Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is characterized by a variety of insurance products, including trip cancellation, medical coverage, baggage loss, and personal liability. Increasing awareness of travel-related risks, especially following the global pandemic, has led consumers to seek comprehensive insurance solutions that provide peace of mind. Digital transformation is also reshaping the landscape, with more travelers opting to purchase policies online through user-friendly platforms. This shift allows for easier comparison and selection of coverage tailored to individual needs.

Additionally, significant demand arises from the influx of pilgrims during Hajj and Umrah, necessitating specialized travel insurance products. Overall, the Saudi Arabia travel insurance market presents substantial opportunities for growth, innovation, and improved customer experiences as the tourism sector continues to expand. The consolidation of regulatory oversight from two entities to one reflects the country’s commitment to achieving the goals of Saudi Vision 2030 and the Financial Sector Development Program (FSPD). A key component of this initiative is fostering growth and advancing the insurance sector. The Authority has already reported a 14.6% growth in the sector during the third quarter of 2023, and this growth is expected to continue into 2024 as the Authority becomes fully operational and implements a new legal framework.

Key Market Drivers

Increasing Influx of Both Domestic and International Tourists

Saudi Arabia’s tourism sector is witnessing rapid growth in 2024, with inbound international visitors reaching around 30 million - a 9.5% increase from the previous year. This surge is driven by strategic efforts to promote non-religious tourism, significantly boosting the country’s economy and global image. International tourist arrivals rose by 73%, while tourism revenues soared by 207%, positioning Saudi Arabia as a leading tourism market globally. On the outbound front, Saudi travelers spent approximately $103.8 billion abroad in 2024, marking an 18% rise from 2023. This growth reflects increased global mobility and interest in international travel among Saudi citizens.The outbound tourism market is projected to reach USD25.49 billion by 2027, growing at over 15% annually. Overall, both inbound and outbound tourism underscore Saudi Arabia’s expanding role as a global tourism hub and its economic diversification efforts. The increasing influx of both domestic and international tourists is a significant driver of the Saudi Arabia travel insurance market. With the government’s Vision 2030 initiative, aimed at diversifying the economy and reducing dependence on oil, there has been a concerted effort to promote tourism. Major investments in infrastructure, such as airports, hotels, and attractions, have made the Kingdom more accessible to travelers.

Events like the Hajj and Umrah pilgrimage attract millions of visitors annually, creating a high demand for travel insurance tailored to this unique demographic. Pilgrims often require specific coverage for medical emergencies and travel disruptions, which insurers are now beginning to provide. Additionally, cultural and entertainment events, like the Riyadh Season, are attracting more tourists, further boosting the need for comprehensive travel insurance. As more people travel to Saudi Arabia for both leisure and religious purposes, the demand for protection against unforeseen events, such as health issues or trip cancellations, will continue to grow, making tourism a key driver in this market.

Key Market Challenges

Low Consumer Awareness

One of the major challenges facing the Saudi Arabia travel insurance market is low consumer awareness regarding the importance and benefits of travel insurance. Many travelers remain uninformed about the potential risks associated with travel, such as medical emergencies, trip cancellations, or lost baggage. This lack of awareness can lead to underinsurance or a complete absence of coverage, leaving travelers vulnerable to significant financial losses. Efforts to educate consumers about travel insurance are still in their infancy, and misconceptions often persist. Some travelers may view insurance as an unnecessary expense rather than a vital safety net.Additionally, cultural attitudes toward insurance in general can hinder the perceived value of travel insurance. This gap in understanding creates a challenge for insurers who need to market their products effectively. To address this issue, companies must invest in educational campaigns that highlight the risks of travel and the benefits of coverage, targeting both local and international travelers. Increased awareness is crucial for expanding the market, as informed consumers are more likely to seek out and purchase travel insurance.

Key Market Trends

Digital Transformation

Digital transformation is revolutionizing the Saudi Arabia travel insurance market, driving increased accessibility and customer convenience. In 2024, over 70% of travel insurance policies were purchased online through mobile apps and digital platforms, reflecting a significant shift from traditional offline channels. Insurers are increasingly investing in user-friendly digital platforms that allow travelers to compare policies, obtain quotes, and purchase coverage with ease. Mobile applications and websites are being enhanced to facilitate instant access to information, making it more convenient for travelers to secure the protection they need.Additionally, the integration of artificial intelligence and data analytics is enabling insurers to offer personalized products based on individual travel habits and preferences. This technological advancement not only improves customer engagement but also streamlines the claims process, making it faster and more efficient. Insurers can leverage data to assess risks more accurately, leading to better pricing strategies. As digital channels become more popular, traditional distribution methods are being supplemented or replaced, pushing the industry toward a more tech-driven future.

Key Market Players

- Tawuniya Insurance Company

- Al-Rajhi Company for Cooperative Insurance

- Walaa Cooperative Insurance Company

- Allianz Saudi Fransi Cooperative Insurance Company

- Gulf Insurance Group (GIG)

- Arabian Shield Cooperative Insurance Company

- Gulf General Cooperative Insurance Company

- LIVA Insurance Company

- SALAMA Cooperative Insurance Company

- AL-Etihad Cooperative Insurance Company

Report Scope:

In this report, the Saudi Arabia Travel Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below::Saudi Arabia Travel Insurance Market, By Trip Type:

- Domestic

- Outbound

- Hajj and Umrah

- Inbound

Saudi Arabia Travel Insurance Market, By Mode Of Purchase:

- Airline

- Banks

- Online Travel Agencies

- Offline Travel Agencies

- Others

Saudi Arabia Travel Insurance Market, By Traveler Type:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Independent Travelers

Saudi Arabia Travel Insurance Market, By Mode of Payment:

- Card Payments

- E-Wallets

- Bank Transfers

- Other Online Payment

Saudi Arabia Travel Insurance Market, By Region:

- Northern & Central

- Western

- Southern

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Travel Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tawuniya Insurance Company

- Al-Rajhi Company for Cooperative Insurance

- Walaa Cooperative Insurance Company

- Allianz Saudi Fransi Cooperative Insurance Company

- Gulf Insurance Group (GIG)

- Arabian Shield Cooperative Insurance Company

- Gulf General Cooperative Insurance Company

- LIVA Insurance Company

- SALAMA Cooperative Insurance Company

- AL-Etihad Cooperative Insurance Company

Table Information

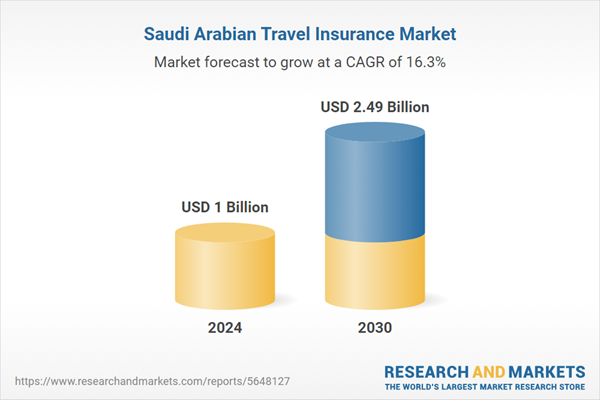

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 2.49 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |