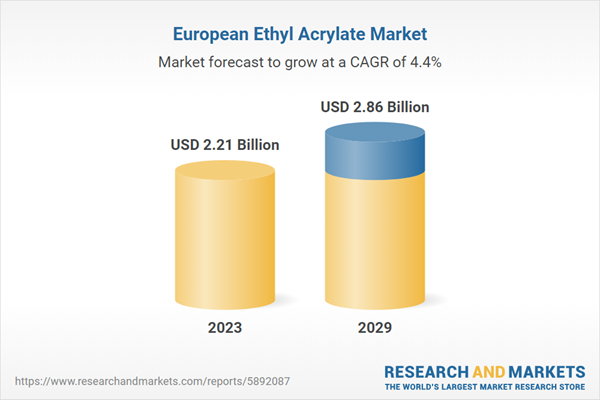

Among these, ethyl acrylate stands out as a versatile chemical compound, finding extensive applications in various industries such as textiles, construction, adhesives, and coatings. The European market for ethyl acrylate is poised for substantial growth in the coming years, driven by a multitude of factors. The increasing demand from end-use industries, coupled with technological advancements and sustainability initiatives, is expected to fuel this growth.

It is worth noting that the price trends in the European market for ethyl acrylate have shown fluctuations. In the fourth quarter of 2022, the prices experienced a decrease, averaging around USD 2992 per ton in Germany. However, the market has demonstrated remarkable resilience and adaptability to changing dynamics.

With the continuously increasing industrial applications, ongoing technological advancements, and sustainability efforts, the market is expected to experience continued growth. Manufacturers are actively investing in research and development to innovate new applications and improve production processes, catering to the evolving needs of end-use industries. This commitment to innovation and adaptability positions the European ethyl acrylate market for a bright and prosperous future.

Key Market Drivers

Growing Demand of Ethyl Acrylate in Manufacturing of Plastics and Polymers

Ethyl acrylate, a versatile chemical compound, is experiencing a remarkable surge in demand across various industries in Europe, particularly in the plastics and polymers sector. This increased demand can be attributed to its wide range of applications, its favorable properties, and the growing emphasis on sustainable and eco-friendly materials. With its extensive use in the manufacturing of plastics and polymers, ethyl acrylate serves as a vital raw material in the production of acrylic polymers. These acrylic polymers find applications in diverse industries such as packaging, automotive, construction, textiles, and more.In Europe, the plastics industry is substantial, with a turnover of approximately USD 421.32 billion in 2021, encompassing over 52,000 companies and providing employment to more than 1.5 million people. The packaging sector is the largest consumer of plastics in Europe, accounting for 39.1% of the total demand in 2021.

By incorporating ethyl acrylate, these materials acquire desirable characteristics including flexibility, durability, weather resistance, and impact strength, making it an indispensable component in the manufacturing process. The growing popularity of ethyl acrylate in the plastics and polymers industry can be attributed to several advantageous properties it possesses. It exhibits excellent adhesion, minimal shrinkage, and exceptional thermal stability, enhancing the overall performance and quality of the end products. These remarkable properties make ethyl acrylate an ideal choice for various applications, including coatings, adhesives, sealants, and elastomers.

The increasing demand for ethyl acrylate in the manufacturing of plastics and polymers, driven by its favorable properties and the need for sustainable materials, has propelled the ethyl acrylate market in Europe. Manufacturers in Europe are actively investing in research and development to innovate new applications and improve the efficiency of production processes. This focus on innovation and sustainability is expected to drive further growth in the market, positioning Europe at the forefront of the ethyl acrylate industry.

The European Union's stringent environmental regulations and the industry's commitment to sustainability have led to significant investments in recycling technologies. In 2021, about 5.5 million tonnes of post-consumer recycled plastics were reintroduced into the EU economy, marking an increase of approximately 20% compared to 2020. Ethyl acrylate's compatibility with these recycling processes further enhances its appeal in the market. These factors collectively drive the growing demand for ethyl acrylate in the manufacturing of plastics and polymers across Europe.

Growing Demand of Ethyl Acrylate in Construction Industry

The construction industry is currently experiencing a significant boom, with numerous infrastructure and building projects happening throughout Europe. Ethyl acrylate, due to its versatile nature and desirable properties, plays a crucial role in this sector. One area where ethyl acrylate is particularly important is in the production of flexible packaging materials, such as films and laminates. These materials have gained popularity in recent years because of their convenience and sustainability.Ethyl acrylate-based materials offer superior resistance to moisture, chemicals, and UV radiation, making them ideal for critical construction applications like roofing, insulation, and protective coatings. The EU's regulatory focus on sustainable construction practices has further propelled the demand for materials that align with its goals. For instance, under the European Green Deal, the EU aims to reduce greenhouse gas emissions by at least 55% by 2030, driving the adoption of eco-friendly building materials. Ethyl acrylate supports these efforts by enabling water-based coatings and adhesives that significantly reduce VOC emissions, meeting the standards outlined in EU Directive 2004/42/EC on VOC limitations in construction products. These eco-friendly solutions not only enhance construction quality but also contribute to regulatory compliance and environmental stewardship, reinforcing ethyl acrylate’s growing relevance in the sector.

Growing Demand of Ethyl Acrylate in Textile Industry

Ethyl acrylate, which is used in the textile industry, is experiencing a significant surge in demand across Europe. This growth can be attributed to several factors, including the expanding textile sector, the increasing need for high-performance materials, and the growing emphasis on sustainability. The textile industry is witnessing a steady growth trajectory, with a rising demand for textiles in various applications such as apparel, home furnishings, and technical textiles.In this industry, ethyl acrylate plays a crucial role due to its unique properties and versatility. It is extensively utilized in the production of coatings, finishes, and binders for textiles, offering enhanced performance characteristics such as water resistance, durability, and flexibility. Beyond its functional benefits, ethyl acrylate-based materials also contribute to the sustainability efforts of the textile industry.

With increasing consumer awareness about environmentally friendly products, there is a growing demand for sustainable textiles. Ethyl acrylate-based materials align with this trend, providing an eco-friendly solution for the industry. To meet the growing demand, manufacturers in Europe are heavily investing in research and development to innovate new applications and improve the efficiency of production processes. They are also exploring ways to further enhance the performance characteristics of ethyl acrylate-based materials, making them even more suitable for various textile applications. The surge in demand for ethyl acrylate within the textile industry is driving the growth of Europe's ethyl acrylate market. With its unique properties, versatility, and contribution to sustainability, ethyl acrylate continues to be a key component in the textile sector, meeting the evolving needs of the industry and consumers alike.

Key Market Challenges

Volatility in Pricing and Supply of Ethyl Acrylate

The Europe ethyl acrylate market faces a significant challenge due to the volatility in pricing and supply of this chemical compound. Fluctuations in feedstock prices, such as ethanol and acrylic acid, directly influence the production cost of ethyl acrylate. Changes in crude oil prices also impact the costs of raw materials, as ethyl acrylate is petroleum-based. Any disruptions or fluctuations in these inputs can lead to price hikes or shortages in the market. For instance, recent analytics highlighted the price increase of ethyl acrylate in the German market, reaching USD 1999 per ton. The volatile financial markets and growing supply chain challenges have contributed to this pricing fluctuation. This price increase has been attributed to various factors, including the rising demand from industries such as adhesives, coatings, and textiles.The unpredictable nature of pricing and supply poses challenges for both buyers and manufacturers in Europe's ethyl acrylate market. Buyers face difficulties in planning their budgets and managing costs, as the prices of ethyl acrylate can impact their profitability and competitiveness. Manufacturers, on the other hand, struggle to maintain stable production levels and meet the demands of end-use industries when faced with supply shortages or rise in prices.

Growing Health and Safety Considerations

One of the primary concerns regarding ethyl acrylate is its potential adverse effects on human health. Exposure to high concentrations of ethyl acrylate vapors or prolonged contact with the skin can cause irritation and sensitization. Inhaling ethyl acrylate fumes can lead to respiratory issues and, in extreme cases, damage to the lungs. These health risks necessitate strict adherence to safety protocols and the implementation of proper control measures in workplaces where ethyl acrylate is handled or processed.Furthermore, ethyl acrylate is a flammable liquid with a low flashpoint, making it susceptible to fire hazards. Careful handling and storage procedures are crucial to minimize the risk of fire or explosion. Adequate ventilation, appropriate personal protective equipment (PPE), and fire safety measures must be in place to ensure the safe handling and storage of this chemical compound. It is also important to note that ethyl acrylate is a volatile compound that can easily evaporate into the air.

This means that not only can it pose risks to workers in direct contact with it, but it can also present hazards to the surrounding environment. Proper containment measures and spill response protocols should be established to prevent environmental contamination and minimize the impact on ecosystems. In summary, understanding and addressing the potential health and safety risks associated with ethyl acrylate is crucial for protecting workers, the environment, and the general public. Implementing comprehensive safety measures and promoting awareness of proper handling practices are essential in minimizing the potential harmful effects of this chemical compound.

Key Market Trends

Surge in Technological Advancements

One of the key areas experiencing significant technological advancements is the production process of ethyl acrylate. Manufacturers are investing in advanced methods and technologies to optimize the production efficiency and reduce the environmental footprint of ethyl acrylate production. For example, innovative reactor designs, catalysts, and process control systems enable better yield, enhanced purity, and reduced energy consumption during the synthesis of ethyl acrylate. These advancements not only improve operational efficiency but also contribute to the overall sustainability of the industry. In addition to the advancements in production, technological innovations are also driving changes in the application of ethyl acrylate.The development of high-performance additives and coatings based on ethyl acrylate has led to improved product properties such as enhanced durability, weather resistance, and adhesion. These advancements open up new possibilities for applications in industries like automotive, aerospace, and marine, where superior performance and protection are crucial.

Advancements in nanotechnology have paved the way for the development of nanocomposites incorporating ethyl acrylate. These nanocomposites offer improved mechanical strength, thermal stability, and barrier properties, expanding the potential applications of ethyl acrylate in various sectors. The integration of ethyl acrylate into nanocomposites enhances performance characteristics and provides opportunities for further innovation and customization.

Technological advancements in the ethyl acrylate market extend beyond production and application processes to sustainability and environmental considerations. Europe's ethyl acrylate market is witnessing the emergence of eco-friendly and bio-based alternatives, driven by advancements in renewable feedstocks and green chemistry principles. These innovations aim to reduce the carbon footprint associated with ethyl acrylate production and contribute to a more sustainable and circular economy.

Digitalization and data-driven technologies are revolutionizing the ethyl acrylate market in terms of supply chain management, quality control, and customer engagement. Real-time monitoring systems, predictive analytics, and automation help optimize production processes, enhance product traceability, and ensure consistent product quality. This enables manufacturers to respond swiftly to market demands, minimize waste, and deliver tailored solutions to customers. The surge in technological advancements not only brings operational benefits but also presents opportunities for market growth and differentiation.

Companies investing in research and development and collaborating with technology partners can gain a competitive edge, meet evolving customer needs, and expand their market share. Additionally, these advancements attract investments and foster innovation ecosystems, stimulating the overall growth and development of the ethyl acrylate market in Europe. As the industry continues to evolve, further advancements are expected to drive even more significant changes, shaping the future of ethyl acrylate production, applications, and sustainability.

Segmental Insights

Grade Insights

Based on grade, the industrial segment emerged as the fastest-growing segment in the Europe market for Ethyl Acrylate in 2023. Industrial-grade ethyl acrylate, a commonly used chemical compound, finds extensive application in various industries such as adhesives, coatings, and textiles. Its widespread usage can be attributed to the consistent and high-volume demands of these industries. Industrial-grade ethyl acrylate is favored for its exceptional functional properties, particularly its role as a crucial monomer in the production of adhesives, coatings, and other industrial products. Its unique ability to polymerize and contribute to the desired properties of end products makes it a preferred choice for many industrial applications.Industries that heavily rely on ethyl acrylate for large-scale manufacturing processes prioritize stable and consistent raw materials. To ensure reliability in production, industrial-grade ethyl acrylate is typically produced to meet specific quality standards, meeting the stringent requirements of these industries. The versatility, reliability, and quality of industrial-grade ethyl acrylate make it an indispensable component in the manufacturing processes of a wide range of industrial applications.

Country Insights

Germany emerged as the dominant region in the Europe ethyl Acrylate Market in 2023, holding the largest market share in terms of value. Germany's focus on research and development, innovation, and technological advancements has been a key driver of the country's strong market position. German companies have consistently invested heavily in developing new formulations, enhancing product performance, and exploring novel applications for ethyl acrylate. This unwavering commitment to innovation has not only helped them stay ahead of the competition but has also solidified their dominance in the industry.Germany's strategic geographical location, nestled in the heart of Europe, coupled with its excellent transportation infrastructure, has provided German manufacturers with a remarkable logistical advantage. This advantage enables them to efficiently distribute ethyl acrylate products throughout the continent, reaching customers in neighboring countries seamlessly. As a result, German manufacturers have established a robust presence in the European market, further reinforcing their position as industry leaders. By continuously pushing the boundaries of research, embracing innovation, and leveraging their logistical strengths, German companies have created a virtuous cycle of success. Their relentless pursuit of excellence and their ability to adapt to changing market dynamics have made them a force to be reckoned with in the global arena.

Key Market Players

- Ernesto Ventós S.A.

- Merck KGaA

- Thermo Fisher Scientific GmbH

- Symrise AG

- ECSA Chemicals AG

- abcr GmbH

- Eastman Chemical B.V.

- Redox Ltd

- Santa Cruz Biotechnology, Inc.

- Ataman Kimya A.S.

By Grade By Application By Country

- Industrial

- Pharmaceutical • Surface Coatings

- Adhesives and Sealants

- Textiles

- Plastic Additives

- Detergents

- Others • Germany

- United Kingdom

- France

- Russia

- Spain

- Italy

- Netherland

- Poland

- Switzerland

- Belgium

Report Scope:

In this report, the Europe Ethyl Acrylate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Ethyl Acrylate Market, By Grade:

- Industrial

- Pharmaceutical

Europe Ethyl Acrylate Market, By Application:

- Surface Coatings

- Adhesives and Sealants

- Textiles

- Plastic Additives

- Detergents

- Others

Europe Ethyl Acrylate Market, By Country:

- Germany

- United Kingdom

- France

- Russia

- Spain

- Italy

- Netherland

- Poland

- Switzerland

- Belgium

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Ethyl Acrylate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ernesto Ventós S.A.

- Merck KGaA

- Thermo Fisher Scientific GmbH

- Symrise AG

- ECSA Chemicals AG

- abcr GmbH

- Eastman Chemical B.V.

- Redox Ltd

- Santa Cruz Biotechnology, Inc.

- Ataman Kimya A.S.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | December 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 2.21 Billion |

| Forecasted Market Value ( USD | $ 2.86 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |