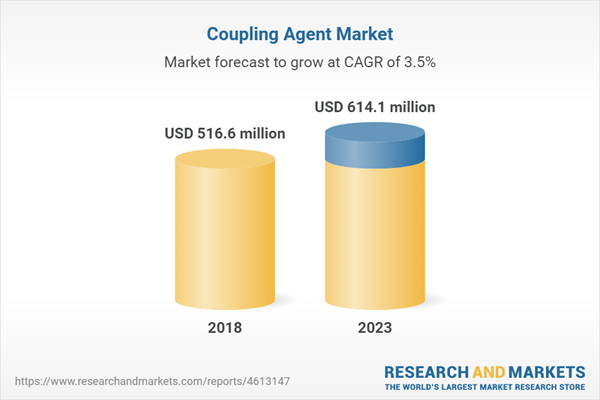

Coupling agent market to register a CAGR of 3.5%, in terms of value (2018-2023)

Sulfur silane is expected to be the largest type segment during the forecast period.

Sulfur silane is estimated to be the largest type segment of the coupling agent market during the forecast period, in terms of value and volume. Sulfur silanes are used as coupling agents and have their major application in the rubber & tire industry. Sulfur silane coupling agents are also used in plastics and composites to improve the strength of the material. The growing demand for green tires has increased the demand for sulfur coupling agents. The demand for green tires is increasing as they provide better fuel efficiency and also because of the initiatives taken by many countries to decrease pollution and carbon emission.

APAC is projected to be the largest as well as the fastest-growing coupling agent market during the forecast period.

APAC is projected to be the largest market for coupling agent and is expected to register the CAGR, in terms of value, during the forecast period. The increasing population and the rise in spending are driving the automotive industry in APAC, which is expected boost the coupling agent market during the forecast period. North America is projected to be the second-largest coupling agent market. Coupling agents provide abrasion resistance, durability, good weather protection, and low maintenance to the products in which they are used.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments gathered through secondary research.

The break-up of primary interviews is given below:

- By Company Type: Tier 1 – 50%, Tier 2 – 37%, and Others – 13%

- By Designation: C Level – 46%, Director Level – 31%, and Others – 23%

- By Region: North America – 33%, Europe – 28%, Asia Pacific – 22%, South America – 11%, and the Middle East & Africa – 6%

The companies profiled in this market research report are Wacker Chemie (Germany), Momentive Performance Materials (US), Dow-DuPont (US), Evonik (Germany), and Shin-Etsu Chemicals (Japan), and others.

Research Coverage:

This research report categorizes the coupling agents market on the basis of type, application, and region. The report includes detailed information regarding major factors influencing the growth of the coupling agents market, such as drivers, restraints, challenges, and opportunities. A detailed analysis of key industry players has been done to provide insights on business overviews, products & services, key strategies, investments & expansions, mergers & acquisitions, and other recent developments associated with the market.

Reasons to Buy the Report:

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the coupling agents market comprehensively and provides the closest approximations of market sizes for the overall market and its subsegments across regions.

2. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders understand their competitors better and gain insights to enhance their position in the market. The competitive landscape section includes the new product developments and mergers & acquisitions in the coupling agent market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Significant Opportunities in the Coupling Agent Market

4.2 APAC Coupling Agent Market, By Application and Country

4.3 Coupling Agent Market, By Application and Region

4.4 Coupling Agent Market Attractiveness

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Initiatives on Fuel Efficiency and Regulation Compliance

5.2.1.2 Increasing Demand From Automotive and Building & Construction Industries

5.2.2 Restraints

5.2.2.1 Decreasing Demand for Plastic Packaging

5.2.3 Opportunities

5.2.3.1 Emerging Applications in the Pharmaceutical and Cosmetics Industries

5.2.3.2 Rapidly Expanding Economies of APAC

5.2.4 Challenges

5.2.4.1 High Cost of Production

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Manufacturing Industry Trends, By Country

5.4.3 Automotive Industry Trends, By Country

5.4.3.1 Automotive Production Statistics

6 Coupling Agent Market, By Type

6.1 Introduction

6.1.1 Sulfur Silane Coupling Agent

6.1.2 Vinyl Silane Coupling Agent

6.1.3 Amino Silane Coupling Agent

6.1.4 Epoxy Silane Coupling Agent

6.1.5 Others7 Coupling Agent Market, By Application

7.1 Introduction

7.2 Rubber & Plastics

7.3 Fiber Treatment

7.4 Adhesives & Sealants

7.5 Paints & Coatings

7.6 Others

8 Coupling Agent Market, By Region

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 Italy

8.3.4 France

8.4 APAC

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 India

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

9 Competitive Landscape

9.1 Overview

9.2 Market Ranking

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 Mergers & Acquisitions

9.3.3 New Product Launches

9.3.4 Agreements & Collaborations

10 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Evonik Industries

10.2 Shin-Etsu Chemical Co. Ltd.

10.3 Momentive Performance Materials Holdings LLC

10.4 Dowdupont

10.5 Wacker Chemie AG

10.6 Gelest Inc.

10.7 WD Silicone Company Limited

10.8 Jingzhou Jianghan Fine Chemical Company Limited

10.9 Nanjing Union Silicon Chemical Co. Ltd.

10.10 Nanjing Shuguang Chemical Group Company Limited

10.11 China National Bluestar (Group) Co, Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables

Table 1 Contribution of Manufacturing Industry to GDP, By Country, Percent of GDP (2015–2017)

Table 2 Automotive Production Statistics, 2015–2017 (Unit)

Table 3 Coupling Agent Market Size, By Type, 2016–2023 (Kiloton)

Table 4 Coupling Agent Market Size, By Type, 2016–2023 (USD Million)

Table 5 Sulfur Silane Coupling Agent Market Size, By Region, 2016–2023 (Kiloton)

Table 6 Sulfur Silane Coupling Agent Market Size, By Region, 2016–2023 (USD Million)

Table 7 Vinyl Silane Coupling Agent Market Size, By Region, 2016–2023 (Kiloton)

Table 8 Vinyl Silane Coupling Agent Market Size, By Region, 2016–2023 (USD Million)

Table 9 Amino Silane Coupling Agent Market Size, By Region, 2016–2023 (Kiloton)

Table 10 Amino Silane Coupling Agent Market Size, By Region, 2016–2023 (USD Million)

Table 11 Epoxy Silane Coupling Agent Market Size, By Region, 2016–2023 (Kiloton)

Table 12 Epoxy Silane Coupling Agent Market Size, By Region, 2016–2023 (USD Million)

Table 13 Other Coupling Agent Market Size, By Region, 2016–2023 (Kiloton)

Table 14 Other Coupling Agent Market Size, By Region, 2016–2023 (USD Million)

Table 15 Coupling Agent Market Size, By Application, 2016–2023 (Kiloton)

Table 16 By Market Size, By Application, 2016–2023 (USD Million)

Table 17 By Market Size in Rubber & Plastics Application, By Region, 2016–2023 (Kiloton)

Table 18 By Market Size in Rubber & Plastics Application, By Region, 2016–2023 (USD Million)

Table 19 By Market Size in Fiber Treatment Application, By Region, 2016–2023 (Kiloton)

Table 20 By Market Size in Fiber Treatment Application, By Region, 2016–2023 (USD Million)

Table 21 By Market Size in Adhesives & Sealants Application, By Region, 2016–2023 (Kiloton)

Table 22 By Market Size in Adhesives & Sealants Application, By Region, 2016–2023 (USD Million)

Table 23 By Market Size in Paints & Coatings Application, By Region, 2016–2023 (Kiloton)

Table 24 By Market Size in Paints & Coatings Application, By Region, 2016–2023 (USD Million)

Table 25 By Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 26 By Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 27 By Market Size, By Region, 2016–2023 (Kiloton)

Table 28 By Market Size, By Region, 2016-2023 (USD Million)

Table 29 North America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 30 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 31 North America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 32 North America: By Market Size, By Application, 2016–2023 (USD Million)

Table 33 North America: By Market Size, By Type, 2016–2023 (Kiloton)

Table 34 North America: By Market Size, By Type, 2016–2023 (USD Million)

Table 35 US: By Market Size, By Application, 2016–2023 (Kiloton)

Table 36 US: By Market Size, By Application, 2016–2023 (USD Million)

Table 37 Canada: By Market Size, By Application, 2016–2023 (Kiloton)

Table 38 Canada: By Market Size, By Application, 2016–2023 (USD Million)

Table 39 Mexico: By Market Size, By Application, 2016–2023 (Kiloton)

Table 40 Mexico: By Market Size, By Application, 2016–2023 (USD Million)

Table 41 Europe: By Market Size, By Country, 2016–2023 (Kiloton)

Table 42 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 43 Europe: By Market Size, By Application, 2016–2023 (Kiloton)

Table 44 Europe: By Market Size, By Application, 2016–2023 (USD Million)

Table 45 Europe: By Market Size, By Type, 2016–2023 (Kiloton)

Table 46 Europe: By Market Size, By Type, 2016–2023 (USD Million)

Table 47 Germany: By Market Size, By Application, 2016–2023 (Kiloton)

Table 48 Germany: By Market Size, By Application, 2016–2023 (USD Million)

Table 49 UK: By Market Size, By Application, 2016–2023 (Kiloton)

Table 50 UK: By Market Size, By Application, 2016–2023 (USD Million)

Table 51 Italy: By Market Size, By Application, 2016–2023 (Kiloton)

Table 52 Italy: By Market Size, By Application, 2016–2023 (USD Million)

Table 53 France: By Market Size, By Application, 2016–2023 (Kiloton)

Table 54 France: By Market Size, By Application, 2016–2023 (USD Million)

Table 55 APAC: By Market Size, By Country, 2016–2023 (Kiloton)

Table 56 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 57 APAC: By Market Size, By Application, 2016–2023 (Kiloton)

Table 58 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 59 APAC: By Market Size, By Type, 2016–2023 (Kiloton)

Table 60 APAC: By Market Size, By Type, 2016–2023 (USD Million)

Table 61 China: By Market Size, By Application, 2016–2023 (Kiloton)

Table 62 China: By Market Size, By Application, 2016–2023 (USD Million)

Table 63 Japan: By Market Size, By Application, 2016–2023 (Kiloton)

Table 64 Japan: By Market Size, By Application, 2016–2023 (USD Million)

Table 65 South Korea: By Market Size, By Application, 2016–2023 (Kiloton)

Table 66 South Korea: By Market Size, By Application, 2016–2023 (USD Million)

Table 67 India: By Market Size, By Application, 2016–2023 (Kiloton)

Table 68 India: By Market Size, By Application, 2016–2023 (USD Million)

Table 69 South America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 70 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 71 South America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 72 South America: By Market Size, By Application, 2016–2023 (USD Million)

Table 73 South America: By Market Size, By Type, 2016–2023 (Kiloton)

Table 74 South America: By Market Size, By Type, 2016–2023 (USD Million)

Table 75 Brazil: By Market Size, By Application, 2016–2023 (Kiloton)

Table 76 Brazil: By Market Size, By Application, 2016–2023 (USD Million)

Table 77 Argentina: By Market Size, By Application, 2016–2023 (Kiloton)

Table 78 Argentina: By Market Size, By Application, 2016–2023 (USD Million)

Table 79 Middle East & Africa: By Market Size, By Country, 2016–2023 (Kiloton)

Table 80 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 81 Middle East & Africa: By Market Size, By Application, 2016–2023 (Kiloton)

Table 82 Middle East & Africa: By Market Size, By Application, 2016–2023 (USD Million)

Table 83 Middle East & Africa: By Market Size, By Type, 2016–2023 (Kiloton)

Table 84 Middle East & Africa: By Market Size, By Type, 2016–2023 (USD Million)

Table 85 Saudi Arabia: By Market Size, By Application, 2016–2023 (Kiloton)

Table 86 Saudi Arabia: By Market Size, By Application, 2016–2023 (USD Million)

Table 87 UAE: By Market Size, By Application, 2016–2023 (Kiloton)

Table 88 UAE: By Market Size, By Application, 2016–2023 (USD Million)

Table 89 Expansions, 2014–2018

Table 90 Mergers & Acquisitions, 2014–2018

Table 91 New Product Launches, 2014–2018

Table 92 Agreements & Collaborations, 2014–2018

List of Figures

Figure 1 Coupling Agent Market Segmentation

Figure 2 Coupling Agent Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Coupling Agent Market: Data Triangulation

Figure 6 Sulfur Silane Coupling Agent to Dominate the Market

Figure 7 Rubber & Plastics Application to Be the Largest Application of Coupling Agents

Figure 8 APAC to Be the Largest Coupling Agent Market During the Forecast Period

Figure 9 High Market Growth is Expected During the Forecast Period

Figure 10 China Accounted for the Largest Share of the APAC Coupling Agent Market in 2017

Figure 11 Rubber & Plastics Application to Drive the Market During the Forecast Period

Figure 12 APAC to Be the Fastest-Growing Market During the Forecast Period

Figure 13 Overview of Factors Driving the Coupling Agent Market

Figure 14 Coupling Agent Market: Porter’s Five Forces Analysis

Figure 15 Contribution of Manufacturing Industry to GDP, 2017

Figure 16 Sulfur Silane Accounted for the Largest Share of the Coupling Agent Market in 2017

Figure 17 APAC to Be the Largest Sulfur Silane Coupling Agent Market During the Forecast Period

Figure 18 APAC to Be the Largest Vinyl Silane Coupling Agent Market During the Forecast Period

Figure 19 APAC to Register the Highest CAGR in the Amino Silane Segment of the Coupling Agent Market

Figure 20 APAC to Be the Largest Epoxy Silane Coupling Agent Market

Figure 21 APAC to Register the Highest CAGR in the Other Coupling Agent Market

Figure 22 Rubber & Plastics to Be the Largest Application of Coupling Agents

Figure 23 APAC to Lead the Coupling Agent Market in the Rubber & Plastics Application

Figure 24 APAC to Lead the Coupling Agent Market in the Fiber Treatment Application

Figure 25 APAC to Lead the Coupling Agent Market in the Adhesives & Sealants Application

Figure 26 APAC to Be the Fastest-Growing Coupling Agent Market in the Paints & Coatings Application

Figure 27 APAC to Be the Largest Coupling Agent Market in Other Applications

Figure 28 North America: Coupling Agent Market Snapshot

Figure 29 Europe: Coupling Agent Market Snapshot

Figure 30 APAC: Coupling Agent Market Snapshot

Figure 31 Companies Adopted Expansion as the Key Growth Strategy Between 2014 and 2018

Figure 32 Ranking of Key Coupling Agent Manufacturers for Passenger Cars, 2017

Figure 33 Evonik Industries: Company Snapshot

Figure 34 Shin-Etsu Chemical Co. Ltd.: Company Snapshot

Figure 35 Momentive Performance Materials Holdings LLC: Company Snapshot

Figure 36 Dowdupont: Company Snapshot

Figure 37 Wacker Chemie AG: Company Snapshot

Companies Mentioned

- China National Bluestar (Group) Co, Ltd.

- Dowdupont

- Evonik Industries

- Gelest Inc.

- Jingzhou Jianghan Fine Chemical Company Limited

- Momentive Performance Materials Holdings LLC

- Nanjing Shuguang Chemical Group Company Limited

- Nanjing Union Silicon Chemical Co. Ltd.

- Shin-Etsu Chemical Co. Ltd.

- WD Silicone Company Limited

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 129 |

| Published | August 2018 |

| Forecast Period | 2018 - 2023 |

| Estimated Market Value ( USD | $ 516.6 million |

| Forecasted Market Value ( USD | $ 614.1 million |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |