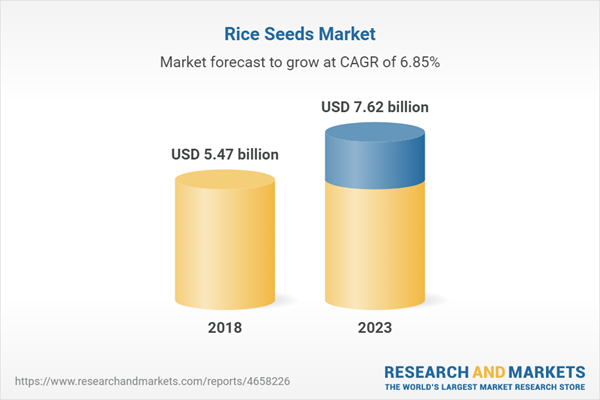

The rice seeds market is projected to grow at a CAGR of 6.85% from 2018 to 2023.

Among different types, the hybrid seeds segment is projected to be the fastest-growing from 2018 to 2023.

Growing awareness about the advantages of hybrid seeds has encouraged adoption across Asian countries. Multiple traits such as grain size and disease resistant, have been targeted by key players such as Bayer and DowDuPont for the development of hybrids. The major target focused by the players has been high crop yield. Innovations such as herbicide-tolerant hybrids have also gained traction in the developed countries such as the US and have increased the scope for market growth in the coming years.

In terms of hybridization technique, the three-line system segment is estimated to dominate the market in 2018.

The three-line system is the most widely adopted hybridization technique by major seed companies for the production of hybrid rice seeds. Majority of the Asian countries are adopting the three-line system except for China, where Dr Yuan Longping extensively promoted the two-line production system for hybrids. In India, the use of the two-line system is very limited as only a few players such as Savannah Seeds (India), a subsidiary of RiceTec Inc., have been using the two-line system. Though the two-line system has multiple advantages as compared to the three-line system, the influence of climatic conditions on these systems restrain its adoption in the Asian countries.

Asia Pacific is estimated to dominate the rice seeds market in 2018.

The Asia Pacific region has been the predominant producer and consumer of rice since a decade due to the high consumption of the crops as a staple food in various countries. The demand for rice seeds is also high in this region due to the increased production rate. Also, the growing seed replacement rate in the Asian countries for paddy the growth of the rice seeds market in the region. Since the cultivation of rice in other regions is minimal, with 90% of the production mainly concentrated in the Asia Pacific region, the market for rice seeds in the region is projected to grow at the highest CAGR from 2018 to 2023. Also, the growing awareness about the benefits of hybrid seeds is expected to fuel the demand for rice seeds in Asia.

The breakdown of the primaries on the basis of company type, designation, and region conducted during the research study is as follows:

By Company type: Tier 1 – 30%, Tier 2 –55%, and Tier 3 – 15%

By Designation: C-Level – 20%, D-Level – 30%, and Others* – 50%

By Region: Asia Pacific – 55%, Americas –15%, Europe – 5%, and RoW -25%

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1: Revenue ≥ USD 1 billion; Tier 2: USD 100 million< Revenue< USD 1 billion; Tier 3: Revenue ≤ USD 100 million

The global market for rice seeds is dominated by large players such as Bayer (Germany), DowDuPont (US), Syngenta (Switzerland), Advanta Seeds (UPL) (India), and Nuziveedu Seeds (India). Other key players in the rice seeds market include Mahyco (India), BASF (Germany), Kaveri Seeds (India), SL Agritech (Philippines), Rasi Seeds (India), Rallis (India), JK Seeds (India), Hefei Fengle (China), LongPing (China), Guard Agri (Pakistan), and National Seeds Corporation (India).

Research Coverage

The report analyzes the rice seeds market across different applications and regions. It aims at estimating the market size and future growth potential of this market across different segments such as type, hybridization technique, grain size, treatment, and region. Furthermore, the report includes an in-depth competitive analysis of the key players in the market along with their company profiles, recent developments, and key market strategies.

Key Benefits

The report will help the market leaders/new entrants in this market by providing them with the closest approximations of the revenue numbers for the overall rice seeds market and its subsegments. This report will help stakeholders to better understand the competitor landscape, gain more insights to position their businesses better and devise suitable go-to-market strategies. The report will also help stakeholders to understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- BASF

- Bayer

- DowDuPont

- Guard Agri

- Hefei Fengle Seeds

- JK Seeds

- Kaveri Seeds

- Krishidhan Seeds

- Long Ping Hi-Tech S

- Mahyco

- National Seed Corporation

- Nuziveedu Seeds

- Rallis India Limited

- Rasi Seeds

- SL Agritech

- Syngenta

- UPL Advanta Seeds

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2018 |

| Forecast Period | 2018 - 2023 |

| Estimated Market Value ( USD | $ 5.47 billion |

| Forecasted Market Value ( USD | $ 7.62 billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |