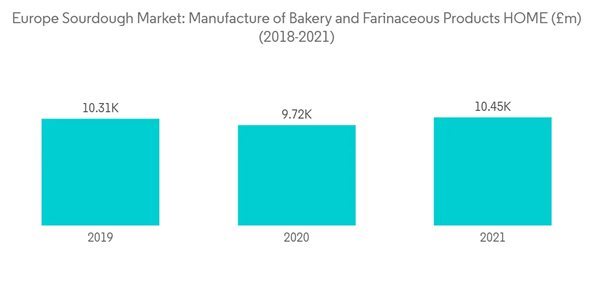

Despite growing at a relatively sluggish pace, baked goods continue to offer growth opportunities for manufacturers and retailers in Europe, thereby driving the sales of the European sourdough market. After the pandemic, people are more aware of their health and nutrition and prefer organic and nutritious products. Due to urbanization and the fast lifestyle in European countries, people prefer their food to be more healthy. These are all the factors that are driving the market studied in a better way.

Moreover, the strong performances of bread and pastries in the European region demonstrate that shoppers are seeking variety to meet their need for different meals and snacks throughout the day. Therefore, European customers are increasingly moving toward new and healthier bakery preparations, leading to an increase in preference for sourdough bread. Sourdough bread is one of the largest market segments in Europe when compared to the rest of the world. Its sales are expected to increase due to its growing popularity in the foodservice sector. There is also an increase in sales in the retail sector in the form of bread, pizza base, and others.

Europe Sourdough Market Trends

Preference for Healthy Food and Beverage Driving the Sourdough Demand in Europe

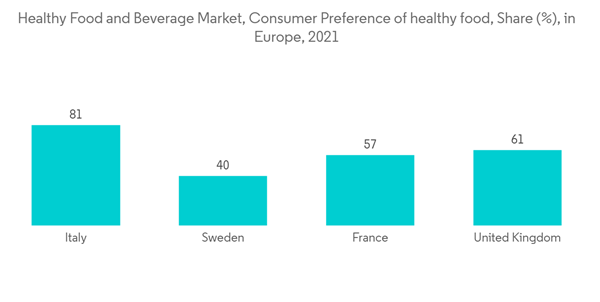

Sourdough has properties of both prebiotics and probiotics. The presence of prebiotics in sourdough makes make it easier to digest than many other pieces of bread, and the presence of probiotic cultures have shown to increase vitamin and mineral absorption. Though probiotics themselves do not survive the baking process in sourdough, the lactic acid bacteria produced during fermentation remain and provide benefits. The presence of lactic acid bacteria in sourdough has also been shown to contain antioxidant benefits, thus safeguarding the body against illness. As a result of the wellness and health trends going on these days, the market players are producing innovative organic ingredients. For example, in 2021, Ernst Bocker GmbH & Co. KG produced two active ingredients, i.e., Bocker organic AvtiVivo Wheat and Bocker organic ActiVivo Rye. These sourdoughs are made to produce good quality baked products.These factors can increase consumption in Europe, as consumers have started to increase the usage of products that are beneficial for their overall health. Moreover, one slice of sourdough has more protein than an egg, making it a perfect protein intake rather than an egg. This supports the growing trend of vegan diets in the European region. Moreover, in February 2021, the European trade association representing the bakery, patisserie, and confectionery ingredients manufacturers launched a campaign to promote sourdough and inform consumers about this fascinating ingredient.

Increasing Application and Use of Sourdough Bread in United Kingdom

Over the past few years, the sales and applications of sourdough bread in Europe have increased, with Britain being one of the largest users of the same. Many companies use sourdough in their production process. Companies form mergers and acquisitions to strengthen their portfolio as well as to produce high-quality baked goods. For instance, in June 2022, Lotus Bakeries acquired Peter's Yard, a British sourdough company that produces healthy and delicious sourdough crackers made only from natural ingredients.With the growing popularity of the age-old breakfast and brunch eating culture among consumers in the country, the market studied is registering growth. Bread made from sourdough is considered the best bread to be eaten for brunches. It is flavorsome with a better texture and retains its structure perfectly when served with classic brunch foods, such as poached eggs, mashed avocado, or roast tomatoes. Considering the development and requirement of sourdough in European countries, the market players are increasing their production according to the market requirement. For instance, in April 2022, International bakery specialist Aryzta doubled its production capacity for sourdough and specialty bread in the United Kingdom and Ireland.

Europe Sourdough Industry Overview

The European sourdough market is a competitive market, with players such as Bread Bread Bakery Ltd, Riverside Sourdough, Real Bread, and Food Company. The majority of companies operating in the market are small-scale companies that offer products for sale in local retail stores or to be applied by the cafes and restaurant owners in the food-making process in Europe. Product innovation and differentiation were some of the most employed strategies by key players to gain a competitive edge in the industry.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BREAD BREAD BAKERY LTD

- Riverside Sourdough

- Real Bread and Food Company

- The Bread Factory Limited

- Portland French Bakery

- Ernst Bocker GmbH & Co. KG

- IREKS GmbH

- Puratos Group

- Aryzta

- Lotus Bakeries