The GCC has seen several Real Estate Investment Trusts (REITs) listed in stock exchanges in the past few years. This accelerated after Saudi Arabia's Capital Markets Authority (CMA) approved the listing of REITs in 2016 as a part of the National Transformation Program (NTP) and Saudi Vision 2030. Due to the economic crisis in the wake of the COVID-19 pandemic, many of the listed REITs have seen a steep decline in their share prices and market capitalizations.

REITs are not as popular in the GCC as in advanced countries despite the region being home to wealthy individuals and large institutional investors. The lack of a regulatory framework for the listing and operation of REITs remains a major hindrance to its development in the region. However, the region's capital markets authority (CMA) has started revamping regulations to pave the way for the development of alternative investments.

The future looks promising for REITs in GCC, especially with the new class of investors looking for investment products to diversify their portfolios in the local markets. Islamic REITs can be a preferable option for traditional investors who wish to invest in Sharia-compliant products in different asset classes, such as real estate.

GCC REIT Market Trends

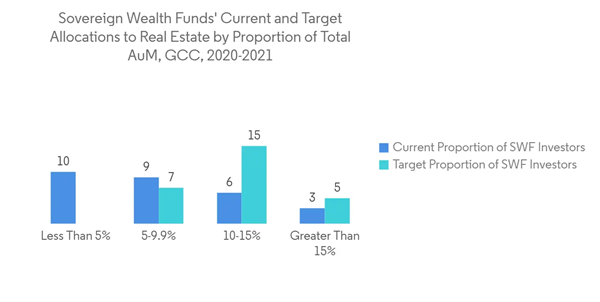

Growing Asset Allocation to Real Estate by Large Investors in The Region

Only 33% of the SWFs allocated 10% or more toward real estate. However, that is expected to change, with about 70% of the SWFs targeting a 10% or more allocation towards real estate in GCC. The reason is the real estate sector's ability to achieve steady cash flows through rental income and inherent ability to act as a hedge against inflation (due to contractual escalations in long-term contracts) besides healthy yields and the prospect of capital appreciation.The property price correction in the United Arab Emirates has triggered many investors to explore alternate investment avenues to preserve and grow their wealth. Ironically, the current downturn in the real estate sector is also an opportune time to invest in a Real Estate Investment Trust (REIT).

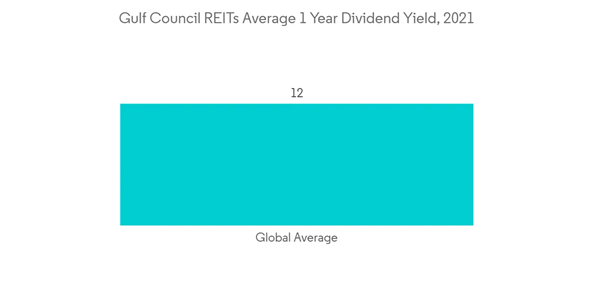

GCC REITs Average 1-Year Returns

REITs in the United Arab Emirates were offering healthy dividend yields compared to the global average. However, the story emerging in Saudi Arabia was a little different, with REITs offering an average dividend yield of 2.7%. Part of the issue in Saudi Arabia was that there was a sudden rush in listings with insufficient diligence done on the quality of assets. Early entrants to the market were able to obtain an initial premium on the listing. However, the long-term performance of a REIT is determined by the underlying quality of the real estate.UAE has higher returns than most of the world's popular real estate investment sites as the rental income is tax-free due to tax exemption on capital gains.

GCC REIT Industry Overview

The report includes an overview of REITs operating across GCC. We wish to present a detailed profiling of a few major companies, which cover product offerings, regulations governing them, their headquarters, and financial performance. Currently, some of the major players dominating the market are Al Rajhi REIT, Riyad REIT, Emirates REIT, ENBD REIT, and Jadwa Saudi REIT.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.