Key Players are Arnold Clark Automobiles, Lookers, Pendragon, and Emil Frey Group

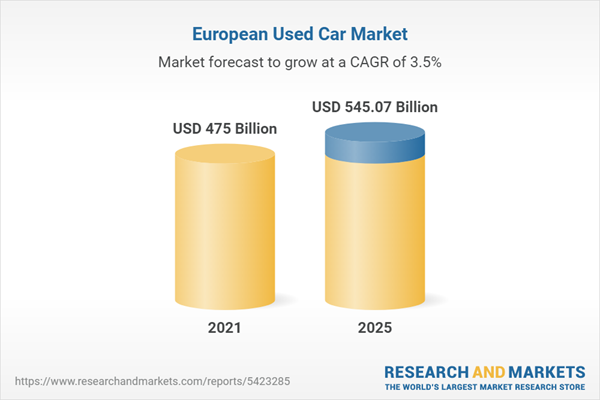

The European used car market is projected to rise in the next four years i.e. 2021-2025 tremendously.

The used car market is expected to increase due to rising disposable income, increase in urban population, rising online sales of used cars, growing total population, growing benefits of used car over new car, etc. Yet the market faces some challenges such as economic slowdown, difficulty in financing of used car, lack of standardization and unorganized regulations, etc.

The European used car market is fragmented and controlled by franchised and non-franchised legacy car dealers. The key players of the European used car market are Arnold Clark Automobiles limited, Lookers PLC, Pendragon PLC and Emil Frey Group are also profiled with their financial information and respective business strategies.

Report Scope

This report provides an in depth analysis of the European used car market by value, by volume, by sales channel, by sourcing type, by type, by car age, by region, etc. The report provides a regional analysis of the used car market, including the following regions: France, Spain, UK, Germany, Italy, Belgium and Rest of Europe. The report also provides a detailed analysis of the COVID-19 impact on the European used car market.

The report also assesses the key opportunities in the market and outlines the factors that are and will be driving the growth of the industry. Growth of the overall European used car market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

Country Coverage

- France

- Spain

- UK

- Germany

- Italy

- Belgium

Company Coverage

- Arnold Clark Automobiles Limited

- Lookers PLC

- Pendragon PLC

- Emil Frey Group

Table of Contents

1. Executive Summary

2. Introduction

2.1 Used Car: An Overview

2.1.1 Factors to Consider Before Buying a Used Car

2.1.2 Benefits of Used Car

2.2 Used Car Segmentation: An Overview

2.2.1 Used Car Segmentation by Type

2.2.2 Used Car Segmentation by Sales Channel

2.2.3 Used Car Segmentation by Car Age

2.2.4 Used Car Segmentation by Sourcing Type

2.3 Online Used Car: An Overview

2.3.1 Factors to Consider Before Buying a Online Used Car

2.3.2 Benefits of Buying Used Cars Online

3. European Market Analysis

3.1 European Used Car Market: An Analysis

3.1.1 European Used Car Market By Value

3.1.2 European Used Car Market By Sourcing Type (Business-to-Customer or B2C and Customer-to-Customer or C2C)

3.1.3 European Used Car Market By Sales Channel (Online and Offline)

3.2 European Used Car Market: Sales Channel Analysis

3.2.1 European Offline Used Car Market by Value

3.2.2 European Online Used Car Market by Value

3.3 European Younger Used Car Market: An Analysis

3.3.1 European Younger Used Car Market by Value

3.3.2 European Younger Used Car Market by Volume

3.3.3 European Younger Used Car Market By Type (Pre-Owned and Pre-Registered)

3.3.4 European Younger Used Car Market By Region (United Kingdom (UK), Germany, France, Italy, Spain, Belgium, and Rest of Europe)

3.3.5 European Younger Used Car Market Volume By Sales Channel (Offline and Online)

3.3.6 European Younger Used Car Market Volume by Sourcing Type (Business-to-Customer or B2C and Customer-to-Customer or C2C)

3.4 European Younger Used Car Market: Type Analysis

3.4.1 European Pre-Owned Younger Used Car Market By Value

3.4.2 European Pre-Registered Younger Used Car Market By Value

3.5 European Younger Used Car Market: Sales Channel Analysis

3.5.1 European Online Younger Used Car Market By Volume

3.5.2 European Offline Younger Used Car Market By Volume

4. European Regional Market Analysis

4.1 France Younger Used Car Market: An Analysis

4.1.1 France Younger Used Car Market by Value

4.1.2 France Younger Used Car Market by Type (Pre-Owned and Pre-Registered)

4.1.3 France Pre-Owned Younger Used Car Market By Value

4.1.4 France Pre-Registered Younger Used Car Market By Value

4.1.5 France Younger Used Car Market By Sales Channel (Offline and Online)

4.1.6 France Offline Younger Used Car Market By Value

4.1.7 France Online Younger Used Car Market By Value

4.2 Spain Younger Used Car Market: An Analysis

4.2.1 Spain Younger Used Car Market by Value

4.2.2 Spain Younger Used Car Market By Type (Pre-Owned and Pre-Registered)

4.2.3 Spain Pre-Owned Younger Used Car Market By Value

4.2.4 Spain Pre-Registered Younger Used Car Market By Value

4.2.5 Spain Younger Used Car Market By Sales Channel (Offline and Online)

4.2.6 Spain Offline Younger Used Car Market By Value

4.2.7 Spain Online Younger Used Car Market By Value

4.3 UK Younger Used Car Market: An Analysis

4.3.1 UK Younger Used Car Market by Value

4.3.2 UK Younger Used Car Market By Type (Pre-Owned and Pre-Registered)

4.3.3 UK Pre-Owned Younger Used Car Market By Value

4.3.4 UK Pre-Registered Younger Used Car Market By Value

4.3.5 UK Younger Used Car Market By Sales Channel (Offline and Online)

4.3.6 UK Offline Younger Used Car Market By Value

4.3.7 UK Online Younger Used Car Market By Value

4.4 Germany Younger Used Car Market: An Analysis

4.4.1 Germany Younger Used Car Market by Value

4.4.2 Germany Younger Used Car Market by Type (Pre-Owned and Pre-Registered)

4.4.3 Germany Pre-Owned Younger Used Car Market by Value

4.4.4 Germany Pre-Registered Younger Used Car Market by Value

4.4.5 Germany Younger Used Car Market by Sales Channel (Offline and Online)

4.4.6 Germany Offline Younger Used Car Market by Value

4.4.7 Germany Online Younger Used Car Market by Value

4.5 Italy Younger Used Car Market: An Analysis

4.5.1 Italy Younger Used Car Market by Value

4.5.2 Italy Younger Used Car Market By Type (Pre-Owned and Pre-Registered)

4.5.3 Italy Pre-Owned Younger Used Car Market By Value

4.5.4 Italy Pre-Registered Younger Used Car Market By Value

4.5.5 Italy Younger Used Car Market By Sales Channel (Offline and Online)

4.5.6 Italy Offline Younger Used Car Market By Value

4.5.7 Italy Online Younger Used Car Market By Value

4.6 Belgium Younger Used Car Market: An Analysis

4.6.1 Belgium Younger Used Car Market by Value

4.6.2 Belgium Younger Used Car Market By Type (Pre-Owned and Pre-Registered)

4.6.3 Belgium Pre-Owned Younger Used Car Market By Value

4.6.4 Belgium Pre-Registered Younger Used Car Market By Value

4.6.5 Belgium Younger Used Car Market By Sales Channel (Offline and Online)

4.6.6 Belgium Offline Younger Used Car Market By Value

4.6.7 Belgium Online Younger Used Car Market By Value

4.7 Rest of Europe Younger Used Car Market: An Analysis

4.7.1 Rest of Europe Younger Used Car Market by Value

5. Impact of COVID-19

5.1 Impact of COVID-19

5.1.1 Impact of COVID-19 on Used Car Market

5.1.2 Impact of COVID-19 on Online Used Car Market

5.1.3 Post COVID-19 Outlook

6. Market Dynamics

6.1 Growth Drivers

6.1.1 Rising Disposable Income

6.1.2 Increase in Urban Population

6.1.3 Rising Online Sales of Used Cars

6.1.4 Growing Total Population

6.1.5 Growing Benefits of Used Cars Over New Cars

6.2 Challenges

6.2.1 Economic Slowdown

6.2.2 Difficulty in Financing of Used Car

6.2.3 Lack of Standardization and Unorganized Regulations

6.3 Market Trends

6.3.1 Rising Demand for Electric Vehicles (EVs)

6.3.2 Demand For Car Sharing Services

6.3.3 Use of Dealership Management System

6.3.4 Use of Big Data Analysis

6.3.5 Growing Demand for Luxury Used Cars

7. Competitive Landscape

7.1 European Used Car Market Players: Key Comparison

7.2 European Used Car Market Players by Sales CAGR

8. Company Profiles

8.1 Arnold Clark Automobiles Limited

8.1.1 Business Overview

8.1.2 Financial Overview

8.1.3 Business Strategy

8.2 Lookers PLC

8.2.1 Business Overview

8.2.2 Financial Overview

8.2.3 Business Strategy

8.3 Pendragon PLC

8.3.1 Business Overview

8.3.2 Financial Overview

8.3.3 Business Strategy

8.4 Emil Frey Group

8.4.1 Business Overview

8.4.2 Business Strategy

List of Tables & Figures

Table 1: European Used Car Market Players: Key Comparison

Figure 1: Factors to Consider Before Buying a Used Car

Figure 2: Benefits of Used Car

Figure 3: Used Car Segmentation by Type

Figure 4: Used Car Segmentation by Sales Channel

Figure 5: Used Car Segmentation by Car Age

Figure 6: Used Car Segmentation by Sourcing Type

Figure 7: Factors to Consider Before Buying a Online Used Car

Figure 8: Benefits of Buying Used Cars Online

Figure 9: European Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 10: European Used Car Market by Sourcing Type; 2020 (Percentage, %)

Figure 11: European Used Car Market by Sales Channel; 2020 (Percentage, %)

Figure 12: European Offline Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 13: European Online Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 14: European Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 15: European Younger Used Car Market by Volume; 2020-2025 (Million)

Figure 16: European Younger Used Car Market by Type; 2020 (Percentage, %)

Figure 17: European Younger Used Car Market by Region; 2020 (Percentage, %)

Figure 18: European Younger Used Car Market Volume by Sales Channel; 2020 (Percentage, %)

Figure 19: European Younger Used Car Market Volume by Sourcing Type; 2020 (Percentage, %)

Figure 20: European Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 21: European Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 22: European Online Younger Used Car Market by Volume; 2020-2025 (Million)

Figure 23: European Offline Younger Used Car Market by Volume; 2020-2025 (million)

Figure 24: France Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 25: France Younger Used Car Market by Type; 2020 (Percentage, %)

Figure 26: France Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 27: France Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 28: France Younger Used Car Market By Sales Channel; 2020 (Percentage, %)

Figure 29: France Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 30: France Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 31: Spain Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 32: Spain Younger Used Car Market By Type; 2020 (Percentage, %)

Figure 33: Spain Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 34: Spain Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 35: Spain Younger Used Car Market By Sales Channel; 2020 (Percentage, %)

Figure 36: Spain Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 37: Spain Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 38: UK Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 39: UK Younger Used Car Market By Type; 2020 (Percentage, %)

Figure 40: UK Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 41: UK Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 42: UK Younger Used Car Market By Sales Channel; 2020 (Percentage, %)

Figure 43: UK Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 44: UK Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 45: Germany Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 46: Germany Younger Used Car Market by Type; 2020 (Percentage, %)

Figure 47: Germany Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 48: Germany Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 49: Germany Younger Used Car Market by Sales Channel; 2020 (Percentage, %)

Figure 50: Germany Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 51: Germany Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 52: Italy Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 53: Italy Younger Used Car Market By Type; 2020 (Percentage, %)

Figure 54: Italy Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 55: Italy Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 56: Italy Younger Used Car Market By Sales Channel; 2020 (Percentage, %)

Figure 57: Italy Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 58: Italy Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 59: Belgium Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 60: Belgium Younger Used Car Market By Type; 2020 (Percentage, %)

Figure 61: Belgium Pre-Owned Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 62: Belgium Pre-Registered Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 63: Belgium Younger Used Car Market By Sales Channel; 2020 (Percentage, %)

Figure 64: Belgium Offline Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 65: Belgium Online Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 66: Rest of Europe Younger Used Car Market by Value; 2020-2025 (US$ Billion)

Figure 67: Europe New Car and Used Car Registrations, 2015-2020 (Million)

Figure 68: UK Mean Household Disposable Income of Individuals, 2018-2020 (US$)

Figure 69: Europe Urban Population, 2016-2020 (Million)

Figure 70: Europe Retail E-commerce Revenue, 2017-2021 (US$ Billion)

Figure 71: Europe Total Population by Broad Age Group; 2016-2020 (Million)

Figure 72: European Union Real GDP Growth Rates; 2016-2025 (Percentage,%)

Figure 73: Europe Vehicle Sales Mix by Engine Type; 2020-2028 (Percentage, %)

Figure 74: Germany Demand For Car Sharing Services, 2012-2020 (Million)

Figure 75: European Used Car Market Players by Sales CAGR; 2021-2023 (Percentage, %)

Figure 76: Arnold Clark Automobiles Limited Revenue; 2015-2019 (US$ Billion)

Figure 77: Arnold Clark Automobiles Limited Revenue by Segments; 2019 (Percentage, %)

Figure 78: Lookers PLC Revenue; 2016-2020 (US$ Billion)

Figure 79: Lookers PLC Revenue by Segments; 2020 (Percentage, %)

Figure 80: Pendragon PLC Revenue; 2016-2020 (US$ Billion)

Figure 81: Pendragon PLC Revenue by Segments; 2020 (Percentage, %)

Executive Summary

A used car or a second hand vehicle is a car that has been previously owned or used by more than one owner. Used cars are known for their affordability and low maintenance. As the world progressing towards the eco-friendly vehicles such as electric and hybrid vehicles, and when use of technologies like Big data and use of computer programmed software for dealership management have been increasing, the context of used car is continuously evolving and growing.

These cars could be sold via different types of outlets which include franchise and non-dependent car dealers, buy here pay here dealerships, rental car companies, auctions, leasing offices, and private party sales. The major benefits of used car include cost-friendly, better for the environment, easily upgradable, slower depreciation, cheaper insurance costs, facilitates affordability, and no registration cost.

The used car market can be segmented on the basis of type (Pre-owned and Pre-registered); sales channel (Online and Offline); car age (Younger or Less than 8 Years and Others or More than Years); and by sourcing type (B2C and C2C).

Companies Mentioned

- Arnold Clark Automobiles Limited

- Emil Frey Group

- Lookers PLC

- Pendragon PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | September 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 475 Billion |

| Forecasted Market Value ( USD | $ 545.07 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 4 |