Introducing new products can ignite positive competition among manufacturers, fostering innovation, lowering prices, and ultimately enhancing choices for both patients and healthcare providers. The potential for expanding the overall market depends upon the manufacturing of novel contrast agents that offer heightened safety, enhanced target specificity, or distinctive imaging properties. This opens up new pathways for both diagnosis and treatment. For instance, in April 2023, GE Healthcare has broadened its range of contrast media by introducing two premier macrocyclic molecules, namely Clariscan (gadoteric acid) and Pixxoscan (gadobutrol), to its customer base for MRI agents. The industry key players are involved in enhancing R&D by introducing novel products to the market by expanding their product portfolio, which drives market growth.

Moreover, increased funding in healthcare budgets often facilitates public health initiatives promoting early cancer detection and enhanced accessibility to advanced diagnostic tools. These initiatives enhance awareness of the importance of contrast-enhanced imaging, consequently fueling demand for corresponding contrast media. The growth in healthcare budgets attracts new players and motivates existing stakeholders to compete in the market. This dynamic stimulates innovation, fosters price competitiveness, and ultimately leads to a broader range of options for both healthcare providers and patients. Such initiatives create a lucrative opportunity for market expansion.

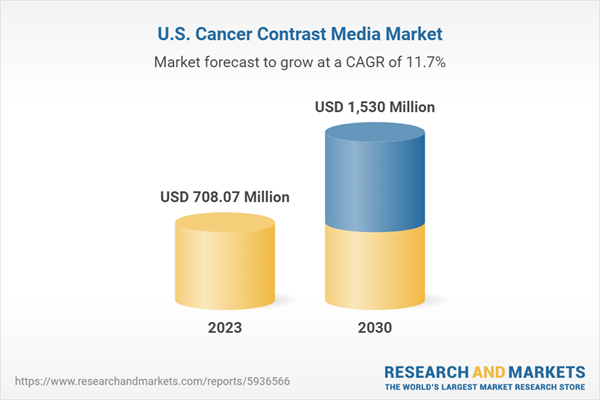

U.S. Cancer Contrast Media Market Report Highlights

- Iodinated contrast media dominated the type segment with a share of 39.5% in 2023 owing to the increasing medical imaging procedures.

- The radioactive agents segment is expected to grow at the fastest CAGR over the forecast period.

- The nuclear imaging segment held the largest market share of 38.2% in 2023 and is anticipated to witness fastest growth over the forecast period owing to its ability to provide detailed and accurate images of internal structures and functions within the body which allows healthcare professionals for precise diagnosis.

- Sedentary lifestyle, increasing incidences of smoking and rising air pollution are contributing to the growing prevalence of cancer cases in U.S.

Table of Contents

Companies Mentioned

- Bayer AG

- Lantheus

- Bracco

- Guerbet

- Trivitron Healthcare

- Cardinal Health

- Telix Pharmaceuticals Limited

- GE HealthCare

- IMAX Diagnostic Imaging

- Nano Therapeutics Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 94 |

| Published | January 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 708.07 Million |

| Forecasted Market Value ( USD | $ 1530 Million |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |