Oral irrigators have high patient satisfaction and are simple to use as part of a regular daily oral hygiene practice since they are convenient. Aiming the irrigator tip at the tooth surface, it is left on each surface for a brief period of time. To ensure that no teeth are missed, this procedure is carried out again for each tooth, taking the same path. While other remedies can be employed, water alone is the most frequently advised because it is the most affordable and readily accessible. Also, it has no negative side effects and is supported by scientific research. Oral irrigators are being used more nowadays as more people witness dental problems.

In addition, oral irrigators, sometimes known as water flossers, were already accessible for use at home. The appliance often resembles a power toothbrush in size, and the wand portion of it has a unique tip that sends water directly to the spaces between teeth and gums, cleaning out debris. These water flossers can be helpful for persons who have implants or braces and have trouble flossing because they come with multiple tips to address different tooth concerns.

COVID-19 Impact Analysis

To address oral and orthodontic health issues even during the COVID-19 pandemic while reducing virus transmission, teledentistry has significantly increased in use in pediatric dentistry, orthodontics, oral medicine, and periodontics. Regardless of these adaptations, the pandemic also induced many cancellations and postponements of appointments. Regular dental operations such as cleaning, polishing, and whitening necessitated the reopening of dental institutions with higher standards. One study also claimed that the increased standard would raise the overall cost of dental care. Therefore, it is seen that the pandemic had a negative impact on the oral irrigator market.Market Growth Factors

An effective and accessible option for flossing

The population's growing worries about maintaining good dental hygiene and improved oral health are becoming a significant role in the current situation. This is because consumers are becoming more and more aware of the product's advantages and benefits on a daily basis, which boosts demand for oral irrigators. The frequency of periodontal disorders is rising internationally, as reported by the International Journal of Health Sciences. The rising frequency of periodontal conditions including gingivitis and periodontitis as well as other widespread conditions like dental plaque and decay would lead to more dentists prescribing oral irrigators for improved flossing.Aids in controlling and preventing gum diseases

Oral irrigators are occasionally used by dentists in the office to help treat gum disease since individuals with the condition may have a separation between their dentures and gum tissue due to inflammation brought on by dangerous bacteria. Due to this lack of connection, concentrated biofilm gathers in pockets between the gums and teeth, and this plaque builds up on the surfaces of the tooth roots. If not removed in a timely manner, this buildup can cause inflammation and even infection and eventually deteriorate the bone that supports the teeth. Because such serious forms of periodontal disease might result in loose teeth or perhaps even tooth loss, effective brushing and flossing techniques are crucial. This is an important factor that helps in the expansion of the oral irrigator market.Market Restraining Factors

Lack of supporting claims for better efficiency of oral irrigators

Some studies have revealed that there isn't much of a difference in the efficiency of plaque removal between string floss and an oral irrigator. Remarkably, a lot of dentists think that using an oral irrigator alone is insufficient to stop periodontal disease and cavities. Oral irrigators are merely a supplement to brushing and flossing. The spaces between teeth might still become infected with cavities if one solely uses oral irrigators and doesn't floss. Flossing is necessary to break up the contact between teeth. These factors prevent the expansion of the oral irrigator market and limit its chances of betterment.Product Type Outlook

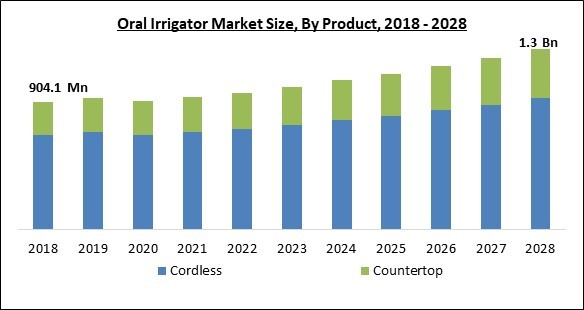

Based on the product type, the oral irrigator market is bifurcated into countertop and cordless. The cordless segment acquired the highest revenue share in the oral irrigator market in 2021. It is a battery-powered device that aids in clearing gums of debris and bacteria. It is a widely used tool for home care because it is portable and simple to use. Additionally, it is less expensive and simpler to transport than the countertop version.Application Outlook

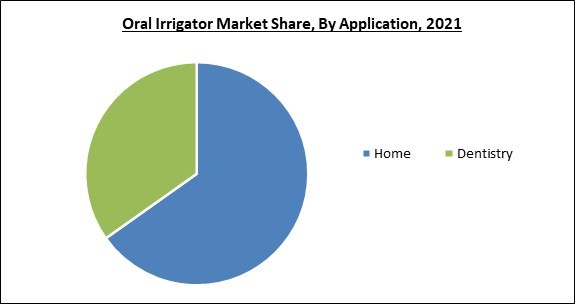

On the basis of application, the oral irrigator market is fragmented into dentistry and home. The dentistry segment procured a substantial revenue use in the oral irrigator market in 2021. This can be attributed to the increased frequency of periodontal diseases among a substantial population, especially in developing economies. The oral irrigator has a range of nozzle sizes that enable the dentist to thoroughly clean gingival crevices and tooth surfaces. The water reservoir of the oral irrigator is used to clear away material from the surface of the tooth.Distribution Channel Outlook

Based on distribution channel, the oral irrigator market is divided into online and offline. The online segment recorded the maximum revenue share in the oral irrigator market in 2021. The pandemic caused consumers to reevaluate their priorities in life, which resulted in the creation of new requirements for values and spending. Due to a greater dependence on technology, performance specifications, and the electronic payments sector, consumer behavior is evolving away from traditional methods.Regional Outlook

On the basis of region, the oral irrigator market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region garnered the highest revenue share in the oral irrigator market in 2021. This is brought on by a rise in the number of periodontal disease cases. Poor dietary habits, especially a high intake of sugary foods, may be to blame for this. An increase in dental clinics and specialists have also been observed in the region. The usage of oral irrigators is expanding as a result of the adoption of cutting-edge technologies, rising medical tourism in the region, and raising oral hygiene awareness.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Procter & Gamble Company, Church & Dwight Co., Inc., Koninklijke Philips N.V., Panasonic Corporation, JETPIK Corporation, Newell Brands, Inc. (Conair Corporation), Hydro Floss, The Colgate-Palmolive Company, GlaxoSmithKline PLC, and Johnson & Johnson.

Strategies deployed in oral-irrigator-market

- Sep-2022: Church & Dwight acquired Hero, the makers of Mighty Patch, the US’ top-selling acne patch brand. From this acquisition, Church & Dwight would establish foot in the anti-blemish solutions market. Additionally, through the success of acne patches as a convenient form of acne treatment, Hero garnered net sales for the 12 months to 30 June 2022 of approximately $115m.

- Aug-2022: Procter & Gamble partnered with the International Association of Disability and Oral Health (iADH), an international network of people who are concerned about those with disabilities and disadvantages. Under this partnership, Oral-B and iADH jointly created a ‘Positive Practices’ training program which aimed to train and educate dental practitioners on how to appear more confident and inclusive when it comes to patients.

- May-2022: Oral-B introduced Oral-B iO10 with iOSense, its latest technological innovation. The Oral-B iO is believed to provide an intense clean of teeth and gums when compared to a manual toothbrush. Now with iOSense, the brushing experience has transformed the relationship with oral health.

- Feb-2022: Philips unveiled a new cordless power flosser. The power flosser is designed with the 'power of X', delivering an X-shaped water stream for effective cleaning. The flosser allows users to get a consistent and easy flossing routine which is guaranteed to better gum health in just six weeks.

- Feb-2022: Johnson & Johnson Medical Devices Companies and DePuy Synthes acquired CrossRoads Extremity Systems, a Tennessee-based foot, and ankle company. Through this acquisition, Johnson & Johnson grabbed the opportunity to expedite innovation by strengthening its offerings for elective foot and ankle procedures. The acquisition aimed to enable Johnson & Johnson to deliver more elaborate and latest options to surgeons and patients.

- Dec-2021: DePuy Synthes, Johnson & Johnson's medical devices company took over OrthoSpin, an Israeli developer of a robot-assisted external fixation system for orthopedic treatments. Under this acquisition, Johnson & Johnson jointly delivered an automated strut system by OrthoSpin with MAXFRAME, a multi-axial correction system consisting of an external ring fixation, provided by Johnson & Johnson. The acquisition of OrthoSpin presented a strong desire of Johnson & Johnson to help patients get through their recovery with less uncertainty and more belief in their strut adjustments.

- Dec-2021: Church & Dwight took over TheraBreath, a brand in the alcohol-free mouthwash category in the United States. From this acquisition, Church and Dwight earned a strong position in the rising category of alcohol-free mouthwash. Additionally, the brand TheraBreath focused more on younger consumers and consistently possess a high brand loyalty and repeat purchase.

- Oct-2019: Oral-B launched GENIUS X. The product is made with modern-day requirements in mind, and comes with a sleek travel case that charges both the brush and any USB device like a smartphone. Oral B has brought oral care at homes to new heights with this product's launch.

Scope of the Study

Market Segments Covered in the Report:

By Product

- Cordless

- Countertop

By Application

- Home

- Dentistry

By Distribution Channel

- Online

- Offline

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Procter & Gamble Company

- Church & Dwight Co., Inc.

- Koninklijke Philips N.V.

- Panasonic Corporation

- JETPIK Corporation

- Newell Brands, Inc. (Conair Corporation)

- Hydro Floss

- The Colgate-Palmolive Company

- GlaxoSmithKline PLC

- Johnson & Johnson

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Procter & Gamble Company

- Church & Dwight Co., Inc.

- Koninklijke Philips N.V.

- Panasonic Corporation

- JETPIK Corporation

- Newell Brands, Inc. (Conair Corporation)

- Hydro Floss

- The Colgate-Palmolive Company

- GlaxoSmithKline PLC

- Johnson & Johnson