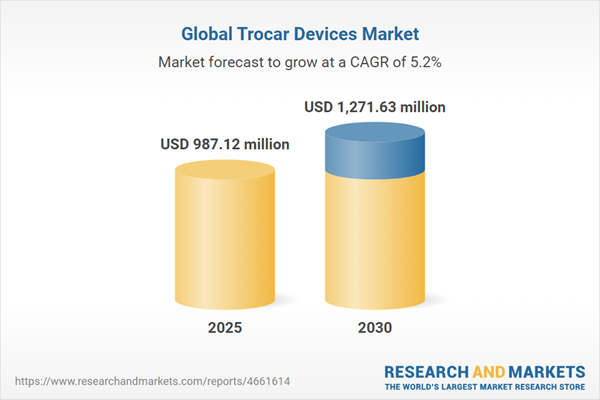

The global trocar devices market is poised for significant growth from 2025 to 2030, driven by the rising prevalence of chronic diseases, increasing demand for minimally invasive surgeries, and an aging population. Trocars, essential surgical instruments used to create access ports for minimally invasive procedures, are critical in specialties such as cardiovascular, urological, and cosmetic surgeries. The market is propelled by technological advancements, growing healthcare infrastructure, and the need for safer, more efficient surgical tools. North America leads the market, while Asia-Pacific shows strong growth potential. Challenges include high costs and the need for skilled professionals.

Market Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic conditions like cardiovascular diseases, obesity, and diabetes is a primary driver of the trocar devices market. These conditions often require surgical interventions, boosting the demand for trocars in procedures such as laparoscopic surgeries. The growing burden of these diseases, particularly in aging populations, necessitates advanced surgical tools to support minimally invasive techniques that reduce recovery times and complications.Aging Population

The global rise in the geriatric population significantly contributes to market growth. By 2030, the World Health Organization projects that 1 in 6 people will be over 60 years old, reaching 1.4 billion globally, with numbers expected to climb to 2.1 billion by 2050. Elderly patients, prone to chronic diseases, require frequent surgical interventions, increasing the demand for trocars in procedures like cardiovascular and urological surgeries.Demand for Minimally Invasive and Cosmetic Surgeries

The growing preference for minimally invasive surgeries, which offer reduced recovery times and lower risks, is driving trocar demand. Additionally, the rise in cosmetic surgeries, fueled by aesthetic trends and increasing disposable incomes, further supports market growth. Trocars are essential for procedures like liposuction and other aesthetic interventions, aligning with the global shift toward less invasive techniques.Technological Advancements

Innovations in trocar design, such as single-use trocars and those with integrated visualization systems, are enhancing safety and efficacy. These advancements improve surgical precision, reduce complications, and increase adoption in hospitals and surgical centers. For instance, modern trocars with built-in safety features and real-time imaging capabilities are streamlining procedures, further driving market demand.Market Restraints

The trocar devices market faces challenges due to the high cost of advanced trocar systems, which can limit adoption in cost-sensitive regions or smaller healthcare facilities. The need for skilled surgeons to operate these sophisticated devices also poses a barrier, particularly in developing countries with limited training resources. Additionally, competition from alternative surgical access technologies may impact market growth. Addressing these challenges through cost-effective designs and enhanced training programs will be critical for sustained expansion.Market Segmentation

By Product Type

The market is segmented into disposable and reusable trocars. Disposable trocars dominate due to their reduced risk of cross-contamination and increasing preference in minimally invasive surgeries. Reusable trocars remain relevant in cost-sensitive markets but face declining demand due to infection control concerns.By Application

The market is segmented into general surgery, urological surgery, cardiovascular surgery, cosmetic surgery, and others. Cardiovascular and urological surgeries hold significant shares due to the high prevalence of related conditions, while cosmetic surgery is a fast-growing segment driven by aesthetic trends.By Geography

The market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America dominates, driven by advanced healthcare infrastructure, high chronic disease prevalence, and a growing elderly population. Asia-Pacific is expected to grow rapidly, fueled by increasing healthcare investments and rising demand for minimally invasive procedures in countries like India and China. Europe, South America, and the Middle East and Africa are emerging markets, supported by improving healthcare systems.The trocar devices market is set for robust growth from 2025 to 2030, driven by chronic disease prevalence, an aging population, demand for minimally invasive and cosmetic surgeries, and technological advancements. Despite challenges from high costs and skill requirements, the market's outlook is positive, particularly in North America and Asia-Pacific. Industry players must focus on affordable, innovative trocar designs and training initiatives to capitalize on the growing demand for advanced surgical tools.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Market Segmentation:

By Type

- Optical Trocars

- Bladed Trocars

- Blunt Tips Trocars

- Bladeless Trocars

- Others

By Product Type

- Disposable Trocars

- Reusable Trocars

By Application

- Gynecological Surgery

- Urological Surgery

- Thoracic Surgery

- Laparoscopic Surgery

- Others

By End-User

- Hospitals

- Ambulatory Care Centers

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- France

- Germany

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Australia

- South Korea

- Others

Table of Contents

Companies Mentioned

- Medtronic

- Olympus Corporation

- Johnson & Johnson

- CONMED Corporation

- B. Braun Melsungen AG

- Teleflex Incorporated

- Adroit Manufacturing Co.

- Purple Surgical

- Molnlycke Health Care AB

- The Cooper Companies Inc.

- Hangzhou Boer Medical Instruments Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 987.12 million |

| Forecasted Market Value ( USD | $ 1271.63 million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |