7 Pest Control Market, by Application

7.1 Introduction

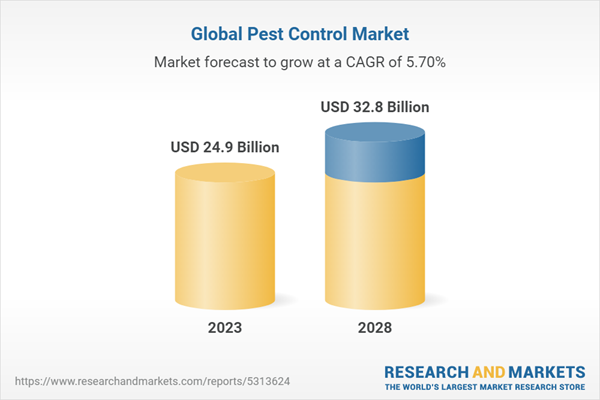

Figure 33 Pest Control Market, by Application, 2023 Vs. 2028 (USD Million)

Table 14 Pest Control Market, by Application, 2018-2022 (USD Million)

Table 15 Pest Control Market, by Application, 2023-2028 (USD Million)

7.2 Commercial

7.2.1 Strong Government Regulations and Hygiene Requirements to Drive Market

Table 16 Commercial: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 17 Commercial: Pest Control Market, by Region, 2023-2028 (USD Million)

7.3 Residential

7.3.1 Rising Consumer Awareness and Urban Lifestyle to Propel Market

Table 18 Residential: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 19 Residential: Pest Control Market, by Region, 2023-2028 (USD Million)

7.4 Livestock

7.4.1 Need for Precautionary Measures to Prevent Diseases to Strengthen Market

Table 20 Livestock: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 21 Livestock: Pest Control Market, by Region, 2023-2028 (USD Million)

7.5 Industrial

7.5.1 Adoption of Regional Laws Pertaining to Hygienic Work Environment to Drive Market Expansion

Table 22 Industrial: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 23 Industrial: Pest Control Market, by Region, 2023-2028 (USD Million)

7.6 Other Applications

Table 24 Other Applications: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 25 Other Applications: Pest Control Market, by Region, 2023-2028 (USD Million)

8 Pest Control Market, by Mode of Application

8.1 Introduction

Figure 34 Pest Control Market Share, by Mode of Application, 2023 Vs. 2028 (Value)

Table 26 Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 27 Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 28 Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 29 Pest Control Market, by Mode of Application, 2023-2028 (Tons)

8.2 Powder

8.2.1 Increased Demand for Powder Applications to Drive Market

Table 30 Powder: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 31 Powder: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 32 Powder: Pest Control Market, by Region, 2018-2022 (Tons)

Table 33 Powder: Pest Control Market, by Region, 2023-2028 (Tons)

8.3 Sprays

8.3.1 High Demand for Liquid Formulations to Propel Demand for Spray Applications

Table 34 Sprays: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 35 Sprays: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 36 Sprays: Pest Control Market, by Region, 2018-2022 (Tons)

Table 37 Sprays: Pest Control Market, by Region, 2023-2028 (Tons)

8.4 Pellets

8.4.1 Increasing Use of Pellets in Urban Areas for Wildlife Control to Boost Market

Table 38 Pellets: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 39 Pellets: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 40 Pellets: Pest Control Market, by Region, 2018-2022 (Tons)

Table 41 Pellets: Pest Control Market, by Region, 2023-2028 (Tons)

8.5 Traps

8.5.1 Need for Innovative Tools to Improve Agriculture to Drive Market

Table 42 Traps: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 43 Traps: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 44 Traps: Pest Control Market, by Region, 2018-2022 (Tons)

Table 45 Traps: Pest Control Market, by Region, 2023-2028 (Tons)

8.6 Baits

8.6.1 Increasing Presence of Rodents and Termites Control to Drive Demand for Baits

Table 46 Baits: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 47 Baits: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 48 Baits: Pest Control Market, by Region, 2018-2022 (Tons)

Table 49 Baits: Pest Control Market, by Region, 2023-2028 (Tons)

9 Pest Control Market, by Pest Type

9.1 Introduction

Figure 35 Pest Control Market, by Pest Type, 2023 Vs. 2028 (USD Million)

Table 50 Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 51 Pest Control Market, by Pest Type, 2023-2028 (USD Million)

9.2 Insects

9.2.1 Climate Change and Increased Urbanization to Bolster Growth

Table 52 Insects: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 53 Insects: Pest Control Market, by Region, 2023-2028 (USD Million)

9.3 Rodents

9.3.1 Lack of Hygiene and Waste Management Issues to Increase Rodent Population in Urban Areas

Table 54 Rodents: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 55 Rodents: Pest Control Market, by Region, 2023-2028 (USD Million)

9.4 Termites

9.4.1 Adoption of New Technologies to Bolster Growth in Termite Control Solutions

Table 56 Termites: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 57 Termites: Pest Control Market, by Region, 2023-2028 (USD Million)

9.5 Wildlife

9.5.1 Increased Suburban Activity and Wildlife Habitat Destruction to Lead to Increased Demand for Wildlife Pest Control

Table 58 Wildlife: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 59 Wildlife: Pest Control Market, by Region, 2023-2028 (USD Million)

9.6 Other Pest Types

Table 60 Other Pest Types: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 61 Other Pest Types: Pest Control Market, by Region, 2023-2028 (USD Million)

10 Pest Control Market, by Control Method

10.1 Introduction

Figure 36 Pest Control Market, by Control Method, 2023 Vs. 2028 (USD Million)

Table 62 Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 63 Pest Control Market, by Control Method, 2023-2028 (USD Million)

10.2 Chemical

10.2.1 Increasing Pest-Causing Diseases to Drive Demand for Chemical Control Methods

Table 64 Chemical: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 65 Chemical: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 66 Chemical: Pest Control Market, by Type, 2018-2022 (USD Million)

Table 67 Chemical: Pest Control Market, by Type, 2023-2028 (USD Million)

10.2.2 Insecticides

10.2.3 Rodenticides

Table 68 Acute Toxicity Classification - Rodenticides

10.2.4 Other Chemicals

10.3 Mechanical

10.3.1 Demand for Advanced Mechanical Control Methods to Prevent Pest-Causing Diseases to Spur Market

Table 69 Mechanical: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 70 Mechanical: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 71 Mechanical: Pest Control Market, by Type, 2018-2022 (USD Million)

Table 72 Mechanical: Pest Control Market, by Type, 2023-2028 (USD Million)

10.3.2 Trapping

Table 73 Trapping Market, by Type, 2018-2022 (USD Million)

Table 74 Trapping Market, by Type, 2023-2028 (USD Million)

10.3.2.1 Light Traps

10.3.2.2 Adhesive Traps

10.3.2.3 Malaise Traps

10.3.3 Mesh Screens

10.3.4 Ultrasonic Vibrations

10.4 Biological

10.4.1 Need for Biological Control Methods to Prevent Pest-Causing Diseases to Drive Market

Table 75 Biological: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 76 Biological: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 77 Biological: Pest Control Market, by Type, 2018-2022 (USD Million)

Table 78 Biological: Pest Control Market, by Type, 2023-2028 (USD Million)

10.4.2 Microbials

10.4.3 Plant Extracts

10.4.4 Predatory Insects

10.5 Software & Services

10.5.1 Increasing Technological Advancements in Software & Services to Drive Growth

Table 79 Software & Service: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 80 Software & Service: Pest Control Market, by Region, 2023-2028 (USD Million)

11 Pest Control Market, by Region

11.1 Introduction

Table 81 Pest Control Market, by Region, 2018-2022 (USD Million)

Table 82 Pest Control Market, by Region, 2023-2028 (USD Million)

11.2 North America

Figure 37 North America: Market Snapshot

11.2.1 North America: Recession Impact Analysis

Figure 38 Inflation: Country-Level Data (2017-2021)

Figure 39 North American Pest Control Market: Recession Impact Analysis

Table 83 North America: Pest Control Market, by Country, 2018-2022 (USD Million)

Table 84 North America: Pest Control Market, by Country, 2023-2028 (USD Million)

Table 85 North America: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 86 North America: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 87 North America: Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 88 North America: Pest Control Market, by Control Method, 2023-2028 (USD Million)

Table 89 North America: Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 90 North America: Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 91 North America: Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 92 North America: Pest Control Market, by Mode of Application, 2023-2028 (Tons)

Table 93 North America: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 94 North America: Pest Control Market, by Application, 2023-2028 (USD Million)

11.2.1.1 Us

11.2.1.1.1 Presence of Strong Service Providers and Pesticide Suppliers in the US to Drive Market

Table 95 Top 5 Cities with Change in Number of Disease Danger Days Since 1970

Table 96 Us: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 97 Us: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 98 Us: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 99 Us: Pest Control Market, by Application, 2023-2028 (USD Million)

11.2.1.2 Canada

11.2.1.2.1 Increasing Demand for Rodent and Wildlife Control Methods to Contribute to Market Growth

Table 100 Canada: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 101 Canada: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 102 Canada: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 103 Canada: Pest Control Market, by Application, 2023-2028 (USD Million)

11.2.1.3 Mexico

11.2.1.3.1 Rising Temperatures and Urbanization to Drive Growth

Table 104 Mexico: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 105 Mexico: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 106 Mexico: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 107 Mexico: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3 Europe

11.3.1 Europe: Recession Impact Analysis

Figure 40 Inflation: Country-Level Data (2017-2021)

Figure 41 European Pest Control Market: Recession Impact Analysis

Table 108 Europe: Pest Control Market, by Country, 2018-2022 (USD Million)

Table 109 Europe: Pest Control Market, by Country, 2023-2028 (USD Million)

Table 110 Europe: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 111 Europe: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 112 Europe: Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 113 Europe: Pest Control Market, by Control Method, 2023-2028 (USD Million)

Table 114 Europe: Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 115 Europe: Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 116 Europe: Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 117 Europe: Pest Control Market, by Mode of Application, 2023-2028 (Tons)

Table 118 Europe: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 119 Europe: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.1 Germany

11.3.1.1.1 Focus on Strong Government Initiatives to Control Pest Infestation to Drive Market

Table 120 Germany: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 121 Germany: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 122 Germany: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 123 Germany: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.2 France

11.3.1.2.1 Taking Initiatives to Combat Rodent Infestations to Bolster Growth

Table 124 France: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 125 France: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 126 France: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 127 France: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.3 Uk

11.3.1.3.1 Increasing Hygiene Standards and Growing Health Consciousness Among Consumers to Propel Market

Table 128 UK: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 129 UK: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 130 UK: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 131 UK: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.4 Spain

11.3.1.4.1 Increasing Insect Population due to Temperature Rise in Spain to Foster Growth

Table 132 Spain: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 133 Spain: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 134 Spain: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 135 Spain: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.5 Italy

11.3.1.5.1 Growing Construction to Minimize Pest Entry to Boost Market

Table 136 Italy: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 137 Italy: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 138 Italy: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 139 Italy: Pest Control Market, by Application, 2023-2028 (USD Million)

11.3.1.6 Rest of Europe

Table 140 Rest of Europe: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 141 Rest of Europe: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 142 Rest of Europe: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 143 Rest of Europe: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Recession Impact Analysis

Figure 42 Inflation: Country-Level Data (2017-2021)

Figure 43 Asia-Pacific Pest Control Market: Recession Impact Analysis, 2022

Table 144 Asia-Pacific: Pest Control Market, by Country, 2018-2022 (USD Million)

Table 145 Asia-Pacific: Pest Control Market, by Country, 2023-2028 (USD Million)

Table 146 Asia-Pacific: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 147 Asia-Pacific: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 148 Asia-Pacific: Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 149 Asia-Pacific: Pest Control Market, by Control Method, 2023-2028 (USD Million)

Table 150 Asia-Pacific: Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 151 Asia-Pacific: Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 152 Asia-Pacific: Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 153 Asia-Pacific: Pest Control Market, by Mode of Application, 2023-2028 (Tons)

Table 154 Asia-Pacific: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 155 Asia-Pacific: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4.1.1 China

11.4.1.1.1 Need for Infrastructure Development and Urbanization to Bolster Growth

Table 156 China: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 157 China: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 158 China: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 159 China: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4.1.2 India

11.4.1.2.1 Focus on Increasing Disease Outbreaks and Strong Government Policies to Drive Market

Table 160 India: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 161 India: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 162 India: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 163 India: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4.1.3 Australia

11.4.1.3.1 Growing Invasive Species and Delicate Ecosystems to Strengthen Market

Table 164 Australia: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 165 Australia: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 166 Australia: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 167 Australia: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4.1.4 Japan

11.4.1.4.1 Increased Habitat Destruction and Urban Activities to Boost Growth

Table 168 Japan: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 169 Japan: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 170 Japan: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 171 Japan: Pest Control Market, by Application, 2023-2028 (USD Million)

11.4.1.5 Rest of Asia-Pacific

Table 172 Rest of Asia-Pacific: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 173 Rest of Asia-Pacific: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 174 Rest of Asia-Pacific: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 175 Rest of Asia-Pacific: Pest Control Market, by Application, 2023-2028 (USD Million)

11.5 South America

11.5.1 South America: Recession Impact Analysis

Figure 44 Inflation: Country-Level Data (2017-2021)

Figure 45 South American Pest Control Market: Recession Impact Analysis

Table 176 South America: Pest Control Market, by Country, 2018-2022 (USD Million)

Table 177 South America: Pest Control Market, by Country, 2023-2028 (USD Million)

Table 178 South America: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 179 South America: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 180 South America: Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 181 South America: Pest Control Market, by Control Method, 2023-2028 (USD Million)

Table 182 South America: Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 183 South America: Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 184 South America: Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 185 South America: Pest Control Market, by Mode of Application, 2023-2028 (Tons)

Table 186 South America: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 187 South America: Pest Control Market, by Application, 2023-2028 (USD Million)

11.5.1.1 Brazil

11.5.1.1.1 High Rates of Urbanization and Habitat Destruction to Foster Market Growth

Table 188 Brazil: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 189 Brazil: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 190 Brazil: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 191 Brazil: Pest Control Market, by Application, 2023-2028 (USD Million)

11.5.1.2 Argentina

11.5.1.2.1 Rising Disease Outbreaks and Rodent Population to Foster Growth

Table 192 Argentina: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 193 Argentina: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 194 Argentina: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 195 Argentina: Pest Control Market, by Application, 2023-2028 (USD Million)

11.5.1.3 Rest of South America

Table 196 Rest of South America: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 197 Rest of South America: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 198 Rest of South America: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 199 Rest of South America: Pest Control Market, by Application, 2023-2028 (USD Million)

11.6 Rest of the World (Row)

11.6.1 Row: Recession Impact Analysis

Figure 46 Inflation: Country-Level Data (2017-2021)

Figure 47 Pest Control Market: Recession Impact Analysis

Table 200 Row: Pest Control Market, by Region, 2018-2022 (USD Million)

Table 201 Row: Pest Control Market, by Region, 2023-2028 (USD Million)

Table 202 Row: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 203 Row: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 204 Row: Pest Control Market, by Control Method, 2018-2022 (USD Million)

Table 205 Row: Pest Control Market, by Control Method, 2023-2028 (USD Million)

Table 206 Row: Pest Control Market, by Mode of Application, 2018-2022 (USD Million)

Table 207 Row: Pest Control Market, by Mode of Application, 2023-2028 (USD Million)

Table 208 Row: Pest Control Market, by Mode of Application, 2018-2022 (Tons)

Table 209 Row: Pest Control Market, by Mode of Application, 2023-2028 (Tons)

Table 210 Row: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 211 Row: Pest Control Market, by Application, 2023-2028 (USD Million)

11.6.1.1 Middle East

11.6.1.1.1 Focus on Government Initiatives and Outreach Programs to Control Pest Infestation to Drive Growth

Table 212 Middle East: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 213 Middle East: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 214 Middle East: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 215 Middle East: Pest Control Market, by Application, 2023-2028 (USD Million)

11.6.1.2 Africa

11.6.1.2.1 Growing Locusts Attacks and Associated Losses to Drive Market

Table 216 Africa: Pest Control Market, by Pest Type, 2018-2022 (USD Million)

Table 217 Africa: Pest Control Market, by Pest Type, 2023-2028 (USD Million)

Table 218 Africa: Pest Control Market, by Application, 2018-2022 (USD Million)

Table 219 Africa: Pest Control Market, by Application, 2023-2028 (USD Million)