The thyroid gland in the human body secretes important hormones that are great determinants of the human body’s growth, development, and proper health. Any increased or decreased production of the hormone can cause a disease condition. Therefore, diagnosis and management are essential in inspecting the thyroid hormones in the human body.

The prime reason driving the market for thyroid function tests during the forecasted period is the rising thyroid hormone imbalance and its adverse effect on health and the body. Surging health consciousness and healthcare expenditure also increase the scope of the market. Furthermore, increasing investment in thehealthcaresector and encouraging early detection of disease for timely medication for better chances of survival are projected to support the market growth.

Market Drivers:

The Growing frequency of thyroid hormone dysfunction has promoted the need for regular monitoring of thyroid function is driving the market growth.

Thyroid hormone dysfunction is another key factor anticipated to fuel the market demand for thyroid function tests in the projected time frame. By controlling the calorie-burning capability, the thyroid hormone influences the metabolism of the body. It alters the shape of the body when its levels are too high or too low, making a person lean or fat, respectively. Increasing instances of thyroid hormone issues owing to lifestyle complexities are expected to encourage periodic testing for better healthcare.According to the American Thyroid Association, in the US, over 12% of the population suffer from thyroid malfunction at least once in their lives. More than 20 million people have thyroid issues, and 60% are unaware of their states. Awareness in terms of the body and persuasive motivation and follow from agencies for consistent timely body checks are anticipated to propel the substantial apparent market in the future.

Rising obesity has raised serious concerns, which are expected to provide significant market prospects for the thyroid function test industry.

Another factor that will contribute significantly to the tremendous growth is the increasing obesity in the worldwide population. The World Health Organization figures out that the overweight rate has tripled in the last 40 years. Consequently, in 2022 the number of overweight adults was 2.5 billion, and 890 million were living with obesity. Moreover, in 2022, 37 million children less than five years old and also 390 million boys and girls between the ages of 5 and 19 years old were overweight or obese.The robust growing obesity rates have raised serious concerns, which are anticipated to increase thyroid hormone testing for better monetization and regulation. In addition, the increased number of diseases associated with the thyroid such as thyroidal cancer is expected to drive the market within the forecasted period.

The rising incidence of thyroid cancer is projected to drive market expansion.

One of the drivers of thyroid function tests includes the growth of thyroid cancer cases. Notably. Thyroid disorders require early diagnosis, while regular monitoring is essential when seeking treatment. In addition, due to exceptional cases of cancer of the thyroid glands the demand for testing of thyroid function is increasing. Also, technological improvements and an aging global population may further increase market demand. The term thyroid cancer refers to the process by which abnormal cells emerge from a normal thyroid gland and the growth of tumors.According to Cancer.net, the United States of America recorded new cases of thyroid cancer. Furthermore, according to the report, the US has been reporting an increasing number of women cases at a rate of 2% annually. The increasing cancer threat will provide a stable market for thyroid function tests.

Market Restraint:

Limited information about thyroid function tests could curb the thyroid function test market growth.

The one of the main obstacles with respective thyroid function tests is limited information or not being able to know the positive output from the test. Data from ATA states that 60% of Americans are unaware of their thyroid condition owing to a lack of awareness and interest in the sector, which reduces potential patient tests and hence hinders’ market growth.Increased cost for testing can hinder the thyroid function test market growth

While the price of the general tests of thyroid function is affordable, the cost of the more complex tests like genetic testing and radioactive iodine uptake scans may be high. This might lead to the restriction of opportunities for some particular patients.Key Developments:

- February 2023-Thyroid Screen in Pregnancy (code: TSP), a new test profile from Parkway Laboratories, added to the portfolio. With a trimester-specific reference period, the new test profile's components are identical to those of the thyroid screen basic profile.

- January 2023-Cipla launched Cippoint, a CE IVD-accredited POCT device that provides healthcare professionals with a handy point-of-care testing device for many non-contagious diseases and infections. It has many parameters to rule the cardiac, diabetes, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers. Cipla, developed in India, is a diagnostic tool that is trusted for its precise tests at a reasonable cost utilizing the immunofluorescence technique. Its automated system (Cippoint) provides an immediate result for Healthcare professionals (2-15 minutes) and smooths the way of clinical decision-making process. The network server is optimized to cater to regions with low connections such as rural, mobile, and remote areas.

- October 2022-Frontier study found that TSH levels increase with obesity in females, with leptin levels being the main metabolic determinant of thyroid function parameters. The pattern of TSH and fT4 levels across different BMI ranges in a large cohort of euthyroid patients with obesity suggests a multifold association between the hypothalamic-pituitary-thyroid axis and body weight. However, the potential mechanisms are incompletely understood, and the small proportion of individuals with obesity in published cohort studies provide limited insights into metabolic correlates of thyroid function in obesity.

- January 2022-Quest Diagnostics began an online preventive care service called QuestDirect™ in collaboration with adults as a way for them to take over their health. The service comprises diagnostic tools, biometric screening, and health risk assessment. It, too, ranks as an educational report on health, including some health tips, and puts forward a one-on-one virtual consultation with a physician. This service is created to ensure users have access to personal health information and preventive care that can be scheduled at a convenient time for each client considering their busy schedules.

Key Market Segments:

By Type

- Thyroid Stimulating Hormone Test

- T4 Tests

- T3 Tests

- Others

By Indication

- Hypothyroidism

- Hyperthyroidism

- Thyroid Cancer

- Others

By End Users

- Hospitals and clinics

- Diagnostic centers

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Spain

- France

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Abbott

- Randox Laboratories Ltd

- bioMérieux SA

- Thermo Fisher

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers

- Qualigen Inc.

- Beckman Coulter, Inc.

- Quidel Corporation

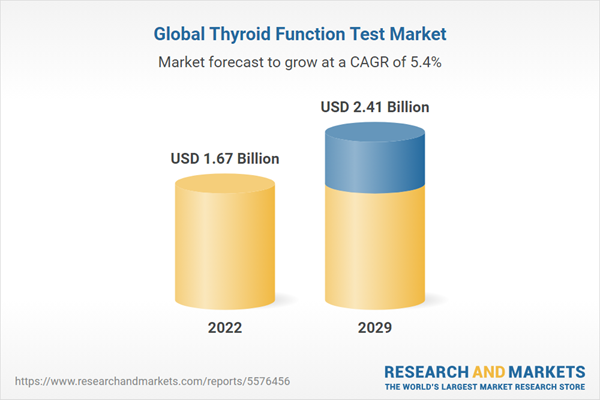

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | April 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 1.67 Billion |

| Forecasted Market Value ( USD | $ 2.41 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |