The rising domestic end-use industries in the U.S. are a significant factor supporting the growth of the chemical sector in the United States. Heat exchangers are necessary for heating, cooling, and mixing materials during the manufacture of chemicals. The rapid expansion of the chemical industry in the U.S. is expected to significantly fuel the U.S. market.

Furthermore, the companies in the U.S. are focusing on the circular economy and with an emphasis on investments in green and sustainable chemicals. With a growing emphasis on sustainability, key players are focused on energy-efficient solutions to reduce greenhouse gas emissions and lower carbon footprints. For instance, SPX FLOW, Inc. provides heat exchangers with low energy usage that use CO2 as a highly efficient cooling medium.

The U.S. market growth is also propelled by the growing utilization of the energy sector. According to the International Energy Agency, in 2022, the total electricity generation from utility-scale generators in the U.S. was around 4.24 trillion kilowatts and about 60% of the electricity generated was generated from fossil fuels (coal, natural gas, and petroleum). The total net electricity generation in 2021 was around 4.10 trillion kilowatts.

Moreover, innovation and technological improvements, such as phase-change technology with the sustainable aspect in the air-cooled heat exchangers, may entail innovative designs. In addition, improvements in the regulatory framework in various end-use industries are likely to facilitate such innovation providing environmentally sound technologies for heat transfer.

Key players in the market are actively engaged in R&D expenditure activities, product launches, mergers & acquisitions, and joint ventures to achieve higher market position and revenue generation. For instance, in February 2023, ALFA LAVAL announced the investment plans to further support the global energy transition. Through this initiative, the company seeks to invest USD 343.7 million (SEK 3.8 billion) in a capacity expansion program for heat exchangers in services, production, and distribution capacity in Sweden, Italy, the U.S., and China.

U.S. Heat Exchangers Market Report Highlights

- Based on product, the plate & frame segment is anticipated to register the fastest CAGR during the forecast period. Various applications of the heat exchanger in power generation, food & beverage, chemical & petrochemical industry, etc. are expected to drive the demand of the segment facilitated by the industry growth.

- Based on product, the shell & tube segment held a significant market share of 35.3% in 2024. Technological advancements in the shell & tube heat exchangers in terms of efficient design and material are expected to impact the adoption of the newly developed heat exchangers in various industries.

- In terms of end-use, the chemical & petrochemical segment held the largest market share of 25.1% in 2024. The large usage of heat exchangers for thermal control operations in the chemical and petrochemical industry is of prime importance.

- Based on end-use, the HVAC & refrigeration segment is anticipated to grow at a significant CAGR during the forecast period. The growth is highly driven by the robust growth of construction projects across the country.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments

- Competitive Landscape: Explore the market presence of key players worldwide

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

The leading players in the U.S. Heat Exchangers market include:

- Mersen

- Chart Industries

- Koch Heat Transfer Company

- SHECO Industries, Inc.

- HEATTRAN

- ALFA LAVAL

- Kelvion Holding GmbH

- Xylem

- API Heat Transfer

- Mason Manufacturing LLC

Table of Contents

Companies Mentioned

- Mersen

- Chart Industries

- Koch Heat Transfer Company

- SHECO Industries, Inc.

- HEATTRAN

- ALFA LAVAL

- Kelvion Holding GmbH

- Xylem

- API Heat Transfer

- Mason Manufacturing LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | October 2024 |

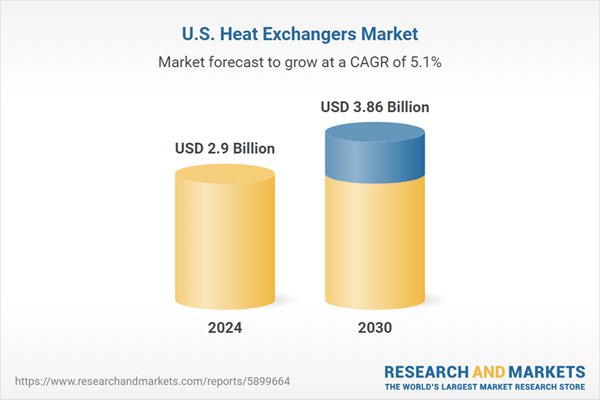

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 3.86 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |