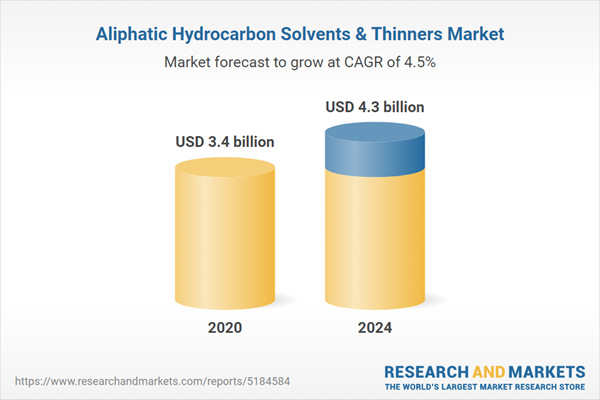

The aliphatic hydrocarbon solvents & thinners market is projected to grow from USD 3.4 billion in 2020 to USD 4.3 billion by 2024, at a CAGR of 4.5% from 2020 to 2025. The increasing demand for aliphatic hydrocarbon solvents & thinners in applications, such as paints & coatings, cleaning & degreasing, and others, drives the global aliphatic hydrocarbon solvents & thinners market. Stringent environmental regulations regarding the usage of aliphatic hydrocarbon solvents & thinners in varnishes and vehicle refinishing products are expected to restrain the growth of this market. These rules and regulations restrict the usage of some aliphatic hydrocarbon solvents & thinners, as they contain Volatile Organic Compounds (VOCs), which are hazardous for health and the environment.

The paints & coatings segment is projected to lead the aliphatic hydrocarbon solvents & thinners market in terms of both value and volume during the forecast period.

Based on application, the paints & coatings segment led the aliphatic hydrocarbon solvents & thinners market in 2020 in terms of both value and volume. The growth of this segment can be attributed to the increasing demand for decorative, automotive, industrial, and protective paints & coatings in both, developed and emerging countries. There is an increased demand for paints & coatings in the architectural paints & coatings segment, which is projected to lead the market during the forecast period. This growing demand for paints & coatings for the increasing number of residential and commercial buildings due to rising population and urbanization majorly in China and India is expected to drive the global market during the forecast period.

The varnish makers’ & painters’ naphtha type segment is projected to lead the aliphatic hydrocarbon solvents & thinners market in terms of both, value and volume from 2020 to 2025.

Based on type, the varnish makers’ & painters’ naphtha segment accounted for the largest share of the aliphatic hydrocarbon solvents & thinners market in 2020. The varnish makers’ & painters’ naphtha segment is projected to lead the market in terms of both value and volume during the forecast period. Varnish makers’ & painters’ naphtha is obtained by the distillation of hydrocarbons. A major source of naphtha is crude oil, which is processed in refineries to break down the chains of hydrocarbons. Varnish makers’ & painters’ naphtha is majorly used in hydrocarbon cracking, laundry soaps, organic chemistry, cleaning fluids, and various other applications.

The Asia Pacific is projected to lead the aliphatic hydrocarbon solvents & thinners market during the forecast period, in terms of both, value and volume.

The Asia Pacific region is projected to lead the aliphatic hydrocarbon solvents & thinners market from 2020 to 2025, in terms of both value and volume. This region is witnessing increasing car ownership due to the rising disposable income of the middle-class population and the increasing number of residential and commercial buildings.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 25%, Directors - 25%, and Others - 50%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 25%, the Middle East & Africa- 5%, and South America - 5%

Furthermore, as a part of the qualitative analysis of the aliphatic hydrocarbon solvents & thinners market, the research provides a comprehensive review of the drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe. It also discusses competitive strategies adopted by the leading market players, such as ExxonMobil Chemical, Inc. (US), SK Global Chemical Co., Ltd. (South Korea), Royal Dutch Shell Plc. (Netherlands), Calumet Specialty Products Partners, L.P. (US), Gotham Industries (Canada), Gulf Chemicals and Industrial Oils Co. (Saudi Arabia), Recochem Inc. (Canada), HCS Group (Germany), W.M. Barr (US), Ganga Rasayanie (P) Ltd (India), NOCO Energy Corporation (US), Gadiv Petrochemical Industries Ltd. (Israel), Hunt Refining Company (US), Honeywell International Inc. (US), BASF SE (Germany), and LyondellBasell Industries Holdings B.V. (Netherlands).

Research Coverage:

The report defines, segments, and projects the size of the aliphatic hydrocarbon solvents & thinners market based on type, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as acquisitions, expansions, partnerships, and new product launches adopted by them in the market.

Reasons to Buy the Report:

The report is expected to help market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the aliphatic hydrocarbon solvents & thinners market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the positions of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

Figure 1 Aliphatic Solvents & Thinners Market Segmentation

1.3.3 Years Considered in the Report

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology

2.1 Research Data

Figure 2 Aliphatic Solvents & Thinners Market: Research Design

2.1.1 Key Data from Secondary Sources

2.1.2 Key Data from Primary Sources

2.1.2.1 Key Industry Insights

Figure 3 Breakdown of Primary Interviews

2.2 Market Size Estimation

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

Figure 6 Aliphatic Solvents & Thinners Market: Data Triangulation

2.4 Assumptions

3 Executive Summary

Table 1 Aliphatic Solvents & Thinners Market

Figure 7 Varnish Makers’ & Painters’ Naphtha Segment Projected to Lead the Aliphatic Solvents & Thinners Market in 2019, in Terms of Value

Figure 8 Paints & Coatings Segment Projected to Lead the Aliphatic Solvents & Thinners Market During Forecast Period, in Terms of Value

Figure 9 Asia-Pacific Estimated to Account for Largest Share of the Aliphatic Solvents & Thinners Market in 2020

4 Premium Insights

4.1 Attractive Opportunities in the Aliphatic Solvents & Thinners Market

Figure 10 The Aliphatic Solvents & Thinners Market is Projected to Witness Moderate Growth During the Forecast Period

4.2 Aliphatic Solvents & Thinners Market, by Type

Figure 11 Varnish Makers’ & Painters’ Naphtha to Grow at the Highest CAGR During the Forecast Period

4.3 Aliphatic Solvents & Thinners Market, by Application

Figure 12 Paints & Coatings Application Segment to Lead the Aliphatic Solvents & Thinners Market During the Forecast Period

4.4 Asia-Pacific Aliphatic Solvents & Thinners Market

Figure 13 Varnish Makers’ & Painters’ Naphtha Segment to Account for the Largest Share in Asia-Pacific in 2020

4.5 Aliphatic Solvents & Thinners Market Growth

Figure 14 Middle East to Grow at the Highest CAGR During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 15 High Growth in the Paints & Coatings Industry to be the Major Driver for the Market Over the Forecast Period

5.2.1 Drivers

5.2.1.1 Replacement of Turpentine with Mineral Spirits

5.2.1.2 Growth in the Paints & Coatings Industry

5.2.1.3 High Demand from the Asia-Pacific Region

5.2.2 Restraints

5.2.2.1 Manufacturers Switching to Green Solvents

5.2.3 Opportunities

5.2.3.1 Growth Opportunities from Emerging Economies in the Middle East

5.2.4 Challenges

5.2.4.1 Environmental Regulations

5.2.5 Economic Disruption due to the COVID-19 Pandemic Across End-Use Industries

5.2.5.1 Automotive Industry

5.2.5.2 Construction & Infrastructure Industry

6 Industry Trends

6.1 Introduction

6.2 Supply Chain Analysis

Figure 16 Supply Chain Analysis

6.3 Porter's Five Forces Analysis

Figure 17 Porter's Five Forces Analysis

6.3.1 Threat 0F New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Aliphatic Solvents & Thinners Market, by Type

7.1 Introduction

Figure 18 Aliphatic Solvents & Thinners, by Type

7.1.1 Disruption due to COVID-19

7.2 Market Size and Projection

7.2.1 Varnish Makers’ & Painters’ Naphtha to Lead the Aliphatic Solvents & Thinners Market, by Type

Table 2 Aliphatic Solvents & Thinners Market, by Type, 2016-2019 (USD Million)

Table 3 Aliphatic Solvents & Thinners Market, by Type, 2020-2025 (USD Million)

Table 4 Aliphatic Solvents & Thinners Market, by Type, 2016-2019 (Kilotons)

Table 5 Aliphatic Solvents & Thinners Market, by Type, 2020-2025 (Kilotons)

Figure 19 Aliphatic Solvents & Thinners Market, by Type, 2020 & 2025 (USD Million)

7.3 Varnish Makers’ & Painters’ Naphtha

7.3.1 Varnish Makers’ & Paints’ Naphtha is Estimated to Account for the Largest Share of the Market

Table 6 Aliphatic Solvents & Thinners Market for Varnish Makers' & Painters’ Naphtha, by Region, 2016-2019 (USD Million)

Table 7 Aliphatic Solvents & Thinners Market for Varnish Makers' & Painters’ Naphtha, by Region,2020-2025 (USD Million)

Table 8 Aliphatic Solvents & Thinners Market for Varnish Makers' & Painters’ Naphtha, by Region, 2016-2019 (Kilotons)

Table 9 Aliphatic Solvents & Thinners Market for Varnish Makers' & Painters’ Naphtha, by Region, 2020-2025 (Kilotons)

7.4 Mineral Spirits

7.4.1 Mineral Spirits Type Segment Accounted for the Second Largest Share in the Process Oil Market

Table 10 Aliphatic Solvents & Thinners Market for Mineral Spirits, by Region, 2016-2019 (USD Million)

Table 11 Aliphatic Solvents & Thinners Market for Mineral Spirits, by Region, 2020-2025 (USD Million)

Table 12 Aliphatic Solvents & Thinners Market for Mineral Spirits, by Region, 2016-2019 (Kilotons)

Table 13 Aliphatic Solvents & Thinners Market for Mineral Spirits, by Region, 2020-2025 (Kilotons)

7.5 Hexane

7.5.1 Growing Demand from Paints & Coatings Industry is Expected to Fuel the Growth of Hexane Segment Market

Table 14 Aliphatic Solvents & Thinners Market for Hexane, by Region, 2016-2019 (USD Million)

Table 15 Aliphatic Solvents & Thinners Market for Hexane, by Region, 2020-2025 (USD Million)

Table 16 Aliphatic Solvents & Thinners Market for Hexane, by Region, 2016-2019 (Kilotons)

Table 17 Aliphatic Solvents & Thinners Market for Hexane, by Region, 2020-2025 (Kilotons)

7.6 Heptane

7.6.1 Asia-Pacific to Lead the Heptane Segment Market During the Forecast Period

Table 18 Aliphatic Solvents & Thinners Market for Heptane, by Region, 2016-2019 (USD Million)

Table 19 Aliphatic Solvents & Thinners Market for Heptane, by Region, 2020-2025 (USD Million)

Table 20 Aliphatic Solvents & Thinners Market for Heptane, by Region, 2016-2019 (Kilotons)

Table 21 Aliphatic Solvents & Thinners Market for Heptane, by Region, 2020-2025 (Kilotons)

7.7 Other Types

Table 22 Aliphatic Solvents & Thinners Market for Other Types, by Region, 2016-2019 (USD Million)

Table 23 Aliphatic Solvents & Thinners Market for Other Types, by Region, 2020-2025 (USD Million)

Table 24 Aliphatic Solvents & Thinners Market for Other Types, by Region, 2016-2019 (Kilotons)

Table 25 Aliphatic Solvents & Thinners Market for Other Types, by Region, 2020-2025 (Kilotons)

8 Aliphatic Solvents & Thinners Market, by Application

8.1 Introduction

Figure 20 Aliphatic Solvents & Thinners Market, by Application

8.1.1 Impact of COVID-19 on the End-Use Industries

8.2 Market Size and Projection

8.2.1 Paints & Coatings Application to Lead the Aliphatic Solvents & Thinners Market, by Application

Figure 21 Aliphatic Solvents & Thinners Market, by Application, 2020 & 2025 (USD Million)

Table 26 Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 27 Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 28 Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 29 Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

8.3 Paints & Coatings

8.3.1 Paints & Coatings is the Largest and the Fastest-Growing Application Segment

Table 30 Aliphatic Solvents & Thinners Market for Paints & Coatings, by Region, 2016-2019 (USD Million)

Table 31 Aliphatic Solvents & Thinners Market for Paints & Coatings, by Region, 2020-2025 (USD Million)

Table 32 Aliphatic Solvents & Thinners Market for Paints & Coatings, by Region, 2016-2019 (Kilotons)

Table 33 Aliphatic Solvents & Thinners Market for Paints & Coatings, by Region, 2020-2025 (Kilotons)

8.4 Cleaning & Degreasing

8.4.1 Cleaning & Degreasing Application Accounted for the Second-Largest Share

Table 34 Aliphatic Solvents & Thinners Market for Cleaning & Degreasing, by Region, 2016-2019 (USD Million)

Table 35 Aliphatic Solvents & Thinners Market for Cleaning & Degreasing, by Region, 2020-2025 (USD Million)

Table 36 Aliphatic Solvents & Thinners Market for Cleaning & Degreasing, by Region, 2016-2019 (Kilotons)

Table 37 Aliphatic Solvents & Thinners Market for Cleaning & Degreasing, by Region, 2020-2025 (Kilotons)

8.5 Adhesives

8.5.1 South America is the Fastest Growing Region in Adhesives Application Segment During the Forecast Period

Table 38 Aliphatic Solvents & Thinners Market for Adhesives, by Region, 2016-2019 (USD Million)

Table 39 Aliphatic Solvents & Thinners Market for Adhesives, by Region, 2020-2025 (USD Million)

Table 40 Aliphatic Solvents & Thinners Market for Adhesives, by Region, 2016-2019 (Kilotons)

Table 41 Aliphatic Solvents & Thinners Market for Adhesives, by Region, 2020-2025 (Kilotons)

8.6 Aerosols

8.6.1 Asia-Pacific to Lead the Aerosols Segment During the Forecast Period

Table 42 Aliphatic Solvents & Thinners Market for Aerosols, by Region, 2016-2019 (USD Million)

Table 43 Aliphatic Solvents & Thinners Market for Aerosols, by Region, 2020-2025 (USD Million)

Table 44 Aliphatic Solvents & Thinners Market for Aerosols, by Region, 2016-2019 (Kilotons)

Table 45 Aliphatic Solvents & Thinners Market for Aerosols, by Region, 2020-2025 (Kilotons)

8.7 Rubbers & Polymers

8.7.1 Asia-Pacific is Estimated to be the Largest Market in Rubber & Polymer Application Segment in 2019

Table 46 Aliphatic Solvents & Thinners Market for Rubbers & Polymers, by Region, 2016-2019 (USD Million)

Table 47 Aliphatic Solvents & Thinners Market for Rubbers & Polymers, by Region, 2020-2025 (USD Million)

Table 48 Aliphatic Solvents & Thinners Market for Rubbers & Polymers, by Region, 2016-2019 (Kilotons)

Table 49 Aliphatic Solvents & Thinners Market for Rubbers & Polymers, by Region, 2020-2025 (Kilotons)

8.8 Printing Inks

8.8.1 Europe to Exhibit Negative Growth in Printing Inks Segment During the Forecast System

Table 50 Aliphatic Solvents & Thinners Market for Printing Inks, by Region, 2016-2019 (USD Million)

Table 51 Aliphatic Solvents & Thinners Market for Printing Inks, by Region, 2020-2025 (USD Million)

Table 52 Aliphatic Solvents & Thinners Market for Printing Inks, by Region, 2016-2019 (Kilotons)

Table 53 Aliphatic Solvents & Thinners Market for Printing Inks, by Region, 2020-2025 (Kilotons)

8.9 Other Applications

Table 54 Aliphatic Solvents & Thinners Market for Other Applications, by Region, 2016-2019 (USD Million)

Table 55 Aliphatic Solvents & Thinners Market for Other Applications, by Region, 2020-2025 (USD Million)

Table 56 Aliphatic Solvents & Thinners Market for Other Applications, by Region, 2016-2019 (Kilotons)

Table 57 Aliphatic Solvents & Thinners Market for Other Applications, by Region, 2020-2025 (Kilotons)

9 Aliphatic Solvents & Thinners Market, by Region

9.1 Introduction

Figure 22 Regional Snapshot: Asia-Pacific to Lead the Aliphatic Solvents & Thinners Market During the Forecast Period

Table 58 Aliphatic Solvents & Thinners Market, by Region, 2016-2019 (USD Million)

Table 59 Aliphatic Solvents & Thinners Market, by Region, 2020-2025 (USD Million)

Table 60 Aliphatic Solvents & Thinners Market, by Region, 2016-2019 (Kilotons)

Table 61 Aliphatic Solvents & Thinners Market, by Region, 2020-2025 (Kilotons)

9.2 Asia-Pacific

9.2.1 Impact of COVID-19 on the Asia-Pacific Market

Figure 23 Asia-Pacific: Aliphatic Solvents & Thinners Market Snapshot

Table 62 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (USD Million)

Table 63 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (USD Million)

Table 64 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (Kilotons)

Table 65 Asia-Pacific Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (Kilotons)

Table 66 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 67 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 68 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 69 Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.2 China

9.2.2.1 China is Projected to be the Largest Market During the Forecast Period in the Asia-Pacific Market

Table 70 China: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 71 China: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 72 China: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 73 China: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.3 India

9.2.3.1 India is Projected to Grow at the Highest CAGR During the Forecast Period in the Asia-Pacific Market

Table 74 India: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 75 India: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 76 India: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 77 India: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.4 South Korea

9.2.4.1 Increasing Demand from the Paint & Coating Industry Has Fueled the Growth of the Market in South Korea

Table 78 South Korea: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 79 South Korea Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 80 South Korea: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 81 South Korea: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.5 Japan

9.2.5.1 Paints & Coatings to Form the Largest Application in Japan in 2020

Table 82 Japan: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 83 Japan: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 84 Japan: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 85 Japan: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.6 Thailand

9.2.6.1 Increasing Demand for Paints & Coatings is Driving the Market in Thailand

Table 86 Thailand: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 87 Thailand: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 88 Thailand: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 89 Thailand: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.7 Indonesia

9.2.7.1 The Adhesives Application Segment is Estimated to Emerge as a Key Market in Indonesia

Table 90 Indonesia: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 91 Indonesia: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 92 Indonesia: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 93 Indonesia: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.2.8 Rest of Asia-Pacific

Table 94 Rest of Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 95 Rest of Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 96 Rest of Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 97 Rest of Asia-Pacific: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3 Europe

9.3.1 Impact of COVID-19 on the European Market

Figure 24 Europe: Aliphatic Solvents & Thinners Market Snapshot

Table 98 Europe: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (USD Million)

Table 99 Europe: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (USD Million)

Table 100 Europe: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (Kilotons)

Table 101 Europe: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (Kilotons)

Table 102 Europe: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 103 Europe: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 104 Europe: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 105 Europe: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.2 UK

9.3.2.1 The UK is Projected to be the Largest Market During the Forecast Period in Europe Aliphatic Solvents & Thinners Market

Table 106 UK: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 107 UK Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 108 UK: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 109 UK: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.3 France

9.3.3.1 Printing Inks Application Segment to Exhibit Negative Growth During the Forecast Period

Table 110 France: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 111 France: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 112 France: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 113 France Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.4 Germany

9.3.4.1 Paints & Coatings to Lead the German Market During the Forecast Period

Table 114 Germany: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 115 Germany: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 116 Germany: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 117 Germany: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.5 Italy

9.3.5.1 Paints & Coatings Application is Projected to be the Fastest-Growing Market in the Italian Market

Table 118 Italy: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 119 Italy Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 120 Italy: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 121 Italy Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.6 Turkey

9.3.6.1 Printing Inks Application Segment to Exhibit Negative Growth During the Forecast Period in the Turkish Market

Table 122 Turkey: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 123 Turkey Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 124 Turkey: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 125 Turkey: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.3.7 Rest of Europe

Table 126 Rest of Europe: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 127 Rest of Europe: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 128 Rest of Europe: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 129 Rest of Europe: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.4 North America

9.4.1 COVID-19 Impact on the North American Market

Figure 25 North America: Aliphatic Solvents & Thinners Market Snapshot

Table 130 North America: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (USD Million)

Table 131 North America: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (USD Million)

Table 132 North America: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (Kilotons)

Table 133 North America: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (Kilotons)

Table 134 North America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 135 North America: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 136 North America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 137 North America: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.4.2 US

9.4.2.1 The Us is Projected to be the Largest Market During the Forecast Period in North America

Table 138 US: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 139 US: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 140 US: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 141 US: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.4.3 Canada

9.4.3.1 Paints & Coatings Application is Projected to be the Fastest-Growing Market in Canada

Table 142 Canada: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 143 Canada: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 144 Canada: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 145 Canada: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.4.4 Mexico

9.4.4.1 Mexico is Projected to Grow at the Highest CAGR During the Forecast Period in North America

Table 146 Mexico: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 147 Mexico: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 148 Mexico: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 149 Mexico: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5 Middle East & Africa

9.5.1 Impact of COVID-19 on the Middle Eastern & African Market

Figure 26 Middle East & Africa: Aliphatic Solvents & Thinners Market Snapshot

Table 150 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (USD Million)

Table 151 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (USD Million)

Table 152 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (Kilotons)

Table 153 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (Kilotons)

Table 154 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 155 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 156 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 157 Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.2 Saudi Arabia

9.5.2.1 Saudi Arabia is Projected to be the Largest Market During the Forecast Period in the Middle East & Africa

Table 158 Saudi Arabia: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 159 Saudi Arabia: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 160 Saudi Arabia: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 161 Saudi Arabia: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.3 UAE

9.5.3.1 UAE is Projected to be the Second-Largest Market During the Forecast Period in the Middle East & Africa

Table 162 UAE: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 163 UAE: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 164 UAE: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 165 UAE: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.4 Qatar

9.5.4.1 The Paints & Coatings Application Segment is Estimated to Lead the Market in Qatar

Table 166 Qatar: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 167 Qatar: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 168 Qatar: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 169 Qatar: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.5 Kuwait

9.5.5.1 Paints & Coatings Application is Projected to be the Fastest-Growing Market in Kuwait

Table 170 Kuwait Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 171 Kuwait Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 172 Kuwait: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 173 Kuwait: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.6 South Africa

9.5.6.1 The Paints & Coatings Application Segment is Estimated to Lead the South African Market

Table 174 South Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 175 South Africa: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 176 South Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 177 South Africa: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.5.7 Rest of the Middle East & Africa

Table 178 Rest of the Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 179 Rest of the Middle East & Africa Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 180 Rest of the Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 181 Rest of the Middle East & Africa: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.6 South America

9.6.1 Impact of COVID-19 on the South American Market

Figure 27 South America: Aliphatic Solvents & Thinners Market Snapshot

Table 182 South America: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (USD Million)

Table 183 South America: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (USD Million)

Table 184 South America: Aliphatic Solvents & Thinners Market, by Country, 2016-2019 (Kilotons)

Table 185 South America: Aliphatic Solvents & Thinners Market, by Country, 2020-2025 (Kilotons)

Table 186 South America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 187 South America Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 188 South America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 189 South America: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.6.2 Brazil

9.6.2.1 Brazil is Projected to be the Largest Market During the Forecast Period in South America

Table 190 Brazil: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 191 Brazil Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 192 Brazil: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 193 Brazil: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.6.3 Argentina

9.6.3.1 Paints & Coatings Application to Lead the Argentinian Aliphatic Solvents & Thinners Market During the Forecast Period

Table 194 Argentina: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 195 Argentina: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 196 Argentina: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 197 Argentina: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

9.6.4 Rest of South America

Table 198 Rest of South America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (USD Million)

Table 199 Rest of South America: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (USD Million)

Table 200 Rest of South America: Aliphatic Solvents & Thinners Market, by Application, 2016-2019 (Kilotons)

Table 201 Rest of South America: Aliphatic Solvents & Thinners Market, by Application, 2020-2025 (Kilotons)

10 Competitive Landscape

10.1 Overview

Figure 28 Companies in the Aliphatic Solvents & Thinners Market Adopted Organic Growth and Inorganic Growth Strategies Between 2015 and 2020

10.2 Competitive Landscape Mapping, 2020

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

Figure 29 Aliphatic Solvents & Thinners Market (Global) Competitive Landscape Mapping, 2020

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio

Figure 30 Product Portfolio Analysis of Top Players in Aliphatic Solvents & Thinners Market

10.3.2 Business Strategy Excellence

Figure 31 Business Strategy Excellence of Top Players in Aliphatic Solvents & Thinners Market

10.4 Emerging Companies Matrix, 2020

10.4.1 Leaders

10.4.2 Contenders

10.4.3 Pacesetters

10.4.4 Masters

Figure 32 Aliphatic Solvents & Thinners Market: Emerging Companies Competitive Leadership Mapping, 2020

10.5 Market Ranking Analysis

Figure 33 Aliphatic Solvents & Thinners Market Ranking, by Companies, 2019

10.6 Competitive Situations & Trends

10.6.1 Acquisitions

Table 202 Acquisitions, 2014-2020

10.6.2 New Product Launches & Developments

Table 203 New Product Launches & Developments, 2014-2020

10.6.3 Expansions

Table 204 Expansions, 2014-2020

10.6.4 Agreements & Contracts

Table 205 Agreements & Contracts, 2014-2020

11 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and Analyst's View)*

11.1 Exxonmobil Chemical, Inc.

Figure 34 Exxonmobil Chemical Inc.: Company Snapshot

Figure 35 Exxonmobil Chemical: SWOT Analysis

11.2 SK Global Chemical Co. Ltd.

Figure 36 SK Holdings Co., Ltd: Company Snapshot

Figure 37 SK Global Chemical Co. Ltd: SWOT Analysis

11.3 Royal Dutch Shell plc

Figure 38 Royal Dutch Shell plc: Company Snapshot

Figure 39 Royal Dutch Shell plc: SWOT Analysis

11.4 Calumet Specialty Products Partners, L.P.

Figure 40 Calumet Specialty Products Partners, L.P.: Company Snapshot

Figure 41 Calumet Specialty Product Partners, L.P: SWOT Analysis

11.5 Gotham Industries

11.6 Gulf Chemicals and Industrial Oils Company

11.7 Recochem Inc.

11.8 HCS Group

11.9 W.M. Barr

11.10 Honeywell International Inc.

Figure 42 Honeywell International Inc.: Company Snapshot

11.11 BASF Se

Figure 43 BASF Se: Company Snapshot

11.12 Lyondellbasell Industries N.V.

Figure 44 Lyondellbasell Industries N.V.: Company Snapshot

11.13 Ganga Rasayanie (P) Ltd

11.14 Noco Energy Corporation

11.15 Gadiv Petrochemical Industries Ltd.

11.16 Hunt Refining Company

11.17 Other Companies

11.17.1 Pure Chemicals Co.

11.17.2 Heritage Crystal Clean

11.17.3 Solvchem Inc.

11.17.4 RB Products, Inc.

11.17.5 Safra Co.Ltd

11.17.6 Phillips 66

11.17.7 Kandla Energy & Chemical Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and Analyst's View Might Not be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Subscription Portal

12.3 Available Customizations

Companies Mentioned

- BASF Se

- Calumet Specialty Products Partners, L.P.

- Exxonmobil Chemical, Inc.

- Gadiv Petrochemical Industries Ltd.

- Ganga Rasayanie (P) Ltd

- Gotham Industries

- Gulf Chemicals and Industrial Oils Company

- HCS Group

- Heritage Crystal Clean

- Honeywell International Inc.

- Hunt Refining Company

- Kandla Energy & Chemical Limited

- Lyondellbasell Industries N.V.

- Noco Energy Corporation

- Phillips 66

- Pure Chemicals Co.

- RB Products, Inc.

- Recochem Inc.

- Royal Dutch Shell plc

- Safra Co.Ltd

- SK Global Chemical Co. Ltd.

- Solvchem Inc.

- W.M. Barr

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | October 2020 |

| Forecast Period | 2020 - 2024 |

| Estimated Market Value ( USD | $ 3.4 billion |

| Forecasted Market Value ( USD | $ 4.3 billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |