The growing significance of faster delivery to save time and labor costs in different industries is positively influencing the market outlook. Moreover, the growth of e-commerce and globalization are expected to create opportunities for the U.S. postal automation systems market over the forecast period. The expansion of e-commerce companies has strengthened the overall market outlook with the heightened adoption of postal automation systems to simplify the mail processing chain, improve service quality, and reduce fixed costs such as labor. A considerable rise in parcel shipping activities across the U.S. is creating lucrative opportunities for the market. According to the annual parcel shipping index report by Pitney Bowes Inc., 21.2 billion parcels were shipped, received, and returned across the country in 2022. The volume is expected to reach 28 billion by 2028.

With the increased globalization and the expansion of the e-commerce sector, individuals and businesses expect faster and more flexible delivery of goods at minimal cost. As a result, the logistics industry is largely focusing on streamlining and optimizing its supply chain operations. In this regard, automation offers greater potential to transform the logistics industry by providing businesses the new levels of efficiency, flexibility, and accuracy. The companies operating in this industry are investing in automation technologies such as transportation management systems, warehouse management systems, and robots to automate various tasks across the supply chain. The increasing consumer preference for online shopping and the need to handle vast volumes of goods have urged several companies to invest in automation solutions that can facilitate efficient logistics operations. For instance, in May 2023, FedEx announced the acquisition of 12 parcel-sorting robotic arms from Plus One Robotics and Yaskawa Motoman

and deployed them at its Express sorting facility in Tennessee. The technology used in these depalletizing arms will enable smooth and efficient movement of goods from palleted shipments across the facility. Such initiatives to optimize the operations and supply chains across the logistics sector will positively influence market growth over the coming years.

U.S. Postal Automation System Market Report Highlights

- Based on technology, the culler facer canceller segment led the market in 2022 with the largest market revenue share of 19.67%. The U.S. postal automation systems market has seen significant growth in recent years due to advances in culler facer canceller segment. This technology has revolutionized the way that mail is processed, making it faster, more efficient, and more accurate

- Based on type, the hardware segment led the market in 2022 with the largest revenue share of 64.7%. This growth can be attributed to the increased demand for faster and more efficient mail processing, as well as the need to reduce costs and improve accuracy. One of the key hardware technologies driving this growth is the use of automated sorting machines.

- In terms of application, the commercial postal segment is anticipated to register the fastest CAGR during the forecast period. The growth of the commercial postal segment in the market is attributed to increased efficiency, cost savings, and streamlined processes. Businesses are leveraging automation to enhance sorting, tracking, and delivery, contributing to the overall expansion of the market.

- In April 2023, Beumer Group expanded its global presence as it opened a new head office in the U.K. Along with this, the company also operates material handling and airport baggage handling systems at Heathrow Airport.

Table of Contents

Companies Mentioned

- Bastian Solutions

- Beumer Group

- BlueCrest (DMT Solutions Global Corporation)

- Dematic

- GBI Intralogistics

- ID Mail Systems

- Lockheed Martin Corporation

- OPEX Corporation

- Pitney Bowes Inc.

- Vanderlande Industries B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 95 |

| Published | January 2024 |

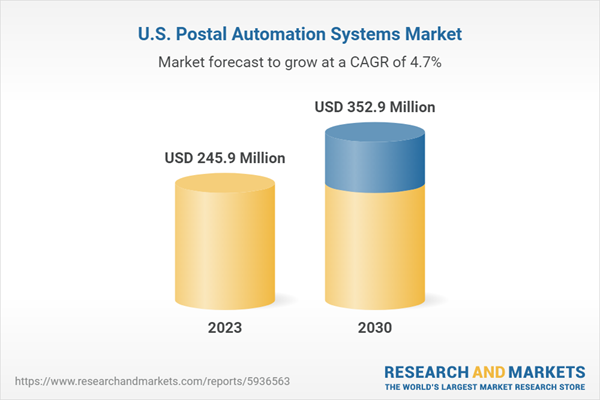

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 245.9 Million |

| Forecasted Market Value ( USD | $ 352.9 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |