Global Psychedelic Drugs Market - Key Trends & Drivers Summarized

Why Are Psychedelic Drugs Gaining Mainstream Acceptance in Medicine?

The global psychedelic drugs market has witnessed a remarkable resurgence, driven by increasing scientific validation of their therapeutic benefits in treating mental health disorders such as depression, anxiety, PTSD, and addiction. Historically associated with countercultural movements and recreational use, psychedelics such as psilocybin, LSD, MDMA, DMT, and ketamine are now being rigorously studied for their potential in psychiatric care. The growing mental health crisis, characterized by rising cases of treatment-resistant depression (TRD) and post-traumatic stress disorder (PTSD), has created an urgent need for novel treatment modalities beyond conventional antidepressants. Clinical trials and research studies have demonstrated that psychedelics, when used under controlled conditions, can induce profound neuroplasticity, promoting long-term psychological healing in a way that traditional pharmaceuticals often fail to achieve. The shift in regulatory stances, with the FDA granting 'breakthrough therapy' designations to psilocybin and MDMA-based treatments, has further accelerated interest in this field. As major pharmaceutical companies and biotech startups enter the space, the psychedelic drugs market is moving toward a more structured, clinically validated, and widely accepted therapeutic model, bringing these substances from the fringes into mainstream medical applications.How Is Research and Regulatory Evolution Fueling Market Expansion?

Regulatory developments and scientific advancements are playing a crucial role in the commercialization of psychedelic drugs. The FDA's recognition of the potential therapeutic benefits of psychedelics has led to expedited pathways for drug approval, enabling companies to fast-track research and development efforts. In parallel, countries such as Canada, Australia, and parts of Europe have begun exploring policy changes to accommodate medical use, while several U.S. states have decriminalized or legalized psychedelics for therapeutic applications. The growing body of clinical evidence supporting the efficacy of psychedelic-assisted therapy has attracted significant investment, with venture capital firms, pharmaceutical giants, and mental health organizations funding research into psilocybin-based antidepressants, MDMA-assisted psychotherapy, and ketamine infusions. Research institutions and biotech firms are focusing on optimizing psychedelic formulations, improving delivery mechanisms, and enhancing safety profiles to ensure that these compounds can be integrated into conventional medical frameworks. Furthermore, the expansion of digital therapeutics and AI-driven mental health platforms is expected to complement psychedelic therapy, offering guided treatment experiences and post-session support. The shift toward evidence-based treatment protocols and physician-led administration models is helping psychedelic drugs gain legitimacy as serious contenders in the mental health treatment landscape.How Are Commercialization Strategies and Investment Trends Reshaping the Industry?

The commercialization of psychedelic drugs is gaining momentum as pharmaceutical companies and mental health clinics develop structured frameworks for widespread adoption. One of the biggest shifts in the industry is the establishment of psychedelic-assisted therapy clinics, where patients undergo controlled therapeutic sessions under medical supervision. The increasing number of startups specializing in psychedelic research has led to the development of novel formulations, microdosing strategies, and extended-release versions of these compounds to enhance their therapeutic potential. Companies are also exploring synthetic derivatives of naturally occurring psychedelics, aiming to minimize side effects while maximizing clinical efficacy. The rapid growth of the market has drawn significant investor interest, with several psychedelic biotech firms going public and raising capital to fund large-scale clinical trials. Moreover, collaborations between academic institutions, mental health organizations, and pharmaceutical companies are accelerating the pipeline for FDA and EMA approvals, bringing psychedelic therapies closer to market availability. As the demand for alternative mental health treatments grows, traditional pharmaceutical players are also entering the space, either through acquisitions or strategic partnerships, further driving the sector's expansion. With a projected increase in mental health spending worldwide, the business model for psychedelic drug therapy is expected to evolve, incorporating insurance reimbursement models and government-backed mental health initiatives.What Are the Key Growth Drivers of the Psychedelic Drugs Market?

The growth in the global psychedelic drugs market is driven by several factors, including increasing prevalence of mental health disorders, rising acceptance of alternative therapies, and regulatory shifts favoring psychedelic-assisted treatment. The significant limitations of conventional antidepressants and the growing cases of treatment-resistant depression have intensified the demand for novel therapeutic options, positioning psychedelics as a viable alternative. Advances in neuroscience and psychopharmacology have provided a better understanding of how psychedelics impact brain function, fostering greater confidence among healthcare professionals and researchers. The increasing destigmatization of psychedelics, coupled with advocacy from mental health organizations and influencers, has also played a role in market expansion. The growing number of clinical trials evaluating psilocybin, MDMA, and ketamine for mental health applications has contributed to greater institutional investment in the field. The rise of psychedelic wellness retreats, digital integration of mental health support, and expansion of therapy clinics specializing in psychedelic-assisted treatments are further broadening the market's reach. Additionally, as pharmaceutical regulations evolve to accommodate psychedelic medicine, large-scale production and commercialization efforts are expected to accelerate. The integration of personalized treatment protocols, AI-driven patient monitoring, and telemedicine support systems will likely enhance the accessibility and effectiveness of psychedelic therapy, ensuring long-term market growth.Report Scope

The report analyzes the Psychedelic Drugs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Drug Type (Gamma Hydroxybutyric Acid, Ketamine, Psilocybin, Lysergic Acid Diethylamide, Others); Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Other Distribution Channels); Application (Treatment-Resistant Depression, Opiate Addiction, Post-Traumatic Stress Disorder, Narcolepsy, Panic Disorders, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 34 companies featured in this Psychedelic Drugs market report include -

- Atai Life Sciences

- Beckley Psytech

- Bexson Biomedical

- Biomind Labs

- Bright Minds Biosciences

- CaaMTech

- Compass Pathways

- Cybin

- Delix Therapeutics

- Eleusis

- Entheon Biomedical

- Enveric Biosciences

- Field Trip Health

- GH Research

- Gilgamesh Pharmaceuticals

- Havn Life Sciences

- Jazz Pharmaceuticals

- Johnson & Johnson

- Lykos Therapeutics

- Mind Medicine (MindMed)

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gamma Hydroxybutyric Acid segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 13.8%. The Ketamine segment is also set to grow at 9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $530 Million in 2024, and China, forecasted to grow at an impressive 16% CAGR to reach $797.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Psychedelic Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Psychedelic Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Psychedelic Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Acurx Pharmaceuticals, Adaptive Phage Therapeutics, Allecra Therapeutics, AmpliPhi Biosciences Corp (now Armata Pharmaceuticals) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- Atai Life Sciences

- Beckley Psytech

- Bexson Biomedical

- Biomind Labs

- Bright Minds Biosciences

- CaaMTech

- Compass Pathways

- Cybin

- Delix Therapeutics

- Eleusis

- Entheon Biomedical

- Enveric Biosciences

- Field Trip Health

- GH Research

- Gilgamesh Pharmaceuticals

- Havn Life Sciences

- Jazz Pharmaceuticals

- Johnson & Johnson

- Lykos Therapeutics

- Mind Medicine (MindMed)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atai Life Sciences

- Beckley Psytech

- Bexson Biomedical

- Biomind Labs

- Bright Minds Biosciences

- CaaMTech

- Compass Pathways

- Cybin

- Delix Therapeutics

- Eleusis

- Entheon Biomedical

- Enveric Biosciences

- Field Trip Health

- GH Research

- Gilgamesh Pharmaceuticals

- Havn Life Sciences

- Jazz Pharmaceuticals

- Johnson & Johnson

- Lykos Therapeutics

- Mind Medicine (MindMed)

Table Information

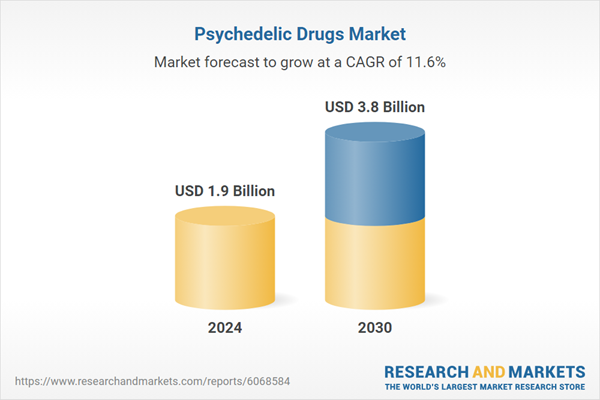

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |