Global Motorcycle Filters Market - Key Trends & Drivers Summarized

What Are Motorcycle Filters and Why Are They Essential for Engine Performance?

Motorcycle filters are essential components designed to protect a motorcycle's engine, fuel system, and air intake by trapping impurities and contaminants. These filters include air filters, oil filters, and fuel filters, each serving a specific function to ensure optimal engine performance and longevity. Air filters prevent dirt, dust, and debris from entering the engine, ensuring clean airflow and combustion efficiency. Oil filters remove contaminants from the engine oil, preventing abrasion and maintaining lubrication quality, while fuel filters ensure that impurities in the fuel do not reach the engine, thereby reducing wear on critical components. By providing clean air, oil, and fuel to the engine, motorcycle filters play a crucial role in maintaining peak performance, fuel efficiency, and emissions control.With motorcycles becoming increasingly sophisticated, the demand for high-quality filters has grown. Performance-oriented motorcycles, as well as everyday commuter bikes, benefit from improved engine efficiency and longevity when equipped with reliable filtration systems. For motorcycle owners, regular filter maintenance is essential to keep their engines running smoothly and to prevent costly repairs. In addition, environmental awareness has led to a greater focus on emissions control, with filters contributing significantly to reducing pollutants emitted by motorcycles. These functions make filters indispensable for any two-wheeler, from high-performance models to city commuters, ensuring both performance and environmental responsibility.

How Are Technological Advancements Shaping the Motorcycle Filters Market?

Technological advancements have introduced new materials and designs in motorcycle filters, enhancing their durability, efficiency, and environmental impact. Innovations in filtration media, such as synthetic fibers, nanofiber technology, and multilayered filtration systems, have made motorcycle filters more efficient at trapping even the smallest particles. Synthetic fibers, in particular, are more resilient to high temperatures and pressure, ensuring that filters maintain their structural integrity over longer periods. This increased durability reduces the frequency of replacements, offering a cost-effective and reliable solution for riders. Advanced designs also optimize airflow, ensuring that engines receive sufficient clean air without compromising on fuel efficiency or performance.Another significant advancement is the use of reusable and washable filters, especially in high-performance motorcycles. Washable air filters are made from durable materials that can be cleaned and reused multiple times, reducing waste and long-term maintenance costs. Performance-focused motorcyclists, who often demand greater airflow to maximize engine power, benefit from washable filters that not only enhance performance but also provide an eco-friendly alternative. These filters are popular among enthusiasts who prioritize both performance and sustainability, as they reduce the need for disposable filters that contribute to environmental waste.

Digital integration and smart sensor technology are also beginning to make their way into the motorcycle filters market. Some advanced motorcycles are equipped with sensors that monitor the condition of filters, alerting riders when they require replacement or cleaning. This digital integration enables more efficient maintenance, ensuring that filters are changed only when necessary, which extends their lifespan and improves overall vehicle performance. The integration of sensor technology aligns with the broader trend of connected vehicles, providing riders with real-time information on their motorcycle's maintenance needs and contributing to a better user experience. Together, these technological advancements in materials, reusability, and digital monitoring are reshaping the motorcycle filters market, enhancing performance, convenience, and environmental responsibility.

What Factors Are Driving the Demand for Motorcycle Filters?

The demand for motorcycle filters is driven by the rising global sales of motorcycles, increased awareness of vehicle maintenance, and the need for compliance with environmental regulations. As motorcycles become an increasingly popular mode of transportation in densely populated urban areas, particularly in Asia-Pacific and Latin America, the need for effective filtration systems has risen. Riders who rely on motorcycles for daily commutes or long-distance travel prioritize vehicles with reliable filters, as they ensure consistent engine performance and fuel efficiency. This urbanization trend, coupled with the demand for high-performance motorcycles, is bolstering the demand for filters that cater to diverse riding needs and conditions.Consumer awareness around vehicle maintenance and engine health has also contributed to the growth in demand for motorcycle filters. With increasing access to information on vehicle care, riders understand the importance of regular filter replacement for optimal engine performance and longevity. Many manufacturers now emphasize the role of filters in maintaining peak performance, offering replacement schedules and instructions to educate customers. The popularity of DIY maintenance has further encouraged riders to take charge of their motorcycle's upkeep, resulting in a steady demand for aftermarket filters. This trend is particularly strong among motorcycle enthusiasts who seek aftermarket filters to enhance performance or customize their bikes.

Environmental regulations and emissions standards are another significant driver for the motorcycle filters market. Governments worldwide are implementing stricter emissions standards to reduce air pollution, pushing manufacturers to develop more efficient filtration systems. In regions like Europe and North America, emissions regulations have become increasingly stringent, requiring motorcycles to be equipped with advanced filters that meet specific standards. Filters that effectively reduce particulate matter and emissions contribute to cleaner air, aligning with regulatory goals and consumer expectations for environmentally friendly transportation. This regulatory pressure encourages manufacturers to innovate and develop filters that reduce environmental impact while maintaining performance, creating sustained demand in the market.

What Factors Are Driving Growth in the Motorcycle Filters Market?

The growth in the motorcycle filters market is driven by advancements in filter technology, expanding motorcycle ownership globally, rising environmental awareness, and the growth of the aftermarket segment. Innovations in materials and filter design have led to the development of more efficient, durable, and reusable filters, aligning with consumer demand for high-performance and eco-friendly products. Advanced filters that trap finer particles and maintain airflow are particularly popular among riders focused on performance, while washable filters appeal to environmentally conscious consumers. As these technologies become more accessible, manufacturers can offer premium filtration options across different motorcycle segments, contributing to market growth.The expansion of motorcycle ownership, especially in emerging markets, is another major growth driver. Motorcycles and scooters have become essential modes of transportation in densely populated regions, where they offer an affordable, flexible commuting solution. As more people rely on motorcycles for daily travel, the demand for effective filtration systems to ensure long-lasting engine health and fuel efficiency increases. In emerging markets such as India, China, and Southeast Asia, rising disposable incomes and urbanization are further boosting motorcycle sales, thereby increasing the need for reliable filters in both OEM and aftermarket segments.

The rise of the aftermarket sector has also fueled growth in the motorcycle filters market, as consumers increasingly seek high-quality replacement parts and performance upgrades. Many motorcycle owners choose aftermarket filters to enhance performance, reduce maintenance costs, or personalize their vehicles. Aftermarket options often include advanced filtration technologies and reusable designs, catering to riders who prioritize quality and customization. This trend is particularly strong among enthusiasts and owners of high-performance motorcycles, who value aftermarket filters for their ability to improve airflow and engine output. Together, these factors - technological innovation, global motorcycle sales, environmental awareness, and the expanding aftermarket - are driving robust growth in the motorcycle filters market, ensuring that the industry adapts to the evolving needs of modern riders.

Report Scope

The report analyzes the Motorcycle Filters market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Fuel Filters, Oil Filters, Air Intake Filters); Distribution Channel (Independent Aftermarket Manufacturers (IAMs), Original Equipment Manufacturers (OEMs), Original Equipment Suppliers (OESs)).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fuel Filters segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of a 4.8%. The Oil Filters segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $863.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Motorcycle Filters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Motorcycle Filters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Motorcycle Filters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AEM Induction Systems, AMSOIL, INC., B.M.C. srl, Baldwin Filters, Inc., DNA Filters and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 56 companies featured in this Motorcycle Filters market report include:

- AEM Induction Systems

- AMSOIL, INC.

- B.M.C. srl

- Baldwin Filters, Inc.

- DNA Filters

- FILTRAK BRANDT GmbH

- Hiflofiltro

- Jieh Jia Enterprise Co., Ltd. (Simota)

- K&N Engineering, Inc.

- MAHLE Aftermarket GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AEM Induction Systems

- AMSOIL, INC.

- B.M.C. srl

- Baldwin Filters, Inc.

- DNA Filters

- FILTRAK BRANDT GmbH

- Hiflofiltro

- Jieh Jia Enterprise Co., Ltd. (Simota)

- K&N Engineering, Inc.

- MAHLE Aftermarket GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | February 2026 |

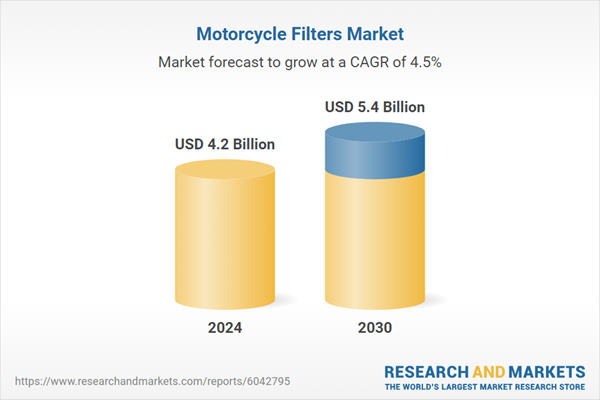

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |