Biofertilizers are a sustainable solution for enhancing soil fertility and promoting plant growth while reducing reliance on chemical fertilizers. Made from living organisms, biofertilizers work by colonizing the plant root zone and facilitating nutrient uptake. They consist of beneficial bacteria, fungi, or algae that fix atmospheric nitrogen, solubilize phosphorus, and enhance nutrient availability through various mechanisms. These microorganisms establish a symbiotic relationship with plants, aiding in nutrient absorption and stimulating plant growth. Biofertilizers offer several advantages, such as improving soil structure, increasing nutrient efficiency, and reducing environmental pollution. They also contribute to the sustainability of agricultural practices and can be used in organic farming. Common product types include nitrogen-fixing rhizobium and azotobacter biofertilizer, phosphate-solubilizing biofertilizer, and mycorrhizal fungi like Glomus species.

The global biofertilizer market is being driven by the increasing demand for organic food products and sustainable agricultural practices. Moreover, the rising environmental concerns and the need to reduce chemical fertilizer usage are creating a positive outlook for the market. Besides this, government initiatives and subsidies to encourage organic farming and promote the use of biofertilizers are driving the market growth. Additionally, the growing awareness among farmers about the benefits of biofertilizers, such as improved soil fertility, nutrient uptake, and crop yield, is fueling the market growth. In line with this, the development of advanced microbial technologies for biofertilizer production and application is playing a significant role in market growth. Other factors, such as the emphasis on reducing greenhouse gas emissions and mitigating climate change and the integration of biofertilizers with other agricultural practices, are boosting the market growth.

Biofertilizer Market Trends/Drivers

Increasing demand for organic food products and sustainable agricultural practices

Consumers are becoming more conscious of the impact of conventional farming practices on their health and the environment. As a result, there is a growing preference for organic food products that are grown without the use of chemical fertilizers and pesticides. Biofertilizers, being organic in nature, are seen as a sustainable alternative that enhances soil fertility and crop yield while reducing the harmful effects of chemical inputs. This consumer demand for organic food is driving farmers to adopt biofertilizers, thereby boosting the market.Rising environmental concerns and increasing demand for greener alternatives

Chemical fertilizers have been associated with negative environmental consequences such as water pollution, soil degradation, and greenhouse gas emissions. In response, governments and environmental agencies are encouraging the use of biofertilizers as a sustainable solution. Many countries have implemented regulations and policies to reduce the usage of chemical fertilizers and promote the adoption of organic farming practices. This support from regulatory bodies, along with the increasing awareness of environmental issues, is driving the demand for biofertilizers and creating a favorable market environment.Government initiatives and subsidies to encourage organic farming

Governments worldwide are recognizing the importance of sustainable agriculture and are actively supporting farmers in transitioning from conventional to organic farming practices. This support comes in the form of financial incentives, tax benefits, research and development grants, and subsidies for purchasing biofertilizers. Such initiatives not only reduce the financial burden on farmers but also create awareness about the benefits of biofertilizers and drive their adoption. The availability of such subsidies and incentives is fostering a favorable ecosystem for the growth of the biofertilizer market, facilitating its expansion on a global scale.Biofertilizer Industry Segmentation

This report provides an analysis of the key trends in each segment of the global biofertilizer market report, along with forecasts at the global and regional levels from 2025-2033. The report has categorized the market based on type, crop, microorganism and mode of application.Breakup by Type

- Nitrogen-fixing biofertilizers

- Phosphate-fixing biofertilizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen-fixing biofertilizers, phosphate-fixing biofertilizers, and others. According to the report, nitrogen-fixing biofertilizers represented the largest segment.

Nitrogen is an essential nutrient for plant growth, and it is often a limiting factor in agricultural systems. Chemical fertilizers have traditionally been used to supply nitrogen to plants, but they are associated with environmental concerns such as groundwater pollution and greenhouse gas emissions. Nitrogen-fixing biofertilizers, on the other hand, offer a sustainable and eco-friendly alternative. These biofertilizers contain beneficial bacteria, such as Rhizobium and Azotobacter, which can convert atmospheric nitrogen into a form that can be utilized by plants. This process is known as biological nitrogen fixation.

The dominance of nitrogen-fixing biofertilizers in the market can be attributed to their several advantages, such as reduced reliance on chemical fertilizers, thereby minimizing the negative environmental impact associated with their production and usage. This aligns with the growing global concern for sustainable agricultural practices and the need to reduce chemical inputs. They also have the potential to improve soil fertility in the long run. By enhancing nitrogen availability, they contribute to increased plant growth and yield. Additionally, they can improve soil structure and microbial activity, leading to healthier and more resilient soils.

Furthermore, the use of nitrogen-fixing biofertilizers can have economic benefits for farmers. By reducing the need for chemical fertilizers, farmers can lower input costs, resulting in potentially higher profit margins. Additionally, nitrogen-fixing biofertilizers can be used in conjunction with other types of biofertilizers or organic practices, further enhancing their effectiveness and overall sustainability.

Breakup by Crop

- Cereals and grains

- Pulses and oilseeds

- Fruits and vegetables

- Others

A detailed breakup and analysis of the market based on the crop has also been provided in the report. This includes cereals and grains, pulses and oilseeds, fruits and vegetables, and others. According to the report, cereals and grains accounted for the largest market share.

Cereals and grains hold the largest share in the global biofertilizer market due to several key factors. Cereals and grains are staple crops worldwide and constitute a significant portion of the global agricultural production. These crops include wheat, rice, maize, and barley, among others, which are consumed by a large population as a primary source of nutrition. The high demand and extensive cultivation of cereals and grains create a substantial market opportunity for biofertilizers.

Moreover, biofertilizers are particularly well-suited for the cultivation of cereals and grains due to their ability to enhance soil fertility and promote nutrient uptake. Cereals and grains are nutrient-intensive crops, requiring a sufficient supply of macronutrients such as nitrogen, phosphorus, and potassium for optimal growth and yield. Biofertilizers, especially nitrogen-fixing bacteria, play a crucial role in fixing atmospheric nitrogen into a form that can be easily absorbed by plants. By providing a sustainable and eco-friendly source of nutrients, biofertilizers contribute to improved crop productivity and yield in the cultivation of cereals and grains.

Breakup by Microorganism

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

A detailed breakup and analysis of the market based on the microorganism has also been provided in the report. This includes cyanobacter, rhizobium, phosphate solubilizing bacteria, azotobacter, and others. According to the report, cyanobacter accounted for the largest market share.

Cyanobacteria, also known as blue-green algae, have emerged as dominant players in the biofertilizer market due to several key factors. It possesses the unique ability to fix atmospheric nitrogen and convert it into a form that plants can readily utilize. This nitrogen-fixing capability reduces the reliance on chemical nitrogen fertilizers, which are not only costly but also contribute to environmental pollution through nitrate runoff and greenhouse gas emissions.

Moreover, cyanobacteria have the capacity to grow in diverse environments, including aquatic and terrestrial ecosystems. This adaptability allows them to thrive in different agricultural systems, making them suitable for a wide range of crops and soils. Another advantage of cyanobacteria is their ability to form symbiotic relationships with plants, particularly in the case of rice cultivation. Furthermore, it can produce a range of growth-promoting substances like phytohormones, vitamins, and enzymes, which aid in plant growth and development.

Breakup by Mode of Application

- Seed treatment

- Soil treatment

- Others

A detailed breakup and analysis of the market based on the mode of application has also been provided in the report. This includes seed treatment, soil treatment, and others. According to the report, seed treatment accounted for the largest market share.

Seed treatment holds the largest share in the global biofertilizer market due to several key factors. Seed treatment offers a convenient and efficient way to introduce biofertilizers into the agricultural system. By coating the seeds with biofertilizer formulations, farmers can ensure that the beneficial microbes or nutrients are directly applied to the seeds, enhancing germination, early growth, and overall plant health. This targeted approach allows for precise dosing and maximizes the effectiveness of biofertilizers, resulting in improved crop performance.

Additionally, it provides long-lasting effects throughout the plant's life cycle. Since the biofertilizers are applied at the early stages of seed germination and root development, they establish a symbiotic relationship with the plant, colonizing the root system and providing a continuous supply of nutrients or growth-promoting substances. This sustained interaction between the biofertilizer and the plant leads to improved nutrient uptake, enhanced disease resistance, and increased tolerance to environmental stress factors, ultimately boosting crop productivity.

Regional Insights

- Asia Pacific

- North America

- Europe

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America held the biggest market share due to the increasing demand for sustainable and eco-friendly agricultural practices in the region. There is a growing awareness among farmers about the detrimental effects of chemical fertilizers on soil health and the environment. As a result, they are turning towards biofertilizers as a greener alternative. Additionally, stringent regulations and government initiatives in the region are promoting the use of biofertilizers to reduce the environmental impact of farming, which is acting as a growth-inducing factor.

Furthermore, the strong emphasis on organic farming in North America has contributed to the growth of the biofertilizer market. With consumers becoming more conscious about food safety and quality, the demand for organically grown produce has surged. Biofertilizers play a crucial role in organic farming by enhancing soil fertility and improving nutrient uptake, leading to healthier crops. Moreover, the well-established agricultural infrastructure and advanced farming techniques in North America have facilitated the adoption of biofertilizers, which, in turn, is favoring the market growth.

Competitive Landscape

The global biofertilizer market is characterized by intense competition among key players aiming to gain a larger market share. Companies are focusing on strategic initiatives, such as mergers and acquisitions, partnerships, and product innovation, to strengthen their market position. They are investing in research and development activities to develop advanced biofertilizer formulations with enhanced efficiency and effectiveness. They are also expanding their production capacities, improving distribution networks, and undertaking marketing campaigns to create awareness and increase product adoption.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Gujarat State Fertilizers & Chemicals Ltd.

- Lallemand Inc.

- Madras Fertilizers Limited

- National Fertilizers Limited

- Novozymes A/S

- Rashtriya Chemicals & Fertilizers Ltd.

- Rizobacter (Bioceres Crop Solutions)

- T.Stanes & Company Limited

Key Questions Answered in This Report

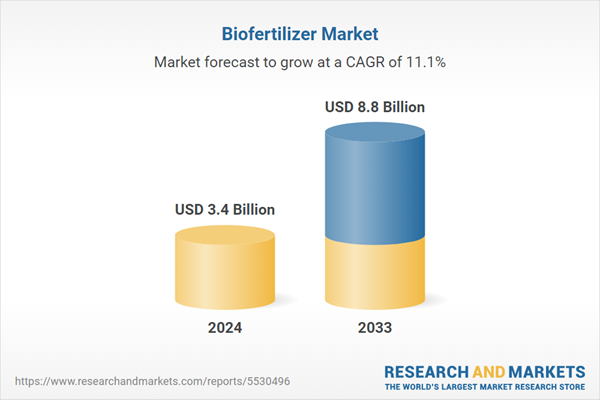

1. What was the size of the global biofertilizer market in 2024?2. What is the expected growth rate of the global biofertilizer market during 2025-2033?

3. What are the key factors driving the global biofertilizer market?

4. What has been the impact of COVID-19 on the global biofertilizer market?

5. What is the breakup of the global biofertilizer market based on the type?

6. What is the breakup of global biofertilizer market based on the crop?

7. What is the breakup of the global biofertilizer market based on the microorganism?

8. What is the breakup of the global biofertilizer market based on the mode of application?

9. What are the key regions in the global biofertilizer market?

10. Who are the key companies/players in the global biofertilizer market?

Table of Contents

Companies Mentioned

- Gujarat State Fertilizers & Chemicals Ltd.

- Lallemand Inc.

- Madras Fertilizers Limited

- National Fertilizers Limited

- Novozymes A/S

- Rashtriya Chemicals & Fertilizers Ltd.

- Rizobacter (Bioceres Crop Solutions)

- T.Stanes & Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 8.8 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |