Key Highlights

- The footwear market consists of the total revenues generated through the sale of all types of men's, women's and children's shoes. It includes all footwear categories for men, women, boys and girls, but excludes sports-specific footwear. All market data and forecasts are represented in nominal terms (i.e., without adjustment for inflation) and all currency conversions used in the creation of this report have been calculated using constant 2020 annual average exchange rates.

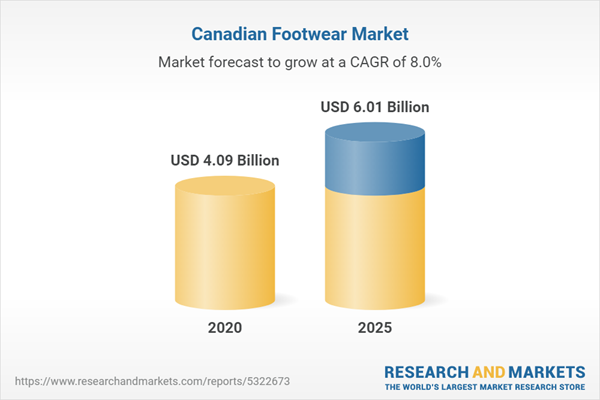

- The Canadian footwear market had total revenues of $4.1bn in 2020, representing a compound annual rate of change (CARC) of -7% between 2016 and 2020.

- The women's footwear segment was the market's most valuable in 2020, with total revenues of $2.2bn, equivalent to 54.1% of the market's overall value.

- The COVID-19 pandemic created unprecedented market conditions in 2020 which caused consumers to spend less on non-essential products.

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the footwear market in Canada

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the footwear market in Canada

- Leading company profiles reveal details of key footwear market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Canada footwear market with five year forecasts by both value and volume

Reasons to Buy

- What was the size of the Canada footwear market by value in 2020?

- What will be the size of the Canada footwear market in 2025?

- What factors are affecting the strength of competition in the Canada footwear market?

- How has the market performed over the last five years?

- How large is Canada’s footwear market in relation to its regional counterparts?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aldo Group Inc

- NIKE Inc

- Belle International Holdings Ltd

- C & J Clark International Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 42 |

| Published | July 2021 |

| Forecast Period | 2020 - 2025 |

| Estimated Market Value ( USD | $ 4.09 Billion |

| Forecasted Market Value ( USD | $ 6.01 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Canada |