Although cats are preferred as pets in the UAE, dog ownership rate has also witnessed a significant rise over the past few years. Growing number of expatriates and increasing prosperity have encouraged the trend of dog ownership in the country. Moreover, owing to pet humanization, a large section of the population is now treating their dogs as a part of their family, and is willing to expend more money on dog food products for maintaining healthy weight and providing them with an overall balanced diet. Apart from this, premium dog food products are also gaining traction in the country as they are made of better-quality ingredients which provide the right balance of nutrients.

UAE Dog Food Industry Drivers:

Dog owners now prefer to buy organic dog food products as they are devoid of pesticides, genetically modified organisms (GMOs), and artificial flavorings and preservatives. Additionally, these products include natural prebiotics which assist in digestion and avert skin diseases and allergic reactions in dogs. Further, several residential buildings and public spaces in the UAE are now allowing the entry of pets with their owners. For instance, Dubai Birds and Pet Market has included a dog-walking area in its plans. Similarly, hotels in Dubai and Abu Dhabi are offering assorted treats, and special customized menu and services for dogs. Other factors such as the increasing number of nuclear families and escalating demand for service dogs for the geriatric population are augmenting the sales of dog food in the country.Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the UAE dog food market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type, ingredient and distribution- Dry Food

- Wet and Canned Food

- Snacks and Treats

Breakup by Ingredient:

- Animal Derivatives

- Plant Derivatives

- Cereals Derivatives

- Others

Breakup by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

Competitive Landscape:

The competitive landscape of the UAE dog food market has also been examined. Some of the key players operating in the market include:- Del Monte Foods Inc.

- Nestlé S.A.

- Mars, Incorporated

- Hill's Pet Nutrition, Inc.

Key Questions Answered in This Report

1. How big is the UAE dog food market?2. What is the expected growth rate of the UAE dog food market during 2025-2033?

3. What are the key factors driving the UAE dog food market?

4. What has been the impact of COVID-19 on the UAE dog food market?

5. What is the breakup of the UAE dog food market based on the product type?

6. What is the breakup of the UAE dog food market based on the ingredient?

7. Who are the key players/companies in the UAE dog food market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 GCC Dog Food Market

5.1 Market Overview

5.2 Market Performance

5.3 Market Breakup by Product Type

5.4 Market Breakup by Ingredient

5.5 Market Breakup by Distribution Channel

5.6 Market Breakup by Region

5.7 Market Forecast

6 UAE Dog Food Market

6.1 Market Overview

6.2 Market Performance

6.3 Impact of COVID-19

6.4 Market Breakup by Product Type

6.5 Market Breakup by Ingredient

6.6 Market Breakup by Distribution Channel

6.7 Market Forecast

7 Market Breakup by Product Type

7.1 Dry Food

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Wet and Canned Food

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Snacks and Treats

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Ingredient

8.1 Animal Derivatives

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Plant Derivatives

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Cereals Derivatives

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Distribution Channel

9.1 Convenience Stores

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Supermarkets and Hypermarkets

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Online Stores

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 UAE Dog Food Industry: SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 UAE Dog Food Industry: Value Chain Analysis

11.1 Overview

11.2 Research and Development

11.3 Raw Material Procurement

11.4 Manufacturing

11.5 Marketing

11.6 Distribution

11.7 End-Use

12 UAE Dog Food Industry: Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 UAE Dog Food Industry: Price Analysis

13.1 Price Indicators

13.2 Price Structure

13.3 Margin Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Del Monte Foods Inc.

14.3.2 Nestlé S.A.

14.3.3 Mars, Incorporated

14.3.4 Hill's Pet Nutrition, Inc.

List of Figures

Figure 1: UAE: Dog Food Market: Major Drivers and Challenges

Figure 2: GCC: Dog Food Market: Sales Value (in Million USD), 2019-2024

Figure 3: GCC: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 4: GCC: Dog Food Market: Breakup by Ingredient (in %), 2024

Figure 5: GCC: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 6: GCC: Dog Food Market: Breakup by Region (in %), 2024

Figure 7: GCC: Dog Food Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 8: UAE: Dog Food Market: Sales Value (in Million USD), 2019-2024

Figure 9: UAE: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 10: UAE: Dog Food Market: Breakup by Ingredient (in %), 2024

Figure 11: UAE: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 12: UAE: Dog Food Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: UAE: Dog Food Industry: SWOT Analysis

Figure 14: UAE: Dog Food Industry: Value Chain Analysis

Figure 15: UAE: Dog Food Industry: Porter’s Five Forces Analysis

Figure 16: UAE: Dog Food Market: Average Prices (in USD/Ton), 2019 & 2024

Figure 17: UAE: Dog Food Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 18: UAE: Dog Food Market Price Structure Analysis (in %)

Figure 19: UAE: Dry Dog Food Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: UAE: Dry Dog Food Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: UAE: Wet and Canned Dog Food Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: UAE: Wet and Canned Dog Food Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: UAE: Snacks and Treats Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: UAE: Snacks and Treats Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: UAE: Dog Food Market: Ingredients Derived from Animal: Sales Value (in Million USD), 2019 & 2024

Figure 26: UAE: Dog Food Market Forecast: Ingredients Derived from Animal: Sales Value (in Million USD), 2025-2033

Figure 27: UAE: Dog Food Market: Ingredients Derived from Plant: Sales Value (in Million USD), 2019 & 2024

Figure 28: UAE: Dog Food Market Forecast: Ingredients Derived from Plant: Sales Value (in Million USD), 2025-2033

Figure 29: UAE: Dog Food Market: Ingredients Derived from Cereals: Sales Value (in Million USD), 2019 & 2024

Figure 30: UAE: Dog Food Market Forecast: Ingredients Derived from Cereals: Sales Value (in Million USD), 2025-2033

Figure 31: UAE: Dog Food Market: Other Ingredients: Sales Value (in Million USD), 2019 & 2024

Figure 32: UAE: Dog Food Market Forecast: Other Ingredients: Sales Value (in Million USD), 2025-2033

Figure 33: UAE: Dog Food Market: Sales through Convenience Stores (in Million USD), 2019 & 2024

Figure 34: UAE: Dog Food Market Forecast: Sales through Convenience Stores (in Million USD), 2025-2033

Figure 35: UAE: Dog Food Market: Sales through Supermarkets and Hypermarkets (in Million USD), 2019 & 2024

Figure 36: UAE: Dog Food Market Forecast: Sales through Supermarkets and Hypermarkets (in Million USD), 2025-2033

Figure 37: UAE: Dog Food Market: Sales through Online Stores (in Million USD), 2019 & 2024

Figure 38: UAE: Dog Food Market Forecast: Sales through Online Stores (in Million USD), 2025-2033

Figure 39: UAE: Dog Food Market: Sales through Other Distribution Channels (in Million USD), 2019 & 2024

Figure 40: UAE: Dog Food Market Forecast: Sales through Other Distribution Channels (in Million USD), 2025-2033

List of Tables

Table 1: GCC: Dog Food Market: Key Industry Highlights, 2024 and 2033

Table 2: UAE: Dog Food Market: Key Industry Highlights, 2024 and 2033

Table 3: UAE: Dog Food Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 4: UAE: Dog Food Market Forecast: Breakup by Ingredient (in Million USD), 2025-2033

Table 5: UAE: Dog Food Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 6: UAE: Dog Food Market Structure

Table 7: UAE: Dog Food Market: Key Players

Companies Mentioned

- Del Monte Foods Inc.

- Nestlé S.A.

- Mars

- Incorporated

- Hill's Pet Nutrition Inc.

Table Information

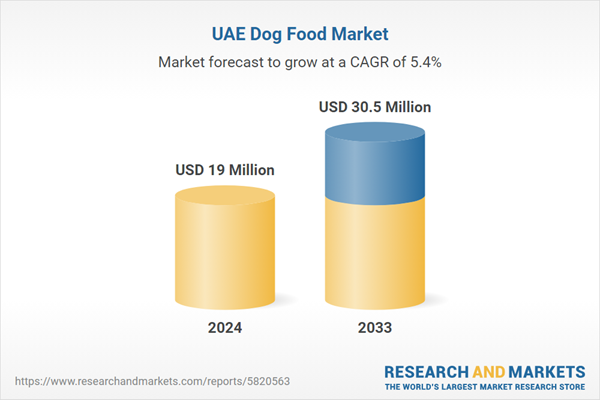

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 19 Million |

| Forecasted Market Value ( USD | $ 30.5 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 5 |