Lifestyle changes and an increase in the number of sedentary jobs are transforming the disease profile of the U.S. population. Noncommunicable diseases such as cancer, diabetes, and cardiovascular diseases are increasing in prevalence. For instance, according to a CDC report, diabetes prevalence had risen to an estimated 37.3 million patients in 2022. Lifestyle diseases due to poor dietary habits, lack of exercise, and smoking, irrespective of gender, age, & heredity, lead to several health problems, such as low body oxygen levels & breathing difficulties. Chronic disease prevalence is expected to rise in the country.

The COVID-19 pandemic adversely impacted the U.S. healthcare system. Healthcare facilities across the U.S. were facing both financial and organizational difficulties. One of the major steps taken by the hospitals at the start of the pandemic was to delay elective procedures, which culminated in monumental monetary losses for the hospitals. According to AHA COVID-19 Financial Impact Report Estimates, due to canceled services during the pandemic, non-federal hospitals lost around USD 161.4 billion in income during the four months from March 2020 to June 2020. Furthermore, the decline in visits was mostly attributed to the cancellation of elective treatments, which resulted in a revenue loss of millions of dollars. According to CovidSurg, 28.4 million surgeries were canceled or postponed during the first 3 months of disruption caused by the pandemic. The aforementioned factors negatively impacted the market.

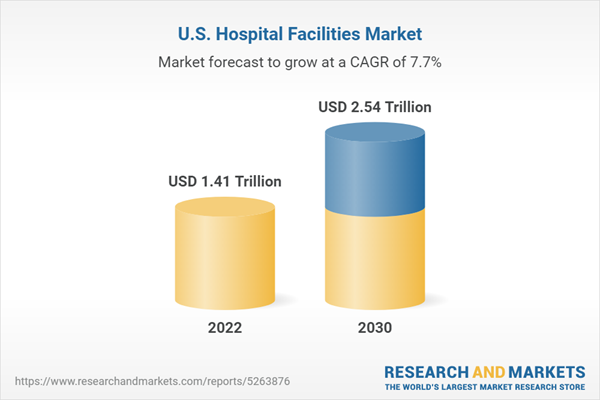

U.S. Hospital Facilities Market Report Highlights

- The cardiovascular segment dominated the market, accounting for a share of around 20% in 2022. The segment is further expected to dominate the market over the forecast period.

- The public/community hospitals segment dominated the market with a share of over 52% in 2022. Community hospitals hold the highest number of patient beds and offer a wide variety of care areas through different services.

- The outpatient services segment dominated the market with a share of around 51% in 2022 and is additionally poised to be the fastest-growing segment with a CAGR of 9.0% over the forecast period.

- Based on bed size, the market is segmented into 0-99, 100-199, 200-299, and 300-more. The 0-99 segment dominated the market in 2022 with a revenue share of 53.2%. This segment comprises small hospitals that primarily serve rural or remote areas with low population density.

Table of Contents

Companies Profiled

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars-Sinai

- Massachusetts General Hospital

- UCSF HEALTH

- NewYork-Presbyterian Hospital

- Brigham and Women's Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 98 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1.41 Trillion |

| Forecasted Market Value ( USD | $ 2.54 Trillion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |