COVID-19 had a substantial effect on the market's expansion. Effective individual COVID-19 infection diagnosis was urgently necessary due to increased cases and significant mortality. Using immunoglobulin tests in the COVID-19 condition was effective for better disease diagnosis. Furthermore, the new research studies of immunoglobulin diagnostic tests will help the market to grow over the coming years. For instance, according to the report published by Virology Journal, in February 2022, the study evaluates and compares the six antibody assays and two combination assays for COVID-19 diagnosis. According to the result of the study, people should use highly sensitive assays as frequently as feasible for epidemiological surveillance of COVID-19 infection. Thus, the new research studies over the coming years will impact the market positively and are expected to have stable growth over the post-pandemic era.

The immunoprotein diagnostic testing market will grow due to the growing burden of chronic diseases and technological advancements related to the products. The rising prevalence of chronic diseases like diabetes will significantly impact the immunoprotein diagnostic testing market as the test can differentiate type 1 diabetes and latent autoimmune diabetes in adulthood. For instance, as per the 2022 JDRF, it is estimated about 8.7 million people are living with type 1 diabetes around the world. Similarly, as per the report published by Lancet Diabetes & Endocrinology in October 2022, it is estimated that by 2040, there will be 13.5-17.4 million cases of type 1 diabetes around the world. Thus the increase in the prevalence of chronic issues increases the demand for immunoprotein diagnostic tests, which will drive the market over the forecast period.

Furthermore, the government provides few surveillance programs for antibody tests, which can significantly impact the market. For instance, in August 2021, the United Kingdom Health Security Agency launched an antibody surveillance program across the UK for the general public. It improves understanding of the protection provided by antibodies generated following COVID-19 infection and vaccination. For the evaluation of the antibodies, immunoprotein diagnostic tests need to get conducted to evaluate the antibodies.

Hence, these expensive techniques will impede market growth over the forecast period.

Immunoprotein Diagnostic Testing Market Trends

Endocrine Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

The endocrine segment is expected to exhibit steady growth in the immunoprotein diagnostic testing market. The growing burden of endocrine diseases, such as diabetes, and the development of products related to immunodiagnostic testing drive the segment's growth.According to the Type 1 Diabetes Index, 2022, in the US, type 1 diabetes is growing at 2.9% each year compared with 4.5% for type 2 diabetes. Similarly, as per the US CDC, in 2022, 96 million adults have prediabetes in the US, and 8 in 10 of them are not aware if they have it. More than 37 million people live with diabetes, and 1 in 5 go undiagnosed. Hence the significant rise in the prevalence of diabetes increases the demand for the diagnosis using immunoprotein tests which will have a positive impact on the market.

Furthermore, the technological advancements in immunoprotein testing help the market growth through product approvals and launches. For instance, in May 2022, Labcorp made screening for diabetes easier by launching an at-home collection kit through Labcorp OnDemand that measures hemoglobin A1c (HbA1c) from a small blood sample.

Thus, the above factors will likely drive the segment's growth during the forecast period.

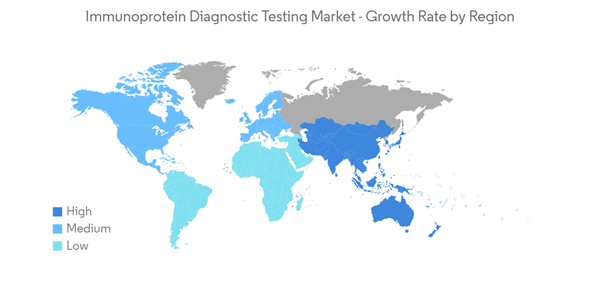

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

The major factors driving the market growth in North America include rising healthcare expenditure and a growing level of consciousness for the products involved in diagnosing autoimmune disorders. North America is expected to be a dominant region, owing to the rising geriatric population and the growing burden of diseases along with the new product developments and launches.According to the IDF Diabetes Atlas 2021, the age-adjusted comparative diabetes prevalence in the US was 10.7% for 2021 and expected to be 12.1% and 12.9% for 2030 and 2045, respectively. As per the same source, the age-adjusted comparative diabetes prevalence in Canada was 7.7% for 2021 and estimated to be 8.9% and 9.% for 2030 and 2045, respectively. It shows the growing prevalence of chronic diseases like diabetes in the North American region. It increases the demand for diagnosis using immunoprotein tests that may positively impact the market's growth over the forecast period.

Furthermore, new product approvals and launches in the region with collaborations among the major players in the market will drive market growth. For instance, in May 2022, OmegaQuant launched an HbA1c Test with a sample collection kit that allows for testing at home. This simple, safe, convenient test measures the amount of sugar (glucose) in the blood. Thus, it will positively influence the immunoprotein diagnostic testing market and witness significant growth in North America over the forecast period due to the abovementioned factors.

Immunoprotein Diagnostic Testing Industry Overview

The immunoprotein diagnostic testing market is slightly fragmented. Key players expected to be dominant in the immunoprotein diagnostic testing market are Thermofisher Scientific Inc., Enzo Lifesciences Inc., Randox Laboratories, Bio-Rad Laboratories Inc., Abbott, SERVA Electrophoresis GmbH, F. Hoffmann-La Roche Ltd, Diazyme Laboratories Inc., DiaSys Diagnostic Systems GmbH, and Calbiotech Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott

- Bio-Rad Laboratories Inc.

- Calbiotech Inc.

- DiaSys Diagnostic Systems GmbH

- Diazyme Laboratories Inc.

- Enzo Lifesciences Inc.

- F. Hoffmann-La Roche Ltd

- Randox Laboratories

- SERVA Electrophoresis GmbH

- Thermofisher Scientific Inc.