Biodegradable Absorbents Fuels Middle East & Africa Industrial Absorbents Market

With burgeoning microplastic pollution and increasing awareness about environmental sustainability, there is a rising demand for biodegradable absorbents made from natural and organic materials. Conventional industrial absorbents are made of polyethylene, polypropylene, and polyurethane, which are effective in cleaning oil and other liquid spills; however, they end up in landfills, potentially leaching harmful chemicals and microplastics into the environment over time. Therefore, manufacturers are developing sustainable alternatives that help in the effective cleanup of spills while being less hazardous to the environment. For instance, in August 2023, EarthSafe expanded its portfolio of spill containment products by introducing FlashDry coir absorbent, which is sustainable and made from 100% organic husks. It is classified as a universal hazmat absorbent that works for all kinds of spills. Its hydrophobic and oleophilic properties make it ideal for various industrial spills, such as automotive fluids, lubricants and degreasers, marine oil spills, paints, chemicals, and resins. Such products are trending in the industrial absorbents market and are expected to witness tremendous demand in the coming years.Government agencies are collaborating with biodegradable industrial absorbent manufacturers to support sustainable economic development. For example, in June 2022, Green Boom, a manufacturer of eco-friendly oil absorbent products, signed a Memorandum of Understanding with the Investment Promotion Agency Qatar (IPA Qatar) during the second annual Qatar Economic Forum to introduce its biodegradable industrial absorbents to the Middle East and Qatari market. The IPA Qatar aims to accelerate innovative manufacturing technologies in Qatar by partnering with Green Boom in an attempt to support the commitment to transforming into a sustainable and knowledge-based economy in the coming years. Such collaborations are also expected to boost the demand for biodegradable industrial absorbents, favoring the market growth.

The companies in the industrial absorbents market are also looking for innovative natural materials to develop lightweight absorbents. Industrial absorbents made with natural materials help manufacturing companies comply with environmental regulations. These absorbents are being extensively used to clean hazardous hydrocarbon oil spills in the most environment-friendly way. Thus, companies in the industrial absorbents market are significantly investing in research and development to develop eco-friendly absorbents that soak petroleum products.

Middle East & Africa Industrial Absorbents Market Segmentation

The Middle East & Africa industrial absorbents market is categorized into product type, type, end-use industry, and country.Based on product type, the Middle East & Africa industrial absorbents market is segmented into pads, rolls, pillows, booms, socks, and others. The booms segment held the largest market share in 2023.

In terms of type, the Middle East & Africa industrial absorbents market is categorized into universal, oil-only, and hazmat/chemical. The hazmat/chemical segment held the largest market share in 2023.

By end-use industry, the Middle East & Africa Industrial Absorbents market is segmented into oil & gas, chemical, food processing, healthcare, automotive, and others. The oil & gas segment held the largest market share in 2023.

By country, the Middle East & Africa industrial absorbents market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa industrial absorbents market share in 2023.

3M Co, Ansell Ltd, Brady Corp, TOLSA SA, SpillTech Environmental Inc, New Pig Corp, Empteezy Ltd, and Green Stuff Absorbents, are among the leading companies operating in the Middle East & Africa industrial absorbents market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa industrial absorbents market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa industrial absorbents market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa industrial absorbents market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Middle East & Africa Industrial Absorbents Market include:- 3M Co

- Ansell Ltd

- Brady Corp

- TOLSA SA

- SpillTech Environmental Inc

- New Pig Corp

- Empteezy Ltd

- Green Stuff Absorbents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | April 2025 |

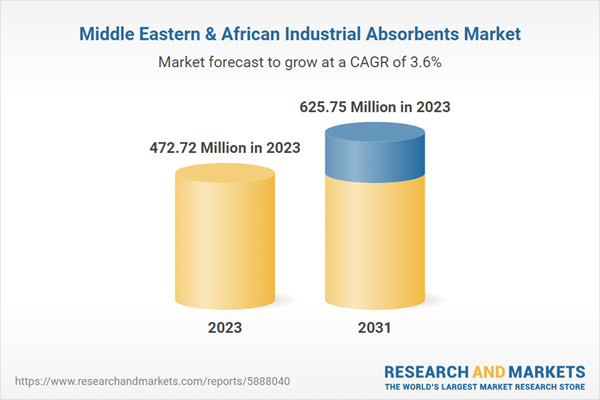

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 472.72 Million in 2023 |

| Forecasted Market Value by 2031 | 625.75 Million by 2031 |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 9 |