Global Immunofluorescence Assays Market - Key Trends and Drivers Summarized

How Do Immunofluorescence Assays Uncover Cellular Secrets?

Immunofluorescence assays (IFA) are powerful tools that have transformed the way scientists visualize and study cells at the microscopic level. These assays leverage the specificity of antibodies to detect particular proteins, molecules, or pathogens in biological samples. What sets immunofluorescence apart is its use of fluorescent dyes attached to antibodies. When these labeled antibodies bind to their target antigen, they emit light under a fluorescence microscope, enabling researchers to see where the specific proteins are located within the cell. This technique can reveal not just the presence of molecules but also their exact distribution, interactions, and behavior in their native environment, providing invaluable insights into cellular processes.There are two main types of immunofluorescence assays: direct and indirect. In direct immunofluorescence, a fluorescently labeled antibody directly binds to the target antigen. Indirect immunofluorescence, on the other hand, uses a two-step process where a primary antibody binds to the target, and then a secondary fluorescent antibody attaches to the primary antibody, amplifying the signal. This flexibility makes IFAs suitable for a wide range of applications, from basic research in cell biology to diagnostic testing in clinical laboratories. The precision and clarity that these assays provide make them essential for understanding complex biological systems, including signaling pathways, gene expression patterns, and disease mechanisms. With advancements in imaging technologies, immunofluorescence assays continue to play a pivotal role in modern biological and medical research.

Why Are Immunofluorescence Assays Indispensable in Disease Research and Diagnostics?

Immunofluorescence assays have become indispensable tools in both disease research and diagnostics, enabling the detection of pathogens, autoimmune disorders, and cancer markers with extraordinary precision. In pathology, for instance, IFAs are used to identify specific antigens that are indicative of diseases like lupus, celiac disease, and certain cancers. By applying antibodies that bind to these disease-associated antigens, clinicians can visualize their presence in tissue samples, offering an accurate diagnosis. This ability to visually confirm the expression of disease markers in cells is particularly critical in conditions where early diagnosis can drastically improve treatment outcomes.In infectious disease research, IFAs are utilized to detect viruses, bacteria, and parasites in biological samples. During outbreaks of diseases like influenza, Ebola, or COVID-19, these assays can be rapidly deployed to test for the presence of viral antigens in patient samples, making them essential tools in public health surveillance and response. The real-time visualization of how pathogens invade cells and replicate also helps researchers understand disease mechanisms at the molecular level, leading to the development of vaccines and therapeutics. In cancer research, immunofluorescence is used to study the expression of oncogenes and tumor suppressor proteins, providing insights into how cancer develops and progresses. By illuminating these critical cellular processes, IFAs have become fundamental in both diagnosing diseases and advancing our understanding of their underlying biology.

What Are the Cutting-Edge Applications of Immunofluorescence in Modern Research?

As technology advances, immunofluorescence assays are finding new and cutting-edge applications in modern biological and medical research. One of the most exciting developments is the integration of immunofluorescence with high-resolution imaging techniques such as confocal and super-resolution microscopy. These advanced imaging platforms allow for ultra-detailed, three-dimensional reconstructions of cellular structures and protein interactions, which were previously invisible using traditional microscopy methods. This enhanced resolution enables scientists to explore cellular architecture with unprecedented precision, uncovering intricate details about how proteins function in real-time.Moreover, the combination of immunofluorescence with automated imaging systems and artificial intelligence (AI) is revolutionizing the way scientists analyze large datasets. Automated platforms can now screen thousands of samples at a time, significantly speeding up the discovery process in drug development and genetic research. AI-driven image analysis tools also enable researchers to identify patterns and anomalies in vast amounts of data, allowing for more accurate interpretation of complex biological phenomena. Additionally, immunofluorescence is being adapted for multiplexing, where multiple antibodies tagged with different fluorescent dyes are used to detect several proteins simultaneously in a single sample. This capability is particularly valuable in immuno-oncology, where researchers can investigate how multiple immune markers are expressed in a tumor microenvironment. As these innovations continue to evolve, immunofluorescence assays remain at the forefront of cutting-edge biological research, offering limitless possibilities for scientific discovery.

What's Driving the Growth in the Immunofluorescence Assay Market?

The growth in the immunofluorescence assay market is driven by several factors, each contributing to its rising demand and expanded applications in research and diagnostics. First, the increasing incidence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases is pushing the need for more accurate diagnostic tools. Immunofluorescence assays, with their ability to detect disease markers at early stages and provide clear, visual confirmations, are being increasingly adopted in clinical laboratories around the world. The rise of personalized medicine, which requires detailed molecular information about a patient's condition, has also fueled the demand for IFAs, as they offer precise, tailored insights into cellular function and disease mechanisms.Another key driver is the ongoing advancement in imaging technologies. Improvements in fluorescence microscopes, particularly confocal and super-resolution microscopy, have allowed researchers to capture more detailed images than ever before, broadening the scope of immunofluorescence applications. The integration of digital imaging and automated systems has further streamlined the workflow, making it easier and faster for laboratories to perform these assays at scale. Additionally, the increasing availability of fluorescent dyes and antibodies tailored for specific applications has contributed to the market's growth, enabling researchers to conduct more complex and targeted experiments.

The rapid development of biotechnology and pharmaceutical research is another major factor propelling the market. Immunofluorescence assays play a crucial role in drug discovery, helping scientists monitor how potential drug candidates interact with target proteins and pathways in cells. As pharmaceutical companies invest heavily in new therapies, particularly in immuno-oncology and rare genetic diseases, the demand for these assays is expected to surge. Furthermore, the growing adoption of immunofluorescence in academic and government-funded research projects, particularly in fields like neuroscience and developmental biology, continues to drive market expansion. Overall, the market for immunofluorescence assays is poised for substantial growth, fueled by technological innovations and the ever-increasing need for detailed, high-precision cellular analysis in both research and clinical settings.

Report Scope

The report analyzes the Immunofluorescence Assays market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Reagents, Instruments, Kits, Antibodies, Consumables & Accessories); Type (Indirect, Direct); End-Use (Pharma & Biotech Companies, Academic & Research Institutes, Hospitals & Diagnostic Centers, Contract Research Organizations).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Reagents segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of 4.4%. The Instruments segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 4.1% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Immunofluorescence Assays Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Immunofluorescence Assays Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Immunofluorescence Assays Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abcam PLC, Bio-Rad Laboratories, Inc., Cell Signaling Technology, Inc., Danaher Corporation, INOVA Diagnostics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Immunofluorescence Assays market report include:

- Abcam PLC

- Bio-Rad Laboratories, Inc.

- Cell Signaling Technology, Inc.

- Danaher Corporation

- INOVA Diagnostics, Inc.

- Medipan GmbH

- MilliporeSigma

- PerkinElmer, Inc.

- Sino Biological Inc.

- Thermo Fisher Scientific, Inc.

- Vector Laboratories, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abcam PLC

- Bio-Rad Laboratories, Inc.

- Cell Signaling Technology, Inc.

- Danaher Corporation

- INOVA Diagnostics, Inc.

- Medipan GmbH

- MilliporeSigma

- PerkinElmer, Inc.

- Sino Biological Inc.

- Thermo Fisher Scientific, Inc.

- Vector Laboratories, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

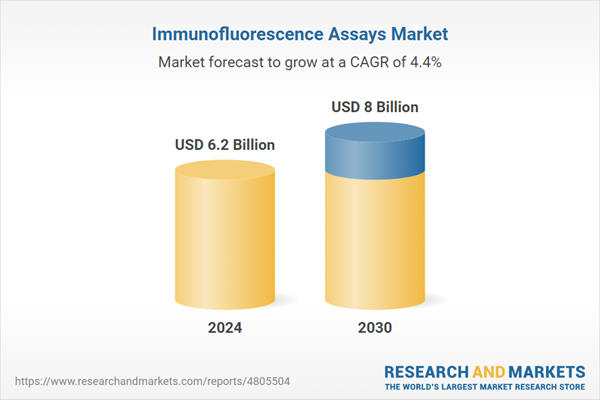

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |