Speak directly to the analyst to clarify any post sales queries you may have.

Governments in the UAE and Saudi Arabia continue to prioritize urban growth and diversification, with Dubai’s long-term 2040 Urban Master Plan and the Saudi Vision 2030-linked mega-projects fuelling ongoing project pipelines that require extensive fleets of earthmoving, lifting, and paving equipment.

KEY HIGHLIGHTS

- Earthmoving equipment accounted for the largest market share of the GCC construction equipment market in 2024. Excavators in the earthmoving segment accounted for the largest share in 2024. The countries in the GCC region are investing in various public infrastructure projects that is expected to drive demand for earthmoving equipment, including crawler excavators.

- On the other hand, demand for material handling equipment is also growing due to the booming manufacturing sector, driving the development of warehouses and logistics parks across the region.

- The forklifts and telescopic handler segment holds the largest share among material handling equipment in the GCC region, driven by ongoing and upcoming warehouse developments. Saudi Arabia is positioning itself as a regional logistics powerhouse with significant warehouse developments across key industrial zones.

- Saudi Arabia's logistics and warehouse sector underwent a rapid transformation, fueled by numerous economic reforms under Vision 2030, surging e-commerce activity, and growing investor confidence. The country has positioned itself as a regional and global logistics powerhouse, with more than $267 billion in investments being planned by 2030 and $53.2 billion already deployed in April 2025.

- The road construction equipment segment is estimated to reach $24.7 million by value by 2030, growing at a CAGR of 3.31%.

- Road roller sales are high in the GCC region in response to the rising renovation and expansion of transport networks. Several countries in the Gulf Cooperation Council (GCC) are investing in large-scale transport infrastructure projects to enhance connectivity and trade, both within their borders and with neighbouring countries.

- In 2024, the Ministry of Transport in Saudi Arabia announced plans for various road construction projects. Public infrastructure development will be a major focus in 2025, with the government planning 1,000 infrastructure and road construction initiatives.

- Construction equipment utilization in the construction industry by end-user (volume) has the largest market share in 2024.

- The government has invested heavily in infrastructure projects, including transportation networks, housing developments, and urban expansion, to support economic diversification

- The significant projects announced in 2023 include the Abu Dhabi National Oil Company’s (ADNOC) Al-Nouf seawater treatment plant and Dubai Municipality’s strategic sewerage tunnel, along with other large-scale construction efforts.

GCC CONSTRUCTION EQUIPMENT MARKET TRENDS & DRIVERS

Increasing Demand for Cranes for LNG Projects

- Qatar Energy has finalized a cooperation agreement with China Petrochemical Corporation (Sinopec) for the North Field East (NFE) expansion in Qatar, the largest Liquefied Natural Gas (LNG) project in history. Sinopec, in collaboration with SANY Heavy Machinery, showcased three large-tonnage crawler cranes at the project site; in June 2023, Sinopec completed the first lift.

- As of January 2024, Saudi Aramco partnered with China's Sinopec Engineering Group and Spain's Técnicas Reunidas to build a $3.3 billion Liquefied Natural Gas (LNG) complex in Saudi Arabia. This project includes engineering, procurement, and construction tasks, aiming to establish distillation and joint facilities with a production capacity of 510,000 barrels per day. The first phase is expected to take 46 months, while the second phase will take 41 months, reflecting the project's scale and complexity. This initiative strengthens Saudi Arabia's position in the global LNG market.

- In 2002, Gulf Haulage Heavy Lift Company (GHHL) signed a contract with Liebherr for 18 mobile cranes, with each unit accounting for a lifting capacity of 100 tons to 300 tons.

- Qatar is enhancing its LNG production capacity to meet the rising demand in key Asian and European markets, alongside making strategic investments in offshore projects to boost oil production.

Surge in Used Wheel Loaders for Waste-to-Energy Generation Projects

- The Saudi Investment Recycling Company (SIRC) has initiated a significant waste-to-fuel project in Saudi Arabia, aimed at converting municipal solid waste into renewable energy. This initiative aligns with Saudi Arabia's broader strategy to reduce dependence on landfills and supports the Kingdom's Vision 2030 goals.

- The project will employ advanced waste-to-energy technologies, such as gasification and pyrolysis, to convert waste into synthetic gas and other valuable byproducts. These byproducts can be used to generate electricity or produce chemicals and fuels. This approach not only supports sustainable waste management but also contributes to reducing greenhouse gas emissions while promoting a circular economy.

- In 2024, a Liebherr L 550-wheel loader is being utilized at Jawdah Construction Solutions, a ready-mix concrete company in Saudi Arabia. The loader is responsible for piling up materials and loading them into hopper systems. Additionally, Volvo Construction Equipment has launched the electric L20 wheel loaders for waste-to-energy generation projects in the Middle Eastern market, including the Gulf Cooperation Council (GCC) countries.

- In 2022, Qatar's Minister of Municipality launched the Integrated National Solid Waste Management Program during the second waste management conference and exhibition. The program aims to recycle 15% of municipal waste, close and rehabilitate 100% of unsanitary landfills, as well as reduce the per capita food waste by 50% at the consumer and retail levels. As a result, solid waste management activities are expected to drive the demand for construction equipment such as crawler excavators and wheel loaders.

Increased Investments in Public Infrastructure and the Real Estate Sector

- The construction sector in the Gulf Cooperation Council (GCC) is one of the fastest-growing industries as compared with others such as energy, manufacturing, logistics, and power generation. There is a significant number of projects in the pipeline; this includes expansion initiatives in the production capacity of the oil & gas sector, new residential and commercial real estate development initiatives, upgrades in the transport, power, and water systems, as well as major industrial projects.

- Saudi Arabia's Vision 2030 aims to diversify the economy through extensive infrastructure projects, many of which are ahead of schedule. This initiative includes the construction of Neom, a $500 billion megacity, along with other ambitious projects like The Line.

- The growth in these sectors is driving the demand for construction equipment, leading to a significant boost in the market. As large-scale projects continue, the sale of construction equipment is expected to rise due to the increased need for advanced machinery and technology to support these developments.

Surge in Renewable Energy Projects

- In Saudi Arabia, the recent signing of power purchase agreements for 5,500 MW of solar photovoltaic (PV) projects marks a significant milestone in its renewable energy strategy. This initiative includes three major solar PV projects, contributing to the country's goal of achieving a renewable energy capacity of 20 GW by the end of 2024.

- These developments are expected to stimulate the demand for material handling equipment, particularly as the projects move into construction phases; this will require extensive logistical and material handling solutions to manage the large-scale deployment of solar panels and associated infrastructure.

- By 2030, renewable energy is projected to account for 18% of Qatar's power generation, up from the current 5%. This increase aligns with Qatar's National Renewable Energy Strategy, which aims to reach a capacity of 4 GW from centralized projects and 200 MW from distributed projects.

- Overall, these continuous investments in the renewable energy sector are expected to boost the demand for material handling equipment across the GCC market during the forecast period.

INDUSTRY RESTRAINTS

High Construction Cost across GCC Countries

- Construction costs are rising sharply worldwide, including in the GCC countries. Several factors contribute to this trend, with inflation remaining a primary concern for the industry, despite some signs of moderation toward the end of 2024.

- The stability of oil prices provides some reassurance; however, volatility persists, affecting developer confidence. Additionally, regulations on sustainability are becoming stricter across the Gulf region, particularly in light of events such as Dubai hosting COP 28. While these measures aim for long-term decarbonization and cost reductions in operations, initial compliance costs are increasing.

- The region is grappling with limited resources and skills, exacerbated by fierce competition for skilled labour, particularly between Saudi Arabia and the UAE. Since the middle of 2024, raw material costs, including steel, cement, and concrete, have surged in both countries, further driving construction expenses.

Overdependency on the Hydrocarbon Industry

- Saudi Arabia's economy is heavily dependent on its hydrocarbon industry, generating 80% of its revenue from oil exports; the country accounted for approximately 40% of the country's GDP in 2024. Despite government efforts to promote the non-hydrocarbon sectors, the economy remains reliant on the oil & gas industry. This trend is prevalent among other countries in the Gulf region that depend significantly on oil revenue.

- Oil prices are volatile and can be adversely affected by various external factors, including fluctuations in supply and demand, political conflicts, tensions between countries, and growing environmental concerns worldwide. Therefore, overreliance on the oil & gas industry can hinder economic independence in the long run.

- A continuous decline in energy prices in the region is estimated to impede the growth of the construction and manufacturing industries, negatively impacting the demand for construction equipment in the forecast period.

VENDOR LANDSCAPE

- Caterpillar, Komatsu, Volvo CE, Hitachi Construction Machinery, Liebherr, XCMG and SANY are the front-runners in the region’s construction equipment market. These companies have strong market share and offer a diverse set of equipment in the GCC market.

- Terex, Tadano, Manitou, & Yanmar are niche market players in the market. These companies offer low product diversification and have a strong presence in the GCC market.

- Kubota, JCB, Kobelco, HD Hyundai Construction Equipment, CNH Industrials, LiuGong, Zoomlion, & Develon are emerging in the market. These companies are introducing new technologically advanced products to challenge the market share of market leaders in the GCC market.

- Kato Works, Wacker Neuson, AUSA, and Sumitomo have low product diversification; these companies are lagging in adopting new technologies used in construction equipment.

- In March 2025, Arabian Trucks & Construction Equipment Co. (ATEC), an official distributor of Hitachi Construction Machinery, began the construction of a new facility in Saudi Arabia. The new facility is set to feature Hitachi construction machines with cutting-edge technology, streamlined operations, and a customer-centric approach.

- In May 2025, Al Marwan became an official distributor of Kobelco excavators in Saudi Arabia.

- In August 2024, DEVELON signed a contract to supply 20 large 50-ton excavators, 40 medium-sized 20-ton excavators, and 40 large wheel loaders to Saudi Pan Kingdom Company (SAPAC) and Nesma & Partners Contracting, Saudi Arabia's leading construction firms.

Key Vendors

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- SANY

- Xuzhou Construction Machinery Group (XCMG)

- JCB

- Liebherr

- Kobelco

- Zoomlion

Other Prominent Vendors

- HD Hyundai Construction Equipment Co., Ltd

- Liugong Machinery Co., Ltd.

- DEVELON

- Tadano

- Terex Corporation

- Manitou

- BOMAG GmbH

- KATO WORKS CO., LTD.

- AUSA

- Wacker Neuson SE

- Sumitomo Construction Machinery Co., Ltd.

- Yanmar Co., Ltd.

- JLG Industries

- Toyota Material Handling International (TMHI)

- CNH Industrial N.V.

Distributor Profiles

- TaT Hong

- United Tractors

- Multicranes Perkasa

Segmentation by Type

Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers, Motor Graders)

Road Construction Equipment

- Road Rollers

- Asphalt Pavers

Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

Other Construction Equipment

- Dumper

- Concrete Mixer

- Concrete Pump Truck

Segmentation by End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities, Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Segmentation by Region

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Rest of GCC

KEY QUESTIONS ANSWERED

1. How big is the GCC construction equipment market?2. Who are the key players in the GCC construction equipment market?

3. Which are the major distributor companies in the GCC construction equipment market?

4. What is the growth rate of the GCC construction equipment market?

5. What are the trends in the GCC construction equipment market?

Table of Contents

Companies Mentioned

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- SANY

- Xuzhou Construction Machinery Group (XCMG)

- JCB

- Liebherr

- Kobelco

- Zoomlion

- HD Hyundai Construction Equipment Co., Ltd

- Liugong Machinery Co., Ltd.

- DEVELON

- Tadano

- Terex Corporation

- Manitou

- BOMAG GmbH

- KATO WORKS CO., LTD.

- AUSA

- Wacker Neuson SE

- Sumitomo Construction Machinery Co., Ltd.

- Yanmar Co., Ltd.

- JLG Industries

- Toyota Material Handling International (TMHI)

- CNH Industrial N.V.

- TaT Hong

- United Tractors

- Multicranes Perkasa

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

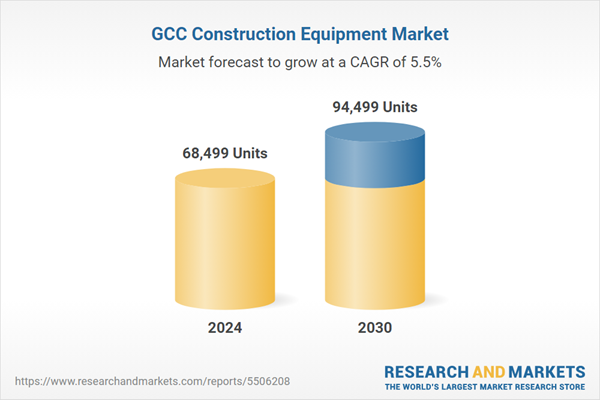

| Estimated Market Value in 2024 | 68499 Units |

| Forecasted Market Value by 2030 | 94499 Units |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 28 |