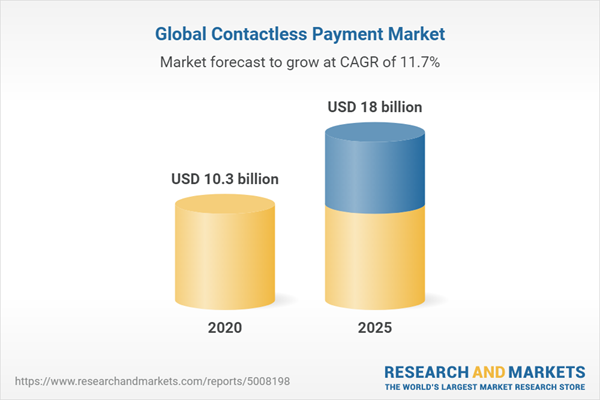

The global contactless payment market size is expected to grow from USD 10.3 billion in 2020 to USD 18.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 11.7% during the forecast period. The major advantage offered by contactless payments is that customers can instantly complete transactions with the tap of a card. This increases the speed of transactions, making contactless payments even more efficient. With the increasing integration of contactless payment technologies in mobile handsets and smartphones, the demand for contactless payment solutions has grown tremendously across all the countries.

POS is a point where customers make payments to retailers. The POS terminal is an electronic device used to process payment transactions at retail stores. These terminals have seen significant growth in the contactless payment market because of various benefits, such as ease of use, low deployment cost, and mobility. Contactless payments have completely changed the way customers pay for goods; eventually, it has also reduced the time spent on queuing at POS terminals.

Based on the vertical, the retail vertical to lead the contactless payment market in 2020

The retail vertical is undergoing a major transformation. Retailers are modernizing their brick-and-mortar stores to provide improved services for customers and establish online stores to increase revenues. They are adopting innovative technologies, such as cloud computing, big data analytics, digital stores, and social networks, to increase their visibility and presence in the market. Retailers are also realizing the benefits of contactless payments, which include reduced transaction time, increased revenue, improved operational efficiency, and minimized operating costs. Mobile payments at retail stores have helped accelerate the transaction process and reduce counter queues.

Among regions, Europe to lead the contactless payment market in 2020

The contactless payment market in Europe is the largest in terms of market size and is highly fragmented based on multi-currencies and multi-languages. The region comprises a diverse range of countries, from economically and technologically advanced countries, such as the UK and Germany to severely debt-ridden countries, such as Greece and Austria. The UK, Poland, Spain, and Germany are the leading countries in the European contactless payment market. The total contactless spending has grown in these countries with the increasing circulation of contactless cards and terminals by card companies, such as Visa and Mastercard.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the contactless payment market.

The following list provides the breakup of primary respondents' profiles:

- By Company Type: Tier 1: 35%, Tier 2: 45%, and Tier 3: 20%

- By Designation: C level Executives: 35%, Director Level: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 20%, Asia Pacific (APAC): 30%, and Rest of the World: 5%

Major vendors in the global contactless payment market include Gemalto (Netherlands), Infineon (Germany), Ingenico (France), Wirecard (Germany), Verifone (US), Giesecke+Devrient (Germany), IDEMIA (France), On Track Innovations (Israel), Identiv (US), CPI Card Group (US), Bitel (South Korea), Setomatic Systems (US), Valitor (Iceland), PAX Global Technology (China), MYPINPAD (UK), Mobeewave (UK), Alcineo (South Africa), Castles (Taiwan), SumUp (UK), and PayCore (Istanbul).

Research coverage:

The report includes an in-depth competitive analysis of key players in the contactless payment market, along with their company profiles, recent developments, and key market strategies. The report segments the global contactless payment market by component (hardware, solutions, and services), vertical, and region.

Key benefits of buying the report:

The report would provide market leaders/new entrants in the contactless payment market, with information on the closest approximations of the revenue numbers for the overall contactless payment market and subsegments. The report would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It further helps stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- Alcineo

- Bitel

- Castles

- CPI Card Group

- Gemalto

- Giesecke+Devrient

- Idemia

- Identiv

- Infineon

- Ingenico

- Mobeewave

- Mypinpad

- On Track Innovations

- Pax Global Technology

- Paycore

- Setomatic Systems

- Sumup

- Valitor

- Verifone

- Wirecard

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | March 2020 |

| Forecast Period | 2020 - 2025 |

| Estimated Market Value ( USD | $ 10.3 billion |

| Forecasted Market Value ( USD | $ 18 billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |