The COVID-19 pandemic impacted the market negatively, resulting in a shutdown of manufacturing units and lockdowns in nearly all the major regions. This trend altered consumer spending patterns across the world. However, post the easing of lockdown measures, many individuals across the world preferred cycling activities due to fitness reasons. Also, several countries witnessed a surge in recreational bicycle activities, which boosted the demand for bike computers to track fitness activities, health monitoring while cycling, and navigation purposes.

Over the medium term, the rising customer inclination toward affordable GPS bike computers may propel key players to manufacture low cost, uniquely designed, easy to use, and featured products. For instance, Omata One is a digital data collector instrument with an intelligent and simple design and intuitive analog displays. It is equipped with ANT+ protocols with heart rate sensors. It is well-suited with Bluetooth Low Energy (BLE) and broad three-dimensional dial and power output meters for measurement statistics, such as smart GPS bike computers. This inclination is projected to positively impact the GPS bike computers market over the Forecasts period.

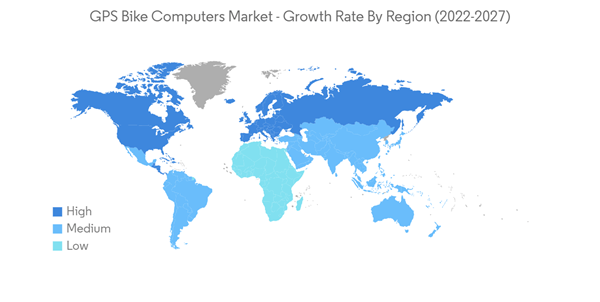

Europe is expected to have significant growth over the Forecasts period. The market demand will likely be supported by the rising cycling population and vivid use of bikes for various sectors like delivery. The North American region, followed by Asia-Pacific, is likely to have notable growth over the Forecasts period due to the strong preference among individuals for outdoor recreational activities.

Key Market Trends

Fitness and Commuting Segment Likely to Have Significant Growth

The demand for GPS bike computers is expected to grow significantly due to the expanding application in fitness and commuting. The COVID-19 pandemic boosted sales, owing to the increased awareness among people about exercise to enhance immunity.

People prefer to cover long routes via bicycles, driving the demand for bicycles, especially e-bikes. With rising health consciousness among cyclists, the demand for bike computers is growing. These devices track numerous parameters such as energy level, water percentage, calories burned, and heart rate based on the course and energy effort. This growing market is supported by product launches by key players. For instance,

- In May 2019, Wahoo Fitness announced the launch of the new ELEMNT ROAM, the brand’s third GPS cycling computer. ROAM is the first with a color screen and the first to offer expanded navigation features. Like other ELEMNT computers, ROAM integrates with the Wahoo Fitness Ecosystem, including KICKR smart trainers, TICKR heart rate monitors, and RPM Speed and Cadence sensors.

- Garmin Ltd offers Edge 130plus, the compact GPS cycling navigation system, which navigates and syncs structured workouts right to the device. The device comes with Bluetooth compatibility.

Europe Expected to Capture Larger Market Share During the Forecasts Period

Europe is expected to have notable growth during the Forecasts period due to the increasing adoption of bicycles for commuting and the increasing participation in cycling sports and events. The rising trips and utilization of bikes for commuting distances and other leisure activities are expected to enhance the demand for GPS bike computers. They are primarily attributed to the availability of cycling-specific maps, enhancing the traveling experience. For instance,

- In 2019, people across the Netherlands made 4.8 billion trips by bicycle, covering 17.6 billion km. One-third of the total distance traveled was for leisure purposes, followed by bicycle trips for shopping purposes and homework commutes.

- In May 2021, Wahoo announced the launch of its new GPS bike computer, the ELEMNT BOLT, featuring a crisp color display, intuitive interface, and expanded navigation features. The BOLT GPS also has a 15-hour runtime, and onboard memory increased to 16 GB. Riders can pair the Wahoo ELEMNT app with the new Bolt GPS, which will allow them to customize their data screens, sync routes, and analyze data.

Competitive Landscape

The GPS bike computers market is moderately consolidated by the existence of international and regional players, resulting in a highly competitive market environment. Some of the leading players in the market include Bryton Inc., CatEye Co. Ltd, Garmin Ltd, Lezyne Inc., Polar Electro Oy, Giant Manufacturing Co. Ltd, MiTAC Holdings Corp., Pioneer Electronics (USA) Inc., and Wahoo Fitness LLC. Many competitors in the market adopted acquisitions and business expansions as their key strategies to develop their geographical foothold and promote their product technologies.

- In April 2019, Garmin acquired Tacx Onroerend en Roerend Goed BV (Tacx), the important manufacturer of indoor bike trainers. It helped Garmin increase its portfolio of high-end indoor bike trainers, accessories, and tools, along with indoor training applications and software.

- In February 2020, Pioneer Corporation signed an agreement to transfer certain assets of its Cycle Sports business to Shimano Inc. Sales of pedaling monitors, cycle computers, and other related products by Pioneer were ceased at the end of March 2020. Pioneer will continue to accept customer inquiries about cycle products and services and provide repair services on Pioneer Cycle Sports products sold before the asset transfer per the terms of any applicable product warranties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Garmin Ltd

- Lezyne Inc.

- Polar Electro Oy

- CatEye Co. Ltd

- Bryton Inc.

- Giant Manufacturing Co. Ltd

- MiTAC Holdings Corp.

- Pioneer Electronics (USA) Inc.

- Wahoo Fitness LLC

- Acer Inc.