Global Air Conditioning Systems Market - Key Trends & Drivers Summarized

Air conditioning systems have become an integral part of modern living, providing essential climate control in residential, commercial, and industrial settings. These systems work by removing heat from indoor spaces and expelling it outside, thereby lowering the indoor temperature and creating a comfortable environment. Air conditioning units come in various types, including window units, split systems, central air conditioning, and portable units, each tailored to different needs and spaces. Window units and portable air conditioners are typically used for single rooms, while split systems and central air conditioning are designed to cool larger areas or entire buildings. Modern air conditioning systems also offer additional features such as humidity control, air filtration, and programmable thermostats, enhancing their functionality and user convenience.Technological advancements have significantly transformed the air conditioning industry, leading to more efficient, environmentally friendly, and intelligent systems. Innovations such as inverter technology, which adjusts the compressor speed to maintain the desired temperature without frequent on-off cycles, have improved energy efficiency and reduced operational costs. Smart air conditioning systems that can be controlled via mobile apps or integrated with home automation systems offer users greater control over their indoor environment. Additionally, advancements in refrigerants have addressed environmental concerns, with newer, eco-friendly options replacing older, ozone-depleting substances. These technological strides have not only improved the performance and efficiency of air conditioning systems but also aligned them with growing environmental and regulatory standards.

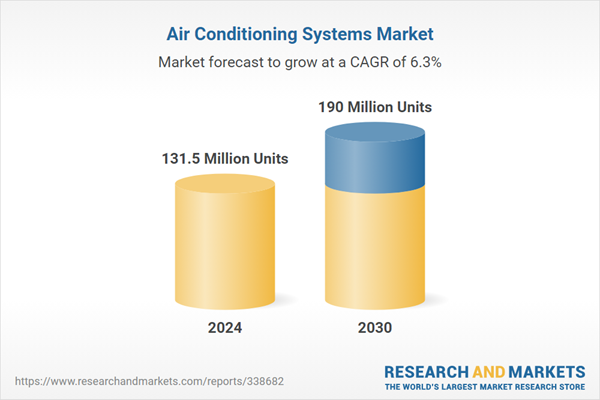

The growth in the air conditioning systems market is driven by several factors. Increasing global temperatures and the frequency of heatwaves have heightened the demand for air conditioning, particularly in regions experiencing extreme weather conditions. Urbanization and rising disposable incomes in emerging economies are also contributing to market expansion, as more households and businesses invest in air conditioning systems. Technological advancements, such as the development of energy-efficient systems and smart technology integration, are attracting consumers seeking modern, cost-effective solutions. Additionally, the emphasis on green building initiatives and energy conservation is promoting the adoption of high-efficiency air conditioning systems that reduce energy consumption and minimize environmental impact. The commercial sector`s need for climate control in office buildings, retail spaces and industrial facilities further drives market growth. These factors, combined with ongoing innovations in the air conditioning industry, are expected to drive sustained growth in the air conditioning systems market in the coming years.

SCOPE OF STUDY:

The report analyzes the Air Conditioning Systems market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Segment (Room Air Conditioners, Commercial Air Conditioners)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Turkey; Rest of Europe; Asia-Pacific; Australia; India; Indonesia; Malaysia; Philippines; South Korea; Taiwan; Thailand; Vietnam; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Room Air Conditioners segment, which is expected to reach 171.1 Million Units by 2030 with a CAGR of a 6.6%. The Commercial Air Conditioners segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 16.0 Million Units in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach 87.4 Million Units by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Air Conditioning Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Air Conditioning Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Air Conditioning Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arcelik A.S., Aliseo S.P.A., A.T.E. Enterprises Pvt., Ltd. (HMX), Ferroli SpA, AAON, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 130 companies featured in this Air Conditioning Systems market report include:

- Arcelik A.S.

- Aliseo S.P.A.

- A.T.E. Enterprises Pvt., Ltd. (HMX)

- Ferroli SpA

- AAON, Inc.

- CIAT Group

- Amana

- Blue-Stream Services

- BBB Rooms

- EnerTrac

- Agoura Hills Air Duct Cleaning Company

- Able Energy, Inc.

- Emmegi Impianti Srl

- Formula One Licensing BV

- AirFixture L.L.C.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arcelik A.S.

- Aliseo S.P.A.

- A.T.E. Enterprises Pvt., Ltd. (HMX)

- Ferroli SpA

- AAON, Inc.

- CIAT Group

- Amana

- Blue-Stream Services

- BBB Rooms

- EnerTrac

- Agoura Hills Air Duct Cleaning Company

- Able Energy, Inc.

- Emmegi Impianti Srl

- Formula One Licensing BV

- AirFixture L.L.C.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 434 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 131.5 Million Units |

| Forecasted Market Value by 2030 | 190 Million Units |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |