The COVID-19 pandemic had a huge impact on the European commercial real estate sector. Although the crisis impacted the European economy and investment sentiment among investors and occupiers, the sector is currently recovering but has not reached the pre-pandemic levels.

Key Highlights

- According to the European Public Real Estate Association, the European Union's commercial real estate sector contributed a combined GDP of more than USD 15.3 trillion in 2021. The sector had 177 REITs, with a combined market cap of USD 133 billion, and 261 Non-REITs, with a combined market cap of USD 308 billion.

- Germany continues to lead the commercial real estate sector, despite the declining growth rate in the market. The growth rate in Q4 2021 declined by 8% compared to Q4 2020 but experienced a growth of 14% compared to pre-pandemic levels.

- The United Kingdom is the next leading country in the market, with an annual growth rate of more than 25% in Q4 2021 compared to the same quarter in 2020. Moreover, countries like Sweden, the United Kingdom, Belgium, and Norway saw the highest growth in the sector. Meanwhile, France, Spain, and the Netherlands experienced a slow recovery due to a decline in the growth of the retail sector.

European Commercial Real Estate Market Trends

Increasing Investments in the Commercial Real Estate Sector

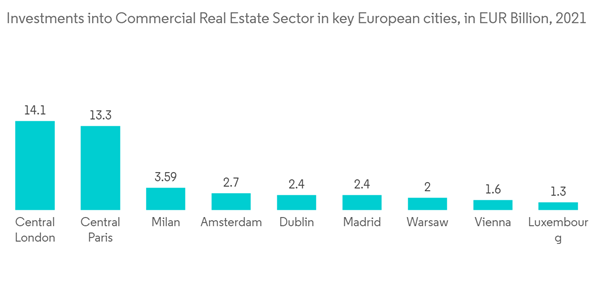

The COVID-19 pandemic severely impacted the sector, and the market is currently recovering as increasing investments flow into the sector. The commercial real estate sector had a strong rebound in investments in Q2 2021, with a growth rate of more than 70% compared to the same quarter in 2020. The investment flow continued in Q3 and Q4, with growth rates of 25% and 22%, respectively.Overall investments in 2021 accounted for more than EUR 270 billion (USD 319 billion), with an increased growth rate of 14% compared to 2020. This represents a strong recovery of the sector after the crisis.

Germany and the United Kingdom experienced the highest investments in the commercial real estate sector. Due to the vaccination roll-outs and pandemic relaxations, Most developers resumed their work with the roll-out of vaccines and pandemic relaxations. There was a rise in investments in the United Kingdom, and the country witnessed a growth rate of 20% in 2021 compared to 2020, followed by Germany, with a 7% growth rate in investments. The French and Dutch markets experienced declining rates in terms of investments.

However, foreign investments in the market were initially impacted by the pandemic but are currently recovering. In 2021, Americans showed strong interest in the sector and brought their investments back to pre-crisis levels, with more than EUR 41 billion (USD 43.56 billion) in investments in the sector.

The Logistics Market is Witnessing Lucrative Growth

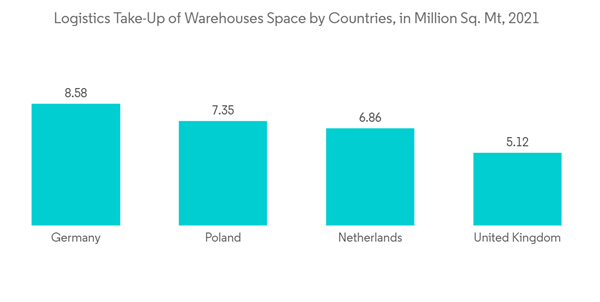

The European logistics real estate market is resilient, despite the disruptions caused by the pandemic. E-commerce remains the main driver of the logistics market in Europe. Strong changes in consumer behavior triggered by the pandemic created the demand for online shopping and drove the penetration of e-commerce in the market.The sector also experienced growth in investments, with more than EUR 25 billion (USD 29.5 billion) in H1 2021. The market set a record growth rate of 62% in 2021 compared to 2020. Meanwhile, the demand in the logistics real estate sector surpasses the supply. The supply in the market is extremely tight due to a severe shortage of development sites and strict regulations. This further resulted in the growth of rental warehouses. For isntance, in H1 2021, the warehouse's average rent increased by 3.2% compared to H1 2020.

Moreover, the United Kingdom and Germany are emerging hotspots for logistics warehouses' space absorption. In H1 2021, Germany experienced record absorption of warehouse spaces, with more than 3.1 million square meters absorbed in 2021.

European Commercial Real Estate Industry Overview

The European commercial real estate market is highly competitive and fragmented, with many players. Most players expand their businesses by investing strategically in partnerships, mergers, and acquisitions, among others.The office, industry, and logistics sectors are the most invested segments in the market. Furthermore, investments in the market are driven by robust office space take-up and a rise in the demand for logistic warehouses, despite the disruption caused by the pandemic. Some

major players in the market include Servo, Covivo, Hines, Blackstone Inc., Strabag Group, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Servo

- Covivio

- Blackstone Inc.

- Hines

- Strabag Group

- Tishman Speyer

- HB Reavis Group

- AG Real Estate

- Futureal Management Szolgaltato Kft.

- Skanska*