The trend of online insurance buying is observed in Norway. The adoption of electric vehicles is increasing rapidly. Norway's government plans to restrict IC engine vehicle sales from 2025. With growing sales of electric vehicles, significant growth in non-life insurance sales is observed. Electric vehicle insurance is expected to contribute a major share of revenue of non-life insurance major share during the forecast period. Owing dual advantage of securing future uncertain labilities due to accidental events and the investment opportunity unit linked insurance plans getting huge popularity among people in Norway's insurance market.

Key Market Trends

Growing Online Sale of Insurance Policy

In the past few years, consumers' inclination toward buying online insurance increasing rapidly. The online channel observed significant growth in purchasing life and non-life insurance. Growing internet penetration in Norway is supporting the Online growth Sale of Insurance Policies. According to World Bank, 97% of the total population of Norway are internet users in 2020. A consumer can compare plans of different companies on aggregators' websites and choose the best suitable plan for them. Due to this convenient feature, the adoption of online insurance purchasing is increasing. Major players in Life & Non-Life Insurance Market in Norway are providing and working on improving online infrastructure to cater to the demand of online insurance consumers. Many insurance companies in Norway are enabling e-KYC for the convenience of insurance buyers.

Travel and Private Car Insurance are getting lucrative growth opportunity

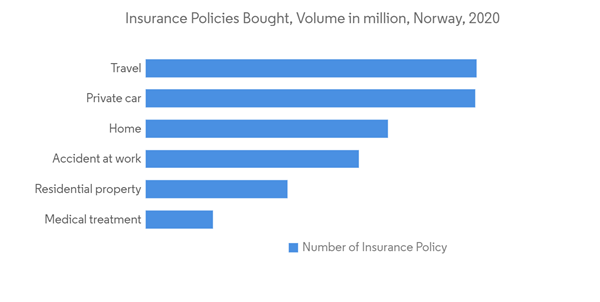

Unfortunate events such as baggage loss, passport loss, a medical emergency, or an accident can affect your travels, whether for business or leisure. Travel insurance protects from an uncertain upcoming situation caused by such events. Hence consumers' inclination toward buying travel insurance is increasing day by day. The sales of 31,88,261 travel insurance policies registered in 2020.

Vehicle sales in Norway are growing steadily. Norway is experiencing a technological shift in the automotive industry. The major share of sales of new vehicles includes electric vehicles. According to Industry Associations, the overall new sales in Norway rose by 25% in 2021 to a record 176,276 cars, of which 65% were fully electric. This market share was up from 54% in 2020. People are opting for private car insurance to protect them from unplanned liabilities caused by accidents. The sales of 31,74,208 travel insurance policies were registered in 2020.

Competitive Landscape

Norway Life & Non-Life Insurance Market is higly competative with presence of local and global players. The market is highly conslidated with top three player holds major share of marketThe report covers the major players operating in the Life and Non-Life insurance market in Norway. KLP, Storebrand Livsforsikring, Nordea Liv, DNB Livsforsikring, SpareBank, Oslo Pensjonsforsikring, Gjensidige Forsikring ASA, Fremtind Forsikring AS, Protector Forsikring ASA, Eika Forsikring AS, DNB Forsikring AS, Frende Skadeforsikring AS are some of the key players operating in Life & Non-Life Insurance Market in Norway.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- KLP

- Storebrand Livsforsikring

- Nordea Liv

- DNB Livsforsikring

- SpareBank

- Oslo Pensjonsforsikring

- Gjensidige Forsikring ASA

- Fremtind Forsikring AS

- Protector Forsikring ASA

- Eika Forsikring AS

- DNB Forsikring AS

- Frende Skadeforsikring AS*