Non-life insurance premium in Poland is observing continuous growth in Gross written premium, leading to a rise in the market value of P&C insurance as well. As natural calamities are emerging as a major factor in property loss, expenditure on environmental protection in the area is observing a continuous increase. These issues also lead people to buy P&C insurance to safeguard their property against these risks.

With the advent of COVID-19, the number of non-life insurance companies in Poland declined, reaching 29 authorized insurance companies last year, with the number of companies operating in the Insurance market declining to 53. The number of Road accidents killed and casualties in Poland has continuously declined over the years, increasing the revenue generated by the insurance market through these policies.

The GDP of Poland has been observing a continuous increase over the years, with an existing growth rate of 5%. As the different sectors of GDP observe growth, demand for property and casualty insurance is also significantly increasing. In addition to this, growing fintech is also driving the P&C insurance market in Poland with a continuous increase in the value of Asset Under Management.

Poland Property & Casualty Insurance Market Trends

Rising Motor Vehicle Insurance is Driving the Market

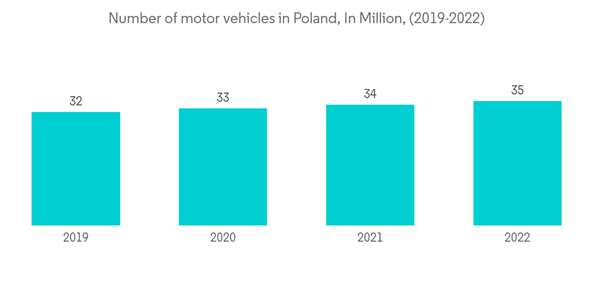

Gross Written Premium of motor insurance in Poland has observed a continuous increase over the years, rising to a value of USD 15 million last year, with the number of motor vehicles in the region observing a continuous increase, rising to 34,080 over previous years, among which passenger cars occupy a major segment.Post-COVID-19, the growth of motor vehicle prices in Poland had moved towards stabilization, making it easier for people to access them and an opportunity for insurers to increase the sale of their motor vehicle insurance. With the availability of online insurance products in Poland, car insurance was the second largest sale in it, driving the motor insurance market.

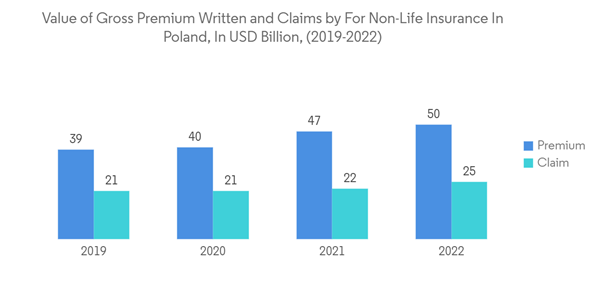

The Increase in Premium for Non-Life Insurance Outpace increase in Claim showing Healthy Market.

Among the personal and property insurance in Poland, motor and property insurance are the segments having the largest gross written premium, with the property claims existing in the insurance market at more than USD 650 Million. The city of Warszawa, Wroclaw, and Gdansk in Poland exists with the largest price of real estate insurance. Last year's increase in non-life insurance claims was 11.6% compared to the previous year.The value of personal and property crime insurance in Poland has continuously risen, existing at USD 91 Million last year. This leads to insurance providers expanding their products with different products based on user requirements. The value of gross premiums written by property insurance companies in Poland rose to USD 2.4 Billion last year, showing a rising P&C insurance market in the region.

Poland Property & Casualty Insurance Industry Overview

The property and casualty insurance market in Poland is highly competitive. A large number of national and international players are operating in the market. Almost 29 non-life insurance companies are operating in the market. Rising fintech and the adoption of digital technology are expanding the reach of P&C insurance in Poland. Some existing players in Poland's P&C insurance market are Allianz, PZU, Ergo Hestia, Uniqua, and Compensa.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- PZU

- ERGO Hestia

- Warta

- Uniqua

- Compensa

- Allianz

- Generali

- InterRisk

- AXA

- Wiener Insurance*