Key Highlights

- The passenger cars manufacturers market value is calculated in terms of manufacturer selling price (MSP), and excludes all taxes and levies.

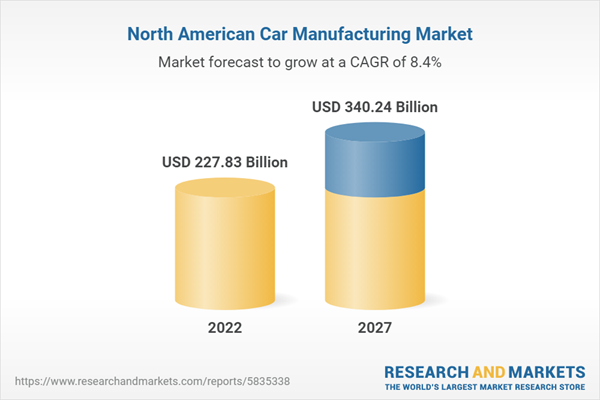

- The North American car manufacturing industry had total revenues of $227.8 billion in 2022, representing a compound annual growth rate (CAGR) of 2.2% between 2017 and 2022.

- Industry consumption volumes declined with a negative CAGR of 3.6% between 2017 and 2022, reaching a total of 13.8 million units in 2022.

- The North American car manufacturing industry’s growth can be attributed to the increase in export demand for cars. According to the latest data from the Observatory of Economic Complexity (OEC), Canada recorded a positive trade balance of $1.8 billion for car vehicles in 2021, whereas Mexico recorded a positive trade balance of $33.5 billion.

Scope

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the car manufacturing market in North America

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the car manufacturing market in North America

- Leading company profiles reveal details of key car manufacturing market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the North America car manufacturing market with five year forecasts

Reasons to Buy

- What was the size of the North America car manufacturing market by value in 2022?

- What will be the size of the North America car manufacturing market in 2027?

- What factors are affecting the strength of competition in the North America car manufacturing market?

- How has the market performed over the last five years?

- Who are the top competitors in North America's car manufacturing market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Tesla, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 54 |

| Published | April 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 227.83 Billion |

| Forecasted Market Value ( USD | $ 340.24 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | North America |