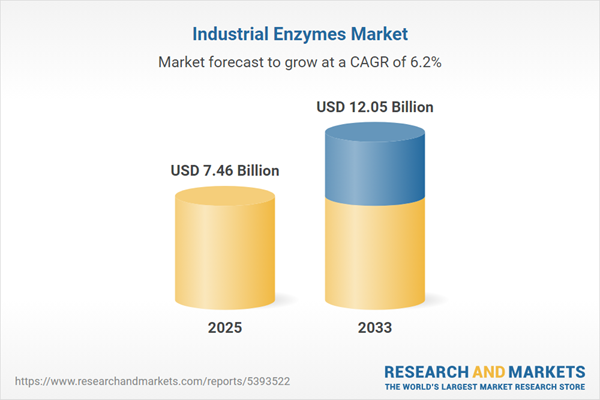

The Industrial Enzymes Industry plays a crucial role across various sectors, including food and beverages, biofuels, pharmaceuticals, textiles, and detergents. These biological catalysts enhance process efficiency, reduce energy consumption, and promote environmentally sustainable manufacturing. The industry is witnessing significant growth driven by rising demand for eco-friendly and cost-effective production methods. Enzymes such as amylases, proteases, lipases, and cellulases are widely used for their ability to improve product quality and optimize industrial operations. Technological advancements in enzyme engineering and biotechnology have further expanded their applications, enabling tailored solutions for specific industrial needs. Additionally, increasing awareness about sustainability and the shift toward green chemistry are accelerating adoption. With continuous innovation and expanding end-user industries, the industrial enzymes market is poised for strong, long-term growth globally.

List of Leading Companies in the Industrial Enzymes Market

BASF SE

Establishment: 1865Headquarters: Germany

Revenue: $70.6B in 2023

The chemical corporation is called BASF SE (BASF). Chemicals, plastics, crop protection goods, and performance items are all produced, marketed, and sold there. Solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, food additives, fungicides, and herbicides are all part of its product portfolio. Construction, furniture and wood, agriculture, electronics and electrical, paints and coatings, automobiles, home care, nutrition, and chemicals are just a few of the sectors that the firm supports. BASF conducts research and development in collaboration with scientists, partners, and customers worldwide. The business uses a global network of manufacturing sites to do business. It is found in the Middle East, Africa, South America, Asia Pacific, Europe, and North America. The headquarters of BASF are located in Ludwigshafen, Germany.

Becton Dickinson and Company

Establishment: 1897Headquarters: United States of America

Revenue: $20.2B in 2023

Becton Dickinson and Co. (BD) is one company that produces medical technology. It manufactures and markets medical devices, supplies, lab equipment, and diagnostic tools. The company's product lines include vascular and urological devices, surgical instruments, molecular diagnostic systems, infusion pumps, pre-fillable drug delivery systems, hemodynamic monitoring equipment, and cell analysis solutions. BD's products are used by healthcare facilities, physicians, life science researchers, clinical laboratories, the pharmaceutical sector, and the general public. The company has production sites in Bosnia and Herzegovina, Brazil, Canada, the United States, France, Germany, Hungary, India, Japan, Mexico, and other countries. BD's headquarters are located in Franklin Lakes, New Jersey, in the United States.

Cardinal Health

Establishment: 1971Headquarters: United States of America

Revenue: $226.8B in 2023

Cardinal Health Inc. (Cardinal Health) provides integrated healthcare products and services. The company's main activities include the distribution of pharmaceuticals, the production and distribution of laboratory and medical products, and performance and data solutions for healthcare facilities. The company distributes laboratory supplies, over-the-counter consumer and healthcare products, medical equipment, surgical gadgets, and specialty drugs. It also operates nuclear pharmacies, cyclotron facilities, and its own line of privately branded medical and surgical goods. Its four areas of expertise are logistics, product, business, and patient solutions. Its clientele includes hospitals, ambulatory care centers, physician offices, clinical labs, alternative care providers, mail order clients, and retail clients, including independent and chain pharmacies, pharmacy outlets in supermarkets, and mass merchandisers. Additionally, the company provides affordable solutions with an efficient supply chain. China, Japan, Europe, Australia, Canada, and the US are among the countries where the company operates. Cardinal Health's headquarters are located in Dublin, Ohio, in the United States.

Teleflex Incorporated

Establishment: 1943Headquarters: United States of America

Revenue: $3.0B in 2023

Medical equipment is produced by Teleflex Inc. (Teleflex). It primarily designs, manufactures, and sells single-use medical equipment for use in critical care and surgery. Among its primary products are respiratory care items, anesthetic supplies, vascular access devices, and interventional catheters. The company also offers custom orders, partial shipments, clinical support services, technical support, and product maintenance. Teleflex sells its products to hospitals, healthcare providers, distributors, and original equipment manufacturers under a variety of names, such as Arrow, Deknatel, LMA, Pilling, QuikClot, Rusch, UroLift, and Weck. The company markets and sells its products through direct sales and distributors. It operates manufacturing facilities in the Czech Republic, Malaysia, Mexico, and the United States. Teleflex's headquarters are located in Wayne, Pennsylvania, in the United States.

Edwards Lifesciences Corporation

Establishment: 1958Headquarters: United States of America

Revenue: $5.4B in 2023

Edwards Lifesciences Corp. (Edwards Lifesciences) is a medical technology company that develops, produces, and markets devices for postoperative monitoring, critical care, and structural heart disease. The company offers transcatheter cardiac valves, hemodynamic monitoring devices, surgical valve replacement and repair devices, pressure monitoring devices, and related instruments and accessories. Its products are used in a variety of therapies, including transcatheter aortic valve replacement (TAVR), blood conservation, infection control, better postoperative recovery, and the treatment of clotting, hypotension, and sepsis. The company advertises its products directly to customers and has a network of independent distributors in North America, Europe, and Asia-Pacific. Irvine, California is home to Edwards Lifesciences' US headquarters.

SWOT Analysis of Industrial Enzymes Market

Medtronic Plc. Strength Analysis

Strong Product Portfolio and Global Market Leadership

Medtronic Plc.’s key strength lies in its extensive and diversified product portfolio, covering cardiovascular, diabetes management, surgical, and neurological solutions. As one of the world’s largest medical technology companies, Medtronic leverages its strong research and development capabilities to deliver innovative, high-quality devices that improve patient outcomes and healthcare efficiency. Its products, such as pacemakers, insulin pumps, and spinal implants, are trusted globally, strengthening its brand reputation and market presence. The company’s robust global distribution network and long-standing relationships with healthcare providers enhance accessibility across more than 150 countries. Moreover, continuous investment in technological advancements, including minimally invasive surgery and connected health devices, positions Medtronic as a leader in driving innovation and shaping the future of healthcare delivery.Medtronic Plc. Opportunity Analysis

Growth in Digital Health and Emerging Markets

Medtronic Plc. has a strong opportunity to expand through the growing adoption of digital health technologies and the increasing demand for advanced medical devices in emerging markets. The integration of artificial intelligence, remote monitoring, and data-driven healthcare solutions allows the company to improve patient engagement and optimize treatment outcomes. Rising healthcare expenditure and infrastructure development in regions such as Asia-Pacific, Latin America, and the Middle East present significant expansion prospects. By strengthening collaborations with hospitals, governments, and digital health providers, Medtronic can broaden its reach and introduce innovative, cost-effective solutions tailored to local needs. Additionally, leveraging telehealth and connected care platforms can enhance its competitive edge and drive sustainable growth in the evolving global healthcare landscape.Stryker Corporation Strength Analysis

Diverse Product Portfolio and Technological Innovation

Stryker Corporation’s major strength lies in its comprehensive and diversified product portfolio, which spans orthopedics, medical and surgical equipment, neurotechnology, and spine solutions. This diversity enables the company to serve multiple healthcare needs while minimizing risks associated with dependence on a single product line. Stryker’s consistent investment in research and development has driven innovations such as robotic-assisted surgery systems, advanced implants, and smart operating room technologies. These advancements enhance surgical precision, improve patient outcomes, and boost hospital efficiency. Additionally, the company’s strong brand reputation, strategic acquisitions, and extensive global distribution network solidify its leadership in the medical technology sector. By combining innovation with customer-focused solutions, Stryker continues to strengthen its position as a trusted partner in modern healthcare delivery.Stryker Corporation Opportunity Analysis

Expansion in Emerging Markets and Digital Health Technologies

Stryker Corporation has significant opportunities for growth through expansion in emerging markets and the integration of digital health technologies. Rapid healthcare infrastructure development and increasing demand for advanced surgical procedures in regions such as Asia-Pacific, Latin America, and the Middle East present promising growth avenues. The company can capitalize on these opportunities by expanding distribution networks, establishing local manufacturing units, and forming partnerships with regional healthcare providers. Moreover, the rise of digital transformation in healthcare - through telemedicine, AI-driven diagnostics, and robotic-assisted surgeries - offers Stryker a platform to strengthen its innovation leadership. By combining its expertise in medical devices with connected digital ecosystems, Stryker can enhance operational efficiency, improve patient care, and create sustainable long-term value in a rapidly evolving global market.Smith & Nephew Strength Analysis

Strong Product Portfolio and Global Brand Recognition

Smith & Nephew’s key strength lies in its extensive product portfolio spanning advanced wound management, orthopedics, and sports medicine. The company’s innovative solutions, such as wound care dressings, joint reconstruction systems, and arthroscopy technologies, enable it to address a wide range of clinical needs. Its continuous investment in research and development drives the creation of technologically advanced and high-quality products that improve surgical precision and patient recovery. Smith & Nephew’s strong global presence across more than 100 countries and long-standing relationships with healthcare providers further reinforce its market leadership. Additionally, its focus on sustainability, quality, and clinical effectiveness enhances brand trust, allowing the company to maintain a solid reputation as a reliable partner in the global medical technology landscape.Smith & Nephew Opportunity Analysis

Growth in Robotics and Digitally Assisted Surgery Solutions

Smith & Nephew has a strong opportunity to expand its presence in the rapidly evolving field of robotics and digitally assisted surgery. With healthcare providers increasingly adopting advanced technologies to improve precision and patient outcomes, the company can leverage its R&D expertise to develop innovative, minimally invasive surgical systems. Its investments in robotic-assisted platforms, such as the CORI Surgical System, position it well to capture growing demand for efficient and data-driven surgical solutions. Moreover, integrating artificial intelligence, data analytics, and remote surgical support can enhance procedural accuracy and workflow efficiency. Expanding these digital capabilities globally, particularly in emerging markets, will not only strengthen Smith & Nephew’s competitive edge but also establish it as a leader in next-generation medical technology innovation.Sustainability Analysis of Johnson & Johnson

Johnson & Johnson (J&J) has established a strong commitment to sustainability through its comprehensive environmental, social, and governance (ESG) initiatives. The company’s sustainability strategy focuses on improving global health outcomes, reducing environmental impact, and fostering ethical business practices. J&J’s “Health for Humanity” goals emphasize sustainable product innovation, responsible sourcing, and expanding access to healthcare worldwide. Environmentally, the company aims for carbon neutrality across its operations by 2030, supported by investments in renewable energy, sustainable packaging, and waste reduction. Socially, J&J prioritizes workplace diversity, community health programs, and patient safety. Its governance framework ensures transparency, ethical compliance, and accountability across all operations. By integrating sustainability into its business model, Johnson & Johnson continues to strengthen stakeholder trust while driving long-term value creation and contributing to global environmental and public health objectives.Recent Developments of Industrial Enzymes Market

- The AB Enzymes and APC Group, one of Asia's top suppliers of specialty chemicals, established a strategic alliance in August 2024. In keeping with their mutual commitment to sustainability and environmentally friendly industrial practices in the region, APC Group will have exclusive distribution rights for AB Enzymes' pulp and paper solutions in China, India, Southeast Asia, and the Middle East.

- Novozymes declared in January 2023 that it will invest in Lyras' microbial control technology in order to achieve ""less downtime, more efficiency & cost savings.""

Industrial Enzymes Market & Forecast

- Historical Trends

- Forecast Analysis

Market Share Analysis - Industrial Enzymes

Company Analysis -BASF SE

Overview

- Company History and Mission

- Business Model and Operations

- Workforce

Key Persons

- Executive Leadership

- Operational Management

- Division Leaders

- Board Composition

Recent Development & Strategies

- Mergers & Acquisitions

- Partnerships

- Investments

Sustainability Analysis

- Renewable Energy Adoption

- Energy-Efficient Infrastructure

- Use of Sustainable Packaging Materials

- Water Usage and Conservation Strategies

- Waste Management and Circular Economy Initiatives

Product Analysis

- Product Profile

- Quality Standards

- Product Pipeline

- Product Benchmarking

Strategic Assessment: SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Revenue Analysis

The above information will be available for all the following companies:

- Becton Dickinson and Company

- Cardinal Health

- Teleflex Incorporated

- Medtronic Plc.

- Johnson and Johnson

- Edwards Lifesciences Corporation

- Stryker Corporation

- Smith & Nephew

- Boston Scientific

- B. Braun Melsungen AG

- Terumo Corporation

- MicroPort Scientific Corporation

- Biosensors International

- Biotronik SE & Co. KG

- Coloplast

- Merit Medical Systems, Inc.

- Hexacath

- OrbusNeich

- Nipro Medical Corporation

Table of Contents

Companies Mentioned

- Becton Dickinson and Company

- Cardinal Health

- Teleflex Incorporated

- Medtronic Plc.

- Johnson and Johnson

- Edwards Lifesciences Corporation

- Stryker Corporation

- Smith & Nephew

- Boston Scientific

- B. Braun Melsungen AG

- Terumo Corporation

- MicroPort Scientific Corporation

- Biosensors International

- Biotronik SE & Co. KG

- Coloplast

- Merit Medical Systems, Inc.

- Hexacath

- OrbusNeich

- Nipro Medical Corporation

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | December 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 7.46 Billion |

| Forecasted Market Value ( USD | $ 12.05 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |