Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Efficiency Improvements

One of the primary drivers behind the nanocomposite solar cell market is the quest for higher energy conversion efficiency. As the world seeks more sustainable energy sources, increasing the efficiency of solar cells becomes crucial for maximizing electricity generation and reducing the overall cost of renewable energy. Growing concerns about climate change and environmental sustainability are driving the adoption of renewable energy sources, including solar power. Nanocomposite solar cells, with their potential to increase efficiency and reduce the environmental impact of solar energy generation, align with these concerns. Solar energy contributes to energy security by diversifying the energy mix and reducing dependence on fossil fuels. Governments and organizations worldwide recognize the strategic importance of renewable energy sources like nanocomposite solar cells in achieving energy security objectives. Advances in materials science and nanotechnology have opened new avenues for the development of nanocomposite solar cells. Researchers are continually discovering novel materials and fabrication techniques that promise even greater efficiency gains, driving innovation in the industry. Many governments offer incentives, subsidies, and favorable regulatory frameworks to promote the adoption of solar energy technologies. These policies can stimulate market growth by reducing the upfront costs of installing nanocomposite solar panels. The availability of research funding and private investments is crucial for advancing the technology and bringing it closer to commercialization. Investors are drawn to the potential for disruptive innovation and long-term profitability in the renewable energy sector. Competition among companies in the nanocomposite solar cell market drives innovation and cost reduction. Companies strive to develop cutting-edge technologies and improve production processes to gain a competitive advantage. The ever-increasing global demand for electricity is a significant driver of the solar energy market, including nanocomposite solar cells. As populations grow and economies expand, the need for clean and sustainable energy sources becomes more pressing. Collaboration among research institutions, universities, and private companies accelerates the development of nanocomposite solar cell technology. These partnerships facilitate knowledge sharing and the pooling of resources for research and development. Ultimately, consumer demand for more efficient and sustainable energy solutions can drive market growth. As awareness of nanocomposite solar cells and their benefits grows, consumers may seek out these advanced solar panels for their homes and businesses.The global nanocomposite solar cell market is a dynamic and evolving segment within the broader solar energy industry. While it was primarily in the research and development phase as of September 2021, the market held immense promise due to its potential to significantly increase the efficiency of solar energy conversion. Key drivers such as efficiency improvements, environmental concerns, and government policies are shaping the future of this technology. As nanocomposite solar cells continue to advance and move closer to commercialization, they have the potential to play a significant role in meeting the world's growing energy needs while reducing greenhouse gas emissions and reliance on fossil fuels. To stay updated on the latest developments in this field, it is essential to monitor technological advancements, market trends, and policy changes related to nanocomposite solar cells.

Key Market Challenges

High Manufacturing Costs:

The production of nanocomposite solar cells can be costly due to the complexity of incorporating nanomaterials and the need for precise fabrication techniques. Ongoing research and development efforts aim to optimize manufacturing processes and reduce production costs. Improvements in scalability and materials synthesis can help make nanocomposite solar cells more cost-competitive. Material Stability and Degradation: Some nanomaterials used in nanocomposite solar cells may be susceptible to degradation over time, impacting the cell's performance and lifespan. Researchers are working to identify stable nanomaterials and protective coatings to enhance the durability and longevity of nanocomposite solar cells. Encapsulation and improved material selection can mitigate degradation issues.Efficiency and Performance Variability:

Achieving consistent and high energy conversion efficiency with nanocomposite solar cells can be challenging, as performance may vary based on materials and fabrication techniques. Ongoing research focuses on optimizing the design and composition of nanocomposite materials to achieve more predictable and improved performance. Standardization of production processes can also enhance consistency.Scalability and Mass Production: Scaling up the production of nanocomposite solar cells to meet global energy demands can be challenging, as it requires maintaining quality and efficiency at larger scales. Solution: Investment in advanced manufacturing technologies and equipment can facilitate scalable production. Collaboration between research institutions and industry partners can accelerate the transition to mass production.

Regulatory and Safety Concerns:

The introduction of new nanomaterials in solar cell technology may raise regulatory and safety concerns regarding their potential environmental and health impacts. Collaborative efforts involving governments, research institutions, and industry stakeholders can establish safety guidelines and regulations for nanocomposite solar cell materials and production processes. Transparent communication about safety measures is essential.Consumer Awareness and Acceptance:

Many consumers are unaware of the benefits of nanocomposite solar cells, leading to slow adoption rates. Public awareness campaigns and educational initiatives can inform consumers about the advantages of nanocomposite solar cells, including increased efficiency, reduced environmental impact, and potential cost savings.Key Market Trends

The global nanocomposite solar cell market is witnessing rapid developments and innovations driven by the increasing demand for clean and sustainable energy sources. Nanocomposite solar cells, which incorporate nanomaterials to enhance energy conversion efficiency, are at the forefront of this transformation. In this article, we will explore the emerging trends in the global nanocomposite solar cell market that are shaping the future of renewable energy generation.Perovskite Nanocomposites

Perovskite nanocomposites have gained significant attention due to their potential to achieve high energy conversion efficiency. Researchers are working on integrating perovskite materials with nanocomposite structures to create next-generation solar cells. These materials exhibit impressive optoelectronic properties and can be engineered for stability, making them a promising trend in the nanocomposite solar cell market. Quantum dots, semiconductor nanoparticles with unique electronic properties, are being extensively researched for their applications in nanocomposite solar cells. They offer the ability to tune their optical properties, allowing for the capture of a broader range of sunlight wavelengths. Quantum dot-based nanocomposite solar cells have the potential to surpass traditional silicon solar cells in terms of efficiency. Two-dimensional (2D) materials, such as graphene and transition metal dichalcogenides (TMDs), are being explored for their compatibility with nanocomposite solar cells. These materials can enhance charge transport and light absorption, improving the overall performance of solar cells. The development of 2D material-based nanocomposite solar cells is a promising trend in the industry.Enhanced Efficiency and Performance

Tandem solar cells involve stacking multiple solar cell layers with varying bandgaps to maximize energy conversion efficiency. This trend allows for the integration of nanocomposite solar cells with other solar cell types, such as perovskite or organic solar cells, to achieve higher efficiencies. Tandem cells are poised to become a game-changer in the industry. Researchers are exploring innovative light-trapping structures to improve sunlight absorption. These structures can include nanostructures and photonic crystals that enhance the capture of light and increase the efficiency of nanocomposite solar cells. Precisely engineering the bandgap of nanocomposite materials is a key trend. This allows researchers to optimize the absorption of specific wavelengths of light and reduce energy losses due to thermalization, leading to higher energy conversion efficiencies.Sustainable and Environmentally Friendly Practices

Sustainability is a growing concern in the solar industry. Companies are increasingly focused on designing nanocomposite solar cells with recyclability in mind. This includes using materials that are abundant and environmentally friendly and developing recycling processes to minimize waste. Researchers are working to replace toxic or environmentally harmful materials in nanocomposite solar cells with more sustainable alternatives. This trend aligns with the broader push for green and environmentally responsible energy technologies.Building-Integrated Photovoltaics (BIPV)

The integration of solar cells into building materials, such as windows, facades, and roofing, is gaining traction. Nanocomposite solar cells are well-suited for BIPV applications due to their flexibility and transparency. This trend supports the development of energy-efficient and sustainable buildings. The demand for portable and wearable solar-powered devices is growing. Nanocomposite solar cells can be integrated into small and flexible form factors, making them ideal for charging smartphones, wearables, and outdoor equipment. This trend caters to the need for mobile and off-grid power solutions. Solar-powered vehicles, including solar cars, bicycles, and drones, are emerging as a niche market. Nanocomposite solar cells play a role in extending the range and sustainability of these vehicles. Solar-powered transportation is an exciting trend at the intersection of renewable energy and transportation.Segmental Insights

Type Insights

The dominating segment of the global nanocomposite solar cell market by type is inorganic. This segment is expected to account for 60% of the market share by 2032. Inorganic nanocomposites are made up of inorganic materials such as metal oxides, semiconductors, and polymers. They are known for their high efficiency, stability, and durability. The main reasons for the dominance of the inorganic segment are: Inorganic materials have a higher absorption coefficient than organic materials, which means that they can absorb more sunlight and convert it into electricity. Inorganic materials are more stable and durable than organic materials, which makes them more suitable for use in solar cells. Inorganic materials are more widely available than organic materials, which makes them more cost-effective to use.Organic materials are lighter and more flexible than inorganic materials, which makes them ideal for use in portable electronics and other applications where weight and flexibility are important. Organic materials are easier to process than inorganic materials, which makes them more cost-effective to use in large-scale production. Organic materials can be modified to have different properties, which makes them more versatile than inorganic materials. Overall, the global nanocomposite solar cell market is expected to grow in the coming years. The market is expected to be driven by the increasing demand for renewable energy sources, the rising awareness about environmental pollution, and the government support for the development of solar energy technologies. The inorganic segment is expected to dominate the market in the coming years, but the organic segment is expected to grow at a faster rate.

Regional Insights

The Asia Pacific region has established itself as the leader in the Global Nanocomposite Solar Cell Market with a significant revenue share in 2022. The Asia-Pacific region is the leading market for nanocomposite solar cells, accounting for 33.4% of the global market share in 2022. The growth of the market in this region is driven by the rapid growth of the solar energy industry in China, India, and Japan. North America and Europe are the other major markets for nanocomposite solar cells. China holds the largest market share for PV solar panels. An increase in government policies that provide financial incentives and subsidies for solar energy is responsible for this rise in demand. Due to technological developments, improvements in nanocomposite solar cells, and increase in the supply of solar panels in the country, product prices are anticipated to decrease and stabilize. Investors and developers are also concentrating on commercial project feasibility, which is expected to create new opportunities for the Chinese solar PV sector in the future. China holds a commanding position accounting for roughly more than half of East Asia’s nanocomposite solar cell production in 2022.Recent Developments

- In February 2022, First Solar Inc and National Grid Renewables signed a framework agreement for advanced thin film photovoltaic (PV) solar modules. The delivery is scheduled in 2024 and 2025 across the United States. Moreover, National Grid has partnered with First Solar Inc for other projects as well as for the development of solar farms.

- The United States government is currently concentrating on renewable energy, and it is anticipated that solar energy will continue to be a substantial source of new energy production capacity. Power generation from commercial sector solar cells has increased as solar cells are more efficient and easily available in the market.

Key Market Players

- First Solar

- SunPower Corporation

- Hanwha Q Cells

- JA Solar

- Canadian Solar

- Trina Solar

- JinkoSolar

- Longi Solar

- Yingli Solar

- Risen Energy

Report Scope

In this report, the Global Nanocomposite Solar Cell Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Nanocomposite Solar Cell Market, by Type:

- Organic

- Inorganic

Global Nanocomposite Solar Cell Market, by Material Type:

- a-Si

- CdTe

- CI(G)S

- Others

Global Nanocomposite Solar Cell Market, by Application BIPV:

- Building Integrated PV

- Vehicle Integrated PV

- Fabric Integrated PV

Global Nanocomposite Solar Cell Market, by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Nanocomposite Solar Cell Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- First Solar

- SunPower Corporation

- Hanwha Q Cells

- JA Solar

- Canadian Solar

- Trina Solar

- JinkoSolar

- Longi Solar

- Yingli Solar

- Risen Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | October 2023 |

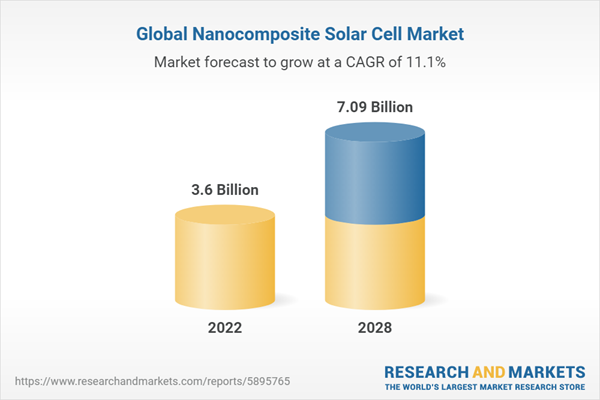

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 7.09 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |