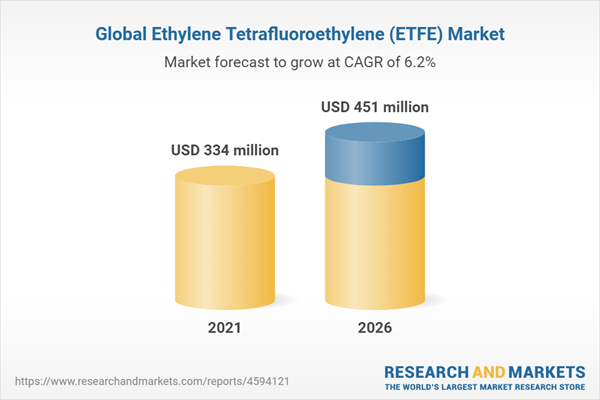

The global Ethylene Tetrafluoroethylene (ETFE) market size is estimated to be USD 334 million in 2021 and is projected to reach USD 451 million by 2026, at a CAGR of 6.2% between 2021 and 2026. Increasing usage of ETFE in solar panels, substitute for glass and other conventional materials, and growing demand in end-use industries are driving the demand for ETFE during the forecast period. However, ETFE is prone to puncture, transmit more sound than glass, and higher cost than other conventional material, which is hampering the market growth.Films & Sheets Application to Offer Growth Opportunities to Market Players

Pellet/granule is projected to be the largest segment by type in ETFE market

Based on type, pellet/granule is estimated to be the largest type of ETFE during the forecast period. The pellet/granule form of ETFE can be both, extruded and injected to convert it to films & sheets, wires & cables, and tubes, which are then used by various end-use industries such as architecture, automotive, chemical processing, and others. They have low melting points and high-melt flow rates (MFRs), making pellets suitable for injection, extrusion, rotational, and other molding processes.Films & sheets is projected to be the largest segment by application in ETFE market

Films & sheets is estimated to be the largest and fastest-growing application segment in the ETFE market during the forecast period. ETFE films & sheets are temperature, aging, and chemical resistant and have superior mechanical strength. ETFE films and sheets are now largely replacing glass in the building & construction industry due to superior light transmission properties. ETFE sheets are more commonly found as roofing in public areas, such as stations, airports, educational centers, museums, conference centers, and other artistic structures. ETFE films are also used for front and backing sheets of photovoltaic (PV) modules. When used as front sheets for PV modules, these films help improve the efficiency of solar cells since they transmit 90%-95% of light.Building & construction is projected to be the largest segment by end-use industry in ETFE market

Building & construction is estimated to be the largest end-user segment in the ETFE market during the forecast period. ETFE is majorly used in non-residential, civil infrastructures, and commercial buildings for roofing application. Energy efficiency, cost control, low carbon emissions, sustainability, recyclability, and green buildings are major factors that influence the construction industry. ETFE films are lightweight, cost-effective, eco-friendly, 100% recyclable and esthetically preferred compared to glass. These properties propel the demand for ETFE films in the construction industry.North America accounts for the largest share in ETFE market by region

North America was the largest ETFE market in 2020. The major end users of ETFE in North America building & construction, automotive, aerospace, electric & electronics, nuclear, and solar energy. . The US dominates the ETFE market in North America in terms of value and volume. New construction projects, greenhouse applications, steady growth in automotive, and an increase in PV installation in the region are driving the ETFE market in the region.Extensive primary interviews were conducted to determine and verify the market size for several segments and sub segments and information gathered through secondary research.

The break-up of primary interviews is given below:

- By Company Type - Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation - C-level Executives - 22%, Director level - 18%, and Others* - 60%

- By Region - North America- 34%, Europe - 25%, Asia Pacific - 30%, South America- 6%, and Middle East & Africa- 5%

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

The companies profiled in this market research report include are AGC Inc. (Japan), The Chemours Company (US), 3M (US), Daikin Industries, Ltd. (Japan), Vector Foiltec (Germany), HaloPolymer (Russia), Guangzhou Li Chang Fluoroplastics Co., Ltd. (China), Hubei Everflon Polymer Co., Ltd. (China), Ensinger Group (Germany), Dongyue Group (China), Saint-Gobain S.A. (France), Mitsubishi Chemical Advanced Materials (Switzerland), Solvay S.A. (Belgium), BASF SE (Germany), SABIC (Saudi Arabia), and others.

Research Coverage:

This research report categorizes the ETFE market on the basis of type, technology, application, end-use industry and region. The report includes detailed information regarding the major factors influencing the growth of the ETFE market, such as drivers, restraints, challenges, and opportunities. A detailed analysis of the key industry players has been done to provide insights into business overviews, products & services, key strategies, expansions, new product developments, and recent developments associated with the market.Reasons to Buy the Report

The report will help market leaders/new entrants in this market in the following ways:

- This report segments the ETFE market comprehensively and provides the closest approximations of market sizes for the overall market and subsegments across verticals and regions.

- The report will help stakeholders understand the pulse of the market and provide them information on the key market drivers, restraints, challenges, and opportunities.

- This report will help stakeholders understand the major competitors and gain insights to enhance their position in the business. The competitive landscape section includes expansions, new product developments, and joint ventures.

- The report includes the COVID-19 impact on the ETFE market.

Table of Contents

Companies Mentioned

- Agc Inc.

- The Chemours Company

- 3M

- Daikin Industries, Ltd.

- Vector Foiltec GmbH

- Halopolymer

- Guangzhou Lichang Fluoroplastics Co. Ltd

- Hubei Everflon Polymer Co., Ltd

- Ensinger Group

- Dongyue Group

- Saint-Gobain S.A.

- Mitsubishi Chemical Advanced Materials

- Solvay S.A.

- Basf Se

- Sabic

- Shandong Hengyi New Material Technology Co., Ltd

- Beijing Starget Chemicals Co., Ltd

- Zeus Industrial Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2022 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 334 million |

| Forecasted Market Value ( USD | $ 451 million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |