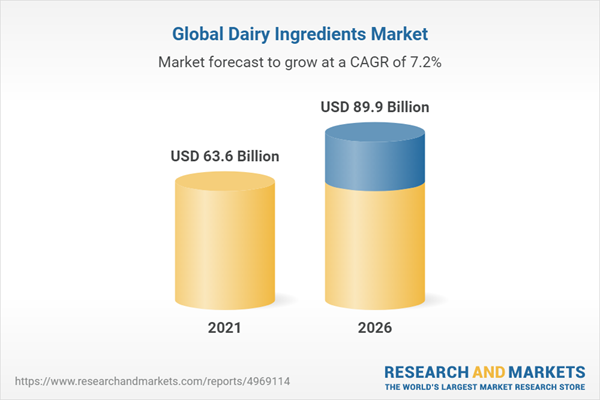

The global dairy ingredients market is estimated to be valued at USD 63.6 billion in 2021 and is projected to reach USD 89.9 billion by 2026, recording a CAGR of 7.2%. Different properties of dairy ingredients are useful for various applications in the food & beverage industry, which is increasing their demand among manufacturers. Also, they are known to possess various nutritional characteristics, which makes them popular among consumers.

The milk powder segment is projected to be the largest segment in the dairy ingredients market during the forecast period.

An increase in the shift toward a healthy lifestyle has altered the food consumption habits among consumers. As a result, the demand for snacks and beverages options, which are indulging as well as nutritional, has been on the rise. Milk powder is used to provide texture, color, and flavor to food products. Milk powder provides enriched taste and texture to food products. It is used to provide mouth fill texture to food without being high on fat content.

The bakery & confectionery segment is the dominant one regarding applications of dairy ingredient.

Consumers are indulging in more healthy snacking habits now, which has so increased the demand for functional and fortified ingredients. Milk powder and whey concentrates find various applications in the bakery segment. They are used to provide texture and color to products. They are also used as browning agents for bread. They are used for increasing the richness of the bread and other related products. As a result of their low-fat content, they are popular among manufacturers.

Asia Pacific is estimated to account for the largest market share.

Currently, the Asia Pacific region is the dominating market for dairy ingredients; it is estimated to be the fastest-growing market in the coming years, as well. The high population and increase in the purchasing capacity have enabled consumers to demand functional and fortified food products. The low mortality rate and improved living standards have also enabled them to invest in health and health-related services more than before. This has increased the market for all kinds of nutritional and ready-to-eat food options.

Break-up of Primaries

- By Designation: D-Level - 38%, C-Level - 35%, and Others - 27%

- By Value Chain: Demand Side - 61%, Supply Side - 39%

- By Region: Europe - 22%, North America - 25%, Asia Pacific - 29%, South America - 11%, RoW- 13%

Leading players profiled in this report

- FrieslandCampina (The Netherlands)

- Groupe Lactalis (France)

- Arla Foods (Denmark)

- Saputo (Canada)

- Fonterra Co-operative Group (New Zealand)

- Dairy Farmers of America (US)

- Kerry Group (Ireland)

- Ornua (Ireland)

- AMCO Proteins (US)

- Prolactal (Austria)

- Valio (Finland)

- Glanbia (Ireland)

- Hoogwegt Group (The Netherlands)

- Batory Foods (USA)

- Ingredia SA (France)

Research Coverage

This report segments the dairy ingredients market based on type, application, livestock, form, and region. In terms of insights, this research report focuses on various levels of analyses - competitive landscape, end-use analysis, and company profiles - which together comprise and discuss the basic views on the emerging & high-growth segments of the dairy ingredients market, the high-growth regions, countries, government initiatives, market disruption, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the dairy ingredients

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions, in which the dairy ingredients market is flourishing

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 Inclusions and Exclusions

1.4 Regions Covered

1.5 Periodization Considered

1.6 Currency

Table 1 Us Dollar Exchange Rates Considered for the Study, 2016-2018

1.7 Unit Considered

1.8 Stakeholders

1.9 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 Dairy Ingredients Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

Figure 2 Data Triangulation Methodology

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary

Table 2 Dairy Ingredients Market Snapshot, 2021 Vs. 2026

Figure 3 Dairy Ingredients Market Size, by Livestock, 2021 Vs. 2026 (USD Million)

Figure 4 Dairy Ingredients Market Size, by Type, 2021 Vs. 2026 (USD Million)

Figure 5 Dairy Ingredients Market Size, by Application, 2021 Vs. 2026 (USD Million)

Figure 6 Dairy Ingredients Market Share and Growth (Value), by Region

4 Premium Insights

4.1 Attractive Opportunities in the Dairy Ingredients Market

Figure 7 Increasing Awareness About Health & Wellness and Growing Applications in Nutrition & Convenience Foods are Driving the Market for Dairy Ingredients

4.2 Dairy Ingredients Market: by Type

Figure 8 Milk Powder Type Segment Dominated the Dairy Ingredients Market in 2020

4.3 Dairy Ingredients Market, by Form and Region

Figure 9 Asia-Pacific to Dominate the Dairy Ingredients Segment in 2020

4.4 Dairy Ingredients Market, by Livestock

Figure 10 Cows Segment Dominated the Dairy Ingredients Market, by Livestock

4.5 United States Holds the Largest Market Share in the Dairy Ingredients Market

Figure 11 United States and China are the Mjor Market Share Holders in the Dairy Ingredients Market, by Region, in 2020

5 Market Overview

5.1 Introduction

Figure 12 Milk Processing to Obtain Milk Powder: Process Flow Diagram

Figure 13 Milk Processing to Obtain Milk Protein Concentrate and Whey Protein Concentrate: Process Flow Diagram

5.2 Macroeconomic Indicators

5.2.1 Growth Opportunities in Developing Regions Such as Asia-Pacific and South America

Figure 14 Gdp Growth Rate in Asian Countries, 2020-2021

5.2.2 Increasing Population Density

Table 3 Global Population Density, 2019

Figure 15 Population Growth Trends, 1950-2050

5.2.3 Effects of Rapid Urbanization and Westernization

Figure 16 Most Urbanized Countries, 2020

5.3 Market Dynamics

Figure 17 Market Dynamics: Dairy Ingredients Market

5.3.1 Drivers

5.3.1.1 Increasing Awareness About Health and Wellness

Figure 18 Percentage of Consumers Seeking Health Benefits from Food in North America, 2019

Figure 19 High Demand for Protein Witnessed in the Daily Diet of Consumers in North America in 2018 (%)

5.3.1.1.1 Increasing Application in the Nutrition and Convenience Food Sectors

Figure 20 Solid Components in Milk (Excluding Fat) (%)

Table 4 Milk Protein Concentration (G/L)

5.3.1.2 Increasing Dairy Production

Figure 21 World Dairy Production, 2018-2021 (Thousand Tons)

5.3.1.2.1 Growing Demand for Dairy Products

Figure 22 Major Markets of United States Dairy Exports, 2020 (USD Million)

Figure 23 Top Ten Countries Exporting Dairy Products, 2020 (USD Million)

5.3.1.3 Technological Advancements to Enhance Production Efficiency

5.3.1.4 Abolition of Milk Quota in the EU$

5.3.2 Restraints

5.3.2.1 Growing Demand for Alternatives, Such as Plant Protein

Figure 24 Familiarity and Interest in Plant-Based Diets in North America, 2020 (%)

5.3.2.2 Health Risks Associated with Whey Protein

5.3.2.3 Consumer Predisposition Toward Vegan Food

5.3.3 Opportunities

5.3.3.1 Emerging Markets in Asia-Pacific and South America: New Growth Frontiers

Figure 25 Dairy Production in India, 2015-2019 (Million Tons)

5.3.3.2 Favorable Government Initiatives and Schemes to Promote Regional Dairy Sectors

5.3.4 Challenges

5.3.4.1 High Capital Investment in Manufacturing Dairy Ingredients

5.3.4.2 Adulteration of Dairy Products Creates a Challenge to Manufacture Quality Ingredients

5.3.4.3 Increasing Incidences of Lactose Intolerance and Allergies

Table 5 Percentage of Population with Lactose Intolerance, by Ethnicity/Geographic Region

5.4 Impact of COVID-19 on Market Dynamics

5.4.1 COVID-19 Impact on the Dairy Ingredients Supply Chain

6 Industry Trends

6.1 Introduction

6.2 Value Chain

Figure 26 Value Chain Analysis of the Dairy Ingredients Market: Processing is One of the Key Contributors

6.2.1 Research & Development

6.2.2 Inputs

6.2.3 Processing

6.2.4 Logistics & Distribution

6.2.5 Marketing & Sales

6.3 Trade Data: Dairy Ingredients Market

Table 6 Top Five Importers and Exporters of Whey and Product Consisting of Natural Milk Constituents, 2020 (Kg)

6.4 Pricing Analysis: Dairy Ingredients Market

Table 7 Global Dairy Ingredients Average Selling Price (ASP), by Type, 2019-2021 (Usd/Tons)

Table 8 Global Dairy Ingredients Average Selling Price (ASP), by Region, 2019-2021 (Usd/Tons)

6.5 Market Map and Ecosystem the Dairy Ingredients Market

6.5.1 Demand Side

6.5.2 Supply Side

Figure 27 Dairy Ingredients: Market Map

Table 9 Dairy Ingredients Market: Supply Chain (Ecosystem)

6.6 Trends Impacting Buyers

Figure 28 Dairy Ingredients Market: Trends Impacting Buyers

6.7 Regulatory Framework

6.7.1 North America: Regulatory Framework

6.7.1.1 Justice Law, Canada

6.7.2 Europe: Regulatory Framework

6.7.3 Asia-Pacific: Regulatory Framework

6.7.4 South America: Regulatory Framework

6.8 Patent Analysis

Figure 29 Number of Patents Granted Between 2012 and 2020

Figure 30 Top 10 Applicants with the Highest Number of Patent Documents

Table 10 Some of the Patents Pertaining to Dairy Ingredients, 2020-2021

6.9 Porter's Five Forces Analysis

Table 11 Dairy Ingredients Market: Porter's Five Forces Analysis

6.9.1 Degree of Competition

6.9.2 Bargaining Power of Suppliers

6.9.3 Bargaining Power of Buyers

6.9.4 Threat of Substitutes

6.9.5 Threat of New Entrants

6.1 Case Studies

6.10.1 Increase in Concern Regarding Human Health and Wellness

7 Dairy Ingredients Market, by Type

7.1 Introduction

Figure 31 Dairy Ingredients Market Size, by Type, 2021 Vs. 2026 (USD Million)

Table 12 Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 13 Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 14 Dairy Ingredients Market Size, by Type, 2017-2020 (Kt)

Table 15 Dairy Ingredients Market Size, by Type, 2021-2026 (Kt)

7.1.1 COVID-19 Impact on the Dairy Ingredients Market, by Type

7.1.1.1 Realistic Scenario

Table 16 Realistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Type, 2018-2021 (USD Billion)

7.1.1.2 Pessimistic Scenario

Table 17 Pessimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Type, 2018-2021 (USD Billion)

7.1.1.3 Optimistic Scenario

Table 18 Optimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Type, 2018-2021 (USD Billion)

7.2 Proteins

7.2.1 Dairy Proteins are Viewed as the Best Source of Protein for Maintaining a Healthy and Balanced Diet

Table 19 Proteins: Dairy Ingredients Market Size, by Subtype, 2017-2020 (USD Million)

Table 20 Proteins: Dairy Ingredients Market Size, by Subtype, 2021-2026 (USD Million)

Table 21 Proteins: Dairy Ingredients Market Size, by Application, 2017-2020 (USD Million)

Table 22 Proteins: Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

Table 23 Proteins: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 24 Proteins: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

7.2.2 Whey Protein Concentrates

7.2.2.1 Whey Protein Concentrates are One of the Ideal Sources of Proteins

7.2.3 Whey Protein Isolates

7.2.3.1 Whey Protein Isolates Find Wide Applications in Sports Drinks

7.2.4 Casein & Caseinates

7.2.4.1 Casein & Caseinates Have Multiple Functions in the Food and Non-Food Sectors

7.2.5 Milk Protein Concentrates

7.2.5.1 Milk Protein Concentrates are Ingredients for Protein-Enriched Food & Beverage Products Owing to Their High-Protein and Low-Lactose Ratio

Table 25 Functional Properties of Milk Protein Concentrates and Their Applications in the Final Product

7.2.6 Milk Protein Isolates

7.2.6.1 Milk Protein Isolates Can be an Alternative for Whey Proteins, as They are Less Expensive

Table 26 Composition of Milk Protein Isolates

7.2.7 Milk Protein Hydrolysates

7.2.7.1 Milk Protein Hydrolysates are Popular Ingredients for Infant Formulas

7.3 Milk Powder

7.3.1 Longer Shelf-Life and Stability of Milk Powder Drive the Market

Table 27 Milk Powder: Dairy Ingredients Market Size, by Subtype, 2017-2020 (USD Million)

Table 28 Milk Powder: Dairy Ingredients Market Size, by Subtype, 2021-2026 (USD Million)

Table 29 Milk Powder: Dairy Ingredients Market Size, by Application, 2017-2020 (USD Million)

Table 30 Milk Powder: Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

Table 31 Milk Powder: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 32 Milk Powder: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

7.3.2 Skimmed Milk Powder

7.3.2.1 Skimmed Milk Powder is Used to Manufacture Products at High Temperatures

7.3.3 Whole Milk Powder

7.3.3.1 Whole Milk Powder is a Popular Dairy Ingredient Among Ice Cream, Confectionery, and Yogurt Manufacturers

7.4 Milk Fat Concentrates

7.4.1 Milk Fat Concentrates are Ideal for the Preparation of Food Products with Rich, Creamy Textures Without High Calories

Table 33 Milk Fat Concentrates: Dairy Ingredients Market Size, by Application, 2017-2020 (USD Million)

Table 34 Milk Fat Concentrates: Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

Table 35 Milk Fat Concentrates: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 36 Milk Fat Concentrates: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

7.5 Lactose & Its Derivatives

7.5.1 Lactose is an Excellent Source of Probiotics to Enhance Gut Health

Table 37 Lactose & Its Derivatives: Dairy Ingredients Market Size, by Application, 2017-2020 (USD Million)

Table 38 Lactose & Its Derivatives: Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

Table 39 Lactose & Its Derivatives: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 40 Lactose & Its Derivatives: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

7.6 Other Types

7.6.1 Milk and Whey Peptides, Colostrum, and Other Dairy Protein Fractions are Excellent Sources of Active Biological Ingredients

Table 41 Other Types: Dairy Ingredients Market Size, by Application, 2017-2020(USD Million)

Table 42 Other Types: Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

Table 43 Other Types: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 44 Other Types: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

8 Dairy Ingredients Market, by Functionality

8.1 Introduction

8.2 Emulsification, Foaming, and Thickening

8.3 Color, Flavor, and Texture

8.4 Gelation

8.5 Solubility and Heat Stability

Table 45 Selected Functional Properties of Dairy Ingredients and Their Applications in the Final Products

Table 46 Dairy Ingredients’ Role in Various Food Applications

Table 47 Type of Dairy Ingredients Used in the Food Industry

9 Dairy Ingredients Market, by Form

9.1 Introduction

Figure 32 Dairy Ingredients Market Size, by Form, 2021 Vs. 2026 (USD Billion)

Table 48 Dairy Ingredients Market Size, by Form, 2017-2020 (USD Billion)

Table 49 Dairy Ingredients Market Size, by Form, 2021-2026 (USD Billion)

9.1.1 COVID-19 Impact on the Dairy Ingredients Market, by Form

9.1.1.1 Realistic Scenario

Table 50 Realistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Form, 2018-2021 (USD Billion)

9.1.1.2 Pessimistic Scenario

Table 51 Pessimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Form, 2018-2021 (USD Billion)

9.1.1.3 Optimistic Scenario

Table 52 Optimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Form, 2018-2021 (USD Billion)

9.2 Dry

9.2.1 Increased Popularity of Dry Dairy Ingredients due to Their High Shelf Lives

Table 53 Dry: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Billion)

Table 54 Dry: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Billion)

9.3 Liquid

9.3.1 Liquid Dairy Ingredients are Popularly Used in Infant Formulas and Beverages

Table 55 Liquid: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 56 Liquid: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

10 Dairy Ingredients Market, by Livestock

10.1 Introduction

Figure 33 Dairy Ingredients Market Size, by Livestock, 2021 Vs. 2026 (USD Million)

Table 57 Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 58 Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

10.1.1 COVID-19 Impact on the Dairy Ingredients Market, by Livestock

10.1.1.1 Realistic Scenario

Table 59 Realistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Livestock, 2018-2021 (USD Million)

10.1.1.2 Pessimistic Scenario

Table 60 Pessimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Livestock, 2018-2021 (USD Million)

10.1.1.3 Optimistic Scenario

Table 61 Optimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Livestock, 2018-2021 (USD Million)

10.2 Cows

10.2.1 Abundance and Availability of Cow Milk Drive the Demand and Supply

Table 62 Cows: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 63 Cows: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

10.3 Other Livestock

10.3.1 Unorganized Sector of Buffalo and Camel Milk Production Indicating Growth Opportunities

Table 64 Other Livestock: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 65 Other Livestock: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

11 Dairy Ingredients Market, by Application

11.1 Introduction

Figure 34 Dairy Ingredients Market Size, by Application, 2021 Vs. 2026 (USD Million)

Table 66 Dairy Ingredients Market Size, by Application, 2017-2020 (USD Million)

Table 67 Dairy Ingredients Market Size, by Application, 2021-2026 (USD Million)

11.1.1 COVID-19 Impact on the Dairy Ingredients Market, by Application

11.1.1.1 Realistic Scenario

Table 68 Realistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Application, 2018-2021 (USD Billion)

11.1.1.2 Pessimistic Scenario

Table 69 Pessimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Application, 2018-2021 (USD Billion)

11.1.1.3 Optimistic Scenario

Table 70 Optimistic Scenario: COVID-19 Impact on the Dairy Ingredients Market Size, by Application, 2018-2021 (USD Billion)

11.2 Bakery & Confectionery

11.2.1 Multi-Functionality of Dairy Ingredients in the Bakery Industry to Drive the Market Growth

Table 71 Bakery & Confectionery: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 72 Bakery & Confectionery: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

11.3 Dairy Products

11.3.1 Milk Powder Replaces Fresh Milk During the Production of Dairy Products

Table 73 Dairy Products: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 74 Dairy Products: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

11.4 Sports Nutrition Products

11.4.1 Dominance of Whey Protein as a Preferred Protein Source for Effective Sports Nutrition

Table 75 Sports Nutrition Products: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 76 Sports Nutrition Products: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

11.5 Infant Formulas

11.5.1 Busier & Sedentary Lifestyles of Parents to Drive the Infant Formulas Market

Table 77 Infant Formulas: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 78 Infant Formulas: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

11.6 Other Applications

11.6.1 Increasing Applicability of Dairy Ingredients to Drive the Market Growth

Table 79 Other Applications: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 80 Other Applications: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12 Dairy Ingredients Market, by Region

12.1 Introduction

Figure 35 Regional Snapshot: New Hotspots to Emerge in Asia-Pacific, 2021-2026

Figure 36 Dairy Ingredients Market Size, by Region, 2021 Vs 2026 (USD Million)

Table 81 Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 82 Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

12.1.1 COVID-19 Impact on the Dairy Ingredients Market, by Region

12.1.1.1 Optimistic Scenario

Table 83 Optimistic Scenario: Dairy Ingredients Market Size, by Region, 2018-2021 (USD Million)

12.1.1.2 Realistic Scenario

Table 84 Realistic Scenario: Dairy Ingredients Market Size, by Region, 2018-2021 (USD Million)

12.1.1.3 Pessimistic Scenario

Table 85 Pessimistic Scenario: Dairy Ingredients Market Size, by Region, 2018-2021 (USD Billion)

12.2 North America

Figure 37 North America: Regional Snapshot

Table 86 North America: Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 87 North America: Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 88 North America: Dairy Ingredients Market Size, by Country, 2017-2020 (Kt)

Table 89 North America: Dairy Ingredients Market Size, by Country, 2021-2026 (Kt)

Table 90 North America: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 91 North America: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 92 North America: Dairy Protein Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 93 North America: Dairy Protein Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 94 North America: Milk Powder Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 95 North America: Milk Powder Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 96 North America: Milk Fat Concentrates Market Size, by Country, 2017-2020 (USD Million)

Table 97 North America: Milk Fat Concentrates Market Size, by Country, 2021-2026 (USD Million)

Table 98 North America: Lactose & Its Derivatives Market Size, by Country, 2017-2020 (USD Million)

Table 99 North America: Lactose & Its Derivatives Market Size, by Country, 2021-2026 (USD Million)

Table 100 North America: Other Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 101 North America: Other Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 102 North America: Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 103 North America: Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

Table 104 North America: Dairy Ingredients Market Size, by Form, 2017-2020 (USD Million)

Table 105 North America: Dairy Ingredients Market Size, by Form, 2021-2026 (USD Million)

12.2.1 US

12.2.1.1 The Us is One of the Leading Exporters of Whey Proteins in the World

Table 106 US: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 107 US: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.2.2 Canada

12.2.2.1 Surplus Production of Skimmed Milk Powders in the Country to Drive Demand

Table 108 Canada: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 109 Canada: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.2.3 Mexico

12.2.3.1 Favorable Government Regulations and Legislations Support the Mexican Dairy Ingredients Market

Table 110 Mexico: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 111 Mexico: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3 Europe

Table 112 Europe: Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 113 Europe: Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 114 Europe: Dairy Ingredients Market Size, by Country, 2017-2020 (Kt)

Table 115 Europe: Dairy Ingredients Market Size, by Country, 2021-2026 (Kt)

Table 116 Europe: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 117 Europe: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 118 Europe: Dairy Protein Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 119 Europe: Dairy Protein Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 120 Europe: Milk Powder Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 121 Europe: Milk Powder Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 122 Europe: Milk Fat Concentrates Market Size, by Country, 2017-2020 (USD Million)

Table 123 Europe: Milk Fat Concentrates Market Size, by Country, 2021-2026 (USD Million)

Table 124 Europe: Lactose & Its Derivatives Market Size, by Country, 2017-2020 (USD Million)

Table 125 Europe: Lactose & Its Derivatives Market Size, by Country, 2021-2026 (USD Million)

Table 126 Europe: Other Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 127 Europe: Other Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 128 Europe: Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 129 Europe: Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

Table 130 Europe: Dairy Ingredients Market Size, by Form, 2017-2020 (USD Million)

Table 131 Europe: Dairy Ingredients Market Size, by Form, 2021-2026 (USD Million)

12.3.1 Germany

12.3.1.1 Fast-Growing Sports Nutrition Sector Augments the Demand for Dairy Ingredients in Germany

Table 132 Germany: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 133 Germany: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.2 UK

12.3.2.1 Large-Scale Employment in the Dairy Sector Spurs the Dairy Ingredients Market in the UK

Table 134 UK: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 135 UK: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.3 France

12.3.3.1 Significant Steps Taken by the French Government to Support the Market for Dairy Ingredients

Table 136 France: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 137 France: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.4 Poland

12.3.4.1 Dairy Proteins Witness High Demand from Polish Consumers

Table 138 Poland: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 139 Poland: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.5 Italy

12.3.5.1 The Rise in Popularity of Ready-To-Eat Food & Beverages Has Increased the Demand for Dairy Ingredients

Table 140 Italy: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 141 Italy: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.6 Ireland

12.3.6.1 Aging Population Demanding More Functional and Fortified Foods

Table 142 Ireland: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 143 Ireland: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.7 Netherlands

12.3.7.1 Increase in the Processing Units Driving the Dairy Ingredients Market

Table 144 Netherlands: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 145 Netherlands: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.3.8 Rest of Europe

12.3.8.1 Favorable Government Initiatives and Legislations Uplift the Dairy Ingredients Market

Table 146 Rest of Europe: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 147 Rest of Europe: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4 Asia-Pacific

Figure 38 Asia-Pacific: Dairy Ingredients Market Snapshot

Table 148 Asia-Pacific: Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 149 Asia-Pacific: Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 150 Asia-Pacific: Dairy Ingredients Market Size, by Country, 2017-2020 (Kt)

Table 151 Asia-Pacific: Dairy Ingredients Market Size, by Country, 2021-2026 (Kt)

Table 152 Asia-Pacific: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 153 Asia-Pacific: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 154 Asia-Pacific: Dairy Protein Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 155 Asia-Pacific: Dairy Protein Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 156 Asia-Pacific: Milk Powder Market Size, by Country, 2017-2020 (USD Million)

Table 157 Asia-Pacific Milk Powder Market Size, by Country, 2021-2026 (USD Million)

Table 158 Asia-Pacific: Milk Fat Concentrates Market Size, by Country, 2017-2020 (USD Million)

Table 159 Asia-Pacific: Milk Fat Concentrates Market Size, by Country, 2021-2026 (USD Million)

Table 160 Asia-Pacific: Lactose & Its Derivatives Market Size, by Country, 2017-2020 (USD Million)

Table 161 Asia-Pacific: Lactose & Its Derivatives Market Size, by Country, 2021-2026 (USD Million)

Table 162 Asia-Pacific: Other Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 163 Asia-Pacific: Other Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 164 Asia-Pacific: Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 165 Asia-Pacific: Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

Table 166 Asia-Pacific: Dairy Ingredients Market Size, by Form, 2017-2020 (USD Million)

Table 167 Asia-Pacific: Dairy Ingredients Market Size, by Form, 2021-2026 (USD Million)

12.4.1 China

12.4.1.1 Increase in Application in Infant Nutrition Driving Market Growth

Table 168 China: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 169 China: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4.2 India

12.4.2.1 The Well-Established Dairy Industry in India Supports the Growth of the Dairy Ingredients Market

Table 170 India: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 171 India: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4.3 Japan

12.4.3.1 Global Partnerships and Agreements Influence the Japanese Dairy Ingredients Market

Table 172 Japan: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 173 Japan: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4.4 Australia

12.4.4.1 Hefty Export and Import Activities Drive the Dairy Ingredients Market

Table 174 Australia: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 175 Australia: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4.5 New Zealand

12.4.5.1 High Milk Production in New Zealand Opens Growth Opportunities for the Export of Dairy Ingredients

Table 176 New Zealand: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 177 New Zealand: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.4.6 Rest of Asia-Pacific

12.4.6.1 Rapid Demand for Functional Food is Projected to Augment the Dairy Ingredients Market

Table 178 Rest of Asia-Pacific: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 179 Rest of Asia-Pacific: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.5 South America

Table 180 South America: Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 181 South America: Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 182 South America: Dairy Ingredients Market Size, by Country, 2017-2020 (Kt)

Table 183 South America: Dairy Ingredients Market Size, by Country, 2021-2026 (Kt)

Table 184 South America: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 185 South America: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 186 South America: Dairy Protein Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 187 South America: Dairy Protein Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 188 South America: Milk Powder Market Size, by Country, 2017-2020 (USD Million)

Table 189 South America: Milk Powder Market Size, by Country, 2021-2026 (USD Million)

Table 190 South America: Milk Fat Concentrates Market Size, by Country, 2017-2020 (USD Million)

Table 191 South America: Milk Fat Concentrates Market Size, by Country, 2021-2026 (USD Million)

Table 192 South America: Lactose & Its Derivatives Market Size, by Country, 2017-2020 (USD Million)

Table 193 South America: Lactose & Its Derivatives Market Size, B Y Country, 2021-2026 (USD Million)

Table 194 South America: Other Dairy Ingredients Market Size, by Country, 2017-2020 (USD Million)

Table 195 South America: Other Dairy Ingredients Market Size, by Country, 2021-2026 (USD Million)

Table 196 South America: Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 197 South America: Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

Table 198 South America: Dairy Ingredients Market Size, by Form, 2017-2020 (USD Million)

Table 199 South America: Dairy Ingredients Market Size, by Form, 2021-2026 (USD Million)

12.5.1 Brazil

12.5.1.1 Favorable Import-Export Regulations Fuel the Demand for Dairy Ingredients

Table 200 Brazil: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 201 Brazil: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.5.2 Argentina

12.5.2.1 Rising Cases of Obesity and Heart Diseases to Drive Market Growth

Table 202 Argentina: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 203 Argentina: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.5.3 Rest of South America

12.5.3.1 The Rising Popularity of Whole Milk Powder Bolsters the Market Growth

Table 204 Rest of South America: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 205 Rest of South America: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.6 Rest of the World (Row)

Table 206 Rest of the World: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 207 Rest of the World: Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 208 Rest of the World: Dairy Ingredients Market Size, by Region, 2017-2020 (Kt)

Table 209 Rest of the World: Dairy Ingredients Market Size, by Region, 2021-2026 (Kt)

Table 210 Rest of the World: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 211 Rest of the World: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 212 Rest of the World: Protein Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 213 Rest of the World: Protein Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 214 Rest of the World: Milk Powder Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 215 Rest of the World: Milk Powder Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 216 Rest of the World: Milk Fat Concentrates Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 217 Rest of the World: Milk Fat Concentrates Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 218 Rest of the World: Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 219 Rest of the World: Lactose & Its Derivatives Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 220 Rest of the World: Lactose & Its Derivatives Dairy Ingredients Market Size, by Region, 2017-2020 (USD Million)

Table 221 Rest of the World: Other Type of Dairy Ingredients Market Size, by Region, 2021-2026 (USD Million)

Table 222 Rest of the World: Other Type of Dairy Ingredients Market Size, by Livestock, 2017-2020 (USD Million)

Table 223 Rest of the World: Dairy Ingredients Market Size, by Livestock, 2021-2026 (USD Million)

Table 224 Rest of the World: Dairy Ingredients Market Size, by Form, 2017-2020 (USD Million)

Table 225 Rest of the World: Dairy Ingredients Market Size, by Form, 2021-2026 (USD Million)

12.6.1 Middle East

12.6.1.1 Health & Wellness Trend to Drive the Middle Eastern Dairy Ingredients Market

Table 226 Middle East: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 227 Middle East: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

12.6.2 Africa

12.6.2.1 Growing Dairy Ingredients Market Improves the Health of Consumers and Helps Combat Malnutrition

Table 228 Africa: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 229 Africa: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

Table 230 Others in Rest of the World: Dairy Ingredients Market Size, by Type, 2017-2020 (USD Million)

Table 231 Others in Rest of the World: Dairy Ingredients Market Size, by Type, 2021-2026 (USD Million)

13 Competitive Landscape

13.1 Overview

13.2 Market Share Analysis

Table 232 Dairy Ingredients Market: Degree of Competition (Consolidated)

13.3 Key Player Strategies

13.4 Revenue Analysis of Key Players, 2016-2020

Figure 39 Revenue Analysis (Segmental) of Key Players in the Market, 2016-2020 (USD Billion)

13.5 COVID-19-Specific Company Response

13.6 Company Evaluation Quadrants

13.6.1 Stars

13.6.2 Emerging Leaders

13.6.3 Pervasive Players

13.6.4 Participants

Figure 40 Dairy Ingredients Market: Company Evaluation Quadrant, 2020

13.6.5 Product Footprint

Table 233 Company Footprint, by Application

Table 234 Company Footprint, by Product Type

Table 235 Company Footprint, by Region

Table 236 Overall Company Footprint

13.7 Competitive Evaluation Quadrant (Other Players)

13.7.1 Progressive Companies

13.7.2 Starting Blocks

13.7.3 Responsive Companies

13.7.4 Dynamic Companies

Figure 41 Dairy Ingredients Market: Company Evaluation Quadrant, 2020

13.8 Competitive Scenario

13.8.1 Deals

Table 237 Dairy Ingredients Market: Deals, 2021

13.8.2 Other Developments

Table 238 Dairy Ingredients Market: Other Developments, 2021

14 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View)*

14.1 Royal Frieslandcampina N.V.

Table 239 Frieslandcampina: Company Overview

Figure 42 Frieslandcampina: Company Snapshot

Table 240 Dairy Ingredients Market: Deals, 2018-2021

Table 241 Dairy Ingredients Market: Product Launches, 2021

14.2 Fonterra Co-Operative Group Limited

Table 242 Fonterra Co-Operative Group Limited: Company Overview

Figure 43 Fonterra Co-Operative Group: Company Snapshot

Table 243 Fonterra Co-Operative Group Limited: Dairy Ingredients Market: Deals, 2021-2018

Table 244 Fonterra Co-Operative Group Limited: Dairy Ingredients Market: Product Launches, 2018

14.3 Arla Foods

Table 245 Arla Foods: Company Overview

Figure 44 Arla Foods: Company Snapshot

Table 246 Arla Foods: Dairy Ingredients Market: Product Launches, 2020-2018

Table 247 Arla Foods: Dairy Ingredients Market: Deals, 2020-2018

Table 248 Arla Foods: Dairy Ingredients Market: Others, April 2021-2019

14.4 Glanbia plc

Table 249 Glanbia: Business Overview

Figure 45 Glanbia: Company Snapshot

Table 250 Glanbia: Dairy Ingredients Market: Deals, 2021-2018

Table 251 Dairy Ingredients Market: Product Launches, 2019

Table 252 Glanbia Dairy Ingredients Market: Others, April 2020

14.5 Kerry Group plc

Table 253 Kerry Group:Business Overview

Figure 46 Kerry Group: Company Snapshot

Table 254 Kerry Group, Dairy Ingredients Market: Deals, 2021-2018

Table 255 Kerry Group, Dairy Ingredients Market: Others, 2021-2019

14.6 Dairy Farmers of America

Table 256 Dairy Farmers of America: Business Overview

Figure 47 Dairy Farmers of America: Company Snapshot

Table 257 Dairy Farmers of America, Dairy Ingredients Market: Deals, 2020-2018

Table 258 Dairy Farmers of America, Dairy Ingredients Market: Product Launches, 2021

14.7 Groupe Lactalis

Table 259 Group Lactalis: Business Overview

Figure 48 Groupe Lactalis: Company Snapshot

Table 260 Group Lactalis, Dairy Ingredients Market: Deals, 2020-2018

14.8 Ornua

Table 261 Ornua: Business Overview

Figure 49 Ornua: Company Snapshot

Table 262 Ornua, Dairy Ingredients Market: Deals, 2021

Table 263 Ornua, Dairy Ingredients Market: Product Launches, 2021

Table 264 Ornua, Dairy Ingredients Market: Others, April 2019-2021

14.9 Saputo Inc.

Table 265 Saputo: Business Overview

Figure 50 Saputo: Company Snapshot

Table 266 Saputo, Dairy Ingredients Market: Deals, 2018-2021

14.10 Volac International Ltd.

Table 267 Volac International: Business Overview

Table 268 Volac International, Dairy Ingredients Market: Deals, 2021

Table 269 Volac International, Dairy Ingredients Market: Product Launches, 2018

14.11 Epi Ingredients

Table 270 Epi Ingredients: Business Overview

Table 271 Epi Ingredients, Dairy Ingredients Market: Product Launches, 2018-2021

14.12 Prolactal

Table 272 Prolactal: Business Overview

Table 273 Prolactal, Dairy Ingredients Market: Deals, 2021-2020

14.13 Hoogwegt Group B.V.

Table 274 Hoogwegt: Business Overview

Table 275 Hoogwegt, Dairy Ingredients Market: Deals, 2019-2021

14.14 Batory Foods

Table 276 Batory Foods: Business Overview

Table 277 Batory Foods, Dairy Ingredients Market: Deals, October 2019-2021

14.15 Valio

Table 278 Valio: Business Overview

Table 279 Valio, Dairy Ingredients Market: Deals, 2018-2021

Table 280 Valio, Dairy Ingredients Market: Product Launches, 2019

14.16 Ingredia Sa

Table 281 Ingredia Sa: Business Overview

Table 282 Ingredia Sa, Dairy Ingredients Market: Product Launches, 2019-2021

Table 283 Ingredia Sa, Dairy Ingredients Market: Deals, 2018-2019

14.17 Cayuga Dairy Ingredients

Table 284 Cayuga Diry Ingredient: Business Overview

Table 285 Cayuga Diry Ingredient, Dairy Ingredients Market: Deals, 2018-2021

14.18 Amco Proteins

Table 286 Amco Protein: Business Overview

Table 287 Amco Protein, Dairy Ingredients Market: Product Launches, 2019

14.19 Valfoo

Table 288 Valfoo: Business Overview

14.20 Interfood

Table 289 Interfood: Business Overview

Table 290 Interfood, Dairy Ingredients Market: Deals, 2020-2021

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies.

15 Adjacent Markets

15.1 Introduction

Table 291 Adjacent Markets to Dairy Ingredients

15.2 Limitations

15.3 Dairy Alternatives Market

15.3.1 Market Definition

15.3.2 Market Overview

Table 292 Dairy Alternatives Market Size, by Source, 2018-2026 (USD Million)

Table 293 Dairy Alternatives Market Size, by Application, 2018-2026 (USD Million)

Table 294 Dairy Alternatives Market Size, by Region, 2018-2026 (USD Million)

15.3.3 Dairy Processing Equipment Market

15.3.3.1 Market Definition

15.3.3.2 Market Overview

Table 295 Dairy Processing Equipment Market Size, by Type, 2020-2025 (USD Million)

Table 296 Dairy Processing Equipment Market Size, by Application, 2020-2025 (USD Million)

Table 297 Dairy Processing Equipment Market Size, by Region, 2020-2025 (USD Million)

15.3.4 Infant Formula Ingredients Market

15.3.4.1 Market Definition

15.3.4.2 Market Overview

Table 298 Infant Formula Ingredients Market Size, by Ingredient, 2017-2025 (USD Million)

Table 299 Infant Formula Ingredients Market Size, by Application, 2017-2025 (USD Billion)

Table 300 Infant Formula Ingredients Market Size, by Region, 2017-2025 (USD Billion)

16 Appendix

16.1 Discussion Guide

16.2 Knowledge Store

16.3 Available Customizations

Companies Mentioned

- Royal Frieslandcampina N.V.

- Fonterra Co-Operative Group Limited

- Arla Foods

- Glanbia plc

- Kerry Group plc

- Dairy Farmers of America

- Groupe Lactalis

- Ornua

- Saputo Inc.

- Volac International Ltd.

- Epi Ingredients

- Prolactal

- Hoogwegt Group B.V.

- Batory Foods

- Valio

- Ingredia Sa

- Cayuga Dairy Ingredients

- Amco Proteins

- Valfoo

- Interfood

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 302 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 63.6 Billion |

| Forecasted Market Value ( USD | $ 89.9 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |