Global Airline Ancillary Services Market - Key Trends and Drivers Summarized

How Have Ancillary Services Revolutionized the Airline Industry?

Airline ancillary services have revolutionized the industry by shifting the focus from traditional revenue streams to a model where additional services significantly contribute to profitability. Ancillary services encompass a wide range of offerings, including checked baggage, seat selection, in-flight meals, priority boarding, and access to airport lounges. This shift allows airlines to maintain competitive base fares while generating extra income through add-ons that cater to diverse passenger needs and preferences. By offering these customizable options, airlines can enhance passenger satisfaction, as travelers can select and pay only for the services they value. This model not only diversifies revenue streams but also provides airlines with greater pricing flexibility and the ability to adapt to fluctuating market demands.What Are the Emerging Trends in Airline Ancillary Services?

The landscape of airline ancillary services is continually evolving, driven by technological advancements and changing consumer behaviors. One of the most notable trends is the rise of bundled and subscription-based services, where passengers can purchase packages that include multiple ancillary options at a discounted rate. Additionally, the integration of mobile apps and online platforms has streamlined the process of booking and managing ancillary services, providing passengers with a seamless and convenient experience. Personalization is another key trend, with airlines leveraging data analytics to tailor ancillary offerings to individual passenger preferences. Innovations such as dynamic pricing, where the cost of services fluctuates based on demand and other factors, are also becoming increasingly prevalent, allowing airlines to maximize revenue opportunities.Why Are Regulations and Customer Feedback Vital in Shaping Ancillary Services?

Regulatory compliance and customer feedback are crucial in the development and implementation of airline ancillary services. Regulatory bodies such as the International Air Transport Association (IATA) and national aviation authorities set guidelines to ensure transparency and fairness in the pricing and provision of these services. Compliance with these regulations helps maintain passenger trust and avoid legal repercussions. Moreover, airlines that actively seek and incorporate customer feedback into their ancillary service offerings can better meet passenger expectations and enhance the overall travel experience. By listening to and addressing customer needs, airlines can refine their ancillary products, improve satisfaction rates, and foster loyalty. Effective communication about the availability and benefits of ancillary services also plays a significant role in encouraging uptake and maximizing their revenue potential.What Factors Are Driving Growth in the Airline Ancillary Services Market?

The growth in the airline ancillary services market is driven by several factors. Firstly, the increasing demand for personalized travel experiences propels the adoption of customizable ancillary options. Passengers now expect to choose and pay for only the services they value, rather than being constrained by a one-size-fits-all model. Secondly, technological advancements, such as mobile platforms and data analytics, enable airlines to offer and manage ancillary services more efficiently and effectively. Thirdly, the competitive landscape of the airline industry drives carriers to differentiate themselves through innovative ancillary offerings. Additionally, the rise of low-cost carriers, which rely heavily on ancillary revenue, has set industry standards for a-la-carte pricing models. Lastly, the impact of fluctuating fuel prices and economic conditions prompts airlines to diversify their revenue streams, making ancillary services a critical component of their financial strategies.Report Scope

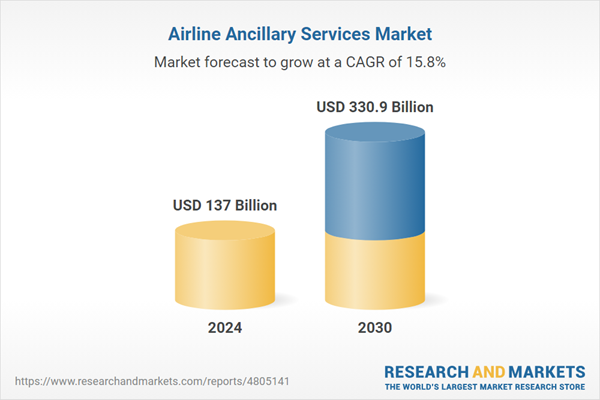

The report analyzes the Airline Ancillary Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (Baggage Fees, On-Board Retail & A La Carte Services, FFP Mile Sales, Airline Retail, Other Service Types); Carrier Type (Full-Service Carriers (FSCs), Low-Cost Carriers (LCCs)).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Baggage Fees segment, which is expected to reach US$181.2 Billion by 2030 with a CAGR of 15.8%. The On-Board Retail & A La Carte Services segment is also set to grow at 17.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.1 Billion in 2024, and China, forecasted to grow at an impressive 19.8% CAGR to reach $44.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Airline Ancillary Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Airline Ancillary Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Airline Ancillary Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alaska Airlines, Inc., American Airlines Group Inc., Delta Air Lines, Inc., KLM Royal Dutch Airlines, Qantas Airways Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 74 companies featured in this Airline Ancillary Services market report include:

- Alaska Airlines, Inc.

- American Airlines Group Inc.

- Delta Air Lines, Inc.

- KLM Royal Dutch Airlines

- Qantas Airways Ltd.

- Southwest Airlines Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alaska Airlines, Inc.

- American Airlines Group Inc.

- Delta Air Lines, Inc.

- KLM Royal Dutch Airlines

- Qantas Airways Ltd.

- Southwest Airlines Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 262 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 137 Billion |

| Forecasted Market Value ( USD | $ 330.9 Billion |

| Compound Annual Growth Rate | 15.8% |

| Regions Covered | Global |