Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Gas hydrates production may become an opportunity for the market players as its economically viable production may pose new problems, which may require better and more efficient drilling management.

Due to the high output of shale oil and gas, North America is expected to be the largest market during the forecast period, with majority demand coming from the United States and Canada.

Key Market Drivers

Rising Focus on Asset Optimization:

Maximizing Reservoir Recovery: In a world with depleting reserves, every drop counts. ADDMS empower operators to analyze real-time drilling data, optimize well placement, and maximize reservoir recovery, leading to increased production and profitability.Boosting Drilling Efficiency: ADDMS enable real-time monitoring of drilling parameters, allowing for proactive adjustments and minimizing non-productive time, resulting in significant cost savings.

Predictive Maintenance: By analyzing sensor data from drilling equipment, ADDMS can predict potential failures and schedule preventive maintenance, ensuring operational continuity and reducing downtime.

Enhanced Wellbore Control:

Safety First: Drilling is an inherently risky operation. ADDMS provide real-time insights into wellbore integrity, allowing for early detection of anomalies and preventing blowouts and other catastrophic events, ensuring the safety of personnel and the environment.Drilling in Challenging Environments: ADDMS equip operators with the tools to navigate complex geological formations and extreme drilling conditions, leading to successful well completions in previously inaccessible areas.

Proliferation of Horizontal and Multilateral Wells:

Unlocking Unconventional Resources: The increasing demand for oil and gas necessitates tapping into unconventional resources like shale formations. ADDMS play a crucial role in planning and executing complex horizontal and multilateral wells, making these resources commercially viable.Enhanced Reservoir Connectivity: ADDMS optimize the placement of laterals in multilateral wells, maximizing reservoir contact and leading to higher production rates.

Technological Advancements:

Data Explosion and Cloud Adoption: The volume and complexity of drilling data are rising exponentially. Cloud-based ADDMS solutions offer the scalability and processing power needed to handle this data deluge, enabling effective analysis and decision-making.Artificial Intelligence and Machine Learning: AI and ML are revolutionizing ADDMS, allowing for automated data analysis, anomaly detection, and predictive insights, further optimizing drilling operations.

Internet of Things (IoT) Integration: The integration of IoT sensors with drilling equipment generates real-time data streams, providing a holistic view of the drilling process and enabling real-time adjustments.

Regulatory Landscape and Environmental Concerns:

Compliance with Safety and Environmental Regulations: Stringent regulations regarding wellbore integrity and environmental protection necessitate the adoption of ADDMS solutions that ensure compliance and minimize environmental impact.Optimizing Resource Utilization: ADDMS enable efficient use of drilling fluids and other resources, minimizing waste and environmental footprint, aligning with sustainability goals.

Key Market Challenges

While the ADDMS market is brimming with potential, there are also challenges to overcome:

High Initial Investment: The upfront cost of implementing ADDMS solutions can be a barrier for smaller oil and gas companies.Data Security and Integration: Concerns around data security and integration with existing IT infrastructure hinder wider adoption.

Lack of Skilled Workforce: Utilizing the full potential of ADDMS requires a skilled workforce trained in data analysis and interpretation.

However, these challenges also present opportunities:

Developing Scalable and Cost-Effective Solutions: Addressing the cost barrier through innovative pricing models and cloud-based solutions can open up the market to wider participation.Investing in Cybersecurity and Training: Strengthening data security protocols and offering comprehensive training programs will alleviate concerns and promote adoption.

Focus on User-Friendly Interfaces and Analytics: Developing intuitive interfaces and user-friendly data visualization tools will empower non-technical personnel to leverage the.

Key Market Trends

Rising demand for energy

The world's insatiable appetite for oil and gas, coupled with the depletion of easily accessible reserves, is pushing exploration and production activities towards complex environments, necessitating sophisticated data management tools.Focus on operational efficiency

In the face of volatile energy prices and fierce competition, oil and gas companies are prioritizing resource optimization. Onshore Advanced Drill Data Management Solutions aid in real-time decision making, wellbore placement optimization, and improved drilling performance, leading to significant cost savings and increased productivity.Technological advancements

The convergence of artificial intelligence, cloud computing, and big data analytics is revolutionizing the oil and gas industry. Advanced drill data platforms are leveraging these technologies to extract actionable insights from massive datasets, enabling better reservoir characterization, improved drilling accuracy, and proactive risk mitigation.Traditional on-premises drill data management systems are giving way to cloud-based solutions offering enhanced scalability, accessibility, and collaboration. Cloud deployment eliminates the need for expensive hardware and software infrastructure, enabling real-time data sharing across geographically dispersed teams and facilitating faster decision-making. Additionally, cloud solutions provide seamless integration with other enterprise applications and analytics platforms, fostering a holistic view of drilling operations.

The integration of AI and machine learning algorithms into drill data management platforms is transforming data analysis capabilities. These algorithms can automatically identify patterns and anomalies in drilling data, predict potential drilling problems, and recommend corrective actions in real-time. This proactive approach minimizes operational downtime, optimizes drilling parameters, and enhances wellbore productivity. Advanced drill data platforms provide real-time visibility into drilling operations, enabling stakeholders across the value chain to collaborate effectively. Geologists, drilling engineers, and field personnel can access accurate, up-to-date data simultaneously, leading to improved communication, faster problem-solving, and more informed decision-making. This real-time visibility also facilitates remote monitoring and support, reducing the need for personnel to be physically present at the drilling site.

The increasing reliance on cloud-based platforms and the sensitive nature of drill data raise concerns about cybersecurity threats. As a result, market players are focusing on developing robust security features and protocols to protect data from unauthorized access, manipulation, and breaches. Moreover, stringent data privacy regulations are prompting vendors to adhere to strict compliance requirements, further ensuring data security and integrity.

Segmental Insights

Reservoir Type Insights

Although conventional resources are considered easier to recover from the reservoirs, the fields have matured around the globe. Also, companies have to drill further to find viable oil and gas sources, which has led to an increase in the requirement for the drilling data management systems. Hence, conventional resources are expected to dominate the market for advanced drilling data management solutions in the forecast period due to a large share of oil and gas production and increasing complexity in the recovery.Regional Insights

North America increased its production of crude oil significantly by 7.1%, to 1116.5 million tonnes of oil, in 2019 from 1042.2 million tonnes of oil in 2018. Crude oil production is expected to increase further in the forecast period due to increasing investments in the increase of the wells. Growing numbers of wells are expected to aid the growth of advanced drill data management solutions. Unconventional resources have created a new paradigm in the industry that require a lot of multilateral and horizontal wells to be drilled, that require a lot of data handling. drilling data management market is expected to gain a lot from the increase in shale oil and gas production increase. Shale oil and gas wells have a characteristic of depleting much faster than a conventional well. So, to maintain the production levels, new wells need to be drilled, which require the assistance provided by the drill data management systems, thereby providing growth to the market. According to U.S. Energy Information Administration, Marcellus shale play is the largest producer of shale gas in the United States with producing 23.13 billion cubic feet of gas in April 2020. An increase in unconventional resources is expected to boost the drill data management market. Hence, North America is expected to dominate the Onshore Advanced Drill Data Management Solutions Market due to the significant scale of investments and an increase in unconventional production in the region.Report Scope

In this report, the Global Onshore Advanced Drill Data Management Solutions Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Onshore Advanced Drill Data Management Solutions Market, By Reservoir Type:

- Conventional

- Unconventional

Onshore Advanced Drill Data Management Solutions Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Onshore Advanced Drill Data Management Solutions Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Onshore Advanced Drill Data Management Solutions Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger NV

- Halliburton Oil Well Cementing Co.

- Baker Hughes Co

- Weatherford International plc

- National Oilwell Varco (NOV)

- Emerson Electric Co.

- Rockwell Automation Inc.

- CGG SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2024 |

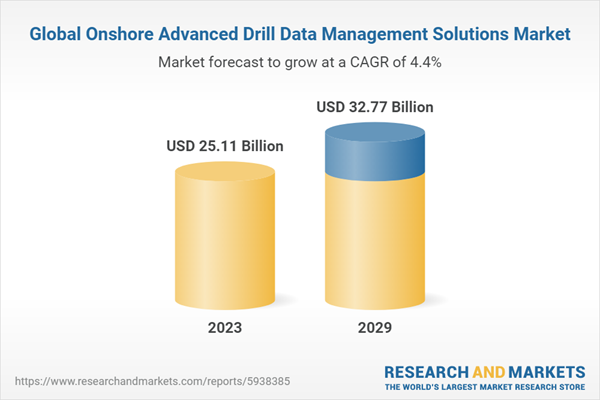

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 25.11 Billion |

| Forecasted Market Value ( USD | $ 32.77 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |