The packaging, tape, and medical sectors all often utilize solvent-based adhesive tapes because of their great resilience to various environmental variables. The rising demand in emerging markets for adhesives with solvent bases is due to the rising preference for solvent-based adhesives over water-based adhesives, technological developments in adhesive compositions using solvents, and the growth of internet purchasing.

- Rising Industrial Adhesive Sales: The increase in net sales of industrial adhesives and tapes has significantly driven the growth of the solvent-based adhesive tape market. Solvent pressure-sensitive adhesive tapes offer numerous advantages, including reliable performance in both low and high temperatures, strong grip or heat sealing, excellent temperature resistance, superior adhesion to various substrates such as ABS, PVC, PS, PA, and aluminum, and an aggressive bonding capability for joining diverse materials.

- Significant Growth Expected in Europe: Germany's industrial sectors, including manufacturing, automotive, electronics, and construction, are major consumers of adhesive tapes. Solvent-based tapes are preferred for their robust bonding strength and versatility across applications. As these industries expand and the demand for adhesive solutions grows, the solvent-based tape market is poised for growth. For example, Germany's construction sector accounts for approximately 26.7% of the nation's GDP, according to the World Bank. The packaging industry, a key user of adhesive tapes, also relies heavily on solvent-based tapes for their strong adhesion properties. With the surge in e-commerce and the growing need for efficient packaging, the demand for solvent-based tapes in Germany is expected to rise.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

How can the data from this report be utilized?

Industry & Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, and Competitive Intelligence.Report Coverage

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Solvent-Based Adhesive Tape Market Segmentation

Solvent-Based Adhesive Tape Market Segmentation by resin type

The market is analyzed by resin type into the following:- Acrylic

- Rubber

- Silicone

- Others

Solvent-Based Adhesive Tape Market Segmentation by material

The report analyzes the market by material as below:- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

Solvent-Based Adhesive Tape Market Segmentation by end-users industry

The report analyzes the market by end-users industry as below:- Packaging, Consumer, and Office

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

Solvent-Based Adhesive Tape Market Segmentation by regions:

The study also analysed the Solvent-Based Adhesive Tape Market into the following regions, with country level forecasts and analysis as below:- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia-Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Solvent-Based Adhesive Tape Market Report Coverage

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different resin types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by material, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-users industry, with historical revenue data and analysis across various segments.

- Solvent-Based Adhesive Tape Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter's five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

Reasons to Purchase This Report

- The report provides a strategic outlook of the solvent-based adhesive tape market to decision-makers, analysts and other stakeholders in easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for executives to gain valuable insights while skimming through the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% free customization to help cater for additional requirements with significant cost-savings.

Table of Contents

Companies Mentioned

- 3M

- Nitto Denko Corporation

- Tesa SE

- Avery Dennison Corporation

- Intertape Polymer Group Inc.

- LINTEC Corporation

- Berry Global Group, Inc.

- Scapa Group plc

- Lohmann GmbH & Co.KG

- Rogers Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | May 2025 |

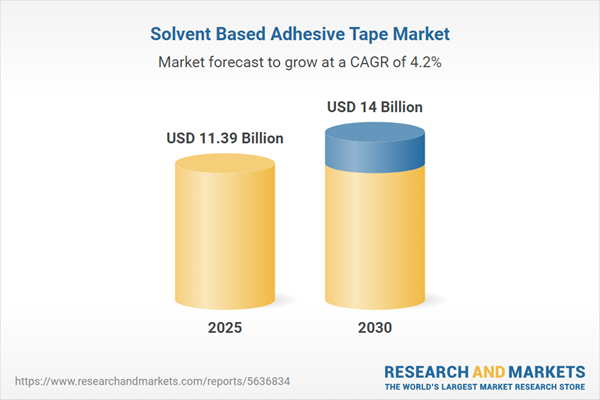

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 11.39 Billion |

| Forecasted Market Value ( USD | $ 14 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |