Key Highlights

- The banks industry profile comprises activities of banks and similar institutions, offering savings, loans, mortgages, and related financial services to consumers and businesses.

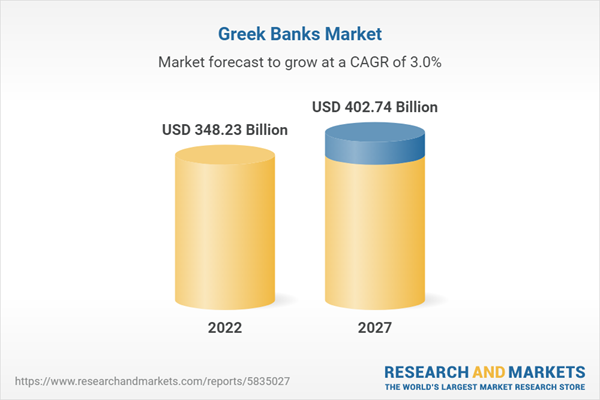

- The Greek banks industry group had total assets of $348.2 million in 2022, representing a compound annual growth rate (CAGR) of 1.2% between 2017 and 2022.

- The Bank Credit segment accounted for the industry group’s largest proportion in 2022, with total assets of $125.5 million, equivalent to 36% of the industry group's overall value.

- According to the OECD, the long-term interest rates of Greek banks had increased significantly during the historic period, from 0.6% per annum in August 2021 to 4.9% per annum in October 2022.

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the banks market in Greece

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the banks market in Greece

- Leading company profiles reveal details of key banks market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Greece banks market with five year forecasts by both value and volume

Reasons to Buy

- What was the size of the Greece banks market by value in 2022?

- What will be the size of the Greece banks market in 2027?

- What factors are affecting the strength of competition in the Greece banks market?

- How has the market performed over the last five years?

- How large is Greece’s banks market in relation to its regional counterparts?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpha Services and Holdings SA

- Eurobank Ergasias Services and Holdings SA

- National Bank of Greece SA

- Piraeus Financial Holdings SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 48 |

| Published | April 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 348.23 Billion |

| Forecasted Market Value ( USD | $ 402.74 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Greece |