Speak directly to the analyst to clarify any post sales queries you may have.

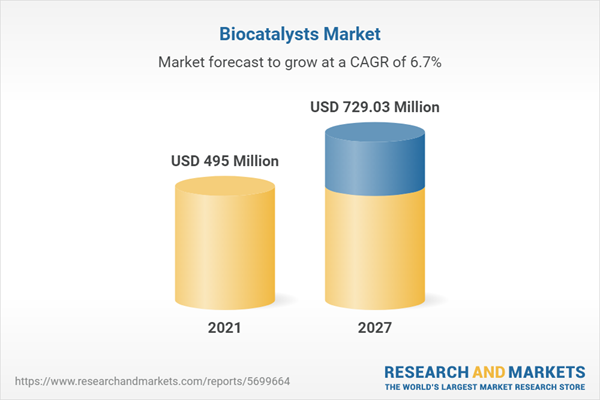

Increasing demand for biobased products drives the biocatalysts market. Due to emerging technology, sustainability is growing all over the world. In the pharmaceutical industry, companies have started using biobased drugs to improve the quality of products, making the pharmaceutical biocatalysts market grow rapidly. Thus, top companies follow the expansion strategy for acquiring a greater biocatalysts market share. The food & beverages industry is rising due to the increasing consumption of food & beverages, thus increasing the demand for biocatalysts in the global industry.

MARKET TRENDS & DRIVERS

Increase in Food Consumption Due to Growth in Population

- The food industry includes four major sectors - producers, marketers, processors, and farm services. During the Covid 19, the demand for food supplies increased, resulting in the food industry's growth. Enzymes are used in the food industry as a preservative, the best substitute for chemical preservatives. They improve the quality of products such as starch, fruit juices, cheese, animal feed, and beer & wine. From the application perspective, the demand for animal feed is increasing due to higher poultry, meat, and dairy consumption.

Increasing Demand from Pharmaceutical Industry

- The pharmaceutical industry’s revenue is increasing yearly due to increasing demand for the drugs used for manufacturing pharmaceutical products. In past years, the Chinese pharma industry has been on the top in terms of growth rate. The consumption of pharmaceutical products is growing due to changes in clinical practices and increasing chronic and aging-related issues.

- The lowering of regulatory barriers for new drugs in the US causes an increased demand for pharma sector products globally. During the Covid-19 pandemic, the highest demand for pharmaceutical products was observed. The demand for new drugs is still high owing to the recurrence of new variants of Covid-19 in various countries. The demand for pharmaceutical products is also increasing in developing countries such as India, China, and Brazil, among others owing to the emergence of Covid-19 variants, lifestyle diseases, and an aging population. Biocatalysts are used in the manufacturing processes of antibiotics to treat such diseases. And with a growing global pharmaceutical industry, the biocatalysts market is also growing.

MARKET RESTRAINT

Technical Barriers Affecting Industry

Biocatalysis is a process that accelerates the chemical process by using biomolecules. It includes mild reaction and high selectivity conditions. Therefore, biocatalysts play an important role in the chemical industry and are gaining relevance in industrial applications. But, there is difficulty in finding the accurate protein structure of biocatalysts. The process is time-consuming and requires more catalysts to fulfilling the chemical reaction process. For the biocatalysts manufacturing process, specific conditions such as new substrate, new concentration, and other conditions are required which are not found easily in nature. Thus, increasing the cost of producing the biocatalysts.SEGMENTATION ANALYSIS

INSIGHTS BY TYPE

- Carbohydrases is the largest segment by type in the global biocatalysts market and is expected to reach USD 231.03 million by 2027. Carbohydrases are mainly used in the food industry as biocatalysts. Most of these biocatalysts used in the food industry are produced from fungi, yeast, and bacteria. Carbohydrases are used in milk products as digestion agents to reduce milk lactose. These are further classified into alpha, beta amylases, cellulases, glucosidase, pectinases, mannanases, galacto, and pullulanase.

- The global proteases-based biocatalysts market was valued at USD 134.40 million in 2021 and is the second largest industry by type segment. The proteases are used in the cleaning, leather, and dairy industries. Based on the catalysis mechanism, the proteases are classified into further classes glutamic, aspartic, metalloproteases, threonine, cysteine, and serine proteases which activate the water molecule and attack the proteins.

- Lipases are used in the catalysis of fats, which helps reduce their food content. These are derived from animal and plant enzymes used in various biological processes, which are used for inflammation, diet, and increasing metabolism. The lipases segment is expected to grow at a CAGR of 5.49% during the forecast period. These are used in esters and have high scope in biofuels. The increased demand for biofuels is due to the increasing prices of crude oil, which further increases the demand for lipases in the biocatalysts markets.

Segmentation by Type

- Carbohydrases

- Proteases

- Polymerases & Nucleases

- Lipases

- Phytases

- Other

INSIGHTS BY END-USE

- The global biocatalysts market by end-use is categorized as pharmaceutical, food & beverages, animal nutrition, household, and others. The pharmaceutical is the largest segment by end-use and is expected to cross USD 215.42 million by 2027. Due to growth in the global population, the demand for pharmaceutical products is increasing. Due to which people are becoming more health conscious, pharmaceutical companies are focusing on increasing the bio-based content in drug formulations. In the pharmaceutical industry, biocatalysts are used for molecular biology, extraction of medically important compounds, diagnostic procedures, chemical pharmaceutical manufacturing, and deficiencies supplements.

- The food & beverages segment is growing with a CAGR of 6.31 % during the forecast period and is the second largest segment by end-use. Biocatalysts have been used for hundreds of years in the food & beverages industry. Commercial biocatalysts are produced from microbial, plants, and animals. There is a massive demand for bakery biocatalysts in the industry for extending shelf life, mainly in Europe and North America. Biocatalyst manufacturing companies are developing new designs to improve bakery food quality.

Segmentation by End Use

- Pharmaceutical

- Food & Beverages

- Animal Nutrition

- Household

- Others

GEOGRAPHICAL ANALYSIS

North America dominates the global biocatalysts market and is expected to grow at a CAGR of 6.27% during the forecast period. The region is the leading market for biocatalysts because of its rapidly developing infrastructure, readily increasing population, and growing demand from various industries such as food & beverage, pharmaceutical, animal nutrition, and household. The US and Canada are the two major countries dominating North America’s biocatalyst market. The demand for biocatalysts in North America's pharmaceutical industry is increasing with the rise in pharma products and the presence of the world-leading ten pharmaceutical companies in the US.APAC biocatalysts market is the second largest industry globally and is expected to grow the highest CAGR during the forecast period. With the changing technology & innovations in food & beverages, the demand for biocatalysts is increasing. Increasing health expenditure, increasing health consciousness, increasing new diseases, and others are the key factors for the growing pharmaceutical market, further contributing to the Asia Pacific industry.

Germany, Italy, France, and Spain are the major countries in the European biocatalyst market. The increasing consumption of biocatalysts is attributed to the rising per capita income in European countries. High spending on healthy food, attributed to people's health-conscious habits, and growing demand for food & beverages biocatalysts are significant market drivers in Europe.

Segmentation by Geography

- APAC

- China

- India

- Japan

- South Korea

- Rest of APAC

- North America

- US

- Canada

- Europe

- Germany

- Spain

- France

- Italy

- Rest of Europe

- Latin America

- Brazil

- Mexico

- Rest Of Latin America

- Middle East & Africa

- South Africa

- South Arabia

- Rest of the Middle East & Africa

VENDOR LANDSCAPE

Some key players in the global biocatalysts market include DuPont (U.S.), AB Enzymes (Germany), BASF SE (Germany), Novozymes (Denmark), and DSM (Netherlands). These players have adopted strategies such as expansion, acquisitions, new product development, joint ventures, and others to increase their revenues in the biocatalysts market. Furthermore, other prominent companies such as Amano Enzymes (Japan), Dyadic International (U.S.), Codexis (U.S.), and others have invested considerable capital in R&D to develop biocatalysts-based products that will appeal to the customers. Therefore, these other prominent companies are giving tough competition to major companies.The major companies follow a merger and acquisition strategy, giving them a competitive advantage to boost their market share. The key vendors have undertaken various strategies to grow in the global biocatalysts market. The growth in sustainable processes and innovations has challenged all companies globally. Investments in R&D, technological advancement, and environmental and economic challenges drive the demand for innovative and sustainable biocatalysts products.

Key Vendors

- DuPont

- BASF SE

- DSM

- AB Enzymes

- Novozymes

Other Prominent Vendors

- Chr Hansen Holding A/S

- Codexis

- Dyadic International Inc.

- Amano Enzymes

- Biocatalysts

- Nature Bioscience Pvt Ltd.

- Johnson Matthey

- Advanced Enzymes Technologies

- Zymtronix, Inc.

- Nutritech

- Hoffmann-La Roche Ltd (Roche CustomBiotech)

- Aumenzymes

- The Soufflet Group

- Iosynth

Key Developments In The Global Biocatalysts Market:

- In 2021 Novozymes bought majority stakes in the Mumbai (India) based Synergia Life Sciences company, a global leader in the microbiome therapeutic and vitamin k2-7 manufacturer and supplier.

- DSM acquired the U.S.-based First Choice Ingredients company, a manufacturer of dairy-based flavorings. This deal gives the company fermentation and biotechnology solutions.

KEY QUESTIONS ANSWERED

1. What is the revenue from the global biocatalysts market?2. What is the growth rate of the biocatalysts market?

3. Who are the key players in the global biocatalysts market?

4. What is the projected biocatalysts market by 2027?

5. What are the key driving factors in the global biocatalysts market?

6. Which region dominates the global biocatalysts Market?

Table of Contents

Companies Mentioned

- DuPont

- BASF SE

- DSM

- AB Enzymes

- Novozymes

- Chr Hansen Holding A/S

- Codexis

- Dyadic International Inc.

- Amano Enzymes

- Biocatalysts

- Nature Bioscience Pvt Ltd.

- Johnson Matthey

- Advanced Enzymes Technologies

- Zymtronix, Inc.

- Nutritech

- Hoffmann-La Roche Ltd (Roche CustomBiotech)

- Aumenzymes

- The Soufflet Group

- Iosynth

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 238 |

| Published | December 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 495 Million |

| Forecasted Market Value ( USD | $ 729.03 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |