The restoration and replacement processes done on automobiles damaged in an accident are referred to as automotive collision repair. It includes denting, painting, restoring, repairing, replacing, and refinishing structural or cosmetic portions of vehicles, such as glass windows, bumpers, and car doors. Paints, scratch-resistant coatings, replacement components, and other refinishing materials are commonly utilized in car collision repair.

An increase in automotive traffic is ascribed to factors such as global population expansion, rising disposable income, and growing sales of light-duty automobiles in emerging markets. This is causing an increase in the number of car accidents.

COVID-19 Impact Analysis

The automotive and transportation sectors are among the most vulnerable to the ongoing COVID-19 pandemic and are presently experiencing exceptional uncertainty. COVID-19 is projected to have a substantial influence on the automotive supply chain and sales trends. The industry's concern has shifted from supply chain challenges from China to a general decline in sales for aftermarket repair supplies. With the suspension of all non-essential services, sales for commercial automotive components experienced adverse impacts.

In addition, changes in consumer purchasing behavior as a result of the due uncertainty caused by the pandemic may have major ramifications for the industry's near-term growth. Meanwhile, market players have already felt the effects of a liquidity deficit and a cash constraint, and this shortfall is anticipated to worsen in the coming months.

Market Growth Factors:

Constant technological advancements

In the last few years, the number of traffic accidents and fatalities has increased drastically. One of the major factors contributing to this number is the adoption of the drink and drive concept. In addition, tremendous expansion in the automotive industry is expected to help the customers to avail these services more readily. The increasing demand for electric and hybrid vehicles (H/EVs), as well as conventional automobiles, has increased customer demand for maintenance services. In accordance with this, automotive stores are increasingly selling do-it-yourself (DIY) kits for consumers that include sophisticated and customized replacement parts.Passenger vehicles are set to boost the market growth

Mainly, the automotive collision repair services market is divided into three vehicle types: passenger cars, light commercial vehicles, and heavy commercial vehicles. On a worldwide basis, the percentage for passenger cars holds a significant number of all automobiles. Passenger cars, which have a bigger fleet, are more likely to be involved in crashes than commercial vehicles. Hence, this factor is expected to help many service providers to provide services by considering the needs and requirements of different types of passenger vehicles.Marketing Restraining Factor:

Absence of trained professionals

Both in developing as well as developed countries, there is less availability of trained individuals who can perform collision repair services effectively. This shortage is expected to motivate people to prefer repairing services from the locally available mechanics. Moreover, these services are associated with high cost, hence many people tend to sell their cars after a major collision or accident. The cost of hiring a repair specialist is the single most important factor that deters individuals from doing so. A damaged car might cost anywhere from a few hundred dollars to several thousand dollars to repair.Product Outlook

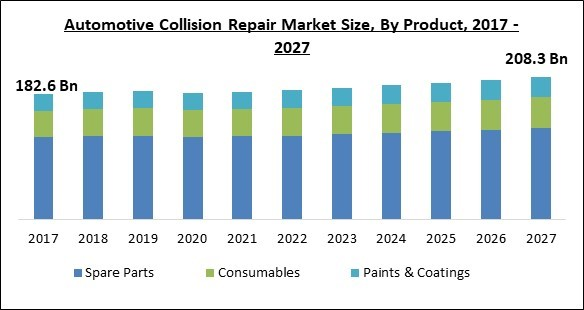

Based on Product, the market is segmented into Spare Parts, Consumables and Paints & Coatings. The Paints & Coatings segment procured a promising revenue share. This is because environmental coatings are becoming more popular as a result of the growing environmental issues associated with the usage of harmful synthetic coatings and refinishing chemicals.

Service Channel Outlook

Based on Service Channel, the market is segmented into OE, do-it-yourself (DIY), and DIFM. The DIY segment held a significant revenue share of the market in 2020. Many companies have begun to produce entire kits that give customers DIY options.

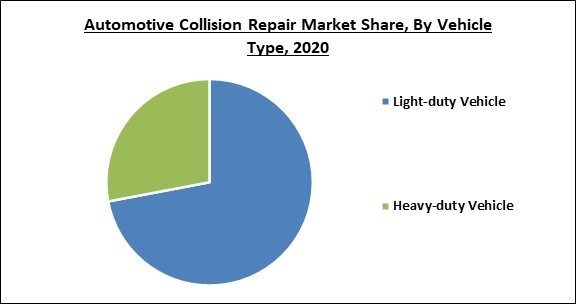

Vehicle type Outlook

Based on Vehicle Type, the market is segmented into Light-duty Vehicle and Heavy-duty Vehicle. The Heavy-duty Vehicle garnered a significant revenue share. Commercial and multi-axle vehicles like trucks and buses are included in the heavy-duty vehicle class. Heavy-duty trucks are expected to be employed for bulk goods delivery inside any country or area.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific region procured the significant revenue share. The growing number of vehicle purchases is fuelling a considerable expansion in the region's automotive collision repair market. An increase in vehicular damage as a result of low driving restrictions in the Asia Pacific area is fuelling regional market expansion.

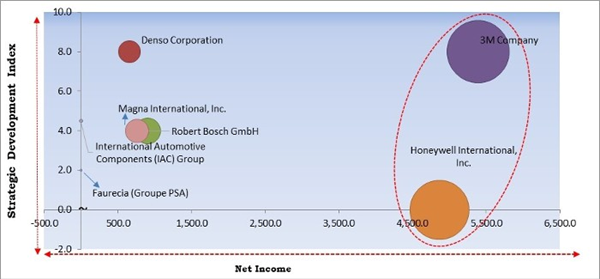

Cardinal Matrix - Automotive Collision Repair Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; 3M Company and Honeywell International, Inc. are the forerunners in the Automotive Collision Repair Market. Companies such as Denso Corporation, Magna International, Inc., and Robert Bosch GmbH are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Automotive Technology Products LLC, International Automotive Components (IAC) Group, 3M Company, Continental AG, Robert Bosch GmbH, Honeywell International, Inc., Denso Corporation, Tenneco, Inc., Magna International, Inc., and Faurecia (Groupe PSA).

Recent Strategies Deployed in Automotive Collision Repair Market

» Partnerships, Collaborations and Agreements:

- Nov-2021: Bosch signed an agreement with Caliber Collision, a company that offers auto collision repair services. The Bosch scanning innovation is expected to help Caliber Collision to continue to be an industry leader through streamlined diagnostic data and workflows.

- Feb-2021: Bosch Automotive Service Solutions, Mitchell, and Collision Repair Industries announced the launch of the MD-TS21, a new computer-based target system. The wireless tablet integrates Bosch's hardware and diagnostic expertise with the mobility of Mitchell's cloud-based software including Mitchell Cloud Estimating and its Integrated Repair Procedures.

- Dec-2020: Faurecia Clarion Electronics, the electronic business of Faurecia Group came into partnership with Groupe Renault for multi-brand electronic repairs. Following this partnership, Renault aims to offer its repair and garage partners access to the repair of over 1,000 products on 23 vehicle brands.

» Acquisitions and Mergers:

- Jul-2021: Magna International signed a merger agreement under which it will acquire Veoneer, a leading company in automotive safety technology. This acquisition will expand the former company's ADAS business with major customers and offers access to new regions and customers.

» Product Launches and Product Expansions:

- Oct-2021: 3M India introduced 3M Performance Spray Gun, a spray technology. This technology offers top-of-the-line performance with unmatched productivity. This spray gun is 50% lighter than other spray guns in the segment.

- Aug-2021: 3M launched the 3M Robotic Paint Repair System, a proprietary software. This software detects flaws and instructs robots on how to repair them effectively. The robots sand and polish the vehicles utilizing 3M abrasives for automation.

Scope of the Study

Market Segments Covered in the Report:

By Product

- Spare Parts

- Consumables

- Paints & Coatings

By Service Channel

- OE

- do-it-yourself (DIY)

- DIFM

By Vehicle Type

- Light-duty Vehicle

- Heavy-duty Vehicle

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Automotive Technology Products LLC

- International Automotive Components (IAC) Group

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Honeywell International, Inc.

- Denso Corporation

- Tenneco, Inc.

- Magna International, Inc.

- Faurecia (Groupe PSA)

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Automotive Technology Products LLC

- International Automotive Components (IAC) Group

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Honeywell International, Inc.

- Denso Corporation

- Tenneco, Inc.

- Magna International, Inc.

- Faurecia (Groupe PSA)