Speak directly to the analyst to clarify any post sales queries you may have.

- Specialty enzymes are used in various industries for various purposes. In the pharmaceutical industry, these are used for manufacturing drugs for DNA/RNA treatment, cancer, heart-related disease, and other treatments. The demand is increasing due to increasing awareness and changing government policies. With the growing specialty enzymes markets, companies must increase the supply of raw materials to produce enzymes in bulk quantities. In the pharmaceutical industry, companies have started using biobased drugs to improve product quality. Companies are adopting sustainable standards in their manufacturing processes. The specialty enzymes market has helped to reduce the by-products in the production process. Companies are getting good financial returns by using specialty enzymes in the production processes. Thus, the global demand for specialty enzymes is increasing.

- The US contributed more than half of the overall demand in North America. Globally, the demand for specialty enzymes is very high in the US, and North America dominates the global specialty enzymes market. The US has the world’s top 10 pharmaceutical companies’ head offices. Thus, the demand for specialty enzymes in North America's pharmaceutical industry is increasing with the growing pharmaceutical industry.

MARKET TRENDS & DRIVERS

Increased Use in Diagnostics Sector

- The diagnostics industry includes two categories such as pathology and radiology. Pathology is used for testing all types of illness, whereas radiology is used for testing images related to diagnoses such as x-rays, CT scans, and others. For the research & development of vaccines for various infectious diseases, enzymes are used. Enzymes are used in testing infectious diseases such as coronaviruses and influenza and are also used in nucleic acid detection. The enzymes are used in the diagnostics and analysis of biological abnormalities.

- The diagnostics segment plays a crucial role in the healthcare sector. After the Covid-19 pandemic, the demand for proper diagnostic equipment and processes in the diagnostics sector is growing rapidly. In the testing of coronaviruses and other infectious diseases, enzymes are used. For immediate recovery from coronavirus diseases, antibiotics are used, which are produced from enzymes. Thus, the specialty enzymes market in the diagnostic sector is increasing globally.

Increasing Demand from Pharmaceutical Industry

- The global revenue of the pharmaceutical industry is increasing due to the global demand for pharmaceutical products. The factors driving the demand for pharmaceutical products include changing clinical practices, aging-related issues, and rising chronic diseases. After the Covid-19 pandemic, the demand for pharmaceutical products used to improve quality of life and preventive approach. The global market of pharmaceutical drugs is increasing due to the lowering the regulatory barrier for new drugs in the US.

- The health consciousness of people has increased after the Covid-19 pandemic. People prefer bio-based pharmaceutical products. Thus, the demand for bio-based substances used in manufacturing antibiotics is rising. Specialty enzymes are used in the pharmaceutical industry to increase the reaction rate and produce the desired molecules, contributing to the specialty enzymes market growth.

INDUSTRY RESTRAINTS

Technical Barriers Affecting Specialty Enzymes Market

- Biocatalysis is a process that accelerates the chemical process by using biomolecules. It includes mild reaction and high selectivity conditions. Therefore, specialty enzymes play an essential role in the chemical industry and are gaining relevance in industrial applications. But, there is difficulty in finding the accurate protein structure of specialty enzymes. The process is time-consuming and requires more catalysts to fulfilling the need of the chemical reaction process. For the manufacturing process of these enzymes, specific conditions such as new concentration, new substrate, and other conditions are required which are not found readily in nature. These unresolved challenges make specialty enzymes unpredictive. Thus, more research & development is necessary for making enzymes in bulk amounts, creating a barrier to the specialty enzymes market growth.

SEGMENTATION INSIGHTS

INSIGHTS BY END-USE

In the pharmaceutical industry, specialty enzymes are very useful and good for treating various diseases. As there is increasing demand for pharmaceutical products, the enzyme has become essential to meet the demand for sustainable and safe industry processes. The specialty enzymes are primarily used in the pharmaceutical and biotechnology industry for research & development and diagnostics. The global specialty enzymes market in the pharmaceutical industry was valued at USD 976.56 million in 2021. The demand for specialty enzymes in North America and APAC is very high due to the increasing pharmaceutical and biotechnology industry.In the biotechnology industry, specialty enzymes are used to increase biochemical reaction rates. Lipases are used in dietary drugs and it is used to increase the metabolism rate. Polymerases & nucleases are used in DNA amplification. In DNA amplification, the increase in the number of the gene causes an increase in proteins and RNA. Thus, it may increase the cancer cells or lower the anticancer cells. Hence, the polymerases & nucleases-based enzymes demand is growing in the global specialty enzymes market.

Segmentation by End Use

- Pharmaceutical

- Biotechnology

- Diagnostics

- Other Specialty

INSIGHTS BY TYPE

Carbohydrases have dominated the global specialty enzymes market and is expected to reach USD 1.9 billion by 2027. Carbohydrases are mainly used in the pharmaceutical industry as specialty enzymes. Most of these enzymes used in the pharmaceutical industry are produced from microorganisms, animals, and plants. Carbohydrases are further classified into glucosidase, pectinases, alpha, beta amylases, cellulases, mannanases, galacto, and pullulanase. These are the cost-effective processes in industrial applications; thus, a cheap technique is required to obstruct.The global proteases-based specialty enzymes market surpassed USD813 million in 2021. The proteases are used in the biotechnology, pharmaceutical, and diagnostics industries - the high use of proteases in the pharmaceutical industry for prognostic and diagnostic biomarkers. Based on the catalysis mechanism, the proteases are classified into additional classes, such as glutamic, aspartic, metalloproteases, threonine, cysteine, and serine proteases which activate the water molecule and attack the proteins.

Segmentation by Type

- Carbohydrase

- Proteases

- Lipases

- Polymerases & nucleases

INSIGHTS BY SOURCE

Globally, microorganisms-based enzymes contributed 77.47%, followed by animal and plant-based enzymes in 2021 in the global specialty enzymes market. The demand for specialty enzymes is very high in North America, followed by Europe and APAC. Microorganisms and plant-based enzymes are easily found in the environment. Animal-based enzymes have fewer resources, and it isn't easy to produce in bulk quantities. Thus, companies are focusing on producing enzymes from microorganisms and plants.The global plants-based specialty enzymes market was valued at USD 297.07 million in 2021. These are used in the agriculture industry to reduce insects from crops. The few plant-based enzymes are phosphatase, esterase, glucanase, chitinase, and others. These enzymes play a crucial role in the production of nutrition. Further, plant-based enzymes are being used to manufacture drugs in the pharmaceutical industry to improve the digestive system.

Segmentation by Source

- Microorganisms

- Plants

- Animal

GEOGRAPHICAL ANALYSIS

The global specialty enzymes market is diverse, with many established and potential growth markets. North America is the leading market because of rapidly developing infrastructure and readily increasing population, increasing demand for various pharmaceutical, biotechnology, and diagnostics industries. The specialty enzymes market in North America was valued at USD 1.2 billion in 2021.Europe is the second-largest market for specialty enzymes. The growth is supported by the increasing demand for healthy pharmaceutical products, which is attributed to the rising health consciousness. Germany, France, Italy, Spain, the UK, Russia, and others led the region. In European countries, various companies are producing specialty enzymes that contribute to the global specialty enzymes market, such as BASF SE (Germany), Johnson Matthey (UK), Biocatalysts (UK), BBI Solutions (UK), and others. Furthermore, the demand is expected to grow significantly as the APAC region population has grown tremendously in recent years. China, Japan, India, and South Korea led the region. The population of APAC countries is increasing rapidly; thus, demand for pharmaceutical and diagnostics specialty enzymes is increasing. China, India, and Japan are the major pharmaceutical industry players in the APAC region.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Rest of Europe

- APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

COMPETITIVE LANDSCAPE

The major companies in the specialty enzymes market are following the merger and acquisition strategy. This gives companies a competitive advantage that boosts their market share of the company. The key companies have undertaken various strategies to grow in the market. The growth in sustainable processes and initiatives has challenged all companies globally. Investments in R&D, technological advancement, and environmental and economic challenges drive the demand for innovative and sustainable specialty enzyme products.Some major players in the global specialty enzymes market include Roche (Switzerland), BASF SE (Germany), DuPont (US), Novozymes (Denmark), and DSM (Netherlands). These players have adopted strategies like acquisitions, expansion, joint ventures, new product development, and others to increase their revenues in the industry. Other prominent companies such as Chr. Hansen Holding A/S (Denmark), Codexis (US), BBI Solutions (UK), and others have invested significant capital in R&D to develop specialty enzymes-based products that will appeal to customers. Therefore, these other prominent companies are giving tough competition to major companies.

Key Vendors

- BASF SE

- DSM

- DuPont

- F. Hoffmann-La Roche Ltd

- Novozymes

Other Prominent Vendors

- Amano Enzyme Inc.

- Amayra Biotech AG

- Antozyme Biotech Pvt Ltd

- Aumgene Biosciences

- Aumenzymes

- BBI Solutions

- Biocatalysts

- Codexis

- Hansen Holding A/S

- Dyadic International Inc.

- Iosynth

- Merck KGaA

- Nature Bioscience Pvt. Ltd.

- Specialty Enzymes & Probiotics

- Zymtronix Inc.

KEY QUESTIONS ANSWERED

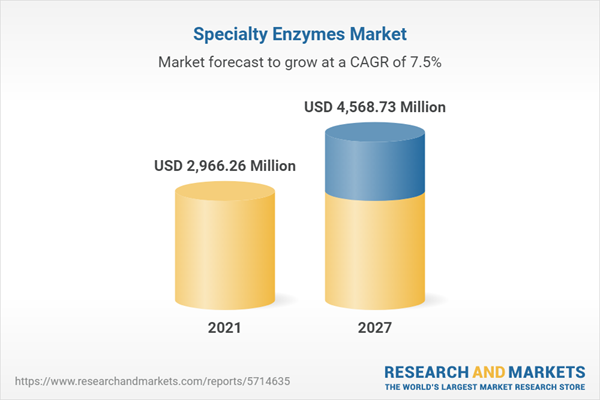

1. What was the global specialty enzymes market size in 2021?2. What is the growth rate of the global specialty enzymes market?

3. What are the key trends in the Specialty Enzymes Market in the world?

4. Which are the key companies in the global specialty enzymes market?

5. Which end-use segment is estimated to lead the Global Specialty Enzymes Market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

6.1 Introduction

6.2 Market Synopsis

6.2.1 Drivers

6.2.2 Opportunity

6.2.3 Challenges

6.3 Segment Review

6.3.1 End-Use

6.3.2 Type

6.3.3 Source

6.3.4 Geography

6.4 Companies & Strategies

7 Market at a Glance

8 Introduction

8.1 Overview

8.2 Value Chain Analysis

8.2.1 Raw Materials

8.2.2 Specialty Enzyme Manufacturers

8.2.3 Distributors

8.2.4 Applications

8.3 Macroeconomic Factors

8.3.1 Pharmaceutical Industry

9 Market Opportunities & Trends

9.1 Demand from Pharmaceutical Industry

9.2 Adoption of Sustainability Standards to Improve Profitability & Productivity

9.3 Demand from Emerging Economies

10 Market Growth Enablers

10.1 Demand for Bio-Sourced Products

10.2 Increased Use in Diagnostics Sector

10.3 Increased R&D & Product Innovation in Developed Countries

11 Market Restraints

11.1 Lack of Awareness of Bio-Based Products

11.2 Existence of Various Technical Barriers

11.3 High Manufacturing Cost

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 by Type

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Carbohydrases

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Proteases

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Lipases

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.6 Polymerases & Nucleases

13.6.1 Market Overview

13.6.2 Market Size & Forecast

13.6.3 Market by Geography

13.7 Other

13.7.1 Market Overview

13.7.2 Market Size & Forecast

13.7.3 Market by Geography

14 by End-Use

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Pharmaceutical

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Biotechnology

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

14.5 Diagnostics

14.5.1 Market Overview

14.5.2 Market Size & Forecast

14.5.3 Market by Geography

14.6 Other End-Use

14.6.1 Market Overview

14.6.2 Market Size & Forecast

14.6.3 Market by Geography

15 by Source

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 Microorganism

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Market by Geography

15.4 Plant

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

15.5 Animal

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

16 Geography

16.1 Market Snapshot & Growth Engine

16.2 Geographic Overview

17 North America

17.1 Market Overview

17.2 Market Size & Forecast

17.3 Type

17.3.1 Market Size & Forecast

17.4 End-Use

17.4.1 Market Size & Forecast

17.5 Source

17.5.1 Market Size & Forecast

17.6 Key Countries

17.7 US

17.7.1 Market Size & Forecast

17.8 Canada

17.8.1 Market Size & Forecast

18 Europe

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Type

18.3.1 Market Size & Forecast

18.4 End-Use

18.4.1 Market Size & Forecast

18.5 Source

18.5.1 Market Size & Forecast

18.6 Key Countries

18.7 Germany

18.7.1 Market Size & Forecast

18.8 France

18.8.1 Market Size & Forecast

18.9 Italy

18.9.1 Market Size & Forecast

18.10 Spain

18.10.1 Market Size & Forecast

18.11 UK

18.11.1 Market Size & Forecast

18.12 Russia

18.12.1 Market Size & Forecast

18.13 Rest of Europe

18.13.1 Market Size & Forecast

19 Apac

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Type

19.3.1 Market Size & Forecast

19.4 End-Use

19.4.1 Market Size & Forecast

19.5 Source

19.5.1 Market Size & Forecast

19.6 Key Countries

19.7 China

19.7.1 Market Size & Forecast

19.8 Japan

19.8.1 Market Size & Forecast

19.9 India

19.9.1 Market Size & Forecast

19.10 South Korea

19.10.1 Market Size & Forecast

19.11 Rest of Apac

19.11.1 Market Size & Forecast

20 Middle East & Africa

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Type

20.3.1 Market Size & Forecast

20.4 End-Use

20.4.1 Market Size & Forecast

20.5 Source

20.5.1 Market Size & Forecast

20.6 Key Countries

20.7 Saudi Arabia

20.7.1 Market Size & Forecast

20.8 South Africa

20.8.1 Market Size & Forecast

20.9 Rest of Middle East & Africa

20.9.1 Market Size & Forecast

21 Latin America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Type

21.3.1 Market Size & Forecast

21.4 End-Use

21.4.1 Market Size & Forecast

21.5 Source

21.5.1 Market Size & Forecast

21.6 Key Countries

21.7 Brazil

21.7.1 Market Size & Forecast

21.8 Mexico

21.8.1 Market Size & Forecast

21.9 Rest of Latin America

21.9.1 Market Size & Forecast

22 Competitive Landscape

22.1 Competition Overview

22.2 Recent Developments

23 Key Company Profiles

23.1 Basf Se

23.1.1 Business Overview

23.1.2 Financial Overview

23.1.3 Product Offerings

23.1.4 Key Strategies

23.1.5 Key Strengths

23.1.6 Key Opportunities

23.2 Dsm

23.2.1 Business Overview

23.2.2 Financial Overview

23.2.3 Product Offerings

23.2.4 Key Strategies

23.2.5 Key Strengths

23.2.6 Key Opportunities

23.3 Dupont

23.3.1 Business Overview

23.3.2 Financial Overview

23.3.3 Product Offerings

23.3.4 Key Strategies

23.3.5 Key Strengths

23.3.6 Key Opportunities

23.4 F. Hoffmann-La Roche Ltd

23.4.1 Business Overview

23.4.2 Financial Overview

23.4.3 Product Offerings

23.4.4 Key Strategies

23.4.5 Key Strengths

23.4.6 Key Opportunities

23.5 Novozymes

23.5.1 Business Overview

23.5.2 Financial Overview

23.5.3 Product Offerings

23.5.4 Key Strategies

23.5.5 Key Strengths

23.5.6 Key Opportunities

24 Other Prominent Vendors

24.1 Amano Enzyme Inc.

24.1.1 Company Overview

24.1.2 Business Overview

24.1.3 Product Offerings

24.2 Amyra Biotech AG

24.2.1 Company Overview

24.2.2 Product Offerings

24.3 Antozyme Biotech Pvt Ltd

24.3.1 Company Overview

24.3.2 Business Overview

24.3.3 Product Offerings

24.4 Aumgene Biosciences

24.4.1 Company Overview

24.4.2 Business Overview

24.4.3 Product Offerings

24.5 Aumenzymes

24.5.1 Company Overview

24.5.2 Product Offerings

24.6 Bbi Solutions

24.6.1 Company Overview

24.6.2 Business Overview

24.6.3 Product Offerings

24.7 Biocatalysts

24.7.1 Company Overview

24.7.2 Business Overview

24.7.3 Product Offerings

24.8 Codexis

24.8.1 Company Overview

24.8.2 Business Overview

24.8.3 Product Offerings

24.9 Chr. Hansen Holding A/S

24.9.1 Company Overview

24.9.2 Business Overview

24.9.3 Product Offerings

24.10 Dyadic International Inc.

24.10.1 Company Overview

24.10.2 Business Overview

24.10.3 Product Offerings

24.11 Iosynth

24.11.1 Company Overview

24.11.2 Business Overview

24.11.3 Product Offerings

24.12 Merck Kgaa

24.12.1 Company Overview

24.12.2 Business Overview

24.12.3 Product Offerings

24.13 Nature Bioscience Pvt. Ltd.

24.13.1 Company Overview

24.13.2 Business Overview

24.13.3 Product Offerings

24.14 Specialty Enzymes & Probiotics

24.14.1 Company Overview

24.14.2 Business Overview

24.14.3 Product Offerings

24.15 Zymtronix, Inc.

24.15.1 Company Overview

24.15.2 Product Offerings

25 Report Summary

25.1 Key Takeaways

25.2 Strategic Recommendations

26 Quantitative Summary

26.1 Type

26.1.1 Carbohydrases

26.1.2 Proteases

26.1.3 Lipases

26.1.4 Polymerases & Nucleases

26.1.5 Other

26.2 End-Use

26.2.1 Pharmaceutical

26.2.2 Biotechnology

26.2.3 Diagnostics

26.2.4 Other End-Use

26.3 Source

26.3.1 Microorganism

26.3.2 Plant

26.3.3 Animal

26.4 Geography

26.5 North America

26.5.1 Type

26.5.2 End-Use

26.5.3 Source

26.6 Europe

26.6.1 Type

26.6.2 End-Use

26.6.3 Source

26.7 Apac

26.7.1 Type

26.7.2 End-Use

26.7.3 Source

26.8 Middle East & Africa

26.8.1 Type

26.8.2 End-Use

26.8.3 Source

26.9 Latin America

26.9.1 Type

26.9.2 End-Use

26.9.3 Source

27 Appendix

27.1 Abbreviations

Companies Mentioned

- BASF SE

- DSM

- DuPont

- F. Hoffmann-La Roche Ltd

- Novozymes

- Amano Enzyme Inc.

- Amayra Biotech AG

- Antozyme Biotech Pvt Ltd

- Aumgene Biosciences

- Aumenzymes

- BBI Solutions

- Biocatalysts

- Codexis

- Hansen Holding A/S

- Dyadic International Inc.

- Iosynth

- Merck KGaA

- Nature Bioscience Pvt. Ltd.

- Specialty Enzymes & Probiotics

- Zymtronix Inc.

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 221 |

| Published | January 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 2966.26 Million |

| Forecasted Market Value ( USD | $ 4568.73 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |