Global Paints and Coatings Market - Key Trends & Drivers Summarized

What Is Shaping the Future of Paints and Coatings?

The paints and coatings market has witnessed significant evolution over the past few decades, driven by a multitude of factors including technological advancements, regulatory influences, and shifting consumer preferences. Technological innovations have led to the development of advanced formulations that offer enhanced durability, better coverage, and environmental benefits. Waterborne coatings, for instance, have gained prominence due to their low VOC (volatile organic compounds) content, aligning with stringent environmental regulations and growing consumer awareness about sustainability. Moreover, nanotechnology has enabled the creation of coatings with superior properties such as self-cleaning, anti-microbial, and anti-corrosive features, catering to diverse industrial applications.How Are Market Dynamics Influencing Consumer Choices?

The market dynamics of paints and coatings are intricately linked to consumer behavior and economic trends. With the rise in urbanization and disposable incomes, there is an increasing demand for aesthetically pleasing and functional coatings in residential and commercial spaces. The DIY (do-it-yourself) trend has also surged, especially in developed economies, driving the market for easy-to-apply, ready-to-use products. Additionally, the construction boom in emerging economies has fueled the demand for high-performance architectural coatings that can withstand harsh environmental conditions. The automotive industry continues to be a major consumer, seeking innovative coatings that provide durability and aesthetic appeal while complying with environmental standards.What Are the Major Regulatory and Environmental Trends?

Regulatory and environmental trends play a crucial role in shaping the paints and coatings market. Governments worldwide are implementing stringent regulations to limit the emission of harmful chemicals, pushing manufacturers to develop eco-friendly alternatives. The adoption of green building standards and certification systems such as LEED (Leadership in Energy and Environmental Design) has further propelled the demand for sustainable coatings. Companies are investing heavily in research and development to create products that meet these standards without compromising on performance. The push for sustainability is also evident in the growing popularity of bio-based and recyclable coatings, which offer a reduced environmental footprint and align with global efforts to combat climate change.What Is Driving the Growth of the Paints and Coatings Market?

The growth in the paints and coatings market is driven by several factors. Firstly, the ongoing expansion in the construction industry, particularly in Asia-Pacific and Latin America, is a significant driver as these regions invest in infrastructure development and housing projects. Secondly, technological advancements such as the development of smart coatings that can respond to environmental changes are opening new avenues for market growth. Thirdly, the increasing demand for automotive and aerospace coatings, driven by the need for lightweight, durable, and aesthetically superior materials, is propelling the market forward. Additionally, the rise in renovation and refurbishment activities in mature markets, coupled with the DIY trend, is boosting the demand for decorative paints. The emphasis on sustainable and environmentally friendly products continues to drive innovation, with manufacturers focusing on low-VOC, waterborne, and bio-based formulations to meet regulatory standards and consumer expectations.Report Scope

The report analyzes the Paints and Coatings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Resin (Acrylic, Polyester, Alkyd, Polyurethane, Epoxy, Other Resins); Technology (Water-based, Powder, Solvent-based, Other Technologies); Application (Architectural, Automotive OEM, Protective, Automotive Refinish, Industrial Wood, Packaging, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Resin segment, which is expected to reach US$110.9 Billion by 2030 with a CAGR of 6.1%. The Polyester Resin segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $33.8 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $78.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Paints and Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Paints and Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Paints and Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Asian Paints Limited, Axalta Coating Systems LLC, BASF SE, Berger Paints India Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 390 companies featured in this Paints and Coatings market report include:

- Akzo Nobel NV

- Asian Paints Limited

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Limited

- Brillux GmbH & Co. KG

- DAW SE

- Dunn-Edwards Corporation

- Hempel A/S

- Jotun Group

- JW Ostendorf GmbH & Co. KG

- Nippon Paint Holdings Co., Ltd

- NIPSEA Group

- PPG Industries Inc.

- RPM International Inc.

- S K Kaken Co., Ltd

- Shalimar Paints Limited

- Sherwin-Williams Company

- Teknos Group Oy

- Tiger Coatings Gmbh& Co. Kg

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Asian Paints Limited

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Limited

- Brillux GmbH & Co. KG

- DAW SE

- Dunn-Edwards Corporation

- Hempel A/S

- Jotun Group

- JW Ostendorf GmbH & Co. KG

- Nippon Paint Holdings Co., Ltd

- NIPSEA Group

- PPG Industries Inc.

- RPM International Inc.

- S K Kaken Co., Ltd

- Shalimar Paints Limited

- Sherwin-Williams Company

- Teknos Group Oy

- Tiger Coatings Gmbh& Co. Kg

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 702 |

| Published | February 2026 |

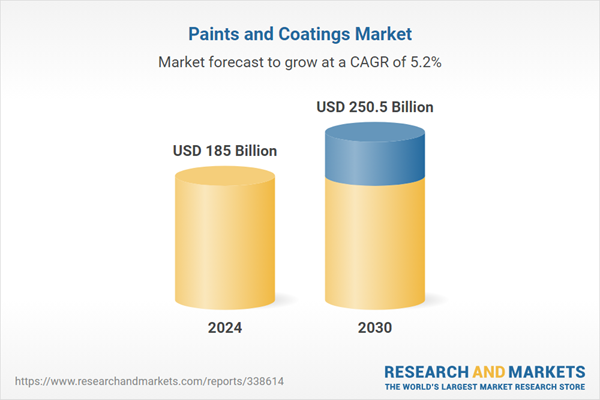

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 185 Billion |

| Forecasted Market Value ( USD | $ 250.5 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |